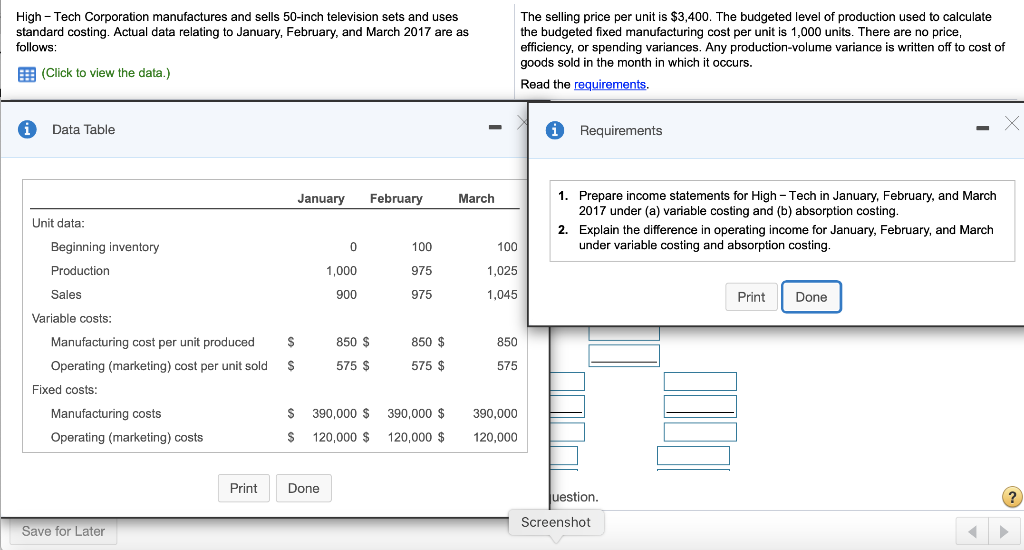

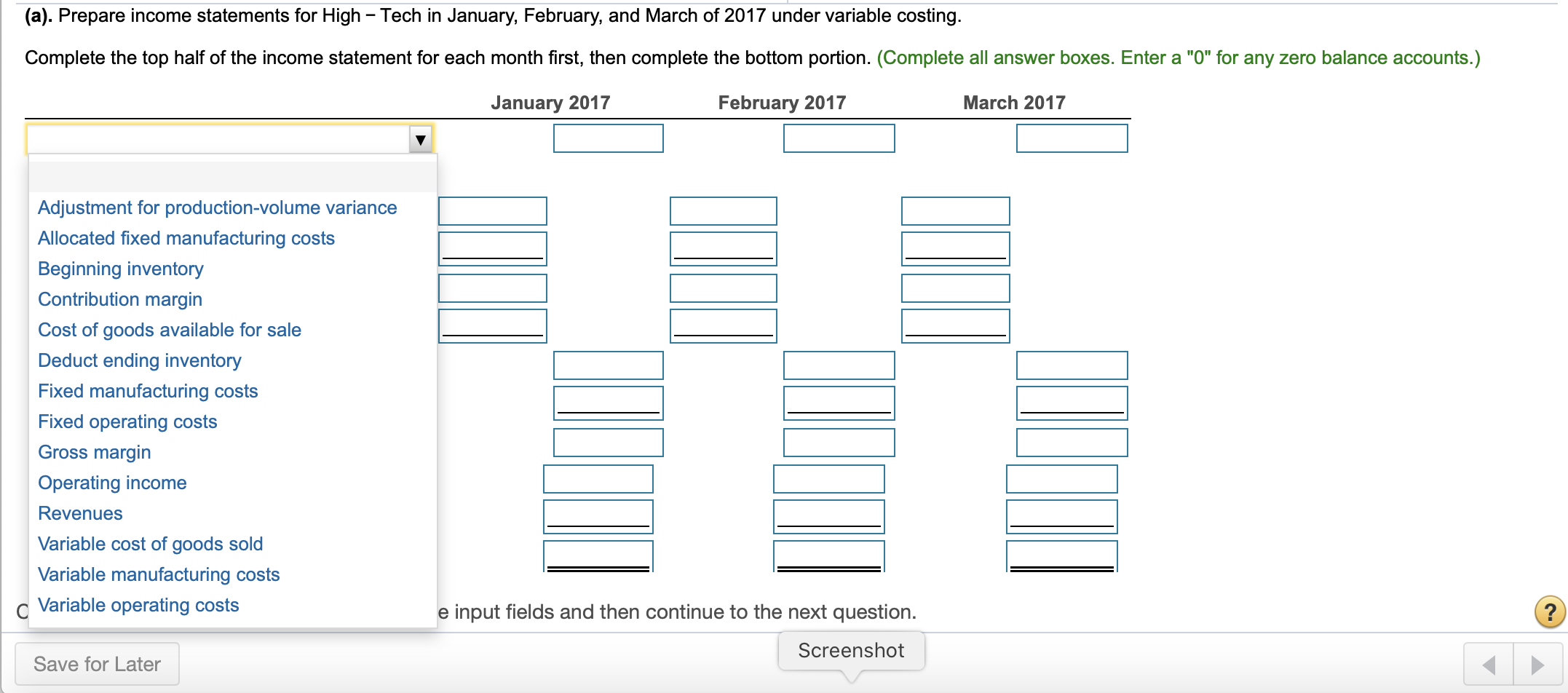

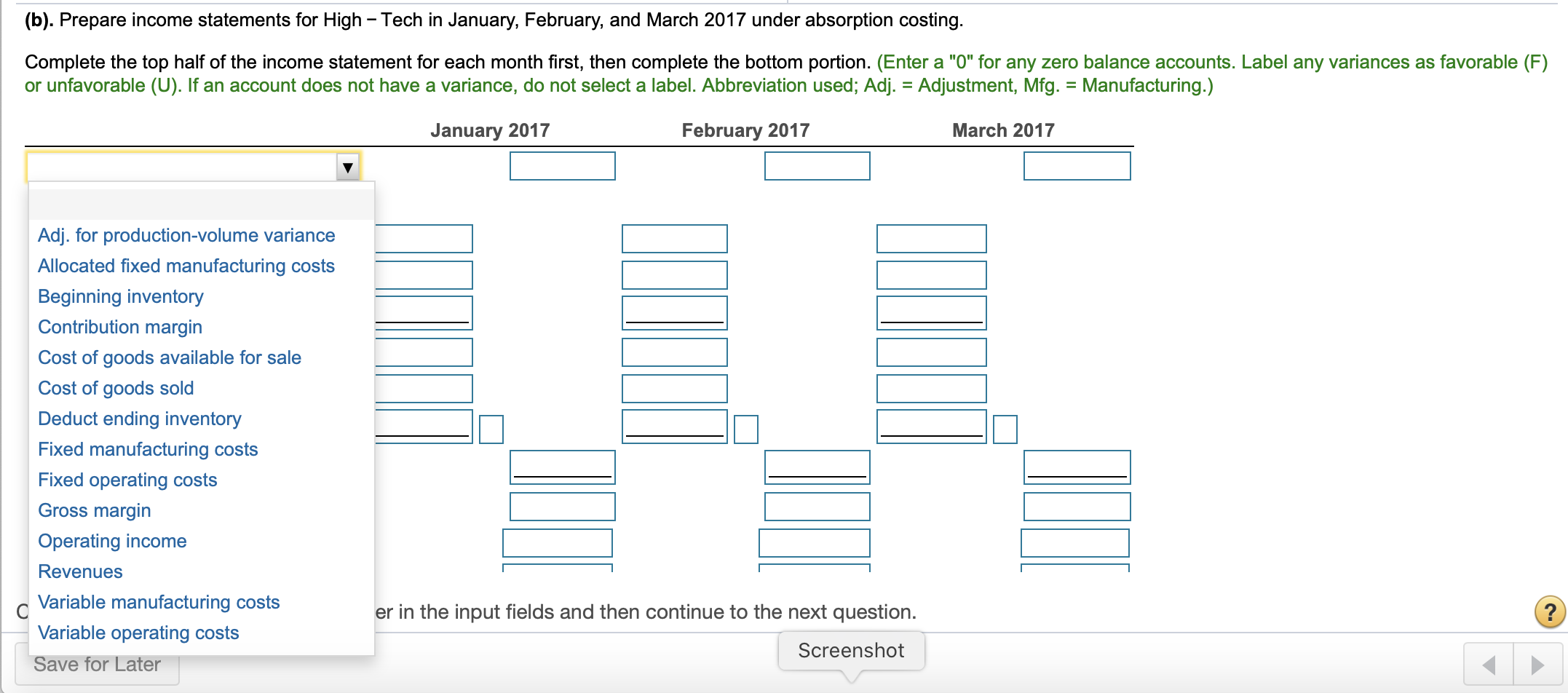

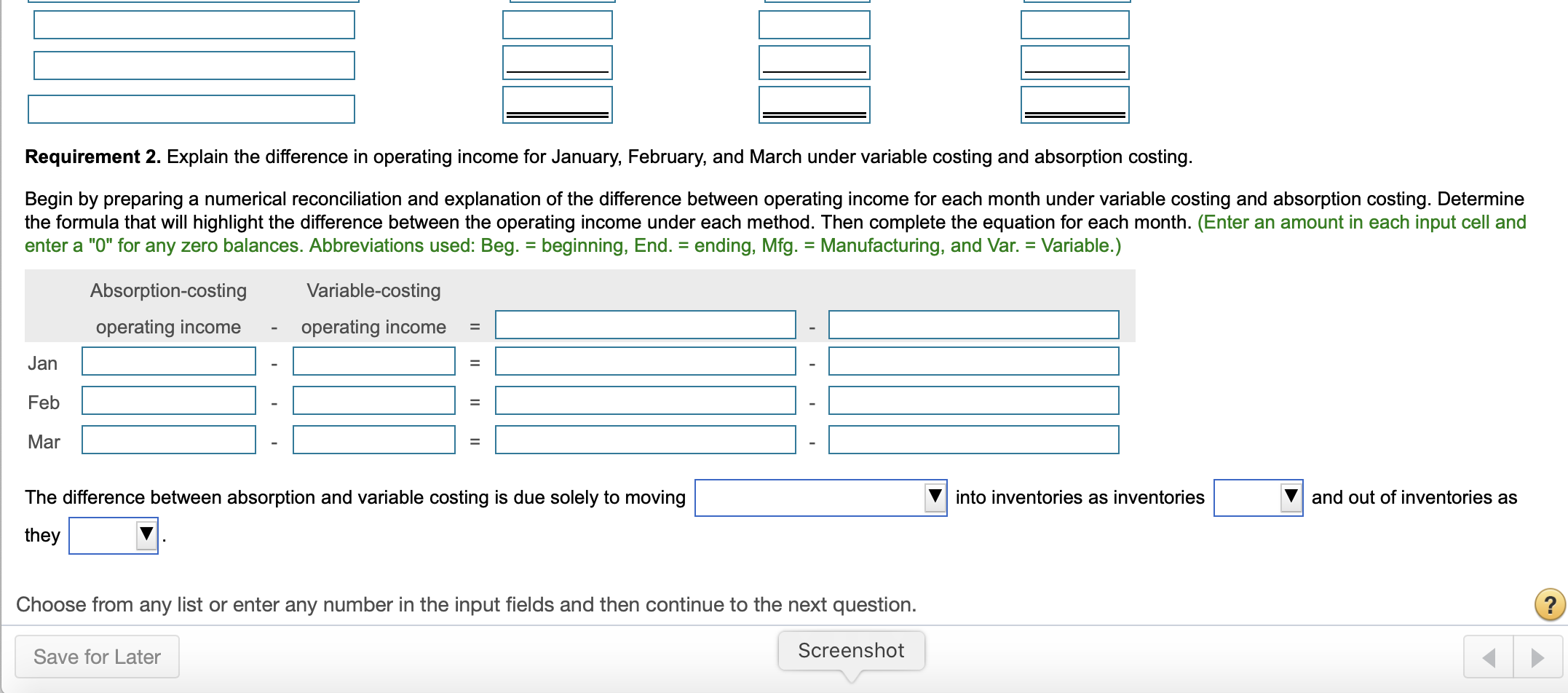

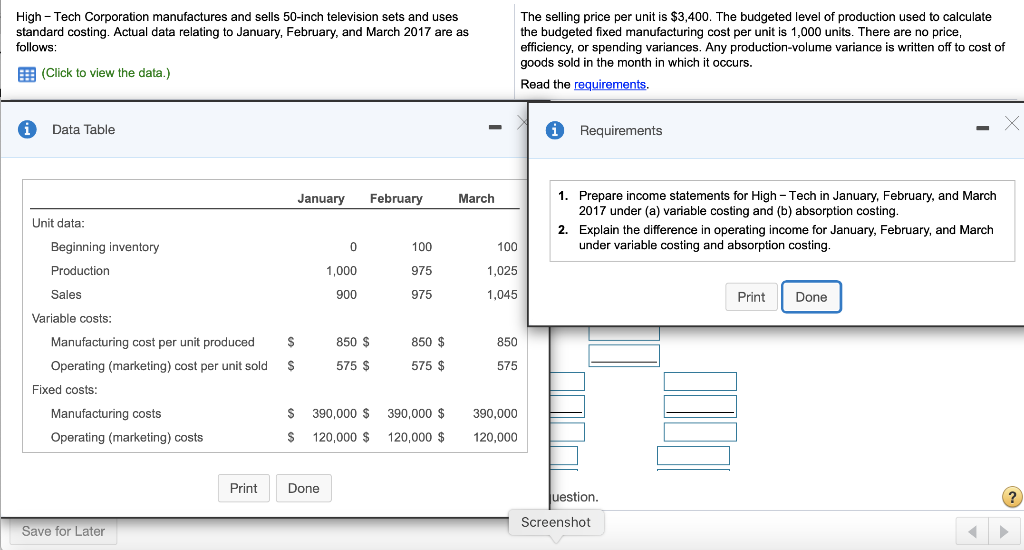

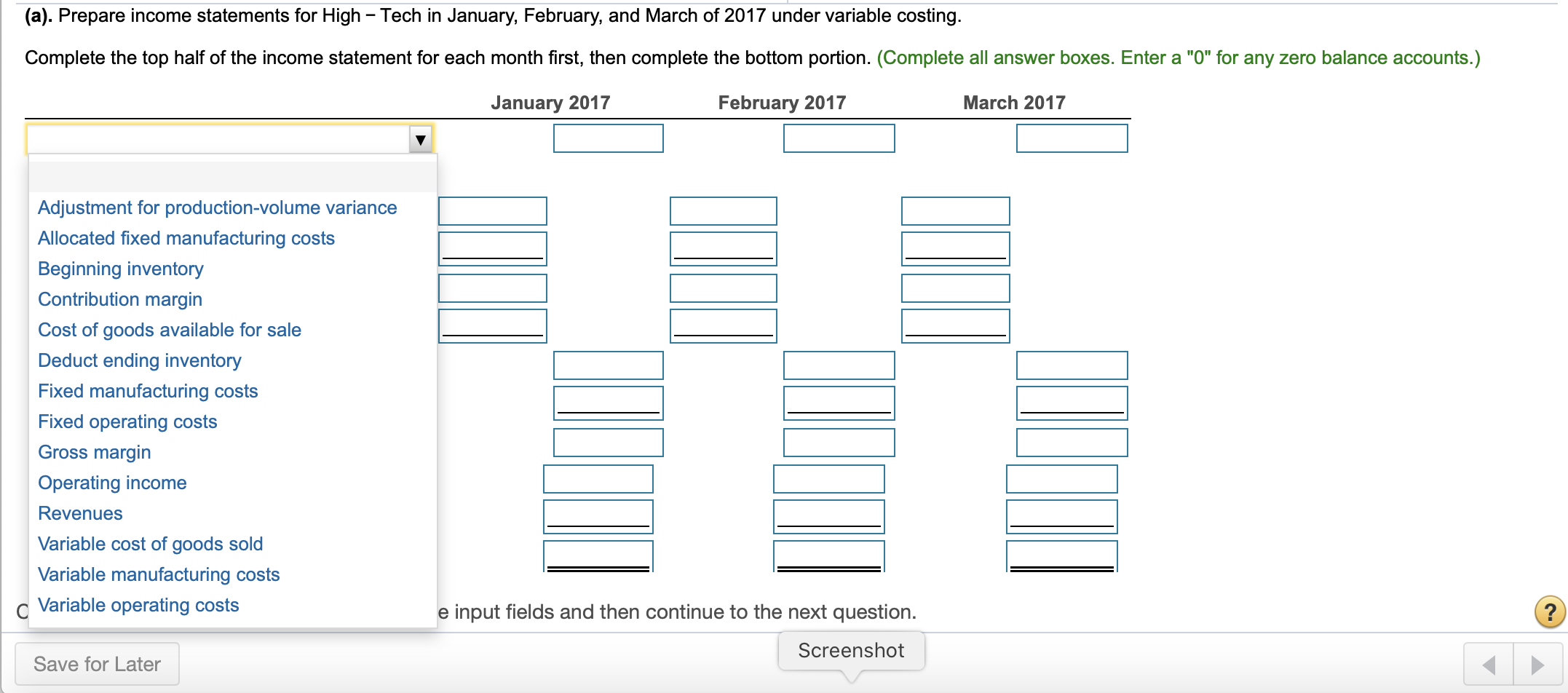

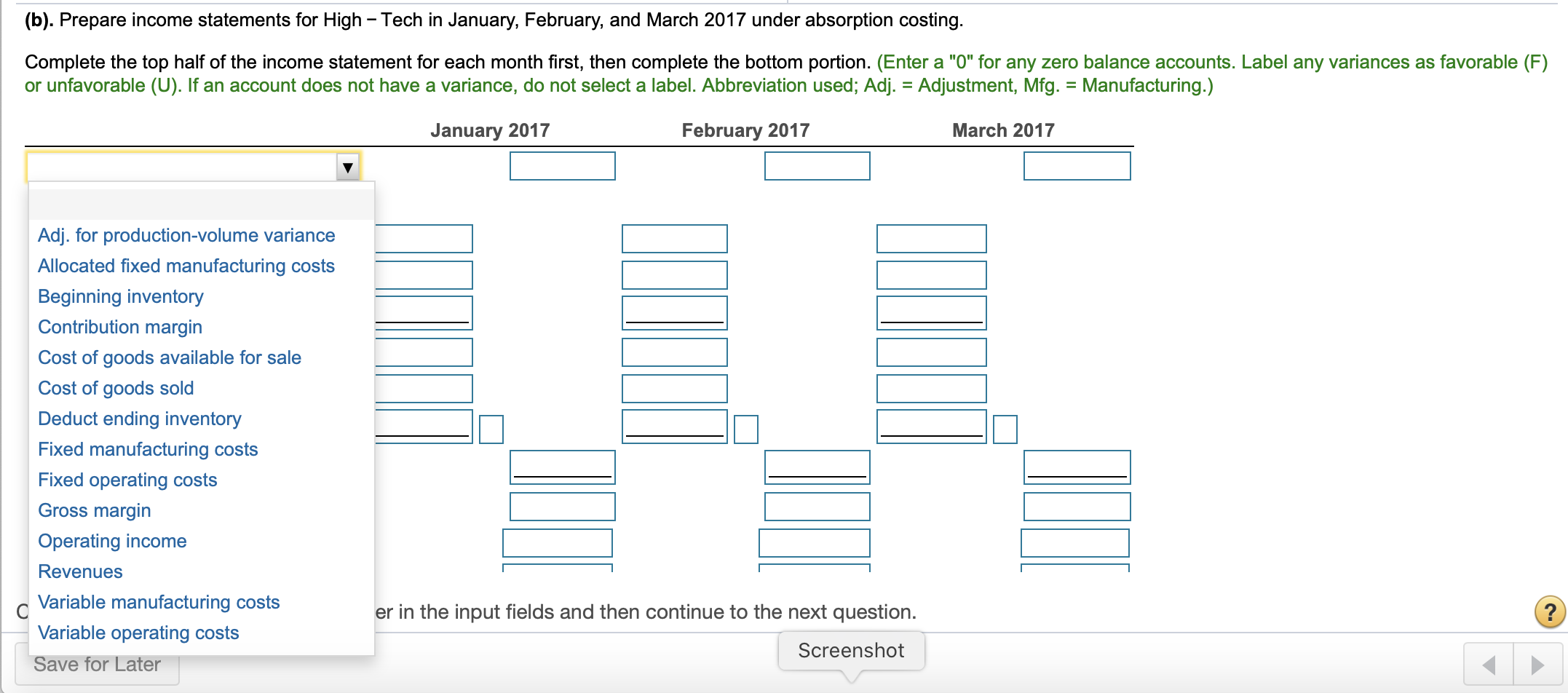

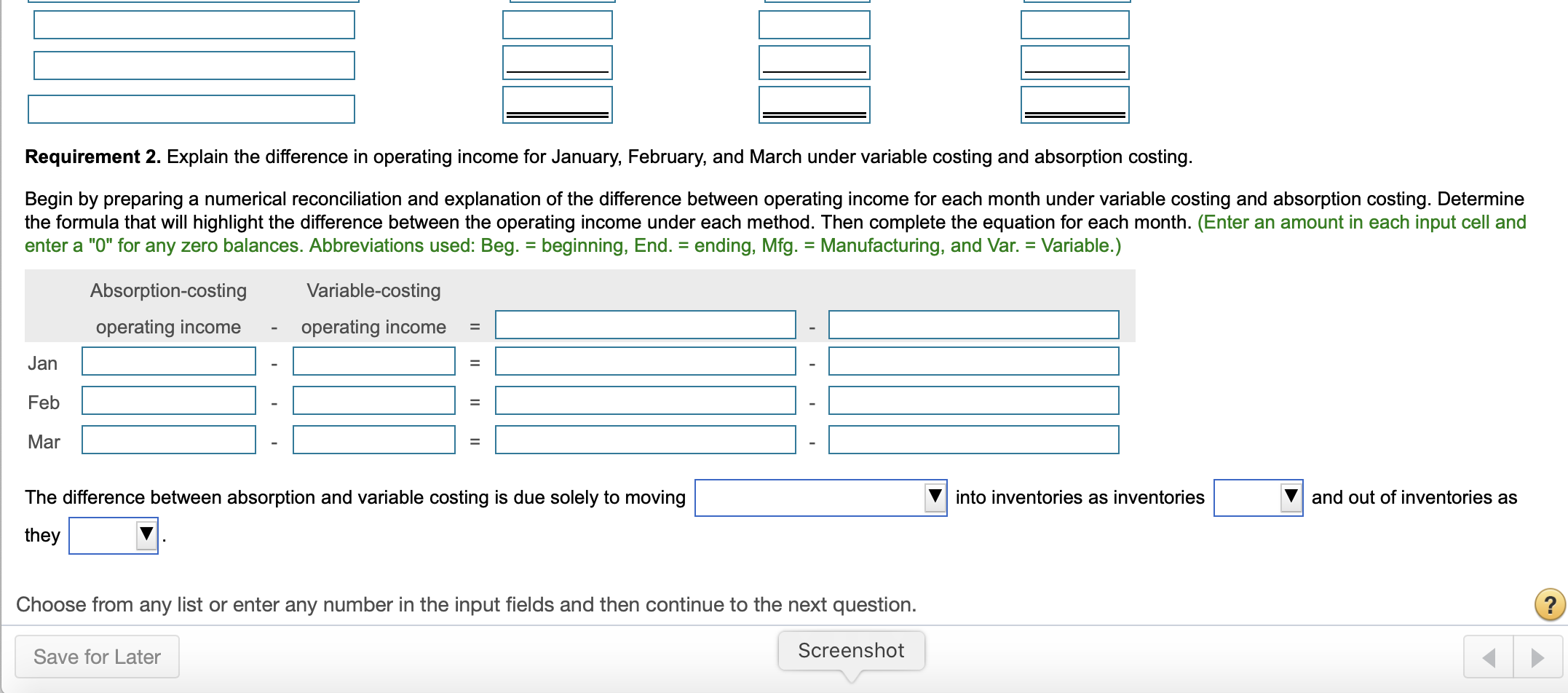

High-Tech Corporation manufactures and sells 50-inch television sets and uses standard costing. Actual data relating to January, February, and March 2017 are as follows: The selling price per unit is $3,400. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 1,000 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. Read the requirements. B (Click to view the data.) Data Table X - i Requirements January February March Unit data: 1. Prepare income statements for High-Tech in January, February, and March 2017 under (a) variable costing and (b) absorption costing. 2. Explain the difference in operating income for January, February, and March under variable costing and absorption costing. 0 100 100 Beginning inventory Production 1,000 1,025 975 975 Sales 900 1,045 Print Done 850 $ 850 $ $ 850 $ 575 $ $ 575 $ 575 Variable costs: Manufacturing cost per unit produced Operating (marketing) cost per unit sold Fixed costs: Manufacturing costs Operating (marketing) costs 390,000 $ 390,000 $ 390,000 $ $ 120,000 $ 120,000 $ 120,000 Print Done uestion. ? Screenshot Save for Later (a). Prepare income statements for High-Tech in January, February, and March of 2017 under variable costing. Complete the top half of the income statement for each month first, then complete the bottom portion. (Complete all answer boxes. Enter a "O" for any zero balance accounts.) January 2017 February 2017 March 2017 Adjustment for production-volume variance Allocated fixed manufacturing costs Beginning inventory Contribution margin Cost of goods available for sale Deduct ending inventory Fixed manufacturing costs Fixed operating costs Gross margin Operating income Revenues Variable cost of goods sold Variable manufacturing costs Variable operating costs ILITI e input fields and then continue to the next question. ? Screenshot Save for Later (b). Prepare income statements for High-Tech in January, February, and March 2017 under