Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hilary Maskona, the CEO of AllVax, met with her advisor, Vincent Purell, to review a capital-expenditure proposal on a production plant to produce COVID-19

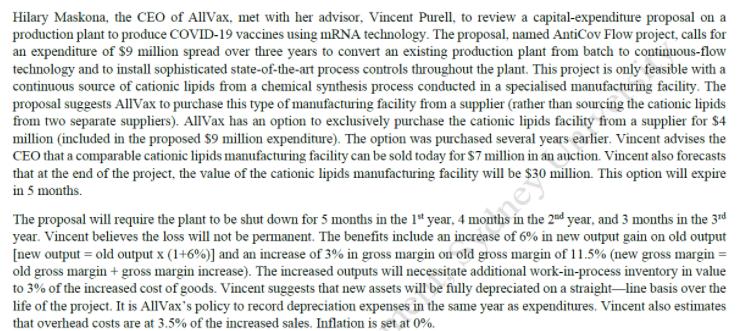

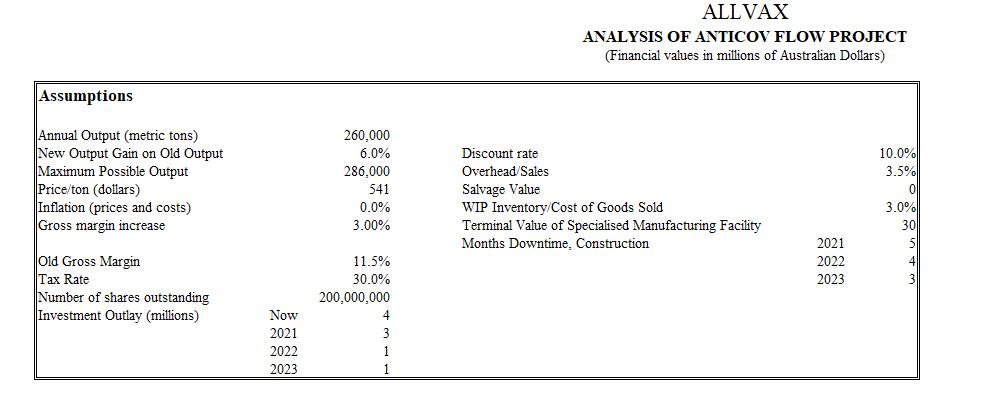

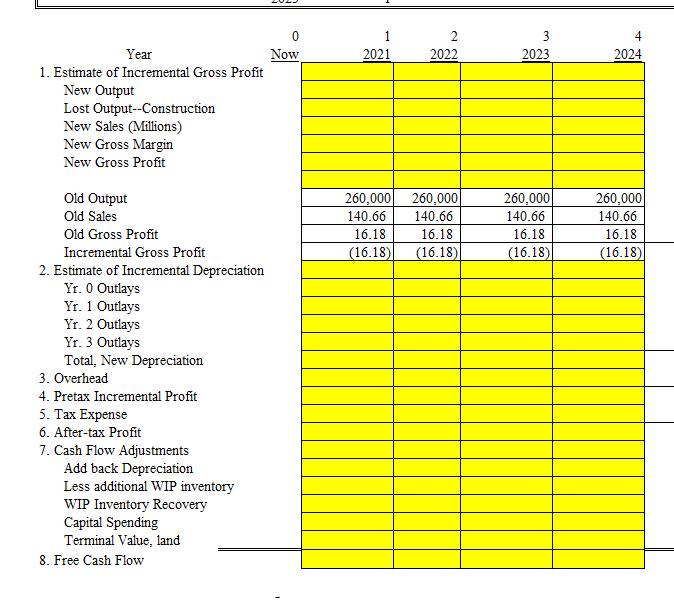

Hilary Maskona, the CEO of AllVax, met with her advisor, Vincent Purell, to review a capital-expenditure proposal on a production plant to produce COVID-19 vaccines using mRNA technology. The proposal, named AntiCov Flow project, calls for an expenditure of $9 million spread over three years to covert an existing production plant from batch to continuous-flow technology and to install sophisticated state-of-the-art process controls throughout the plant. This project is only feasible with a continuous source of cationic lipids from a chemical synthesis process conducted in a specialised manufacturing facility. The proposal suggests AllVax to purchase this type of manufacturing facility from a supplier (rather than sourcing the cationic lipids from two separate suppliers). AllVax has an option to exclusively purchase the cationic lipids facility from a supplier for $4 million (included in the proposed $9 million expenditure). The option was purchased several years earlier. Vincent advises the CEO that a comparable cationic lipids manufacturing facility can be sold today for $7 million in an auction. Vincent also forecasts that at the end of the project, the value of the cationic lipids manmufacturing facility will be $30 million. This option will expire in 5 months. 2nd year, and 3 months in the 3rd The proposal will require the plant to be shut down for 5 months in the 1" year, 4 months in the: year. Vincent believes the loss will not be permanent. The benefits include an increase of 6% in new output gain on old output [new output = old output x (1+6%)] and an increase of 3% in gross margin on old gross margin of 11.5% (new gross margin = old gross margin + gross margin increase). The increased outputs will necessitate additional work-in-process inventory in value to 3% of the increased cost of goods. Vincent suggests that new assets will be fully depreciated on a straight-line basis over the life of the project. It is AllVax's policy to record depreciation expenses in the same year as expenditures. Vincent also estimates that overhead costs are at 3.5% of the increased sales. Inflation is set at 0%. ALLVAX ANALYSIS OF ANTICOV FLOW PROJECT (Financial values in millions of Australian Dollars) Assumptions Annual Output (metric tons) New Output Gain on Old Output Maximum Possible Output Price/ton (dollars) Inflation (prices and costs) Gross margin increase 260.000 Discount rate Overhead/Sales 10.0% 3.5% 6.0% 286,000 Salvage Value WIP Inventory/Cost of Goods Sold Terminal Value of Specialised Manufacturing Facility 541 0.0% 3.0% 3.00% 30 Months Downtime, Construction 2021 5 Old Gross Margin Tax Rate Number of shares outstanding Investment Outlay (millions) 11.5% 30.0% 2022 4 2023 200,000,000 Now 4 2021 3 2022 1 2023 1 3 Year Now 2021 2022 2023 2024 1. Estimate of Incremental Gross Profit New Output Lost Output--Construction New Sales (Millions) New Gross Margin New Gross Profit Old Output 260,000 260,000 260,000 260,000 Old Sales 140.66 140.66 140.66 140.66 Old Gross Profit 16.18 16.18 16.18 16.18 Incremental Gross Profit (16.18) (16.18) (16.18) (16.18) 2. Estimate of Incremental Depreciation Yr. 0 Outlays Yr. 1 Outlays Yr. 2 Outlays Yr. 3 Outlays Total, New Depreciation 3. Overhead 4. Pretax Incremental Profit 5. Tax Expense 6. After-tax Profit 7. Cash Flow Adjustments Add back Depreciation Less additional WIP inventory WIP Inventory Recovery Capital Spending Terminal Value, land 8. Free Cash Flow

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Free Cash Flows in millions for the years Now Year 0 400 2021 Year 1 348 2022 Year 2 345 2023 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started