Answered step by step

Verified Expert Solution

Question

1 Approved Answer

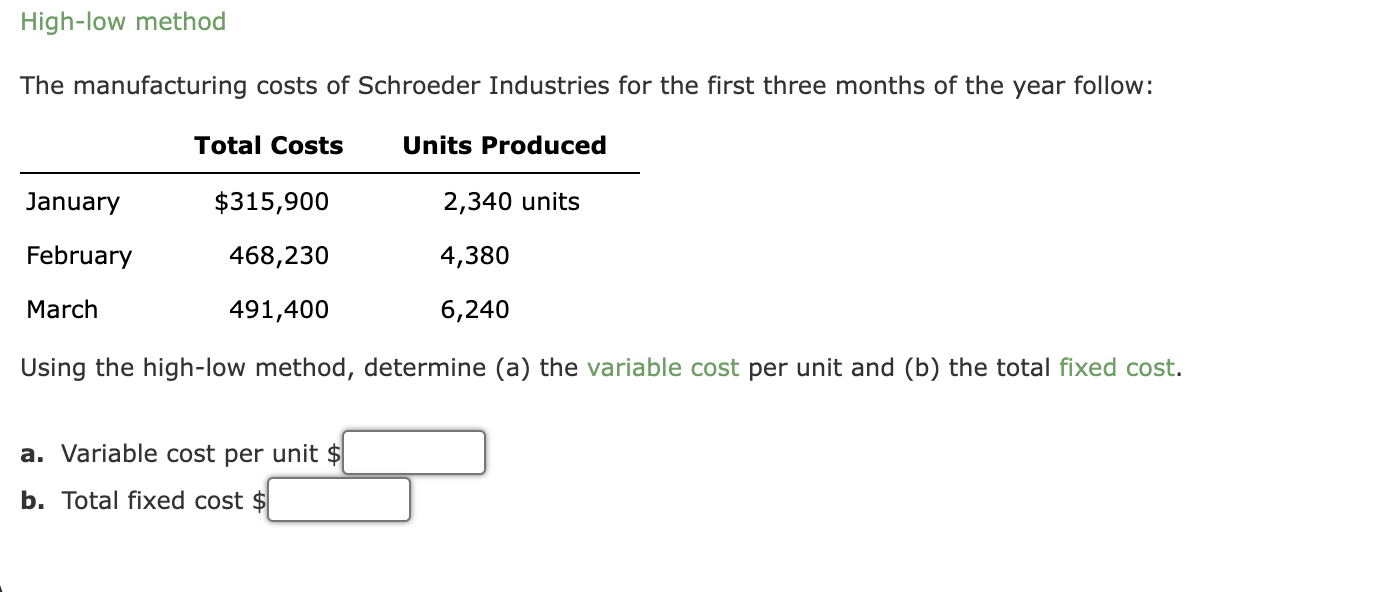

High-low method The manufacturing costs of Schroeder Industries for the first three months of the year follow: Total Costs Units Produced January $315,900 2,340

