Hi These questions deals with sections 2033, 2036, 2511, 2512, & 2503. Could you please help me determine the tax liabilty for parts C, D, and G in particular? Thanks!

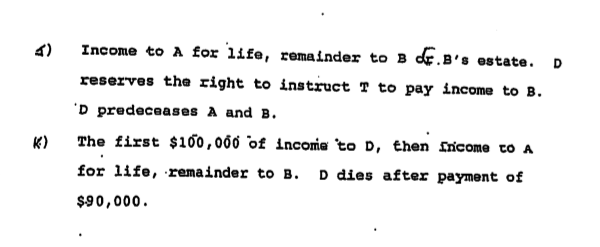

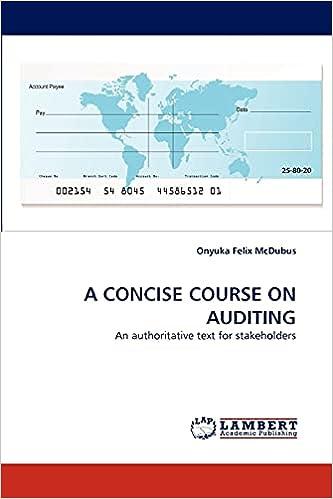

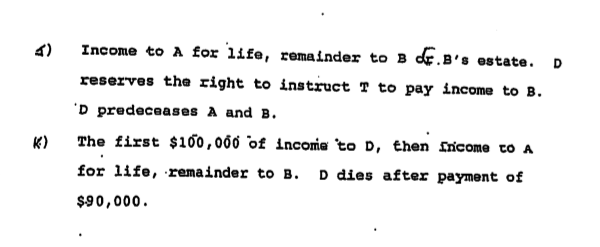

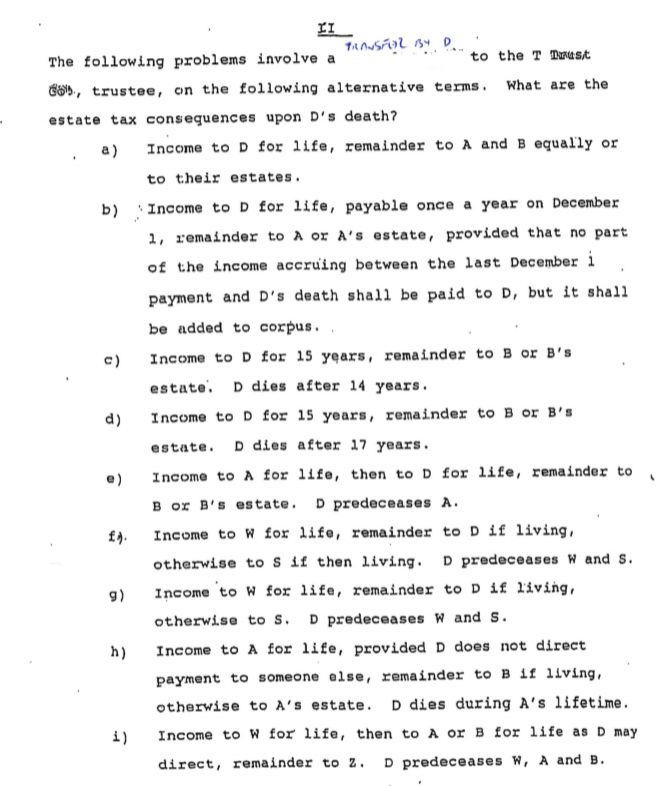

Income to A for life, remainder to B .B's estate. D reserves the right to instruct T to pay income to B. 'D predeceases A and B. The first $100,000 of income to D, then tricome to A for life, remainder to B. D dies after payment of $.90,000. II TROUSEL BYD The following problems involve a to the T Tuust tay, trustee, on the following alternative terms. What are the estate tax consequences upon D's death? a) Income to D for life, remainder to A and B equally or to their estates. b) Income to D for life, payable once a year on December 1, remainder to A or A's estate, provided that no part of the income accruing between the last December i payment and D's death shall be paid to D, but it shall be added to corpus. c) Income to D for 15 years, remainder to B or B's estate. D dies after 14 years. d) Income to D for 15 years, remainder to B or B's estate. D dies after 17 years. Income to A for 11fe, then to D for life, remainder to BOX B's estate. D predeceases A. Income to w for life, remainder to D if living otherwise to s if then living. D predeceases W and s. Income to w for life, remainder to D 1f living, otherwise to s. D predeceases w and s. Income to A for life, provided D does not direct payment to someone else, remainder to B 11 living, otherwise to A's estate. D dies during A's lifetime. Income to w for life, then to A or B for life as D may direct, remainder to 2. D predeceases W, A and B. Income to A for life, remainder to B .B's estate. D reserves the right to instruct T to pay income to B. 'D predeceases A and B. The first $100,000 of income to D, then tricome to A for life, remainder to B. D dies after payment of $.90,000. II TROUSEL BYD The following problems involve a to the T Tuust tay, trustee, on the following alternative terms. What are the estate tax consequences upon D's death? a) Income to D for life, remainder to A and B equally or to their estates. b) Income to D for life, payable once a year on December 1, remainder to A or A's estate, provided that no part of the income accruing between the last December i payment and D's death shall be paid to D, but it shall be added to corpus. c) Income to D for 15 years, remainder to B or B's estate. D dies after 14 years. d) Income to D for 15 years, remainder to B or B's estate. D dies after 17 years. Income to A for 11fe, then to D for life, remainder to BOX B's estate. D predeceases A. Income to w for life, remainder to D if living otherwise to s if then living. D predeceases W and s. Income to w for life, remainder to D 1f living, otherwise to s. D predeceases w and s. Income to A for life, provided D does not direct payment to someone else, remainder to B 11 living, otherwise to A's estate. D dies during A's lifetime. Income to w for life, then to A or B for life as D may direct, remainder to 2. D predeceases W, A and B