Hi there!

I specifically need help on the accrual basis ie, Unadjusted Trial Balance, Adjusting Entries, Adjusted Trial Balance. As well as the financial statements ie Income Statement, Statement of Owner's Equity, Balance Sheet, Closing Entries and Post Closing Trial Balance. Below is the prompt and the work done so far. Thank you so much for the help!!!!!

Your completed accounting workbook will consist of journal entries for each transaction and postings of transactions to account ledgers. You will develop a trial balance from ledger balances and adjust revenue and expense accounts, as necessary, to ensure that revenues and expenses are reported in the appropriate period under the accrual accounting method. The adjusted trial balance will be used to prepare the income statement, the statement of owners equity, and the balance sheet. After the preparation of the financial statements, closing entries will be entered to transfer earnings to equity and prepare temporary accounts for the new accounting period.

Use the instructions below to complete your workbook.

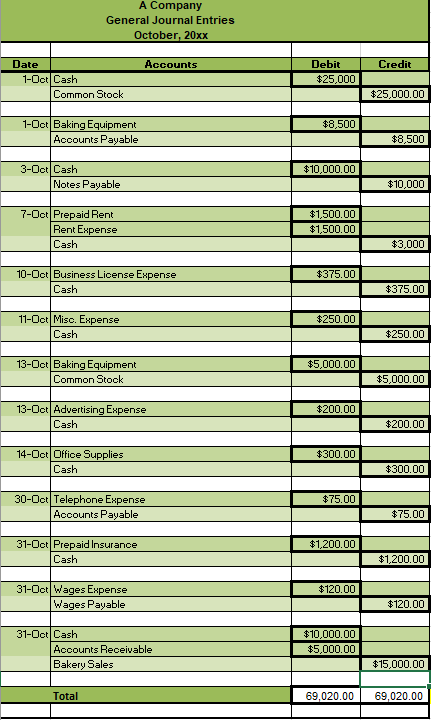

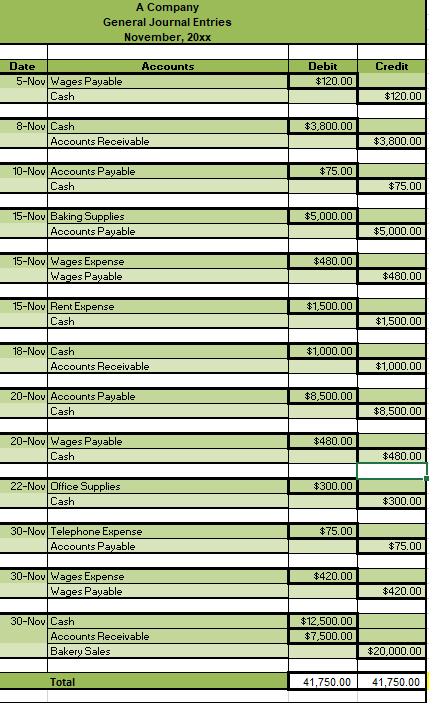

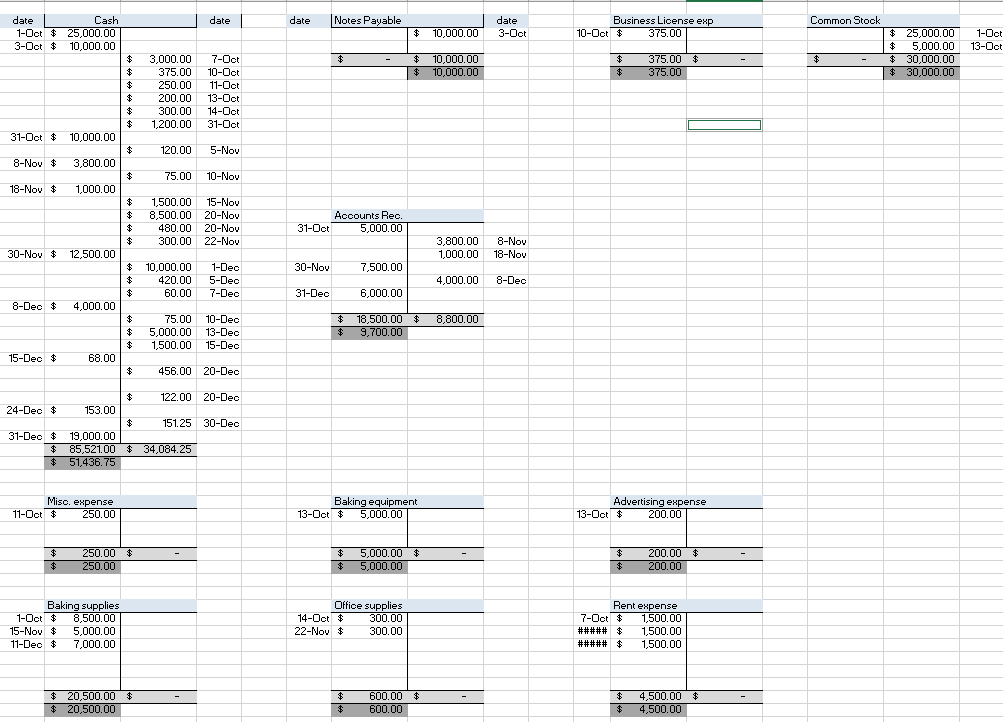

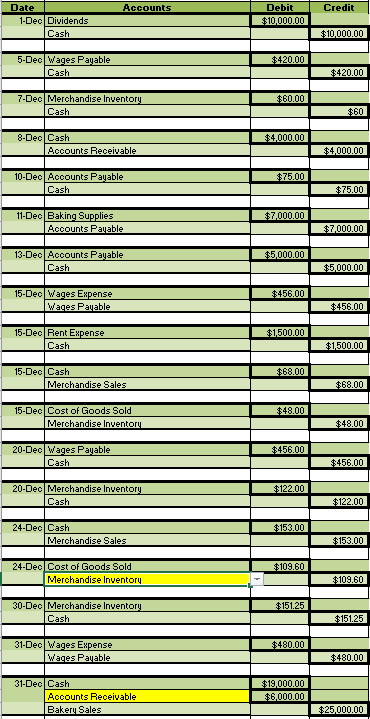

- Record Financial Data: Use accepted accounting principles to accurately capture business transactions for October, November, and December using the data provided in the accounting data appendix (linked in the Supporting Materials section). You will need to address the following:

- Accuracy: Prepare entries that are accurate in that they fully reflect the appropriate information.

- Completeness: Prepare entries that are complete for each month, including transferring posted entries to T accounts.