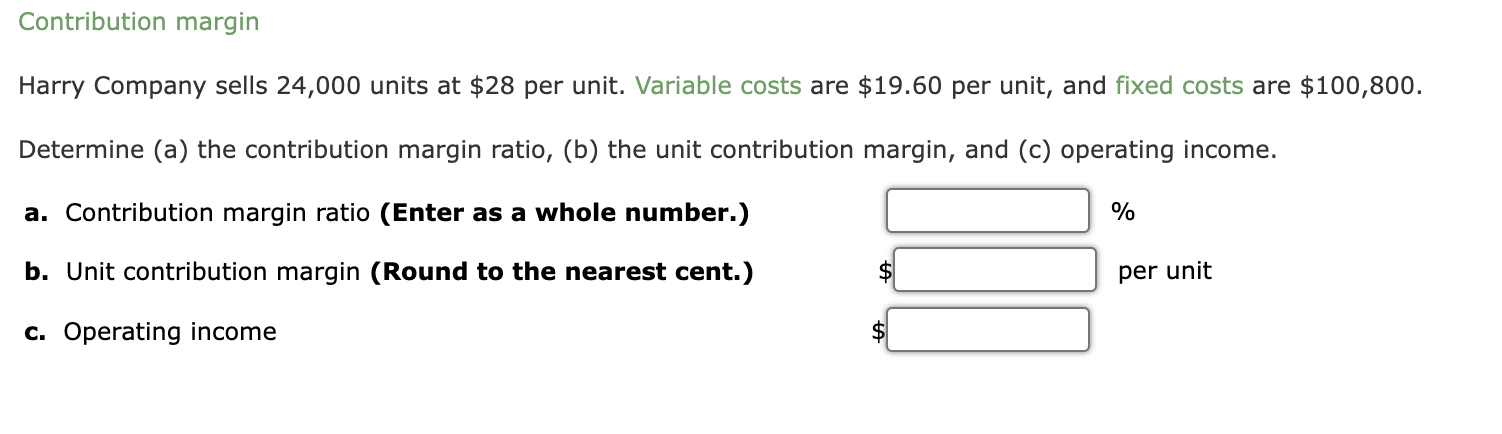

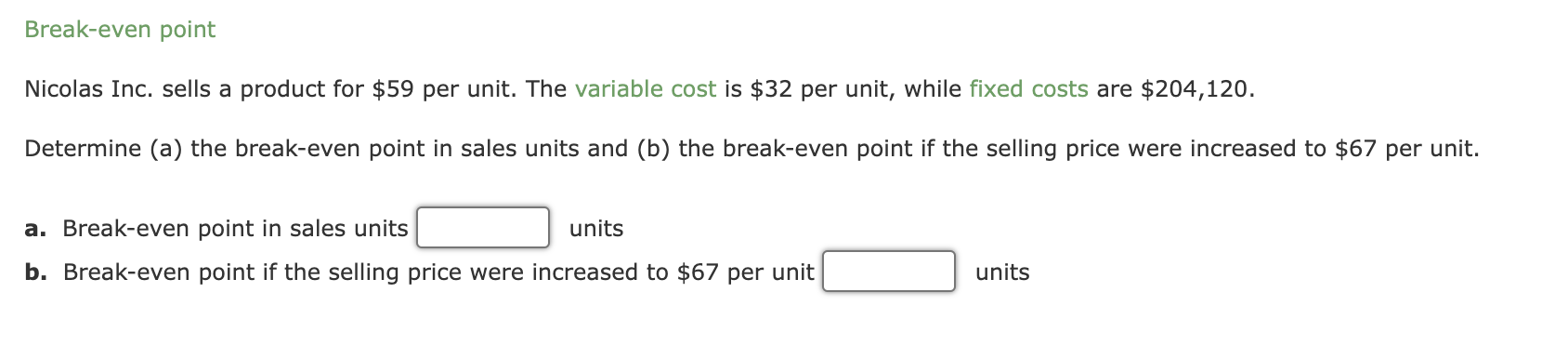

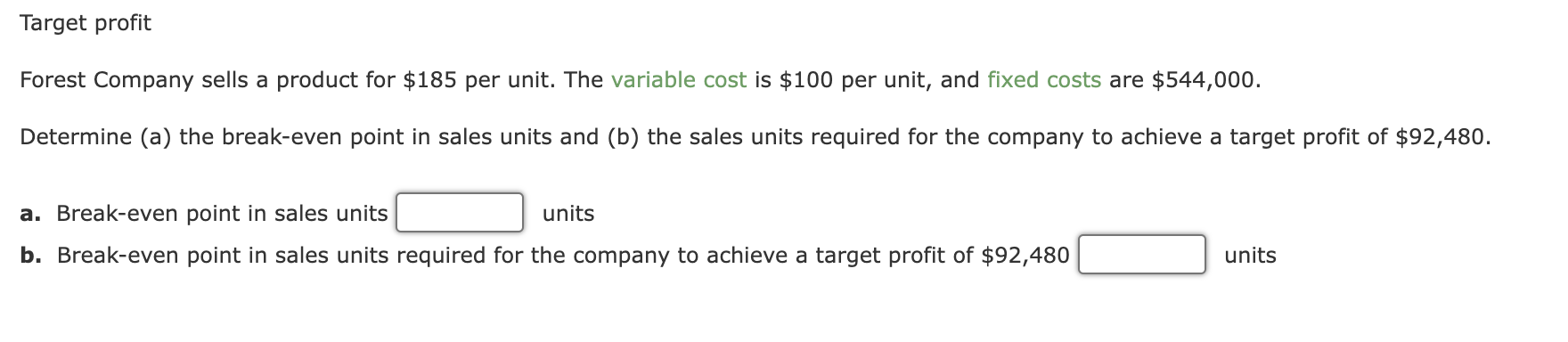

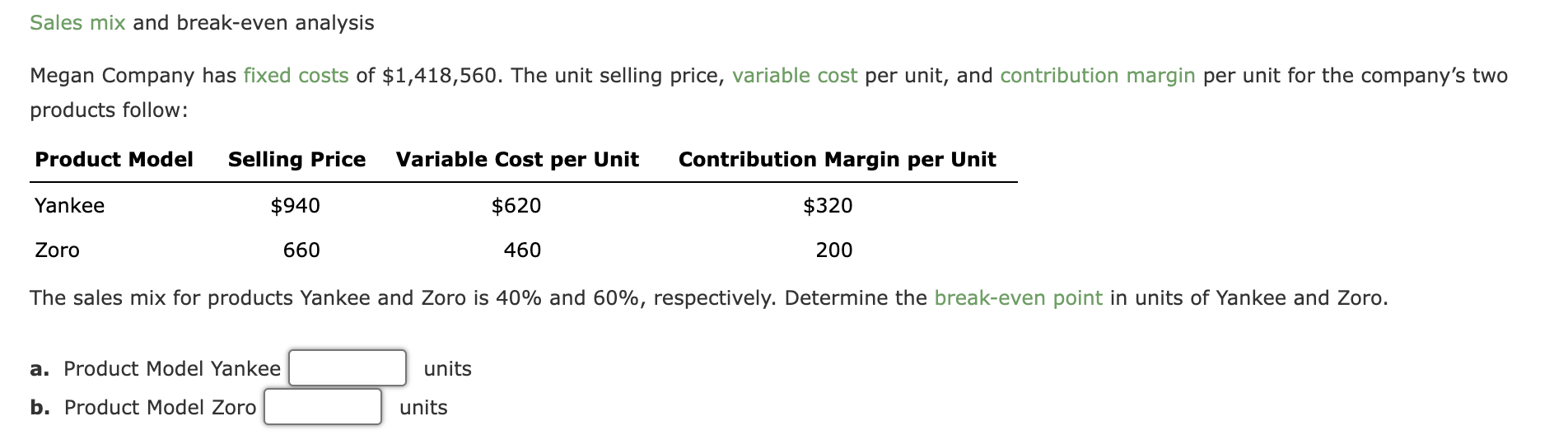

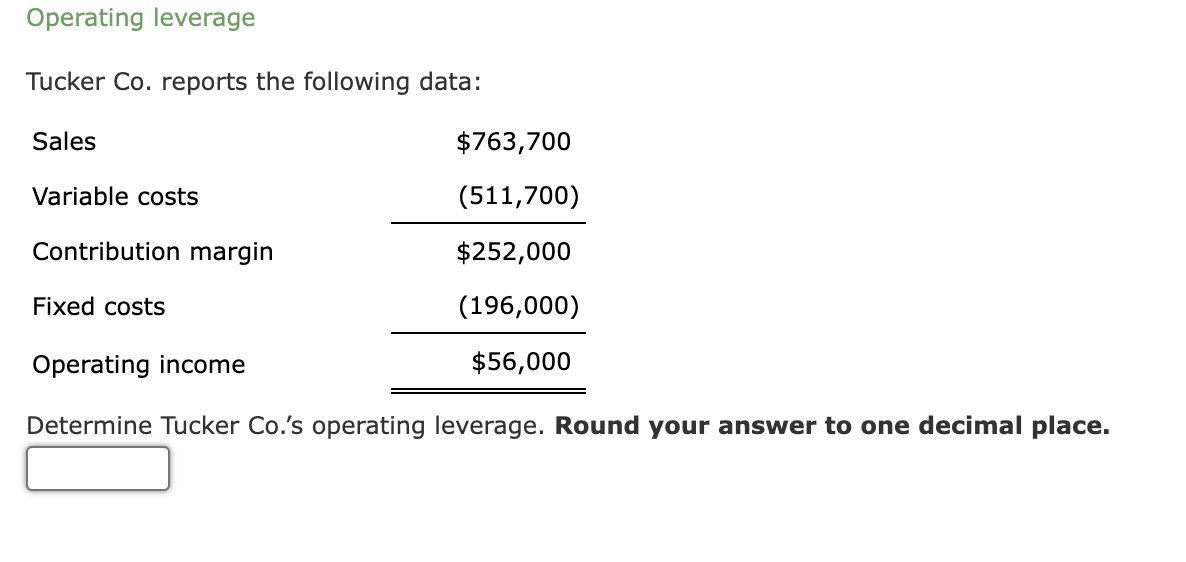

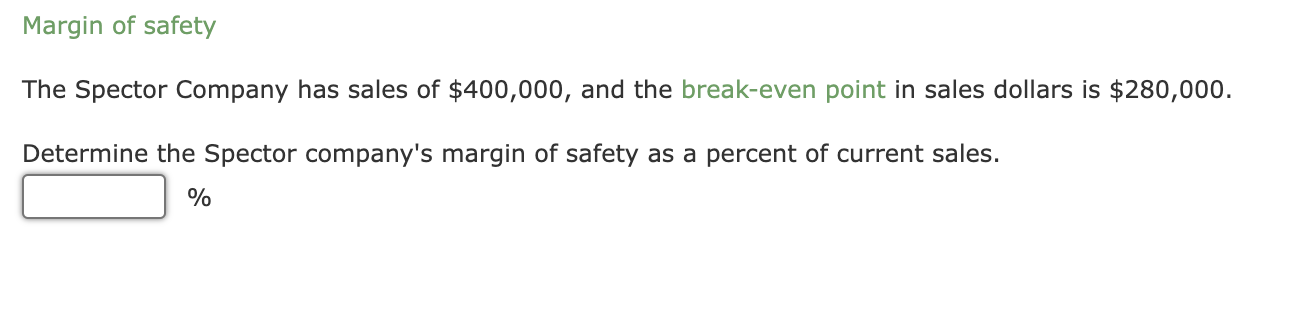

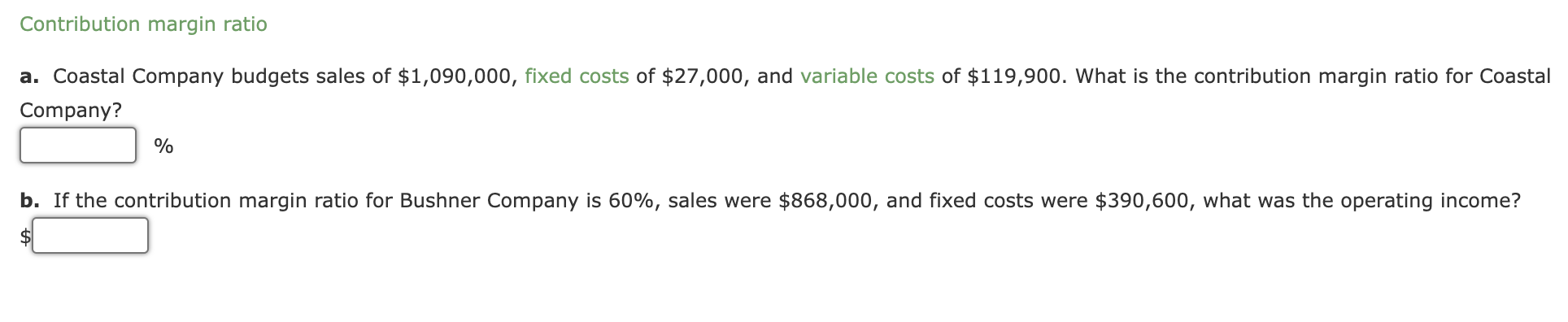

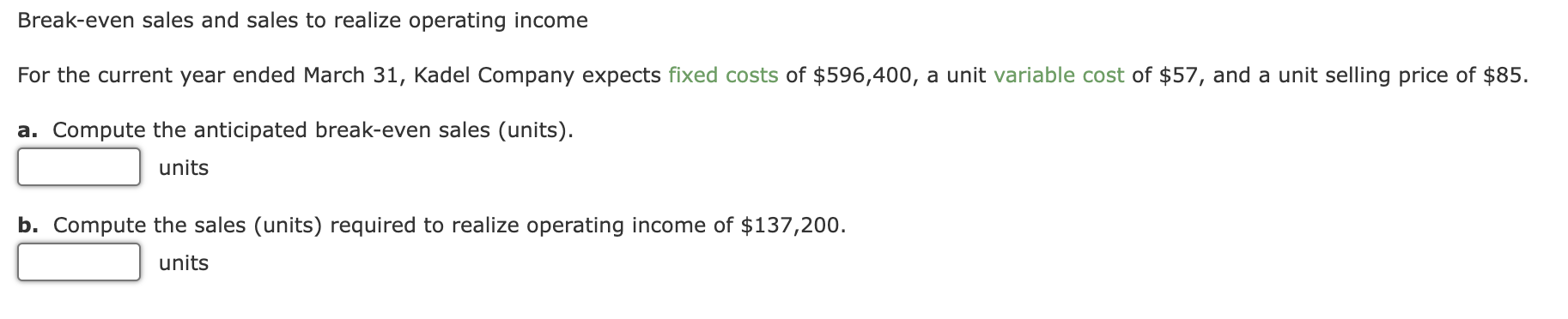

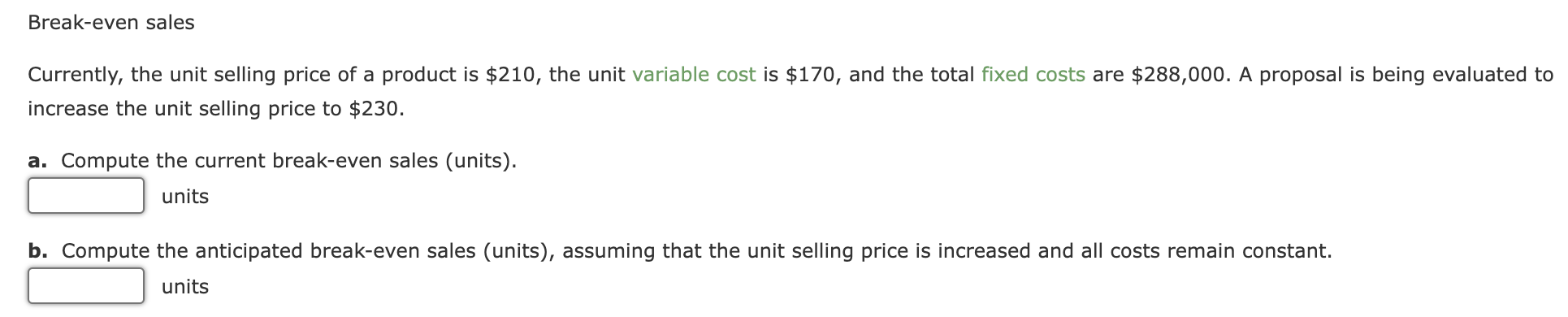

High-low method The manufacturing costs of Schroeder Industries for the first three months of the year follow: Total Costs Units Produced January $315,900 2,340 units February 468,230 4,380 March 491,400 6,240 Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost. a. Variable cost per unit $ b. Total fixed cost $ Contribution margin Harry Company sells 24,000 units at $28 per unit. Variable costs are $19.60 per unit, and fixed costs are $100,800. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) operating income. a. Contribution margin ratio (Enter as a whole number.) b. Unit contribution margin (Round to the nearest cent.) c. Operating income % per unit Break-even point Nicolas Inc. sells a product for $59 per unit. The variable cost is $32 per unit, while fixed costs are $204,120. Determine (a) the break-even point in sales units and (b) the break-even point if the selling price were increased to $67 per unit. a. Break-even point in sales units units b. Break-even point if the selling price were increased to $67 per unit units Target profit Forest Company sells a product for $185 per unit. The variable cost is $100 per unit, and fixed costs are $544,000. Determine (a) the break-even point in sales units and (b) the sales units required for the company to achieve a target profit of $92,480. a. Break-even point in sales units units b. Break-even point in sales units required for the company to achieve a target profit of $92,480 units Sales mix and break-even analysis Megan Company has fixed costs of $1,418,560. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow: Product Model Selling Price Variable Cost per Unit Contribution Margin per Unit Yankee $940 $620 $320 Zoro 660 460 200 The sales mix for products Yankee and Zoro is 40% and 60%, respectively. Determine the break-even point in units of Yankee and Zoro. a. Product Model Yankee b. Product Model Zoro units units Operating leverage Tucker Co. reports the following data: Sales $763,700 Variable costs (511,700) Contribution margin $252,000 Fixed costs (196,000) Operating income $56,000 Determine Tucker Co.'s operating leverage. Round your answer to one decimal place. Margin of safety The Spector Company has sales of $400,000, and the break-even point in sales dollars is $280,000. Determine the Spector company's margin of safety as a percent of current sales. % Contribution margin ratio a. Coastal Company budgets sales of $1,090,000, fixed costs of $27,000, and variable costs of $119,900. What is the contribution margin ratio for Coastal Company? % b. If the contribution margin ratio for Bushner Company is 60%, sales were $868,000, and fixed costs were $390,600, what was the operating income? Break-even sales and sales to realize operating income For the current year ended March 31, Kadel Company expects fixed costs of $596,400, a unit variable cost of $57, and a unit selling price of $85. a. Compute the anticipated break-even sales (units). units b. Compute the sales (units) required to realize operating income of $137,200. units Break-even sales Currently, the unit selling price of a product is $210, the unit variable cost is $170, and the total fixed costs are $288,000. A proposal is being evaluated to increase the unit selling price to $230. a. Compute the current break-even sales (units). units b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased and all costs remain constant. units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started