Hi tutors,

I need help with this homework assignment. If it can be completed hours, the price is negotiable.

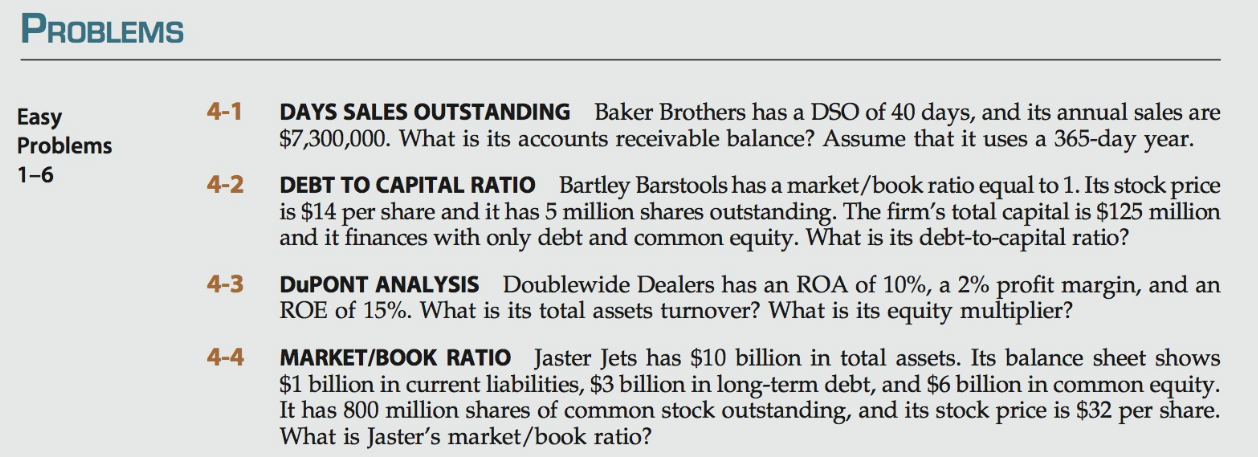

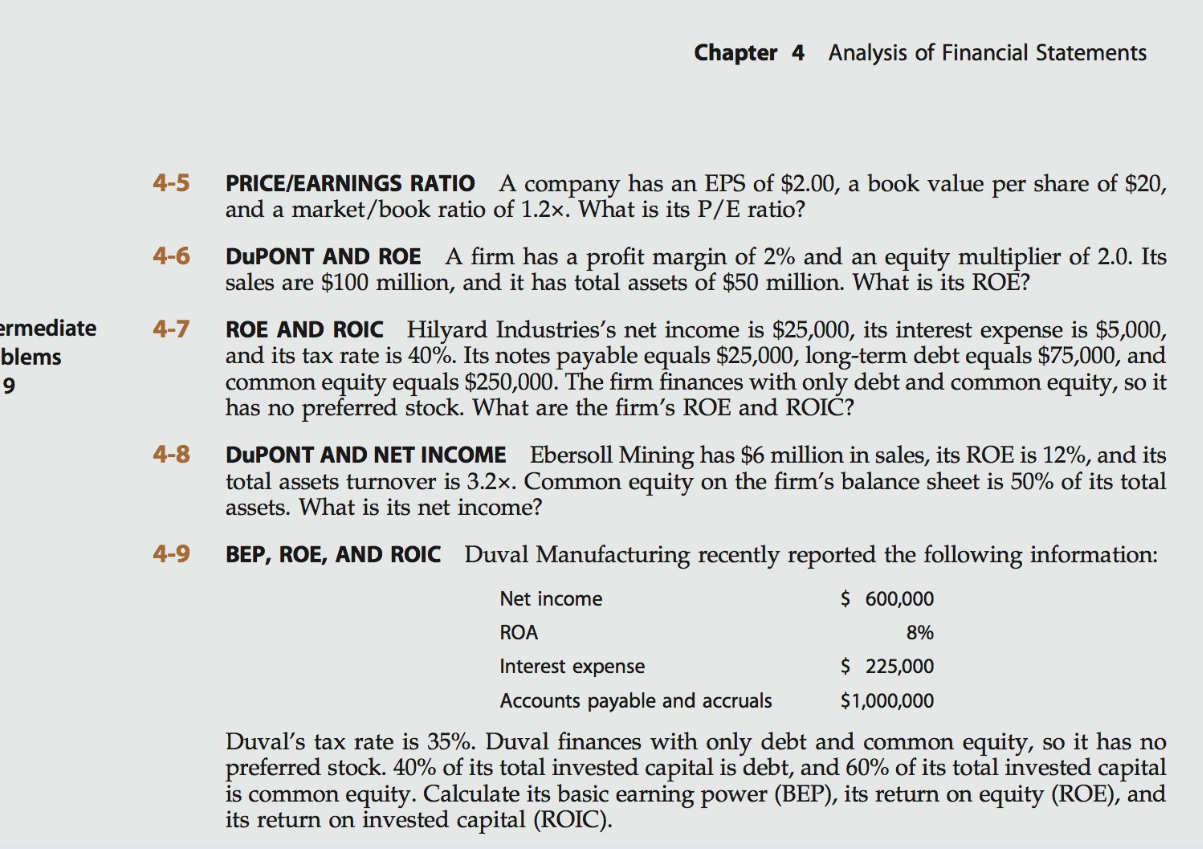

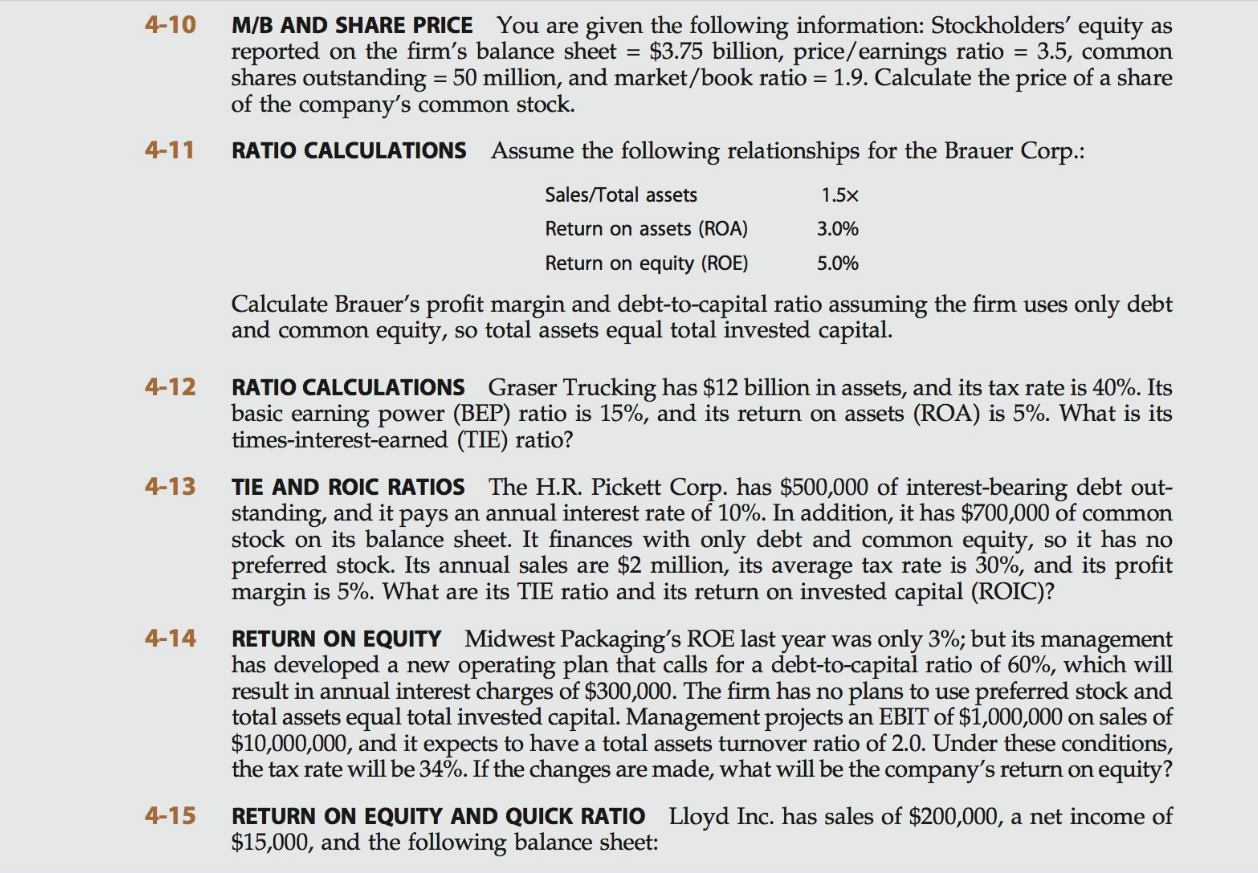

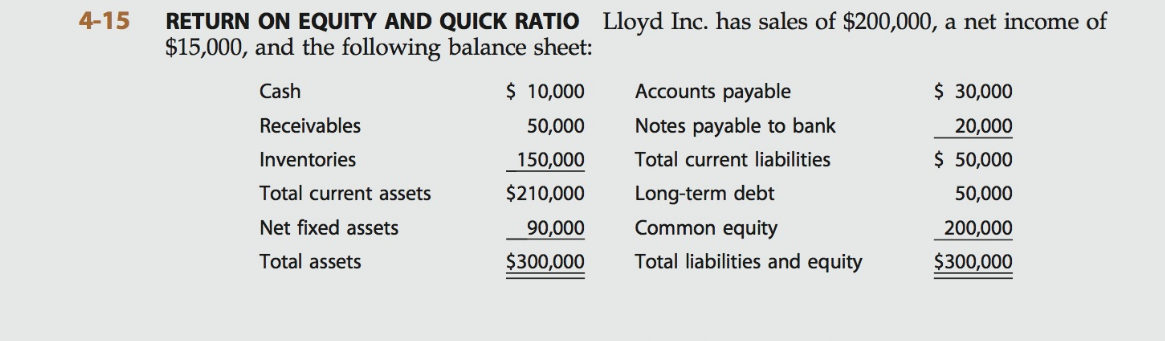

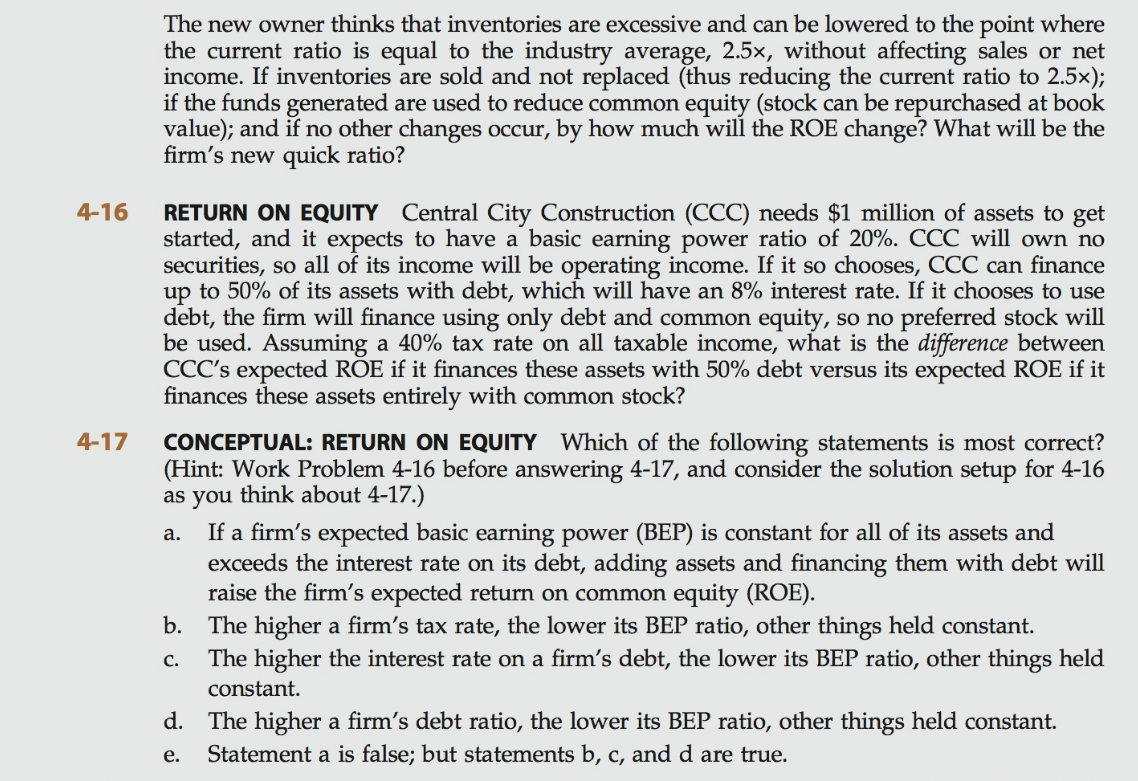

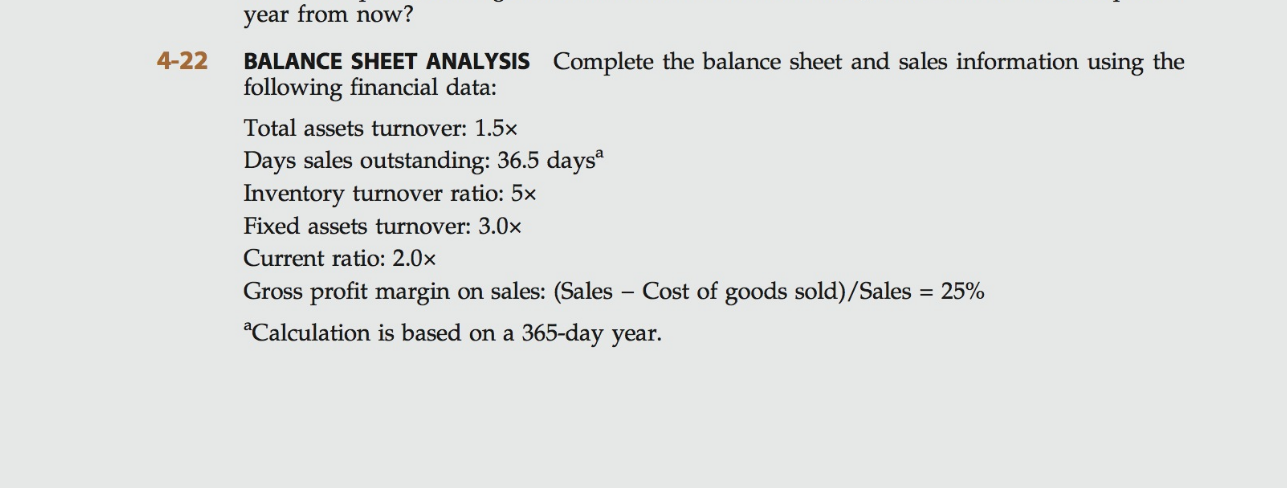

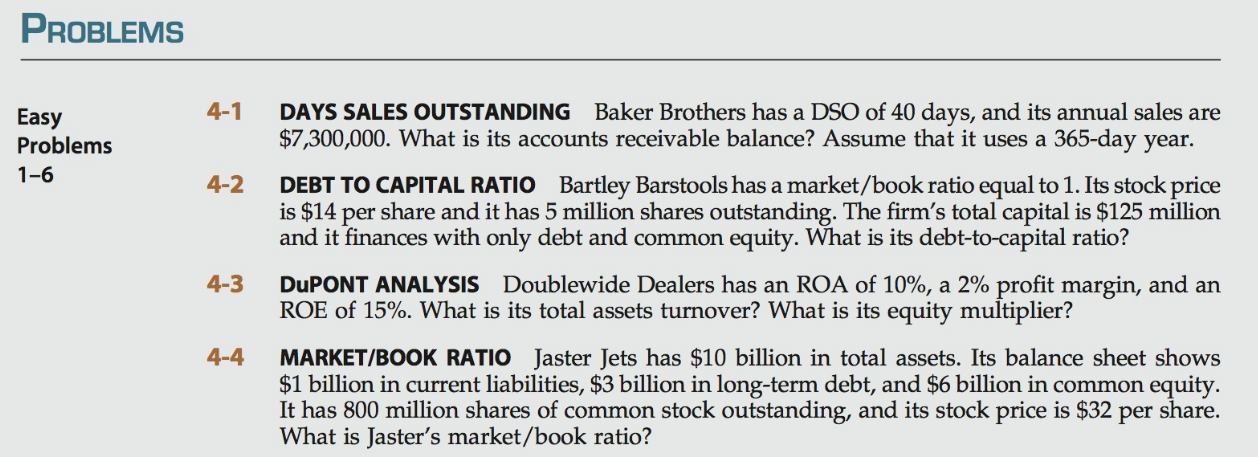

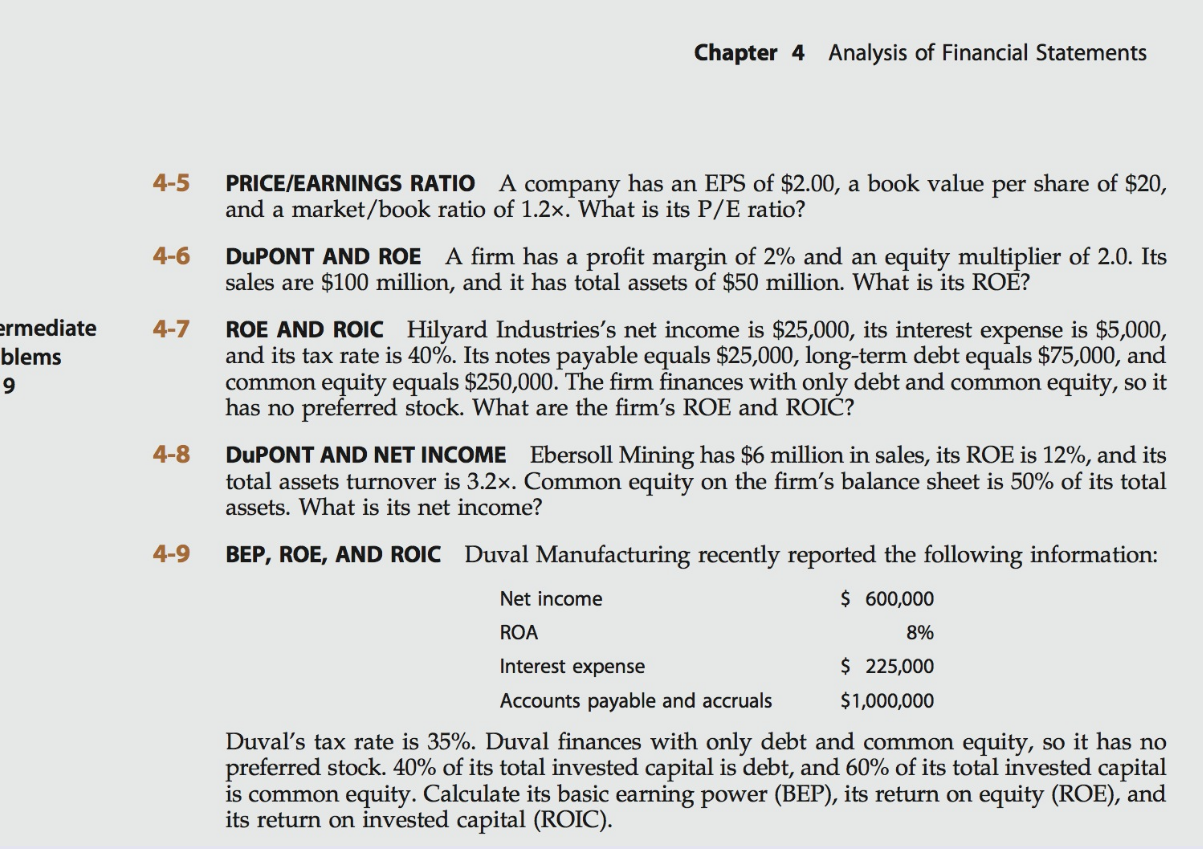

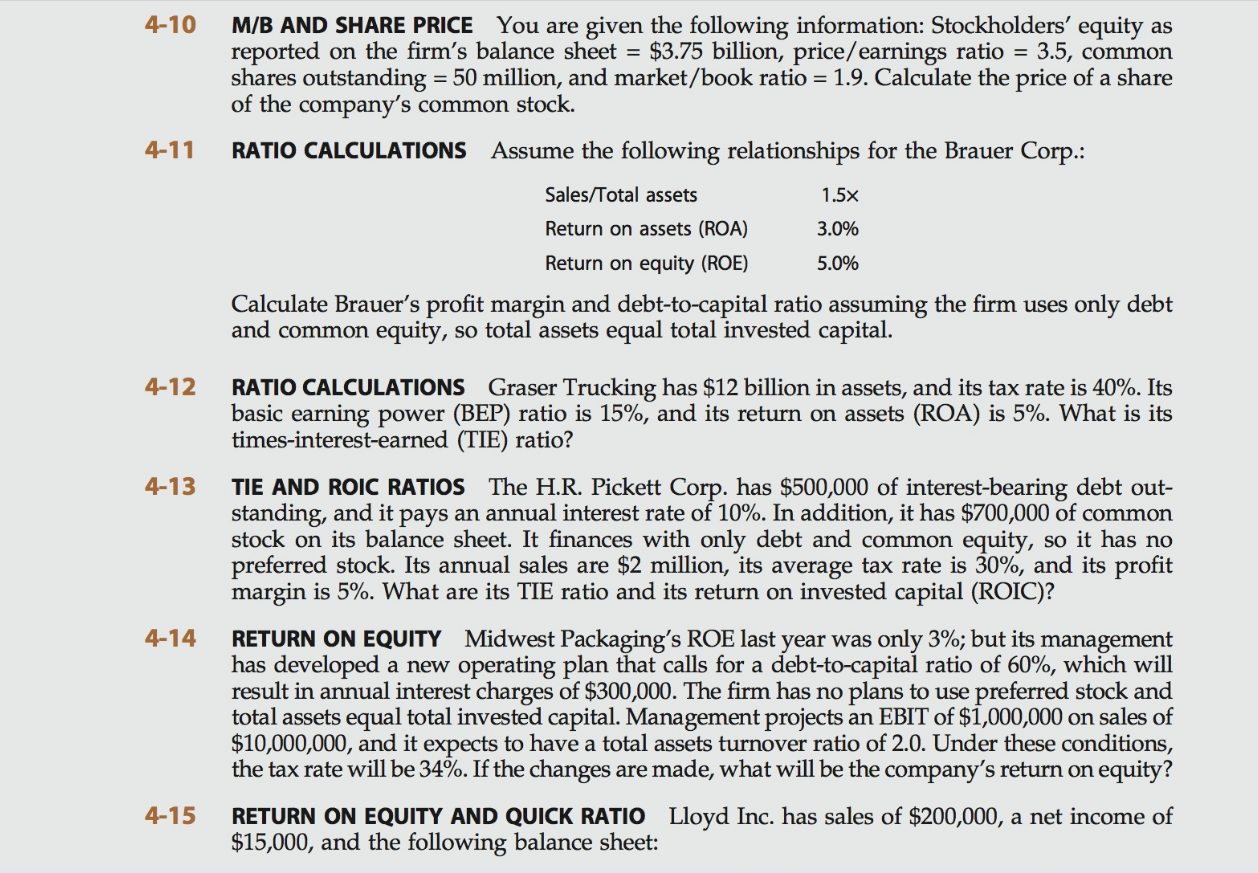

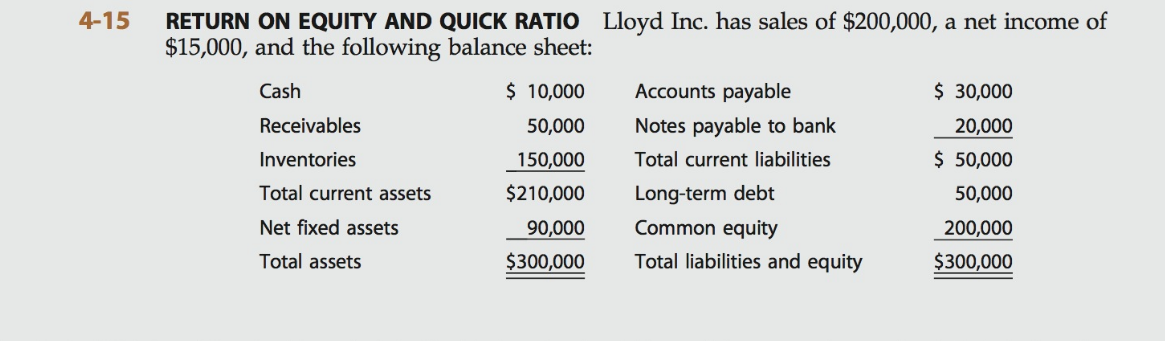

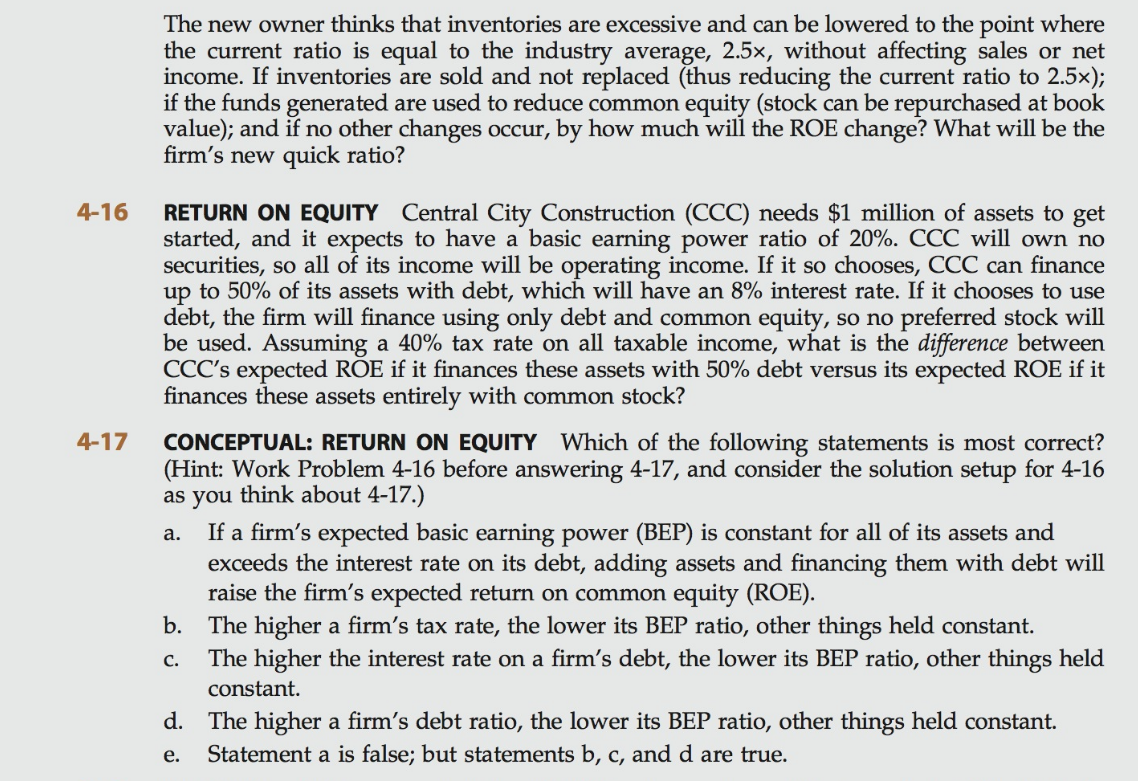

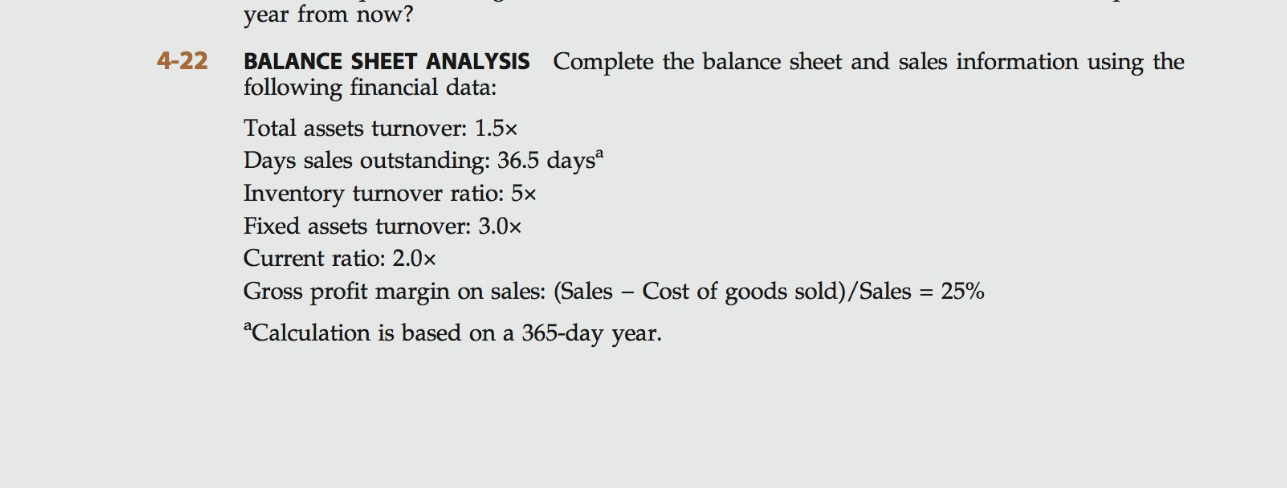

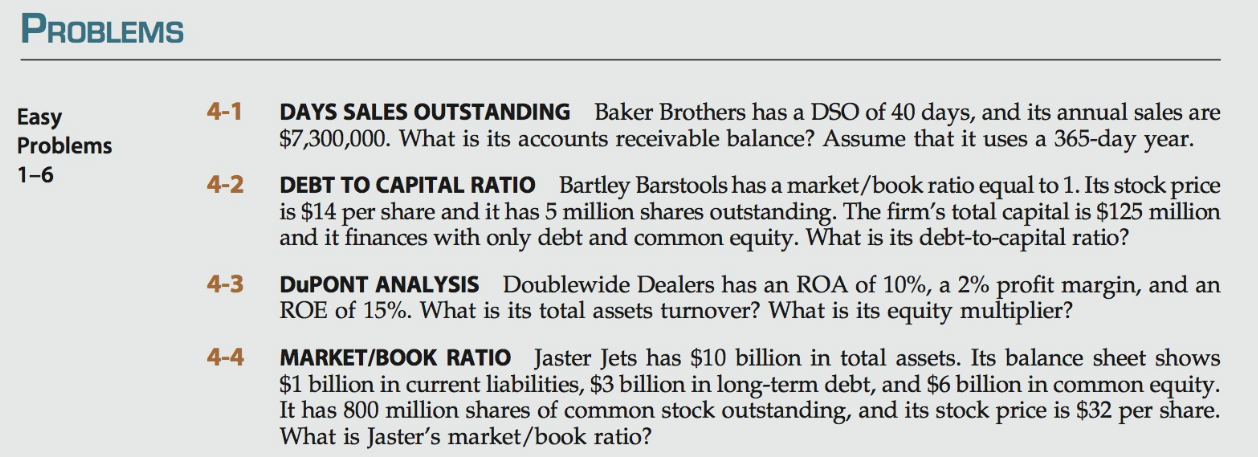

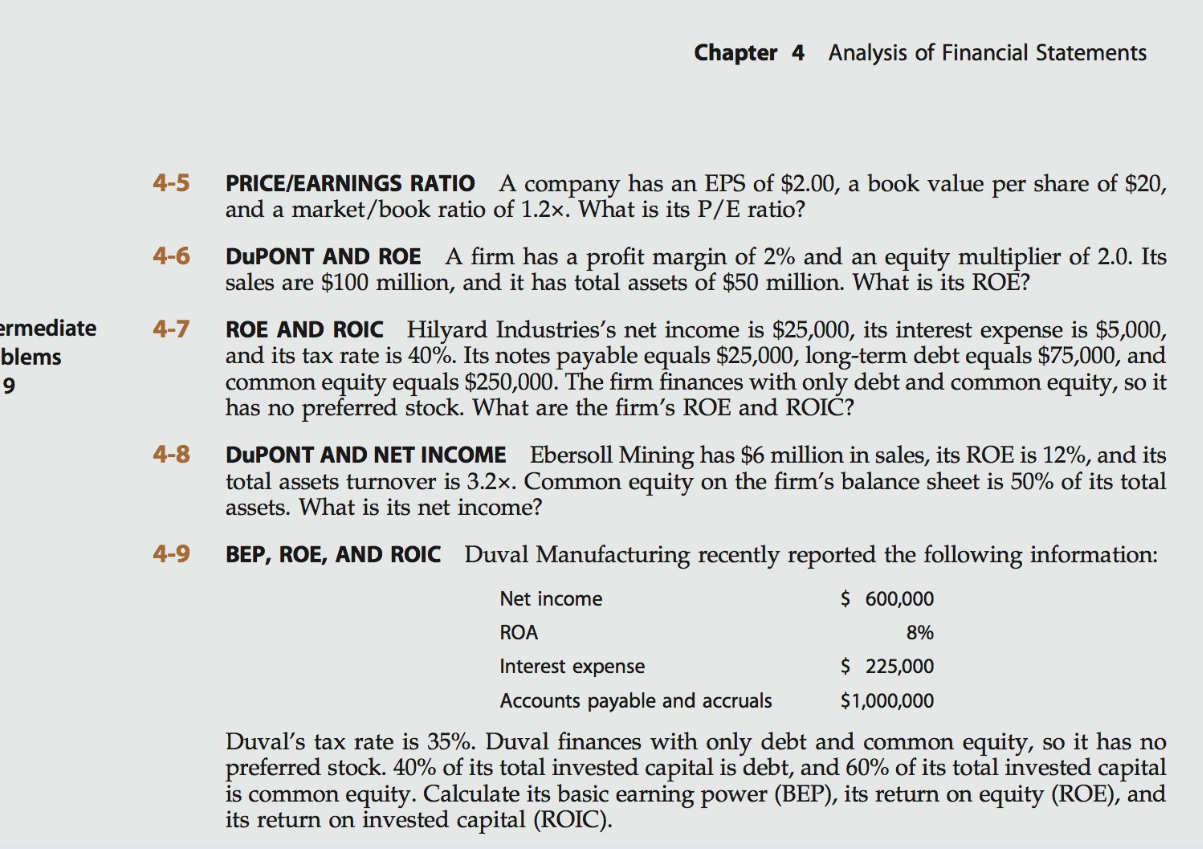

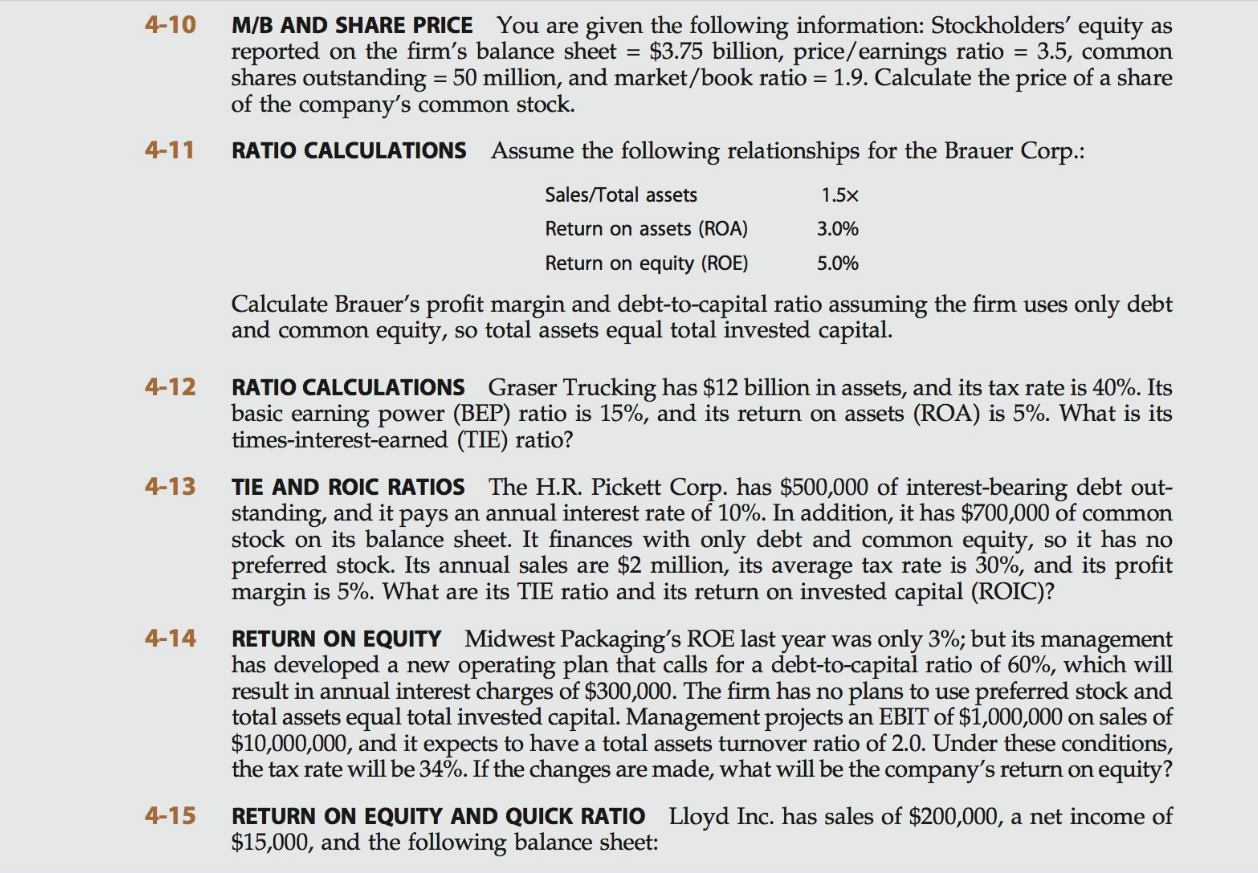

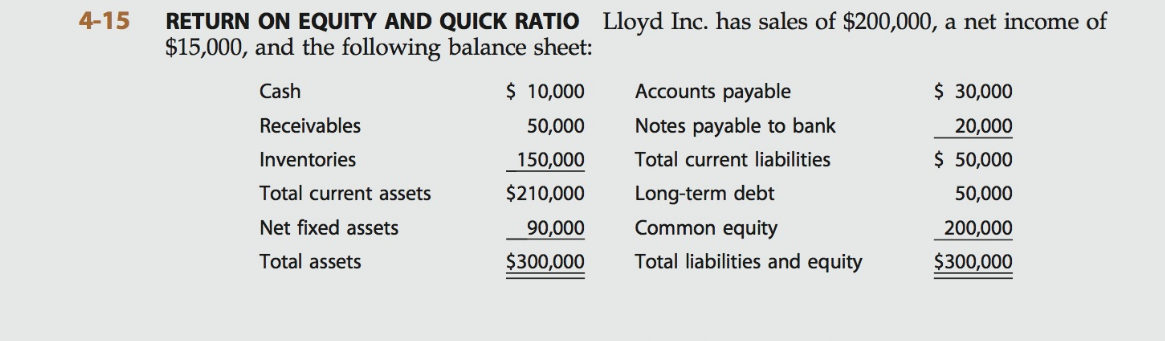

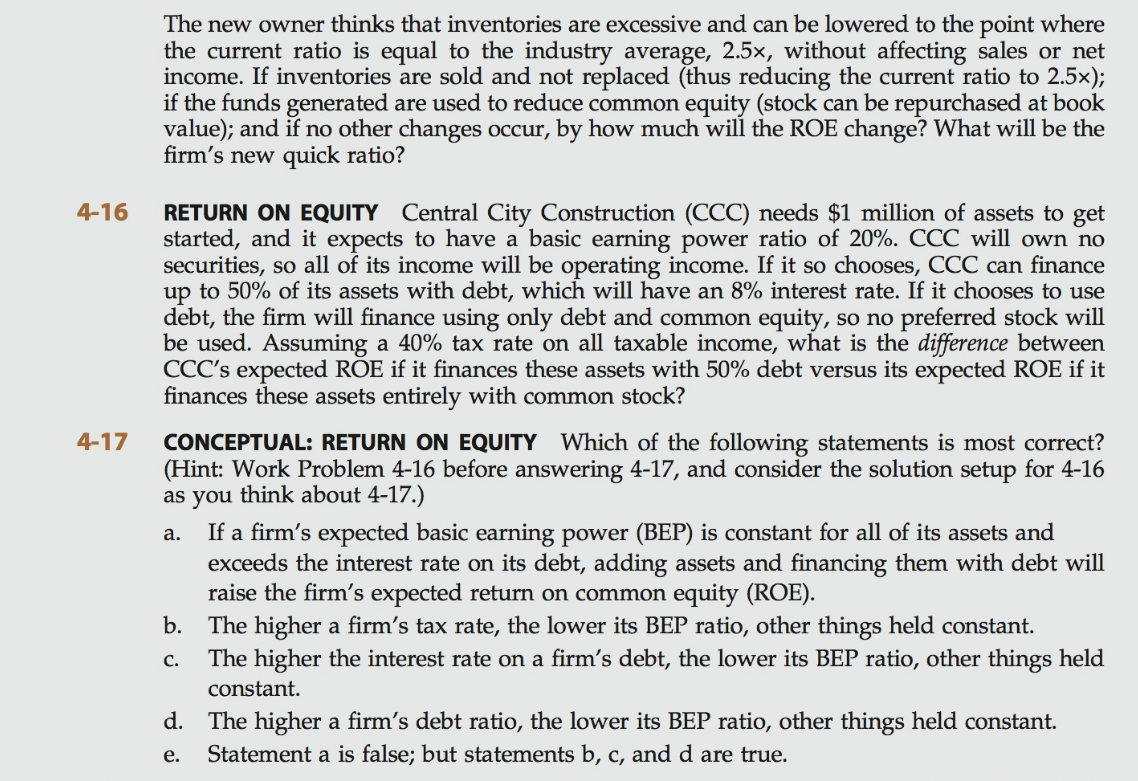

