Answered step by step

Verified Expert Solution

Question

1 Approved Answer

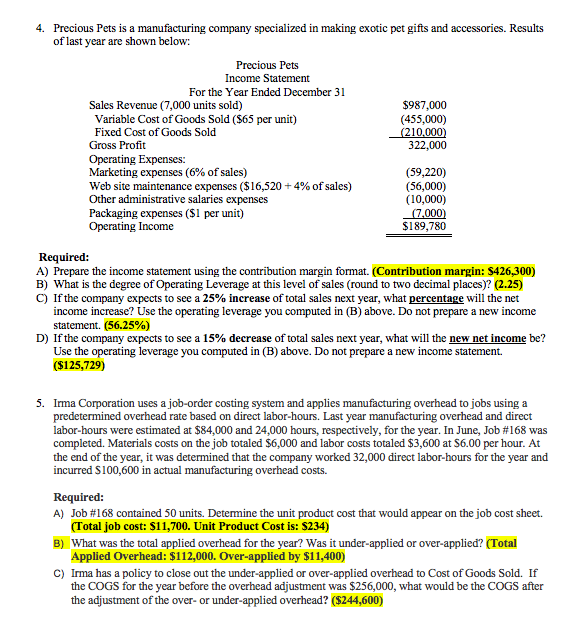

Highlighted are the checked figures! 4. Precious Pets is a manufacturing company specialized in making exotic pet gifts and accessories. Results of last year are

Highlighted are the checked figures!

4. Precious Pets is a manufacturing company specialized in making exotic pet gifts and accessories. Results of last year are shown below: Precious Pets Income Statement For the Year Ended December 3l $987,000 (455,000) Sales Revenue (7,000 units sold) Variable Cost of Goods Sold ($65 per unit) Fixed Cost of Goods Sold Gross Profit 322,000 Marketing expenses (6% of sales) web site maintenance expenses ($ 16,520 Other administrative salaries expenses Packaging expenses ($1 per unit) Operating Income (59,220) (56,000) (10,000) (7.000) $189,780 4% of sales) Required: A) Prepare the income statement using the contribution margin format. (Contribution margin: $426,300) B) What is the degree of Operating Leverage at this level of sales (round to two decimal places)? (2.25) C) If the company expects to see a 25% increase of total sales next year, what percentage will the net income increase? Use the operating leverage you computed in (B) above. Do not prepare a new income statement. (56.25%) D) If the company expects to see a 15% decrease of total sales next year, what will the new net income be? Use the operating leverage you computed in (B) above. Do not prepare a new income statement (S125,729) 5. Irma Corporation uses a job-order costing system and applies manufacturing overhead to jobs using a predetermined overhead rate based on direct labor-hours. Last year manufacturing overhead and direct labor-hours were estimated at $84,000 and 24,000 hours, respectively, for the year. In June, Job #168 was completed. Materials costs on the job totaled $6,000 and labor costs totaled $3,600 at S6.00 per hour. At the end of the year, it was determined that the company worked 32,000 direct labor-hours for the year and incurred S100,600 in actual manufacturing overhead costs. Required: A) Job #168 contained 50 units. Determine the unit product cost that would appear on the job cost sheet. (Total job cost: $11,700. Unit Product Cost is: $234) What was the total applied overhead for the year? Was it under-applied or over-applied? (Total Applied Overhead: $112,000. Over-applied by $11,400) Irma has a policy to close out the under-applied or over-applied overhead to Cost of Goods Sold. the COGS for the year before the overhead adjustment was $256,000, what would be the COGS after the adjustment of the over- or B) C) IfStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started