absorption costing. Complete the top half of the income statement for each month first, then complete the bottom portion. (Enter a "0" for any zero balance accounts. Label any variances as favorable (F) or unfavorable (U). If an account does not have a variance, do not select a label. Abbreviation used; Adj. = Adjustment, Mfg. = Manufacturing.) January 2017 February 2017 March 2017 Adj. for production-volume variance Allocated fixed manufacturing costs Beginning inventory Contribution margin Cost of goods available for sale Cost of goods sold Deduct ending inventory Fixed manufacturing costs Fixed operating costs Gross margin Operating income Revenues Variable manufacturing costs Variable operating costs Save for Later ? er in the input fields and then continue to the next question. Screenshot Requirement 2. Explain the difference in operating income for January, February, and March under variable costing and absorption costing. Begin by preparing a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing. Determine the formula that will highlight the difference between the operating income under each method. Then complete the equation for each month. (Enter an amount in each input cell and enter a "0" for any zero balances. Abbreviations used: Beg. = beginning, End. = ending, Mfg. = Manufacturing, and Var. = Variable.) Absorption-costing operating income Variable-costing operating income Jan Feb Mar II The difference between absorption and variable costing is due solely to moving into inventories as inventories and out of inventories as they Choose from any list or enter any number in the input fields and then continue to the next question. (? Save for Later Screenshot