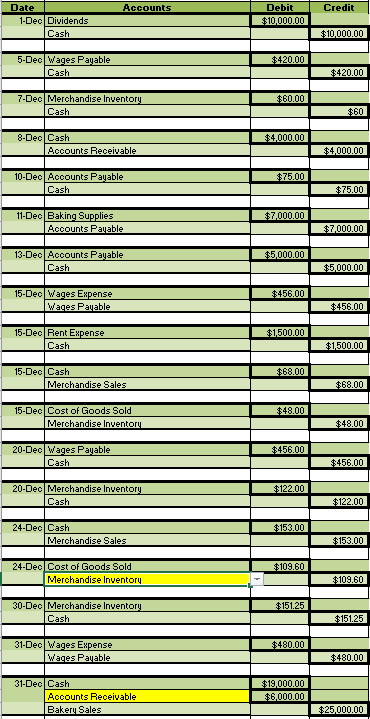

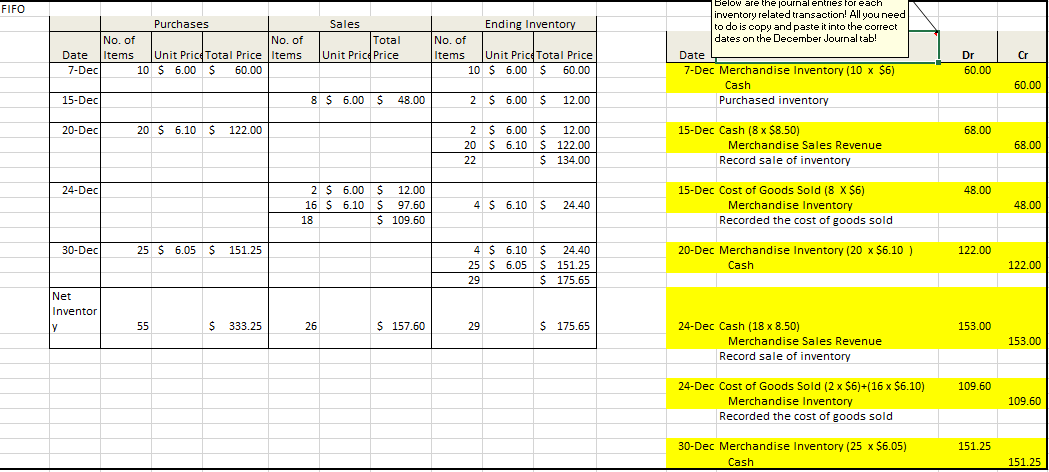

- Inventory Valuation: Prepare entries for the month of December to reflect the new line of products offered by the company, which includes using the data from the Inventory Valuation tab of the company accounting workbook.

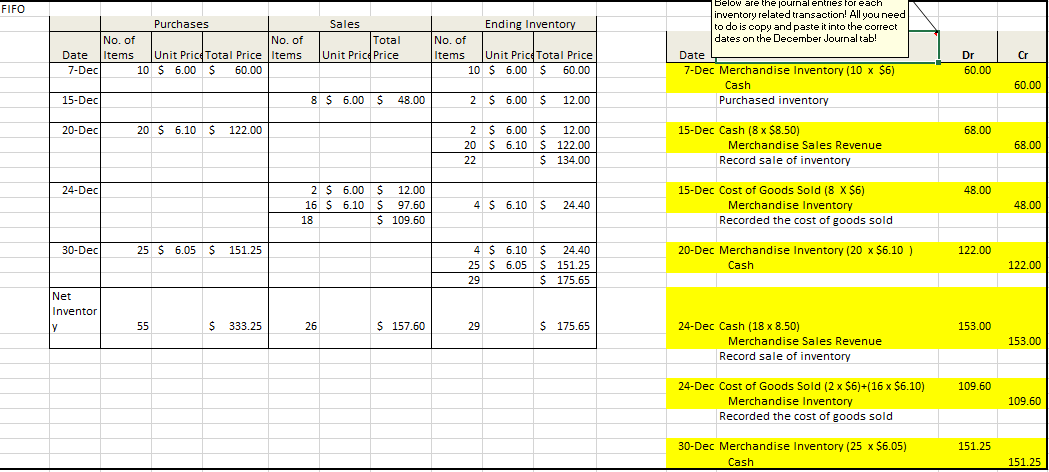

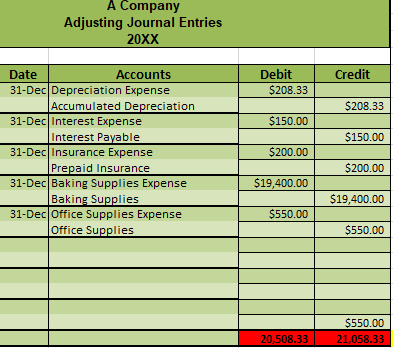

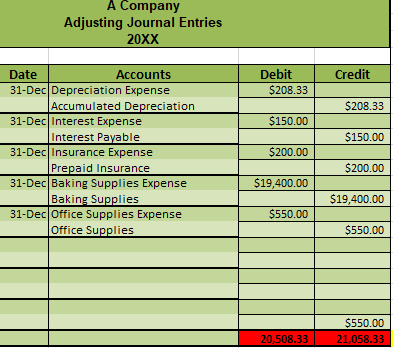

- Accrual Basis: Apply the accrual basis of accounting and prepare adjusting entries to ensure accurate accounting for expenses that lack transactions in the current period.

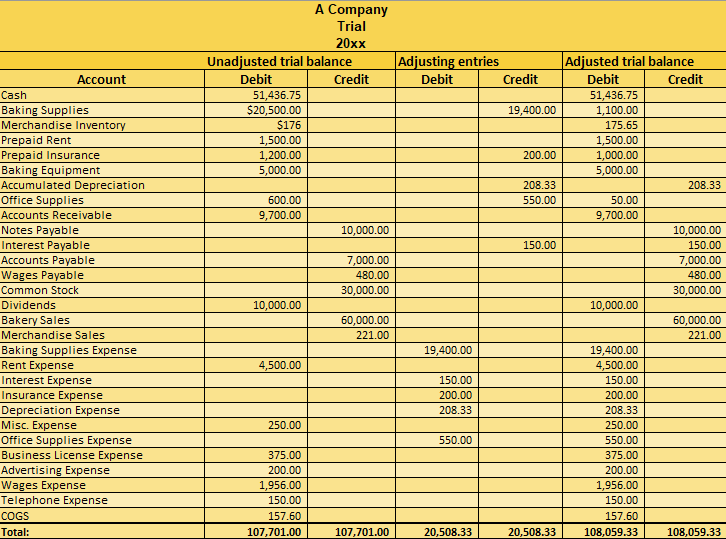

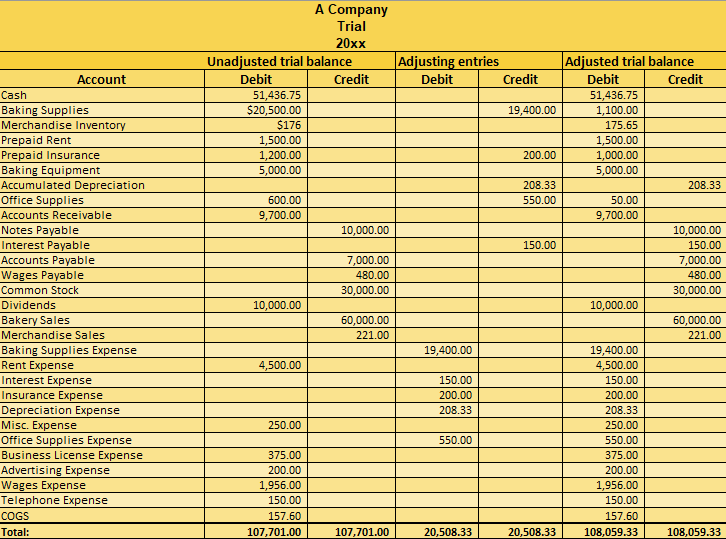

- Unadjusted Trial Balance: Prepare the unadjusted trial balance portion of the Trial Balance tab of the company accounting workbook, ensuring that the total debits and credits match.