Assignment: Application - Using Ratio Analysis To Inform Organizational Decisions The Assignment: Barry Computer Company Prepare a performance report on Barry Computer Company. (Problem 4-23 on pages 131-132 of the course text provides a balance sheet and an income statement for the company.) Prepare your performance report to show calculations for the eleven ratios listed on page 131132, as well as a comparison of your computed ratios with the listed industry averages. Write a short memo to your supervisor explaining your findings and your recommendations for improvement. Suggest some ways in which the company can plan to improve below industry average ratio performance. Explain why your recommendations would be effective. Be sure to list your computations in an appendix to your report. By Day 7 Submit your Assignment. General Guidance on Application Length: The memo portion of this assignment will typically be 2 pages in length as a general expectation/estimate. You can show your calculations of financial ratios in a supplemental appendix to your memo. PROBLEMS Easy Problems 1 6 4-1 4-2 4-3 DAYS SALES OUTSTANDING Baker Brothers has a D50 0f 40 days, and its annual sales are $7,300,000. What is its accounts receivable balance? Assume that it uses a 365-day year. DEBT TO CAPITAL RATIO Hartley Barstoolshas a market/book ratio equal to 1.1m stock pn'oe is $14 per share and it has 5 million shares outstanding. The firm's total capital is $125 million and it nances with only debt and common equity. What is its debt-tocapital ratio? DuPONT ANALYSIS Doublewide Dealers has an RCA of 10%, a 2% prot margin, and an ROE of 15%. What is its total assets turnover? What is its equity multiplier? MARKETIBOOK RATIO Iaster Jets has $10 billion in total assets. Its balance sheet shows $1 billion in current liabilities, $3 billion in long-term debt, and $6 billion in common equity. It has 800 million shares of common stock outstanding, and its shock price is $32 per share. What is Iaster's market/book ratio? armediate blems 4-5 4-7 4-3 4-9 Chapter 4 Analysis