Question

Hikmah Bhd is one of the largest consumer products manufacturers in Malaysia. The financial statements of the company ended on 30 June 2020 has been

Hikmah Bhd is one of the largest consumer products manufacturers in Malaysia. The financial statements of the company ended on 30 June 2020 has been authorised for issue by its board of directors on 30 October 2020. The following were material transactions or events that occurred in 2020:

1. Hikmah Bhd bought building AAA at RM3.1 million with 10 years of useful life and RM1,000,000 salvage value on 1 July 2017. Beginning 1 July 2019, Hikmah Bhd revised the economic life of the building from 10 years to 13 years. Changes in the economic life of the building was not incorporated in the drafted Profit and Loss statement for the year 2020.

2. On 1 July 2018, Hikmah Bhd involved in a long-term research and development costs on project BBB. The board of directors decided to change the accounting policy from expensing to capitalising of development costs on 1 July 2020. The new policy will take effect from 1 July 2019 whereby all development costs shall be capitalised in the year they were incurred. The accounts for the year ended 30 June 2020, however, have been drafted based on the previous policy of expensing development costs.

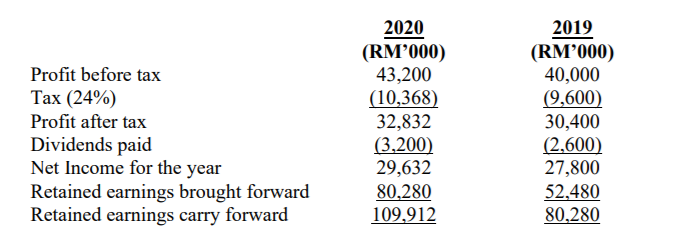

The summarised profit or loss and retained earnings profits for the year ended 30 June and its comparative figures are as follows:

The estimated capitalised development costs for 2020 and 2019 were RM5 million and RM4 million respectively. Actual development cost incurred during 2020 and 2019 were RM2.4 million and RM2 million correspondingly while the estimated amortisation for development costs were RM1.6 million and RM1 million for year 2020 and 2019, respectively. The tax rate applied in all years was 24%.

3. Hikmah Bhd had among its receivables a debtor, Casia Sdn Bhd with a balance of RM 300,000 as at 1 July 2019. On 23 July 2020, Hikmah Bhd was informed that Casia Sdn Bhd faced financial difficulty and had been placed under receivership. It is estimated that only 20% of the amount would be collectible.

4. On 1 August 2020, Malaysias Prime Minister announced to implement drastic restrictions on movement control order (MCO) to curb the spreading of Covid-19 pandemic. All business premises, schools, higher learning institutions, government and private premises must be shut down, except for essential businesses such as utilities, telecommunications, transport, banking, health, pharmacies, supermarkets and grocery stores selling daily basic needs. These restraints have a detrimental effect on the companys operations and financial performance.

REQUIRED: (Round up your answers to the nearest RM)

(a) Determine the type of transaction or events regarding transactions 1 to 4 and discuss the accounting treatment for each in accordance to MFRS 108 Accounting Policies, Changes in Accounting Estimates and Errors and MFRS 110 Events after the Reporting Period.

(b) Prepare a partial comparative Statement of Profit or Loss and Other Comprehensive Income and Statement of Financial Position for the year ended 30 June 2020 incorporating the accounting changes made by Hikmah Bhd in (a).

Profit before tax Tax (24%) Profit after tax Dividends paid Net Income for the year Retained earnings brought forward Retained earnings carry forward 2020 (RM'000) 43,200 (10,368) 32,832 (3,200) 29,632 80,280 109,912 2019 (RM'000) 40,000 (9,600) 30,400 (2,600) 27,800 52,480 80,280Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started