- Adjusting Entries: Prepare the Adjusting Entries tab of the company accounting workbook.

- Adjusted Trial Balance: Prepare the adjusted trial balance on the Trial Balance tab, ensuring that the debit and credit totals match.

- Financial Statements: Create financial statements using appropriate methods based on accepted accounting principles. Be sure to prepare these financial statements in the order listed, as there are important interdependencies among them.

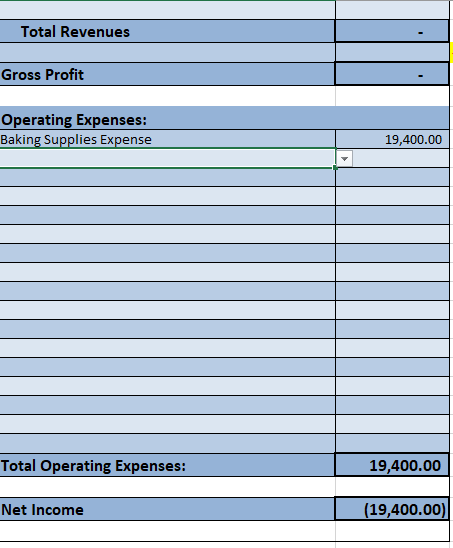

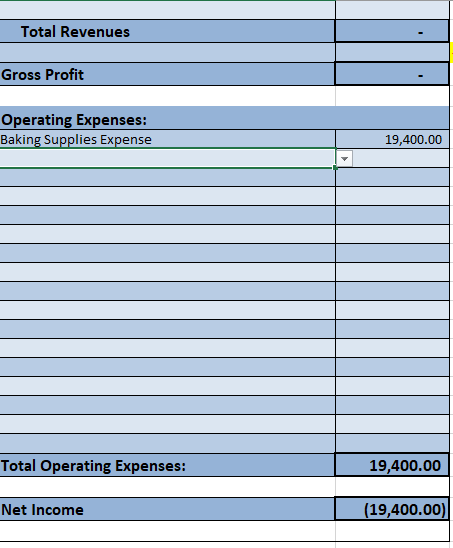

- Income Statement: Prepare the income statement using the adjusted trial balance.

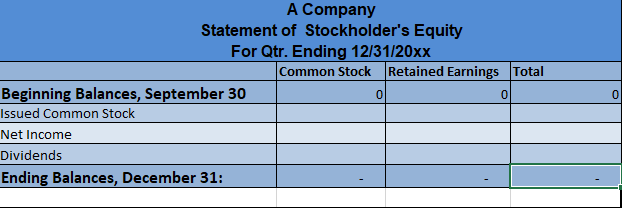

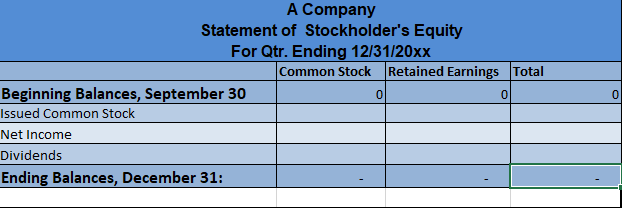

- Statement of Owners Equity: Prepare the statement of owners equity using the adjusted trial balance.

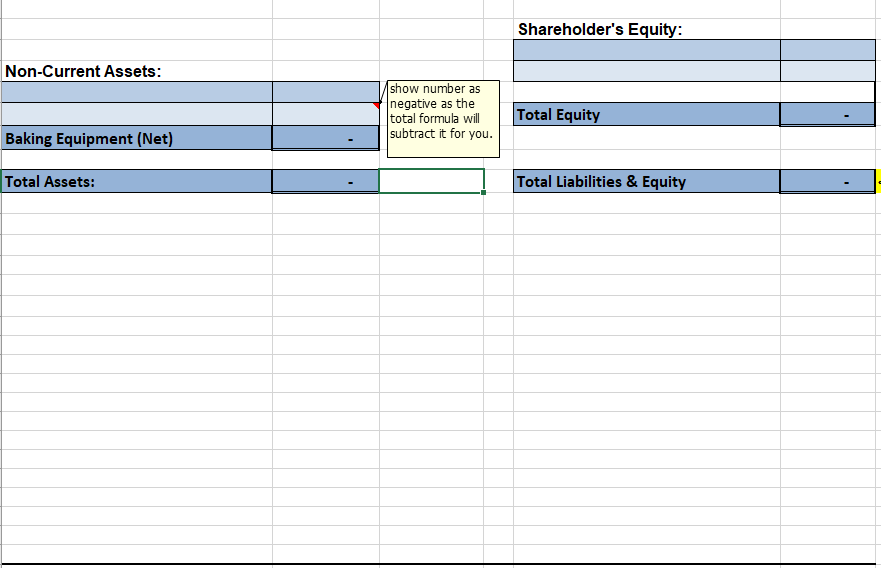

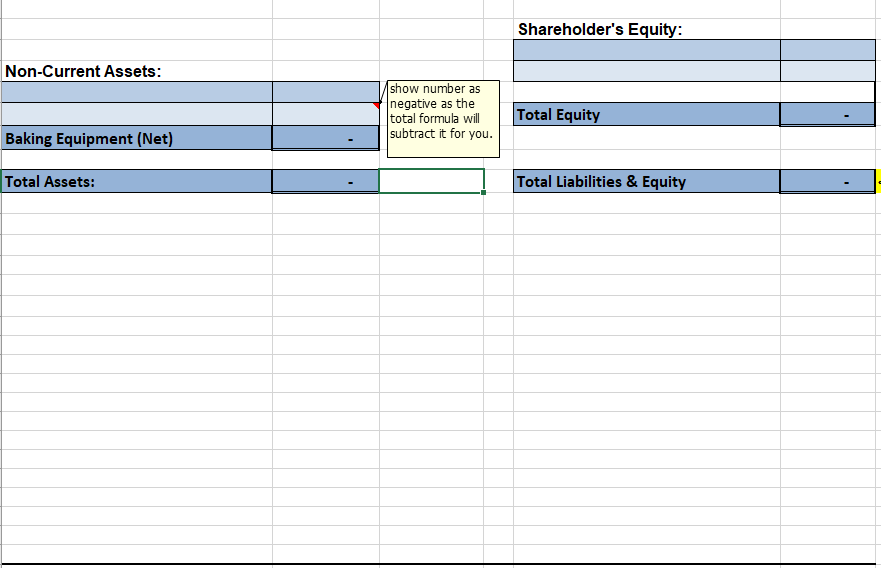

- Balance Sheet: Prepare the balance sheet using the adjusted trial balance.

