Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hightec Toy Manufacturing Company Limited is planning to purchase an injection machine for $3,000,000. The machine has an estimated life of 4 years. It

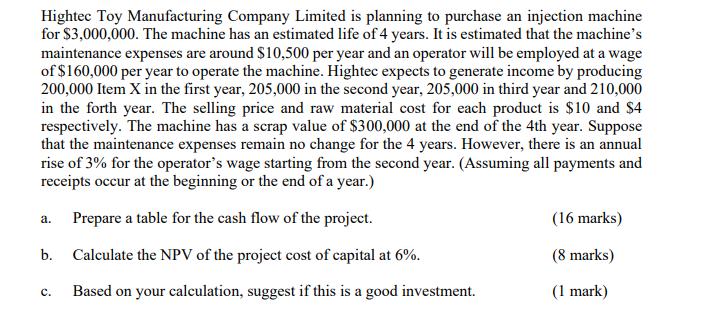

Hightec Toy Manufacturing Company Limited is planning to purchase an injection machine for $3,000,000. The machine has an estimated life of 4 years. It is estimated that the machine's maintenance expenses are around $10,500 per year and an operator will be employed at a wage of $160,000 per year to operate the machine. Hightec expects to generate income by producing 200,000 Item X in the first year, 205,000 in the second year, 205,000 in third year and 210,000 in the forth year. The selling price and raw material cost for each product is $10 and $4 respectively. The machine has a scrap value of $300,000 at the end of the 4th year. Suppose that the maintenance expenses remain no change for the 4 years. However, there is an annual rise of 3% for the operator's wage starting from the second year. (Assuming all payments and receipts occur at the beginning or the end of a year.) Prepare a table for the cash flow of the project. (16 marks) . b. Calculate the NPV of the project cost of capital at 6%. (8 marks) Based on your calculation, suggest if this is a good investment. (1 mark) c.

Step by Step Solution

★★★★★

3.59 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

First year Cash flow Sales 200000 Selling price 10 Cash from Sales 102000002000000 Expenses Raw material 4 per unit Total raw material cost 2000004800...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started