Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hiap Seng Tyre Sdn. Bhd. is a Malaysian tire and tube manufacturer with its factory located in Shah Alam. Hiap Seng's products obtained ISO-9001 certification.

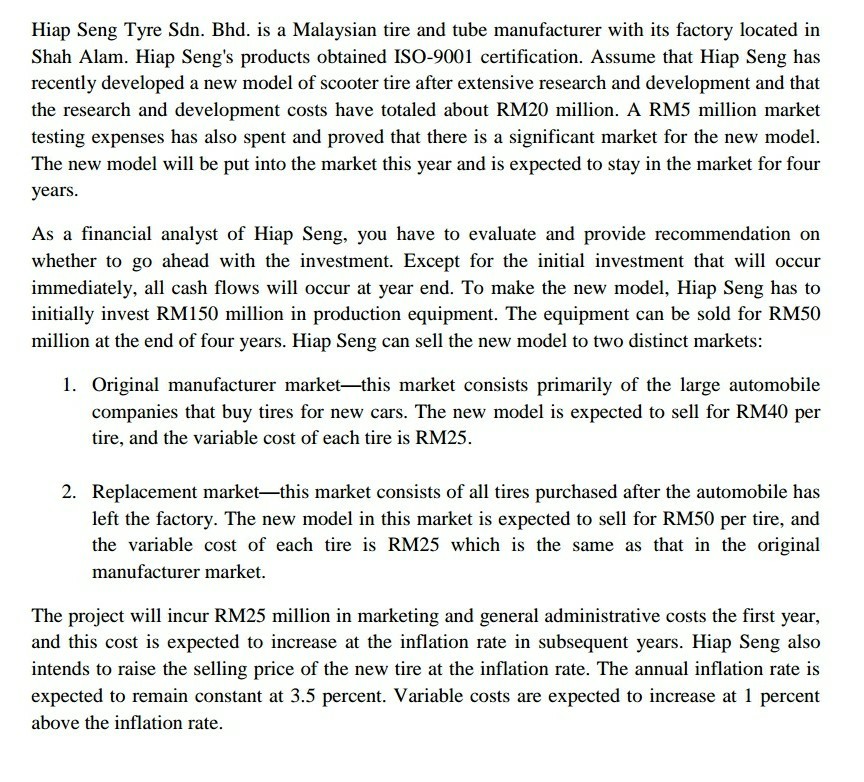

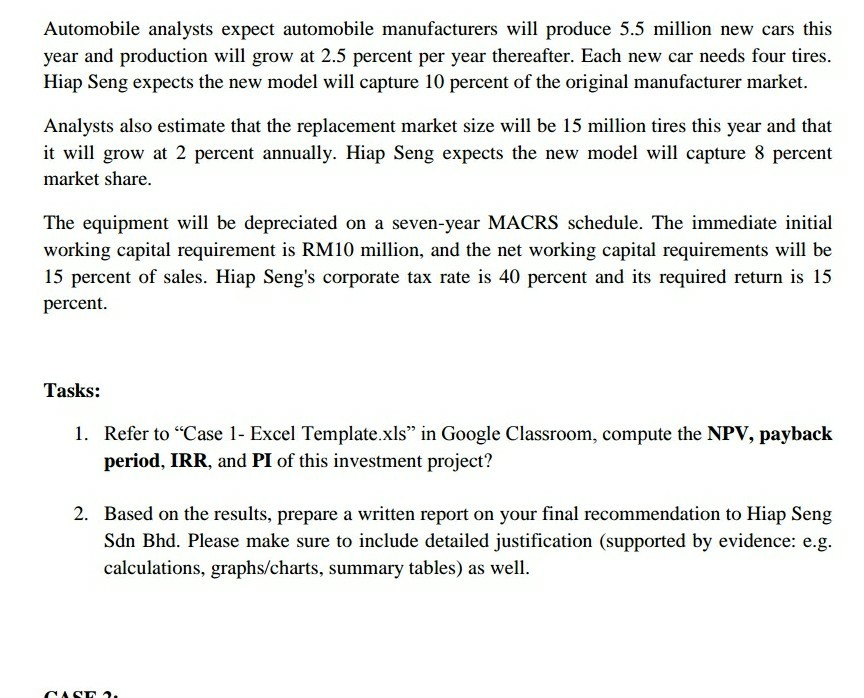

Hiap Seng Tyre Sdn. Bhd. is a Malaysian tire and tube manufacturer with its factory located in Shah Alam. Hiap Seng's products obtained ISO-9001 certification. Assume that Hiap Seng has recently developed a new model of scooter tire after extensive research and development and that the research and development costs have totaled about RM20 million. A RM5 million market testing expenses has also spent and proved that there is a significant market for the new model The new model will be put into the market this year and is expected to stay in the market for four years As a financial analyst of Hiap Seng, you have to evaluate and provide recommendation on whether to go ahead with the investment. Except for the initial investment that will occur immediately, all cash flows will occur at year end. To make the new model, Hiap Seng has to initially invest RM150 million in production equipment. The equipment can be sold for RM50 million at the end of four years. Hiap Seng can sell the new model to two distinct markets 1. Original manufacturer market-this market consists primarily of the large automobile companies that buy tires for new cars. The new model is expected to sell for RM40 per tire, and the variable cost of each tire is RM25 2. Replacement market-this market consists of all tires purchased after the automobile has left the factory. The new model in this market is expected to sell for RM50 per tire, and the variable cost of each tire is RM25 which is the same as that in the original manufacturer market. The project will incur RM25 million in marketing and general administrative costs the first year and this cost is expected to increase at the inflation rate in subsequent years. Hiap Seng also intends to raise the selling price of the new tire at the inflation rate. The annual inflation rate is expected to remain constant at 3.5 percent. Variable costs are expected to increase at 1 percent above the inflation rate. Hiap Seng Tyre Sdn. Bhd. is a Malaysian tire and tube manufacturer with its factory located in Shah Alam. Hiap Seng's products obtained ISO-9001 certification. Assume that Hiap Seng has recently developed a new model of scooter tire after extensive research and development and that the research and development costs have totaled about RM20 million. A RM5 million market testing expenses has also spent and proved that there is a significant market for the new model The new model will be put into the market this year and is expected to stay in the market for four years As a financial analyst of Hiap Seng, you have to evaluate and provide recommendation on whether to go ahead with the investment. Except for the initial investment that will occur immediately, all cash flows will occur at year end. To make the new model, Hiap Seng has to initially invest RM150 million in production equipment. The equipment can be sold for RM50 million at the end of four years. Hiap Seng can sell the new model to two distinct markets 1. Original manufacturer market-this market consists primarily of the large automobile companies that buy tires for new cars. The new model is expected to sell for RM40 per tire, and the variable cost of each tire is RM25 2. Replacement market-this market consists of all tires purchased after the automobile has left the factory. The new model in this market is expected to sell for RM50 per tire, and the variable cost of each tire is RM25 which is the same as that in the original manufacturer market. The project will incur RM25 million in marketing and general administrative costs the first year and this cost is expected to increase at the inflation rate in subsequent years. Hiap Seng also intends to raise the selling price of the new tire at the inflation rate. The annual inflation rate is expected to remain constant at 3.5 percent. Variable costs are expected to increase at 1 percent above the inflation rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started