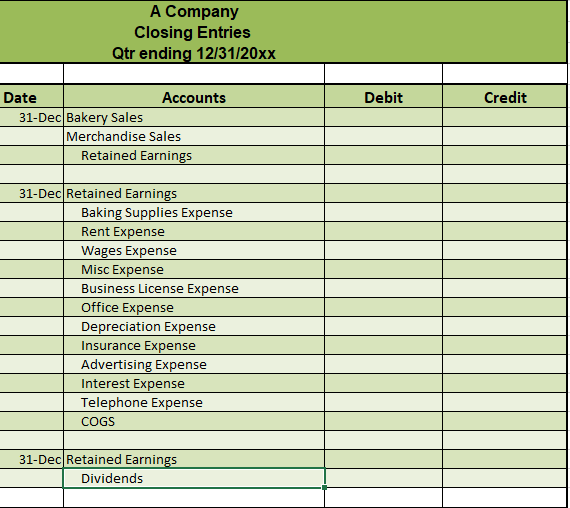

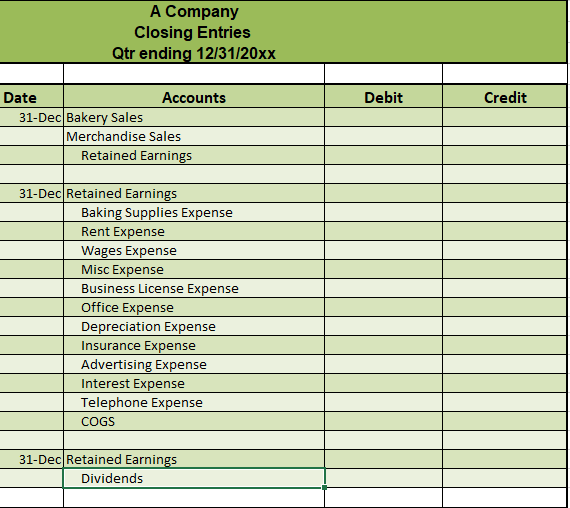

- Closing Entries: Complete the Closing Entries tab of the company accounting workbook by closing all temporary income statement amounts to create closing entries.