of Financial Statements PRICEIEARNINGS RATIO A company has an EPS of $2.00, a book value per share of $20, and a market/book ratio of 1.2x. What is its P/E ratio? DuPONT AND ROE A firm has a prot margin of 2% and an equity multiplier of 2.0. Its sales are $100 million, and it has total assets of $50 million. What is its ROE? ROE AND ROIC Hjlyard Industries's net income is $25,000, its interest expense is $5,000, and its tax rate is 40%. Its notes payable equals $25,000, long-tam debt equals $75,000, and common equity equals $250,000. The firm nances with only debt and common equity, so it has no preferred stock. What are the rm's ROE and ROIC? DuPONT AND NET INCOME Ebersoll Mining has $6 million in sales, its ROE is 12%, and its total assets turnover is 3.2x. Common equity on the firm's balance sheet is 50% of its total assets. What is its net income? BEP. ROE. AND ROIC Duval Manufacturing recently reported the following information: Net income 5 600,000 RCA 8% Interest expense 5 225,000 Accounts payable and accruals $1 00,000 Duval's tax rate is 35%. Duval finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital' IS debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC). 4-10 4-11 4-12 4-13 4-14 4-15 M AND SHARE PRICE You are given the following information: Stockholders' equity as reported on the rm's balance sheet = $3.75 billion, price/ earnings ratio = 3.5, common shares outstanding = 50 million, and market/book ratio = 1.9. Calculate the price of a share of the company's common stock. RATIO CALCULAHONS Assume the following relationships for the Brauer Corp: Sales/Total assets 1.5x Return on assets (BOA) 3.096 Return on equity (ROE) 5.0% Calculate Brauer's prot margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. RATIO CALCULATIONS Graser Trucking has $12 billion in assets, and its tax rate is 40%. Its basic earning power (BEP) ratio is 15%, and its return on assets (ROA) is 5%. What is its mes-interest-eamed (TIE) ratio? 