Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! Would you be able to solve #5 problem using only a financial calculator ? Thanks in advance for your time. 91.53 percent of its

Hi!

Would you be able to solve #5 problem using only a financial calculator ?

Thanks in advance for your time.

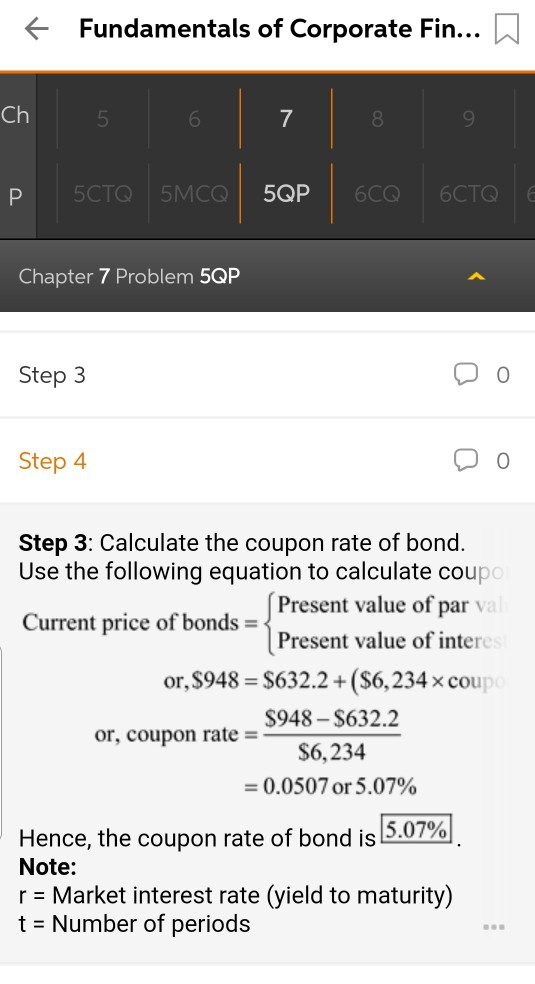

91.53 percent of its 100,000 par value. The bond has a coupuri ale ul 1.4 puitul paid annually and matures in 16 years. What is the yield to maturity of this bond? Coupon Rates [LO2] Essary Enterprises has bonds on the market making annual % Payments, with eight years to maturity, a par value of $1,000, and selling for $948. At mis price, the bonds yield 5.9 percent. What must the coupon rate be on the bonds? rn issued 15-year bonds a year ago at a coupon rate munlue of $1.000. 6. Dn . Lol lano Cossiled 1-ya + Fundamentals of Corporate Fin... a e scTo smco | SOP | GO GCTO Chapter 7 Problem 5QP Step 3 Do Step 4 Do Step 3: Calculate the coupon rate of bond. Use the following equation to calculate coupo Present value of par val Current price of bonds = Present value of interes or $948 = $632.2+($6,234 x coup $948 - $632.2 or, coupon rate = $6,234 = 0.0507 or 5.07% Hence, the coupon rate of bond is 5.07% Note: r = Market interest rate (yield to maturity) t = Number of periodsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started