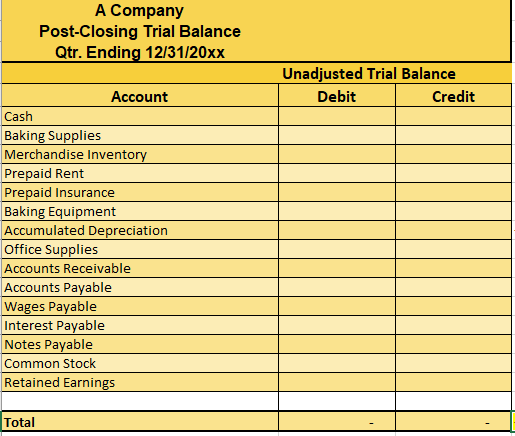

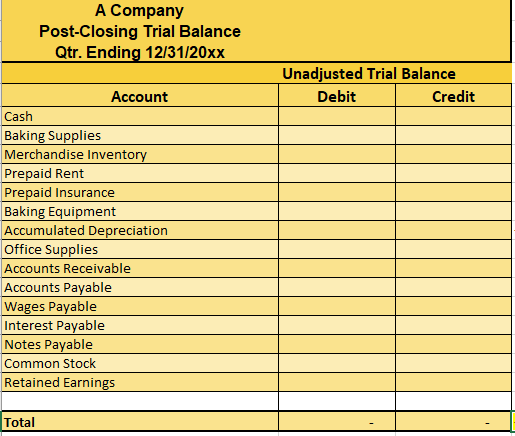

- Post-Closing Trial Balance

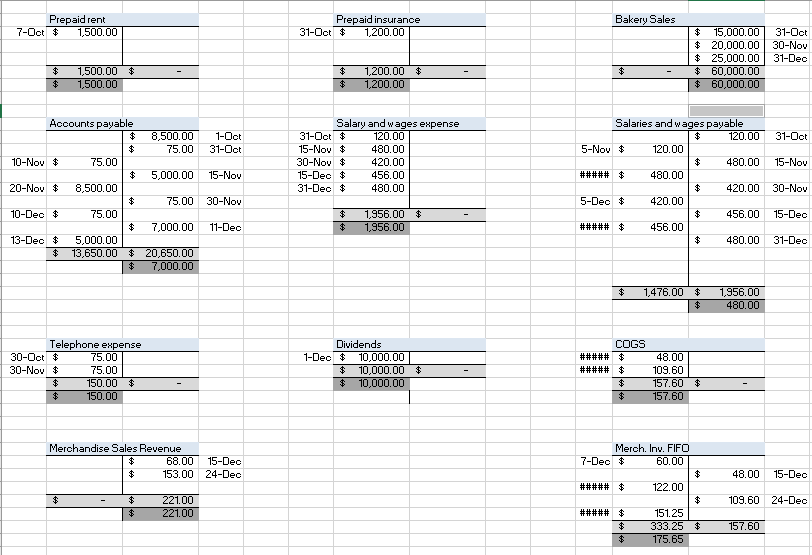

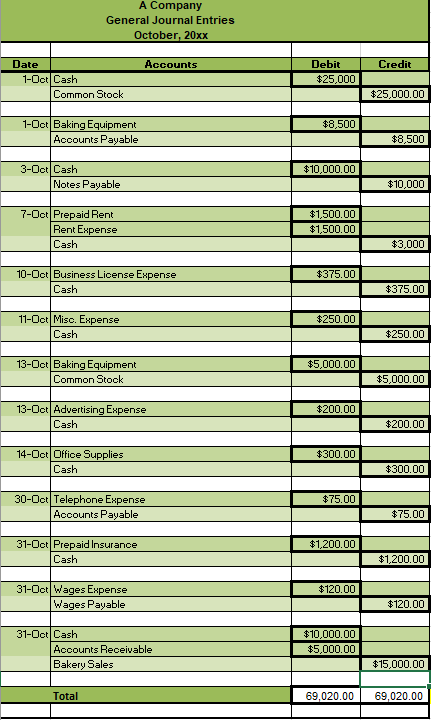

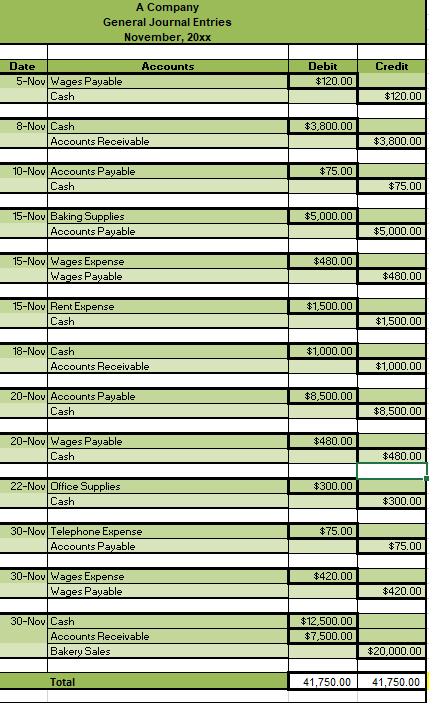

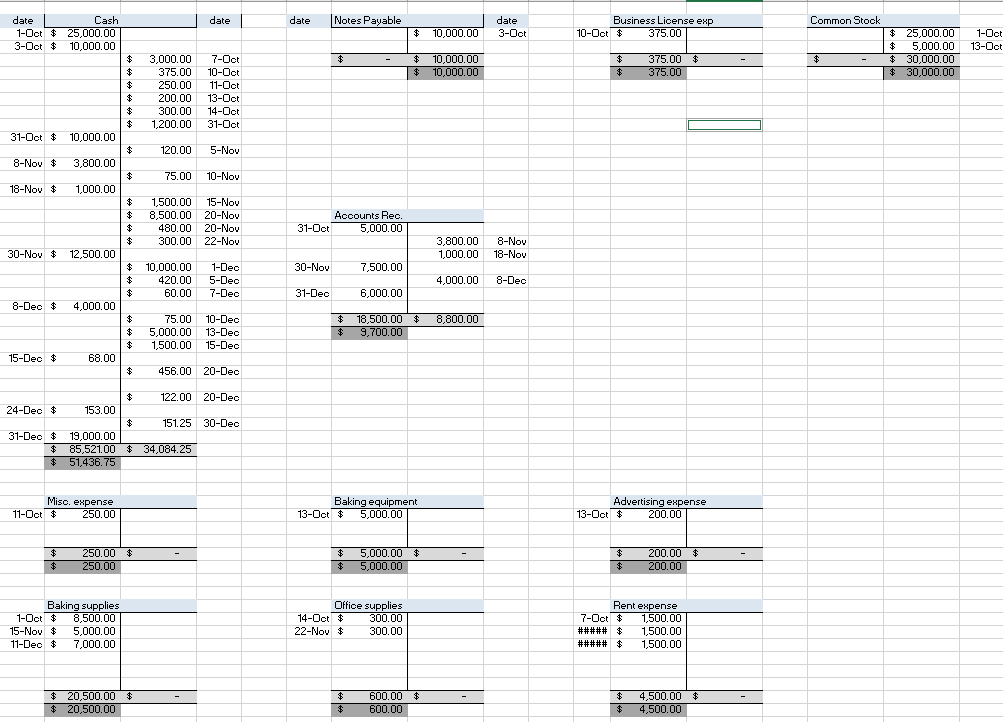

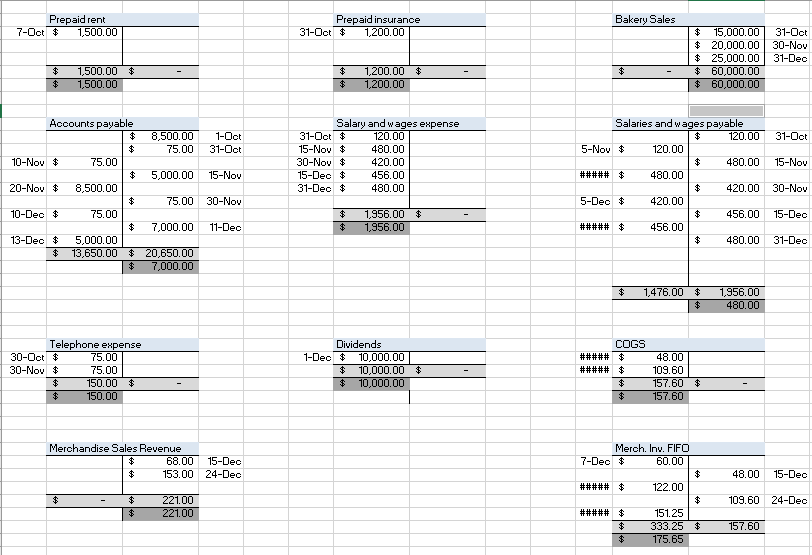

A Company General Journal Entries October, 20xx Accounts Credit Date 1-Oct Cash Common Stock Debit $25,000 $25,000.00 $8,500 1-Oct Baking Equipment Accounts Payable $8,500 $10,000.00 3-Oct Cash Notes Payable $10,000 7-OctPrepaid Rent Rent Expense Cash $1,500.00 $1,500.00 $3,000 $375.00 10-Oct Business License Expense Cash $375.00 $250.00 11-Oct Misc. Expense Cash $250.00 $5,000.00 13-00 Baking Equipment Common Stock $5,000.00 $200.00 13-Oct Advertising Expense Cash $200.00 $300.00 14-Oct Office Supplies Cash $300.00 $75.00 30-Oct Telephone Expense Accounts Payable $75.00 31-Oct Prepaid Insurance Cash $1,200.00 $1,200.00 $120.00 31-OotWages Expense Wages Payable $120.00 31-Oct Cash Accounts Receivable Bakery Sales $10,000.00 $5,000.00 $15,000.00 Total 69,020.00 69,020.00 A Company General Journal Entries November, 20xx Accounts Credit Date 5-Nov Wages Payable Cash Debit $120.00 $120.00 $3,800.00 8-Nov Cash Accounts Receivable $3,800.00 $75.00 10-Nov Accounts Payable Cash $75.00 $5,000.00 15-Nov Baking Supplies Accounts Payable $5,000.00 $480.00 15-Nov Wages Expense Wages Payable $480.00 $1,500.00 15-Nov Rent Expense Cash $1,500.00 $1,000.00 18-Nov Cash Accounts Receivable $1,000.00 $8,500.00 20-Nov Accounts Payable Cash $8,500.00 $480.00 20-Nov Wages Payable Cash $480.00 $300.00 22-Nov Office Supplies Cash $300.00 $75.00 30-Nov Telephone Expense Accounts Payable $75.00 $420.00 30-Nov Wages Expense Wages Payable $420.00 30-Nov Cash Accounts Receivable Bakery Sales $12,500.00 $7,500.00 $20,000.00 Total 41,750.00 41,750.00 Accounts Credit Date 1-Dec Dividends Cash Debit $10,000.00 $10,000.00 5-Dec Wages Payable Cash $420,00 $420,00 $60.00 7-Dec Merchandise Inventory Cash $60 $4,000.00 8-Dec Cash Accounts Receivable $4,000.00 $75.00 10-Dec Accounts Payable Cash $75.00 $7,000.00 11-Dec Baking Supplies Accounts Payable $7,000.00 $5,000.00 13-Dec Accounts Payable Cash $5,000.00 $456.00 15-Dec Wages Expense Wages Payable $456.00 $1,500.00 15-Dec Rent Expense Cash $1,500.00 $68.00 15-Dec Cash Merchandise Sales $68.00 $48.00 15-Dec Cost of Goods Sold Merchandise Inventory $48.00 $456.00 20-Dec Wages Payable Cash $456.00 $122.00 20-Dec Merchandise Inventory Cash $122.00 $153.00 24-Dec Cash Merchandise Sales $153.00 $109.60 24-Dec Cost of Goods Sold Merchandise Inventory $109.60 30-Dec Merchandise Inventory Cash $151.25 $151.25 $480.00 31-Dec Wages Expense Wages Payable $480.00 31-Dec Cash Accounts Receivable Bakery Sales $19,000.00 $6,000.00 $25,000.00 FIFO Purchases No. of No. of Date Items Unit Price Total Price Items 7-Dec 10 $ 6.00 $ 60.00 $ Sales Total Unit Price Price Ending Inventory No. of Items Unit Price Total Price 10 $ 6.00 $ 60.00 Below are the journal entries for each inventory related transaction! All you need to do is copy and paste it into the correct dates on the December Journaltab! Date 7-Dec Merchandise Inventory (10 x $6) Cash Purchased inventory Cr Dr 60.00 60.00 15-Dec 8 $ 6.00 $ 48.00 2 $ 6.00 $ $ 12.00 20-Dec 20 $ 6.10 $ 122.00 68.00 2 2 $ 6.00 $ 12.00 20 $ 6.10 $ 122.00 22 $ 134.00 15-Dec Cash (8 x $8.50) Merchandise Sales Revenue Record sale of inventory 68.00 24-Dec 48.00 2 $ 6.00 $ 12.00 16 $ 6.10 $ 97.60 18 S 109.60 4 $ 6.10 S 24.40 15-Dec Cost of Goods Sold (8 X $6) Merchandise Inventory Recorded the cost of goods sold 48.00 30-Dec 25 $ 6.05 S $ 151.25 122.00 4 $ 6.10 $ 24.40 25 $ 6.05 $ 151.25 $ 29 $ 175.65 20-Dec Merchandise Inventory (20 x $6.10 ) Cash 122.00 Net Inventor Y 55 $ 333.25 26 $ 157.60 29 $ 175.65 153.00 24-Dec Cash (18 x 8.50) Merchandise Sales Revenue Record sale of inventory 153.00 109.60 24-Dec Cost of Goods Sold (2 x $6)+(16 x $6.10) Merchandise Inventory Recorded the cost of goods sold 109.60 151.25 30-Dec Merchandise Inventory (25 x $6.05) Cash 151.25 A Company Adjusting Journal Entries 20XX Credit Debit $208.33 $208.33 $150.00 $150.00 Date Accounts 31-Dec Depreciation Expense Accumulated Depreciation 31-Dec Interest Expense Interest Payable 31-Dec Insurance Expense Prepaid Insurance 31-Dec Baking Supplies Expense Baking Supplies 31-Dec Office Supplies Expense Office Supplies $200.00 $200.00 $19,400.00 $19,400.00 $550.00 $550.00 $550.00 21,058.33 20,508.33 Adjusting entries Debit Credit