Answered step by step

Verified Expert Solution

Question

1 Approved Answer

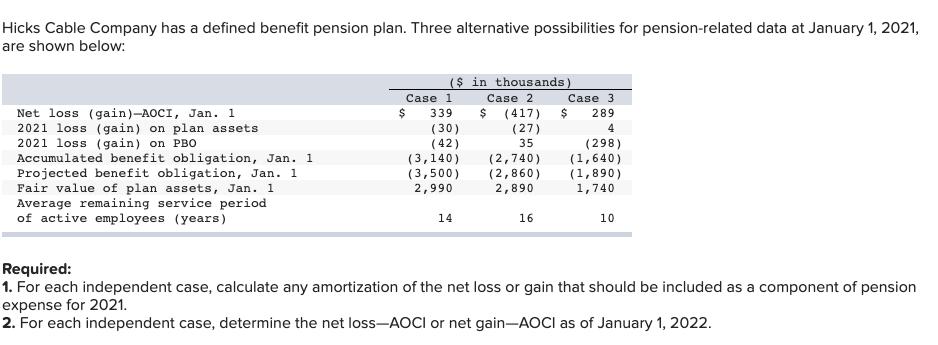

Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2021, are shown below: ($ in

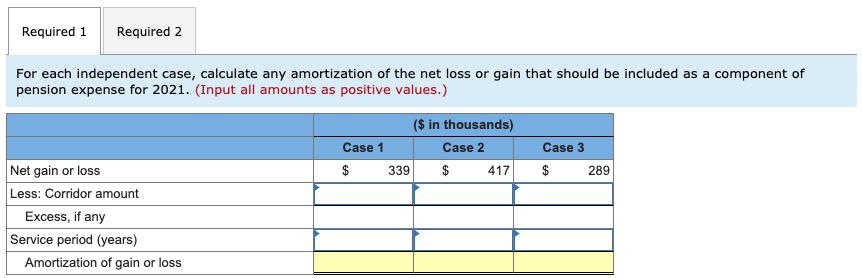

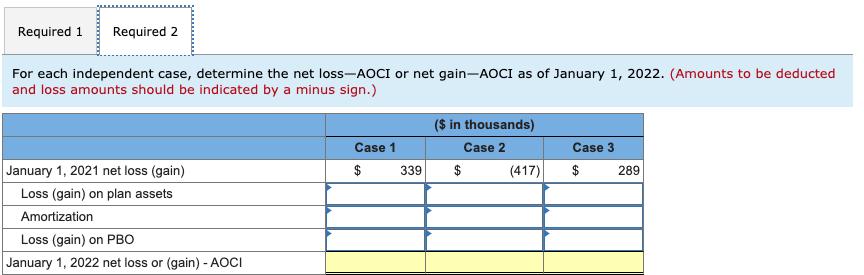

Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2021, are shown below: ($ in thousands) Case 1 Case 2 Case 3 $ (417) $ Net loss (gain)-AOCI, Jan. 1 2021 loss (gain) on plan assets 2021 loss (gain) on PBO Accumulated benefit obligation, Jan. 1 Projected benefit obligation, Jan. 1 Fair value of plan assets, Jan. 1 Average remaining service period of active employees (years) $ 339 289 (30) ( 42) (3,140) (3,500) 2,990 (27) 4 35 (2,740) (2,860) 2,890 (298) (1,640) (1,890) 1,740 14 16 10 Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2021. 2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2022. Required 1 Required 2 For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2021. (Input all amounts as positive values.) ($ in thousands) Case 1 Case 2 Case 3 Net gain or loss Less: Corridor amount $ 339 $ 417 $ 289 Excess, if any Service period (years) Amortization of gain or loss Required 1 Required 2 For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2022. (Amounts to be deducted and loss amounts should be indicated by a minus sign.) ($ in thousands) Case 1 Case 2 Case 3 January 1, 2021 net loss (gain) $ 339 $ (417) $ 289 Loss (gain) on plan assets Amortization Loss (gain) on PB0 January 1, 2022 net loss or (gain) - AOCI

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Case POB or Plan Asset Choose greater 10 of greater Case 1 35...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started