11E AND ROIC RATIOS The HR. Pickett Corp. has $500,000 of interest-bearing debt out- standing, and it pays an annual interest rate of 10%. In addition, it has $700,000 of common stock on its balance sheet. It nances with only debt and common equity, so it has no preferred stock. Its annual sales are $2 million, its average tax rate is 30%, and its prot margin is 5%. What are its TIE ratio and its return on invested capital (ROIC)? RETURN ON EQUITY Midwest Packaging' 5 ROE last year was only 3%; but iis management has developed a new operating plan that calls for a debt-tocapital ratio of 60%, which will resultmannualintetestcharges of$300,000.'IhermhasnoplanstouseprefeIred stockand total Ms equal total invested capital. Management projects an EBIT of $1,000,000 on sales of $10,000,000, and it expects to have a total assets turnover ratio of 20. Under tl'lese conditions, the tax rate will be 34%. Ifthe changes are made, what will be the company's return on equity? RETURN 0N EQUITY AND QUICK RATIO Lloyd Inc. has sales of $200,000, a net income of $15,000, and the following balance sheet: \f4-16 417 The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 2.5x, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 2.5x); if the funds generated are used to reduce common equity (stock can be repurchased at book value); and if no other changes occur, by how much will the ROE change? What will be the rm's new quick ratio? RETURN ON EQUITY Central City Construction (CCC) needs $1 million of assets to get started, and it expects to have a basic earning power ratio of 20%. CCC will own no securities, so all of its income will be operating income. If it so chooses, CCC can nance up to 50% of its assets with debt, which will have an 8% interest rate. If it chooses to use debt, the firm will nance using only debt and common equity, so no preferred stock will be used. Assuming a 40% tax rate on all taxable income, what is the :1me between CCC's expected ROE if it nances these assets with 50% debt versus its expected ROE if it nances these assets entirely with common stock? CONCEPTUAL: RETURN ON EQUITY Which of the following statements is most correct? (Hint: Work Problem 4-16 before answering 4-17, and consider the solution setup for 4-16 as you think about 4-17.) a. If a rm's expected basic earning power (BEP) is constant for all of its assets and exceeds the interest rate on its debt, adding assets and nancing them with debt will raise the firm's expected return on common equity (ROE). The higher a firm's tax rate, the lower its BEP ratio, other things held constant. c. The higher the interest rate on a firm's debt, the lower its BEP ratio, other things held constant. d. The higher a rm's debt ratio, the lower its BEP ratio, other things held constant. Statement a is false; but statements b, c, and d are true. 9