A Company Trial 20xx Unadjusted trial balance Debit Credit 51,436.75 $20,500.00 $176 1,500.00 1,200.00 5,000.00 19,400.00 200.00 208.33 550.00 600.00 9,700.00 10,000.00 150.00 7,000.00 480.00 30,000.00 Account Cash Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation Office Supplies Accounts Receivable Notes Payable Interest Payable Accounts Payable Wages Payable Common Stock Dividends Bakery Sales Merchandise Sales Baking Supplies Expense Rent Expense Interest Expense Insurance Expense Depreciation Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense COGS Total: Adjusted trial balance Debit Credit 51,436.75 1,100.00 175.65 1,500.00 1,000.00 5,000.00 208.33 50.00 9,700.00 10,000.00 150.00 7,000.00 480.00 30,000.00 10,000.00 60,000.00 221.00 19,400.00 4,500.00 150.00 200.00 208.33 250.00 550.00 375.00 200.00 1,956.00 150.00 157.60 108,059.33 108,059.33 10,000.00 60,000.00 221.00 19,400.00 4,500.00 150.00 200.00 208.33 250.00 550.00 375.00 200.00 1,956.00 150.00 157.60 107,701.00 107,701.00 20,508.33 20,508.33 Total Revenues Gross Profit Operating Expenses: Baking Supplies Expense 19,400.00 Total Operating Expenses: 19,400.00 Net Income (19,400.00) Common Stock A Company Statement of Stockholder's Equity For Qtr. Ending 12/31/20xx Retained Earnings Total Beginning Balances, September 30 Issued Common Stock Net Income Dividends Ending Balances, December 31: 0 0 0 Shareholder's Equity: Non-Current Assets: show number as negative as the total formula will subtract it for you. Total Equity Baking Equipment (Net) Total Assets: Total Liabilities & Equity A Company Closing Entries Qtr ending 12/31/20xx Debit Credit Date Accounts 31-Dec Bakery Sales Merchandise Sales Retained Earnings 31-Dec Retained Earnings Baking Supplies Expense Rent Expense Wages Expense Misc Expense Business License Expense Office Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense COGS 31-Dec Retained Earnings Dividends A Company Post-Closing Trial Balance Qtr. Ending 12/31/20xx Unadjusted Trial Balance Debit Credit Account Cash Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation Office Supplies Accounts Receivable Accounts Payable Wages Payable Interest Payable Notes Payable Common Stock Retained Earnings Total date date Notes Payable Common Stock date Cash 1-Oct $ 25,000.00 3-Oct $ 10,000.00 date 3-Oct 3 Business License exp 10-Oct $ 375.00 $ 10,000.00 1-Oct 13-Oct $ 25,000.00 $ 5,000.00 $ 30,000.00 $ 30,000.00 $ - - $ - $ $ 10,000.00 10,000.00 $ $ 375.00 $ 375.00 $ $ $ $ $ $ 3,000.00 7-Oct 375.00 10-Oct 250.00 11-Oct 200.00 13-Oot 300.00 14-Oct 1,200.00 31-Oct 31-Oot $ 10,000.00 $ 120.00 5-Nov 5 8-Nov $ 3,800.00 $ 75.00 10-Nov 18-Nov $ 1,000.00 $ $ 1,500.00 15-Nov 8,500.00 20-Nov 480.00 20-Nov 300.00 22-Nov Accounts Rec. 31-Oct 5,000.00 $ 3,800.00 1,000.00 30-Nov 12,500.00 8-Nov 18-Nov 30-Nov 7,500.00 $ 10,000.00 $ 420.00 $ 60.00 1-Dec 5-Dec 7-Dec 4,000.00 8-Dec 31-Dec 6,000.00 8-Dec $ 4,000.00 8.800.00 $ $ $ 75.00 10-Dec 5,000.00 13-Dec 1,500.00 15-Dec $ $ 18,500.00 $ 9,700.00 15-Dec $ 68.00 $ 456.00 20-Dec - $ 122.00 20-Dec 24-Dec $ 153.00 $ 151.25 30-Dec 31-Dec $ 19,000.00 $ 85,521.00 $ 34,084.25 $ 51,436.75 Misc. expense 11-Oot $ 250.00 Baking equipment 13-Oct $ 5.000.00 Advertising expense 13-Oot $ 200.00 - $ $ - $ $ 250.00 $ 250.00 $ $ 5,000.00 $ 5,000.00 200.00 $ 200.00 $ Baking supplies 1-Oct $ 8,500.00 15-Nov $ $ 5,000.00 11-Dec $ 7,000.00 Office supplies 14-Oct $ 300.00 22-Nov $ 300.00 Rent expense 7-Oct $ 1,500.00 ##### $ 1,500.00 ##### $ 1,500.00 $ $ 20,500.00 $ $ 20,500.00 600.00 $ 600.00 $ $ $ 4,500.00 $ 4,500.00 $ Prepaid rent 7-Oot $ 1,500.00 Prepaid insurance 31-Oot $ 1,200.00 Bakery Sales $ 15,000.00 31-Oct $ 20,000.00 30-Nov $ 25,000.00 31-Dec $ 60,000.00 $ 60,000.00 $ $ 1,500.00 $ 1,500.00 $ $ 1,200.00 $ 1,200.00 31-Oct 1-Oct 31-Oot Salary and wages expense 31-Oct $ 120.00 15-Nov $ 480.00 30-Nov $ 420.00 15-Deo $ 456.00 31-Dec $ 480.00 15-Nov 15-Nov Salaries and wages payable $ 120.00 5-Nov $ 120.00 $ 480.00 ##### $ 480.00 $ 420.00 5-Dec $ 420.00 $ 456.00 ##### $ 456.00 $ 480.00 Accounts payable $ 8,500.00 $ 75.00 10-Nov $ 75.00 $ 5,000.00 20-Nov $ 8,500.00 $ 75.00 10-Deo $ 75.00 $ 7,000.00 13-Dec $ 5,000.00 $ 13,650.00 $ 20,650.00 $ 7,000.00 30-Nov 30-Nov - 15-Dec $ $ 1,956.00 $ 1956.00 11-Dec 31-Dec $ 1.476.00 $ $ 1,956.00 480.00 48.00 Telephone expense 30-Oct $ 75.00 30-Nov $ 75.00 $ 150.00 $ $ 150.00 Dividends 1-Dec $ 10,000.00 $ 10,000.00 $ $ 10,000.00 COGS ##### $ ##### $ $ $ 109.60 157.60 $ 157.60 Merchandise Sales Revenue $ 68.00 $ 