Answered step by step

Verified Expert Solution

Question

1 Approved Answer

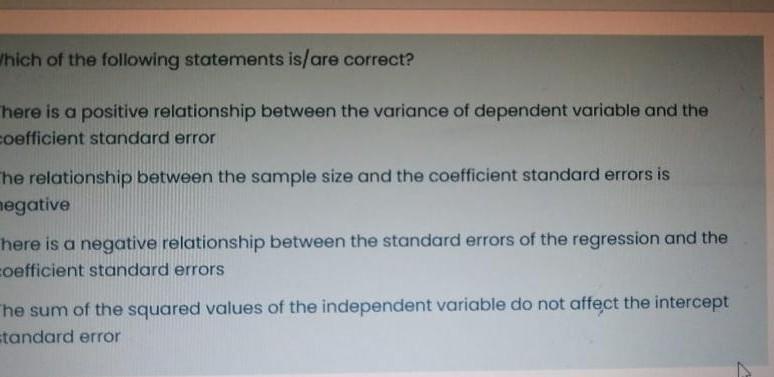

hich of the following statements is/are correct? here is a positive relationship between the variance of dependent variable and the coefficient standard error The relationship

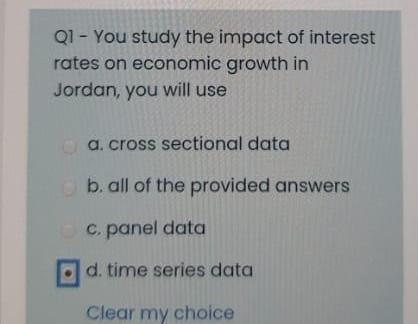

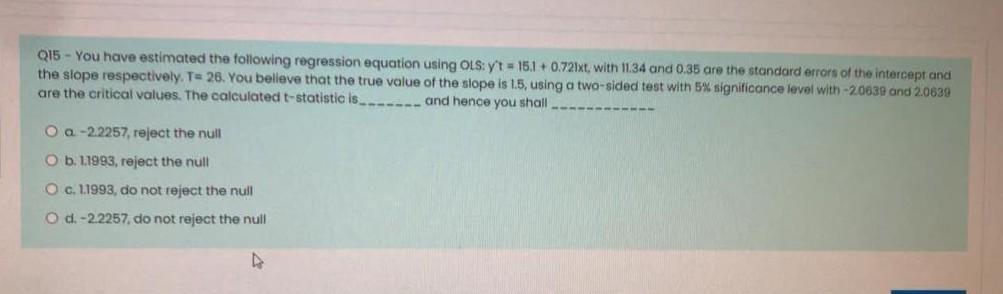

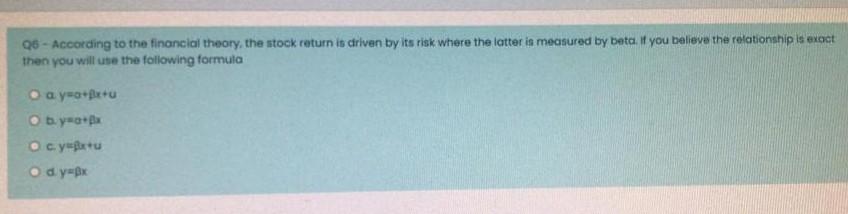

hich of the following statements is/are correct? here is a positive relationship between the variance of dependent variable and the coefficient standard error The relationship between the sample size and the coefficient standard errors is negative here is a negative relationship between the standard errors of the regression and the oefficient standard errors The sum of the squared values of the independent variable do not affect the intercept standard error Q1 - You study the impact of interest rates on economic growth in Jordan, you will use a. cross sectional data b. all of the provided answers c. panel data d. time series data Clear my choice Q15 - You have estimated the following regression equation using OLS:yt = 15.1 +0.72ixt, with 11.34 and 0.35 are the standard errors of the intercept and the slope respectively. T= 26. You believe that the true value of the slope is 1.5, using a two-sided test with 5% significance level with -20830 and 2.0639 are the critical values. The calculated t-statistic is --- and hence you shall O a-22257, reject the null O b. 1.1993, reject the null O c. 1.1993, do not reject the null O d.-22257, do not reject the null 96 - According to the financial theory, the stock return is driven by its risk where the latter is measured by bata. If you believe the relationship is exact then you will use the following formula a yafuu O d.y=Bx hich of the following statements is/are correct? here is a positive relationship between the variance of dependent variable and the coefficient standard error The relationship between the sample size and the coefficient standard errors is negative here is a negative relationship between the standard errors of the regression and the oefficient standard errors The sum of the squared values of the independent variable do not affect the intercept standard error Q1 - You study the impact of interest rates on economic growth in Jordan, you will use a. cross sectional data b. all of the provided answers c. panel data d. time series data Clear my choice Q15 - You have estimated the following regression equation using OLS:yt = 15.1 +0.72ixt, with 11.34 and 0.35 are the standard errors of the intercept and the slope respectively. T= 26. You believe that the true value of the slope is 1.5, using a two-sided test with 5% significance level with -20830 and 2.0639 are the critical values. The calculated t-statistic is --- and hence you shall O a-22257, reject the null O b. 1.1993, reject the null O c. 1.1993, do not reject the null O d.-22257, do not reject the null 96 - According to the financial theory, the stock return is driven by its risk where the latter is measured by bata. If you believe the relationship is exact then you will use the following formula a yafuu O d.y=Bx

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started