Answered step by step

Verified Expert Solution

Question

1 Approved Answer

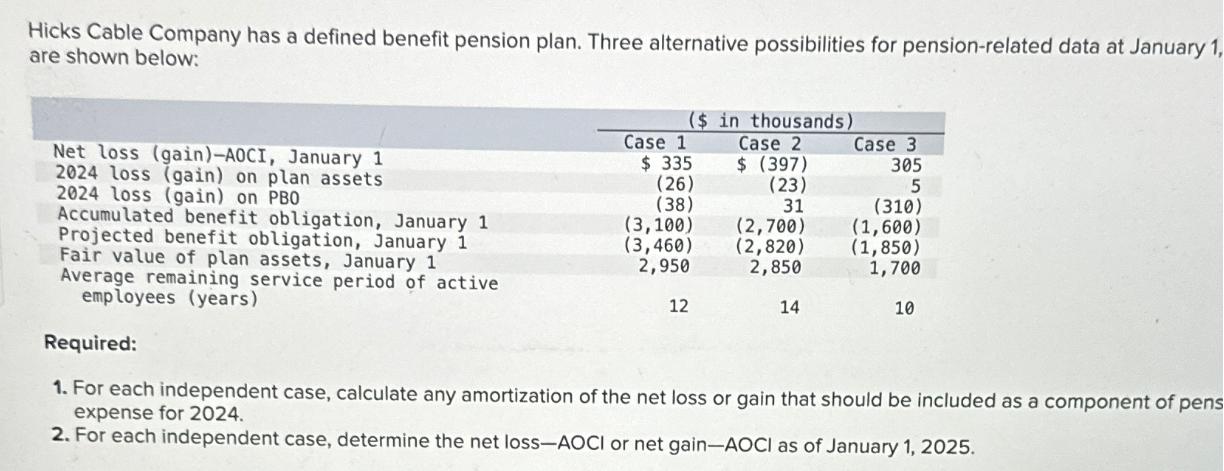

Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, are shown below: Case 1 Net

Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, are shown below: Case 1 Net loss (gain)-AOCI, January 1 2024 loss (gain) on plan assets 2024 loss (gain) on PBO $ 335 (26) ($ in thousands) Case 2 $ (397) (23) Case 3 305 5 (38) Accumulated benefit obligation, January 1 Projected benefit obligation, January 1 Fair value of plan assets, January 1 Average remaining service period of active employees (years) 31 (3,100) (2,700) (310) (1,600) (3,460) (2,820) (1,850) 2,950 2,850 1,700 12 14 10 Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pens expense for 2024. 2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2025.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculation of Amortization of Net Loss or Gain for Pension Expense Case 1 Net Loss GainAOCI January 1 335 2024 Loss Gain on Plan Assets 26 2024 Los...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66430b6636620_952798.pdf

180 KBs PDF File

66430b6636620_952798.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started