153.00 15-Dec 24-Dec 48.00 15-Dec Merch. Inv. FIFO 7-Dec $ 60.00 $ ##### $ 122.00 $ ##### $ 151.25 $ 333.25 $ $ 175.65 $ - $ $ 109.60 24-Dec 221.00 221.00 157.60 A Company General Journal Entries October, 20xx Accounts Credit Date 1-Oct Cash Common Stock Debit $25,000 $25,000.00 $8,500 1-Oct Baking Equipment Accounts Payable $8,500 $10,000.00 3-Oct Cash Notes Payable $10,000 7-OctPrepaid Rent Rent Expense Cash $1,500.00 $1,500.00 $3,000 $375.00 10-Oct Business License Expense Cash $375.00 $250.00 11-Oct Misc. Expense Cash $250.00 $5,000.00 13-00 Baking Equipment Common Stock $5,000.00 $200.00 13-Oct Advertising Expense Cash $200.00 $300.00 14-Oct Office Supplies Cash $300.00 $75.00 30-Oct Telephone Expense Accounts Payable $75.00 31-Oct Prepaid Insurance Cash $1,200.00 $1,200.00 $120.00 31-OotWages Expense Wages Payable $120.00 31-Oct Cash Accounts Receivable Bakery Sales $10,000.00 $5,000.00 $15,000.00 Total 69,020.00 69,020.00 A Company General Journal Entries November, 20xx Accounts Credit Date 5-Nov Wages Payable Cash Debit $120.00 $120.00 $3,800.00 8-Nov Cash Accounts Receivable $3,800.00 $75.00 10-Nov Accounts Payable Cash $75.00 $5,000.00 15-Nov Baking Supplies Accounts Payable $5,000.00 $480.00 15-Nov Wages Expense Wages Payable $480.00 $1,500.00 15-Nov Rent Expense Cash $1,500.00 $1,000.00 18-Nov Cash Accounts Receivable $1,000.00 $8,500.00 20-Nov Accounts Payable Cash $8,500.00 $480.00 20-Nov Wages Payable Cash $480.00 $300.00 22-Nov Office Supplies Cash $300.00 $75.00 30-Nov Telephone Expense Accounts Payable $75.00 $420.00 30-Nov Wages Expense Wages Payable $420.00 30-Nov Cash Accounts Receivable Bakery Sales $12,500.00 $7,500.00 $20,000.00 Total 41,750.00 41,750.00 Accounts Credit Date 1-Dec Dividends Cash Debit $10,000.00 $10,000.00 5-Dec Wages Payable Cash $420,00 $420,00 $60.00 7-Dec Merchandise Inventory Cash $60 $4,000.00 8-Dec Cash Accounts Receivable $4,000.00 $75.00 10-Dec Accounts Payable Cash $75.00 $7,000.00 11-Dec Baking Supplies Accounts Payable $7,000.00 $5,000.00 13-Dec Accounts Payable Cash $5,000.00 $456.00 15-Dec Wages Expense Wages Payable $456.00 $1,500.00 15-Dec Rent Expense Cash $1,500.00 $68.00 15-Dec Cash Merchandise Sales $68.00 $48.00 15-Dec Cost of Goods Sold Merchandise Inventory $48.00 $456.00 20-Dec Wages Payable Cash $456.00 $122.00 20-Dec Merchandise Inventory Cash $122.00 $153.00 24-Dec Cash Merchandise Sales $153.00 $109.60 24-Dec Cost of Goods Sold Merchandise Inventory $109.60 30-Dec Merchandise Inventory Cash $151.25 $151.25 $480.00 31-Dec Wages Expense Wages Payable $480.00 31-Dec Cash Accounts Receivable Bakery Sales $19,000.00 $6,000.00 $25,000.00 FIFO Purchases No. of No. of Date Items Unit Price Total Price Items 7-Dec 10 $ 6.00 $ 60.00 $ Sales Total Unit Price Price Ending Inventory No. of Items Unit Price Total Price 10 $ 6.00 $ 60.00 Below are the journal entries for each inventory related transaction! All you need to do is copy and paste it into the correct dates on the December Journaltab! Date 7-Dec Merchandise Inventory (10 x $6) Cash Purchased inventory Cr Dr 60.00 60.00 15-Dec 8 $ 6.00 $ 48.00 2 $ 6.00 $ $ 12.00 20-Dec 20 $ 6.10 $ 122.00 68.00 2 2 $ 6.00 $ 12.00 20 $ 6.10 $ 122.00 22 $ 134.00 15-Dec Cash (8 x $8.50) Merchandise Sales Revenue Record sale of inventory 68.00 24-Dec 48.00 2 $ 6.00 $ 12.00 16 $ 6.10 $ 97.60 18 S 109.60 4 $ 6.10 S 24.40 15-Dec Cost of Goods Sold (8 X $6) Merchandise Inventory Recorded the cost of goods sold 48.00 30-Dec 25 $ 6.05 S $ 151.25 122.00 4 $ 6.10 $ 24.40 25 $ 6.05 $ 151.25 $ 29 $ 175.65 20-Dec Merchandise Inventory (20 x $6.10 ) Cash 122.00 Net Inventor Y 55 $ 333.25 26 $ 157.60 29 $ 175.65 153.00 24-Dec Cash (18 x 8.50) Merchandise Sales Revenue Record sale of inventory 153.00 109.60 24-Dec Cost of Goods Sold (2 x $6)+(16 x $6.10) Merchandise Inventory Recorded the cost of goods sold 109.60 151.25 30-Dec Merchandise Inventory (25 x $6.05) Cash 151.25 A Company Adjusting Journal Entries 20XX Credit Debit $208.33 $208.33 $150.00 $150.00 Date Accounts 31-Dec Depreciation Expense Accumulated Depreciation 31-Dec Interest Expense Interest Payable 31-Dec Insurance Expense Prepaid Insurance 31-Dec Baking Supplies Expense Baking Supplies 31-Dec Office Supplies Expense Office Supplies $200.00 $200.00 $19,400.00 $19,400.00 $550.00 $550.00 $550.00 21,058.33 20,508.33 Adjusting entries Debit Credit A Company Trial 20xx Unadjusted trial balance Debit Credit 51,436.75 $20,500.00 $176 1,500.00 1,200.00 5,000.00 19,400.00 200.00 208.33 550.00 600.00 9,700.00 