Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi Tutor, please assist with the below question: Assume a firm is considering a new project that requires an initial investment and has equal sales

Hi Tutor, please assist with the below question:

- Assume a firm is considering a new project that requires an initial investment and has equal sales and costs over its life. Elaborate on the accounting, cash, or financial break-even point. Justified which breakeven it will reach first, second and the last. Will this ordering always apply? 10marks

- Please provide the definition and the equation to illustrate the concepts.

- Table 11.1 (see screenshot below) may help.

- Please justify and explain whether this rank order will always apply or not.

Marks allocation

2.5 m elaboration on accounting break-even

2.5 m elaboration on cash break-even

2.5 m elaboration on financial break-even

2.5 m ranking and justification

10 m Total

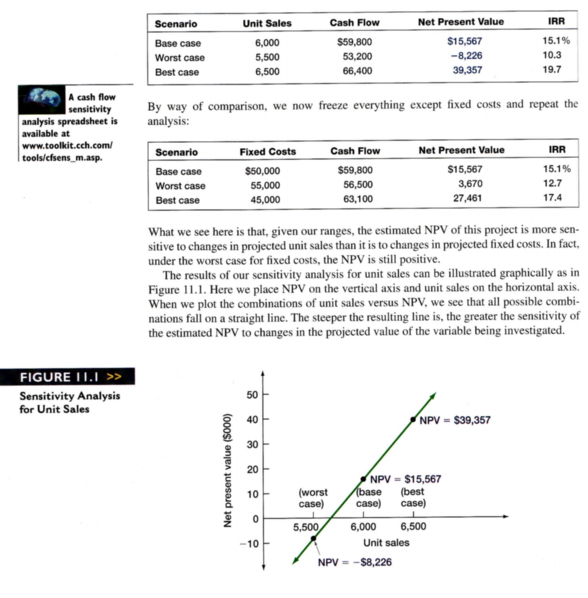

Cash Flow IRR Scenario Base case Worst case Best case Unit Sales 6,000 5,500 6,500 $59,800 53,200 66,400 Net Present Value $15,567 -8,226 39,357 15.1% 10.3 19.7 A cash flow sensitivity analysis spreadsheet is available at www.toolkit.cch.com/ tools/cfsens_m.asp. By way of comparison, we now freeze everything except fixed costs and repeat the analysis: IRR Scenario Base case Worst case Best case Fixed Costs $50,000 55,000 45,000 Cash Flow $59,800 56,500 63,100 Net Present Value S15,567 3,670 27,461 15.1% 12.7 17.4 What we see here is that, given our ranges, the estimated NPV of this project is more sen- sitive to changes in projected unit sales than it is to changes in projected fixed costs. In fact, under the worst case for fixed costs, the NPV is still positive. The results of our sensitivity analysis for unit sales can be illustrated graphically as in Figure 11.1. Here we place NPV on the vertical axis and unit sales on the horizontal axis. When we plot the combinations of unit sales versus NPV, we see that all possible combi- nations fall on a straight line. The steeper the resulting line is, the greater the sensitivity of the estimated NPV to changes in the projected value of the variable being investigated. FIGURE ILI >> Sensitivity Analysis for Unit Sales 50 40 NPV - $39,357 T T 30 Net present value (5000) 20 10 - 0 NPV - $15,567 (worst (base (best case) case) case) 5,500 6,000 6,500 Unit sales NPV = -58,226 -10 Cash Flow IRR Scenario Base case Worst case Best case Unit Sales 6,000 5,500 6,500 $59,800 53,200 66,400 Net Present Value $15,567 -8,226 39,357 15.1% 10.3 19.7 A cash flow sensitivity analysis spreadsheet is available at www.toolkit.cch.com/ tools/cfsens_m.asp. By way of comparison, we now freeze everything except fixed costs and repeat the analysis: IRR Scenario Base case Worst case Best case Fixed Costs $50,000 55,000 45,000 Cash Flow $59,800 56,500 63,100 Net Present Value S15,567 3,670 27,461 15.1% 12.7 17.4 What we see here is that, given our ranges, the estimated NPV of this project is more sen- sitive to changes in projected unit sales than it is to changes in projected fixed costs. In fact, under the worst case for fixed costs, the NPV is still positive. The results of our sensitivity analysis for unit sales can be illustrated graphically as in Figure 11.1. Here we place NPV on the vertical axis and unit sales on the horizontal axis. When we plot the combinations of unit sales versus NPV, we see that all possible combi- nations fall on a straight line. The steeper the resulting line is, the greater the sensitivity of the estimated NPV to changes in the projected value of the variable being investigated. FIGURE ILI >> Sensitivity Analysis for Unit Sales 50 40 NPV - $39,357 T T 30 Net present value (5000) 20 10 - 0 NPV - $15,567 (worst (base (best case) case) case) 5,500 6,000 6,500 Unit sales NPV = -58,226 -10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started