Question

Highland plc owns two subsidiaries acquired as follows: 1 July 1991 80% of Aviemore Ltd for 5 million when the book value of the net

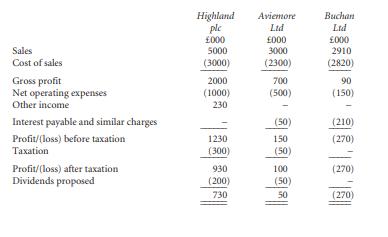

Highland plc owns two subsidiaries acquired as follows: 1 July 1991 80% of Aviemore Ltd for £5 million when the book value of the net assets of Aviemore Ltd was £4 million. 30 November 1997 65% of Buchan Ltd for £2 million when the book value of the net assets of Buchan Ltd was £1.35 million. The companies’ profit and loss account for the year ended 31 March 1998 were:

Additional information

(1) On 1 April 1997, Buchan Ltd issued £2.1 million 10% loan stock to Highland plc. Interest is payable twice yearly on 1 October and 1 April. Highland plc has accounted for the interest received on 1 October 1997 only.

(2) On 1 July 1997, Aviemore Ltd sold a freehold property to Highland plc for £800 000 (land element – £300 000). The property originally cost £900 000 (land element – £100 000) on 1 July 1987. The property’s total useful economic life was 50 years on 1 July 1987 and there has been no change in the useful economic life since. Aviemore Ltd has credited the profit on disposal to ‘Net operating expenses’.

(3) The fixed assets of Buchan Ltd on 30 November 1997 were valued at £500 000 (book value £350 000) and were acquired in April 1997. The fixed assets have a total useful economic life of ten years. Buchan Ltd has not adjusted its accounting records to reflect fair values.

(4) All companies use the straight-line method of depreciation and charge a full year’s depreciation in the year of acquisition and none in the year of disposal.

(5) Highland plc charges Aviemore Ltd an annual fee of £85 000 for management services and this has been included in ‘Other income’.

(6) Highland plc has accounted for its dividend receivable from Aviemore Ltd in ‘Other income’.

(7) It is group policy to amortize goodwill arising on acquisitions over ten years.

Requirement

Prepare the consolidated profit and loss account for Highland plc for the year ended 31 March 1998.

(ICAEW, Financial Reporting, May 1998)

Sales Cost of sales Gross profit Net operating expenses Other income Interest payable and similar charges Profit/(loss) before taxation Taxation Profit/(loss) after taxation Dividends proposed Highland plc 000 5000 (3000) 2000 (1000) 230 1230 (300) 930 (200) 730 Aviemore Ltd 000 3000 (2300) 8888888*|| (500) (50) Buchan Ltd 000 2910 (2820) 90 (150) (210) (270) (270) (270)

Step by Step Solution

3.44 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

Highland plc Consolidated Profit and Loss Account For the year ended 31 Ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started