10,000.00 150.00 7,000.00 480.00 30,000.00 Account Cash Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation Office Supplies Accounts Receivable Notes Payable Interest Payable Accounts Payable Wages Payable Common Stock Dividends Bakery Sales Merchandise Sales Baking Supplies Expense Rent Expense Interest Expense Insurance Expense Depreciation Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense COGS Total: Adjusted trial balance Debit Credit 51,436.75 1,100.00 175.65 1,500.00 1,000.00 5,000.00 208.33 50.00 9,700.00 10,000.00 150.00 7,000.00 480.00 30,000.00 10,000.00 60,000.00 221.00 19,400.00 4,500.00 150.00 200.00 208.33 250.00 550.00 375.00 200.00 1,956.00 150.00 157.60 108,059.33 108,059.33 10,000.00 60,000.00 221.00 19,400.00 4,500.00 150.00 200.00 208.33 250.00 550.00 375.00 200.00 1,956.00 150.00 157.60 107,701.00 107,701.00 20,508.33 20,508.33 Total Revenues Gross Profit Operating Expenses: Baking Supplies Expense 19,400.00 Total Operating Expenses: 19,400.00 Net Income (19,400.00) Common Stock A Company Statement of Stockholder's Equity For Qtr. Ending 12/31/20xx Retained Earnings Total Beginning Balances, September 30 Issued Common Stock Net Income Dividends Ending Balances, December 31: 0 0 0 Shareholder's Equity: Non-Current Assets: show number as negative as the total formula will subtract it for you. Total Equity Baking Equipment (Net) Total Assets: Total Liabilities & Equity A Company Closing Entries Qtr ending 12/31/20xx Debit Credit Date Accounts 31-Dec Bakery Sales Merchandise Sales Retained Earnings 31-Dec Retained Earnings Baking Supplies Expense Rent Expense Wages Expense Misc Expense Business License Expense Office Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense COGS 31-Dec Retained Earnings Dividends A Company Post-Closing Trial Balance Qtr. Ending 12/31/20xx Unadjusted Trial Balance Debit Credit Account Cash Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation Office Supplies Accounts Receivable Accounts Payable Wages Payable Interest Payable Notes Payable Common Stock Retained Earnings Total date date Notes Payable Common Stock date Cash 1-Oct $ 25,000.00 3-Oct $ 10,000.00 date 3-Oct 3 Business License exp 10-Oct $ 375.00 $ 10,000.00 1-Oct 13-Oct $ 25,000.00 $ 5,000.00 $ 30,000.00 $ 30,000.00 $ - - $ - $ $ 10,000.00 10,000.00 $ $ 375.00 $ 375.00 $ $ $ $ $ $ 3,000.00 7-Oct 375.00 10-Oct 250.00 11-Oct 200.00 13-Oot 300.00 14-Oct 1,200.00 31-Oct 31-Oot $ 10,000.00 $ 120.00 5-Nov 5 8-Nov $ 3,800.00 $ 75.00 10-Nov 18-Nov $ 1,000.00 $ $ 1,500.00 15-Nov 8,500.00 20-Nov 480.00 20-Nov 300.00 22-Nov Accounts Rec. 31-Oct 5,000.00 $ 3,800.00 1,000.00 30-Nov 12,500.00 8-Nov 18-Nov 30-Nov 7,500.00 $ 10,000.00 $ 420.00 $ 60.00 1-Dec 5-Dec 7-Dec 4,000.00 8-Dec 31-Dec 6,000.00 8-Dec $ 4,000.00 8.800.00 $ $ $ 75.00 10-Dec 5,000.00 13-Dec 1,500.00 15-Dec $ $ 18,500.00 $ 9,700.00 15-Dec $ 68.00 $ 456.00 20-Dec - $ 122.00 20-Dec 24-Dec $ 153.00 $ 151.25 30-Dec 31-Dec $ 19,000.00 $ 85,521.00 $ 34,084.25 $ 51,436.75 Misc. expense 11-Oot $ 250.00 Baking equipment 13-Oct $ 5.000.00 Advertising expense 13-Oot $ 200.00 - $ $ - $ $ 250.00 $ 250.00 $ $ 5,000.00 $ 5,000.00 200.00 $ 200.00 $ Baking supplies 1-Oct $ 8,500.00 15-Nov $ $ 5,000.00 11-Dec $ 7,000.00 Office supplies 14-Oct $ 300.00 22-Nov $ 300.00 Rent expense 7-Oct $ 1,500.00 ##### $ 1,500.00 ##### $ 1,500.00 $ $ 20,500.00 $ $ 20,500.00 600.00 $ 600.00 $ $ $ 4,500.00 $ 4,500.00 $ Prepaid rent 7-Oot $ 1,500.00 Prepaid insurance 31-Oot $ 1,200.00 Bakery Sales $ 15,000.00 31-Oct $ 20,000.00 30-Nov $ 25,000.00 31-Dec $ 60,000.00 $ 60,000.00 $ $ 1,500.00 $ 1,500.00 $ $ 1,200.00 $ 1,200.00 31-Oct 1-Oct 31-Oot Salary and wages expense 31-Oct $ 120.00 15-Nov $ 480.00 30-Nov $ 420.00 15-Deo $ 456.00 31-Dec $ 480.00 15-Nov 15-Nov Salaries and wages payable $ 120.00 5-Nov $ 120.00 $ 480.00 ##### $ 480.00 $ 420.00 5-Dec $ 420.00 $ 456.00 ##### $ 456.00 $ 480.00 Accounts payable $ 8,500.00 $ 75.00 10-Nov $ 75.00 $ 5,000.00 20-Nov $ 8,500.00 $ 75.00 10-Deo $ 75.00 $ 7,000.00 13-Dec $ 5,000.00 $ 13,650.00 $ 20,650.00 $ 7,000.00 30-Nov 30-Nov - 15-Dec $ $ 1,956.00 $ 1956.00 11-Dec 31-Dec $ 1.476.00 $ $ 1,956.00 480.00 48.00 Telephone expense 30-Oct $ 75.00 30-Nov $ 75.00 $ 150.00 $ $ 150.00 Dividends 1-Dec $ 10,000.00 $ 10,000.00 $ $ 10,000.00 COGS ##### $ ##### $ $ $ 109.60 157.60 $ 157.60 Merchandise Sales Revenue $ 68.00 $ 153.00 15-Dec 24-Dec 48.00 15-Dec Merch. Inv. FIFO 7-Dec $ 60.00 $ ##### $ 122.00 $ ##### $ 151.25 $ 333.25 $ $ 175.65 $ - $ $ 109.60 24-Dec 221.00 221.00 157.60