Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hillary's Handbags Manufacturing Co. produces nylon handbags and larger bags to sell to tourists visiting the Western United States and other tourist areas. The

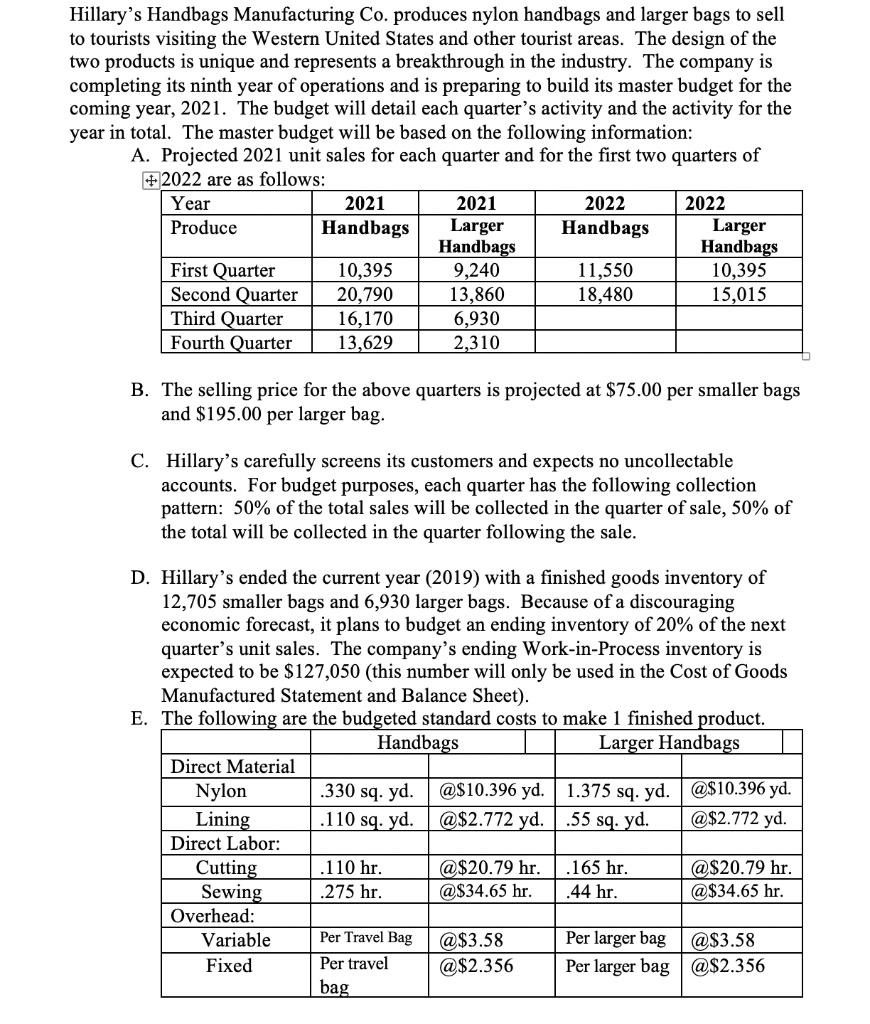

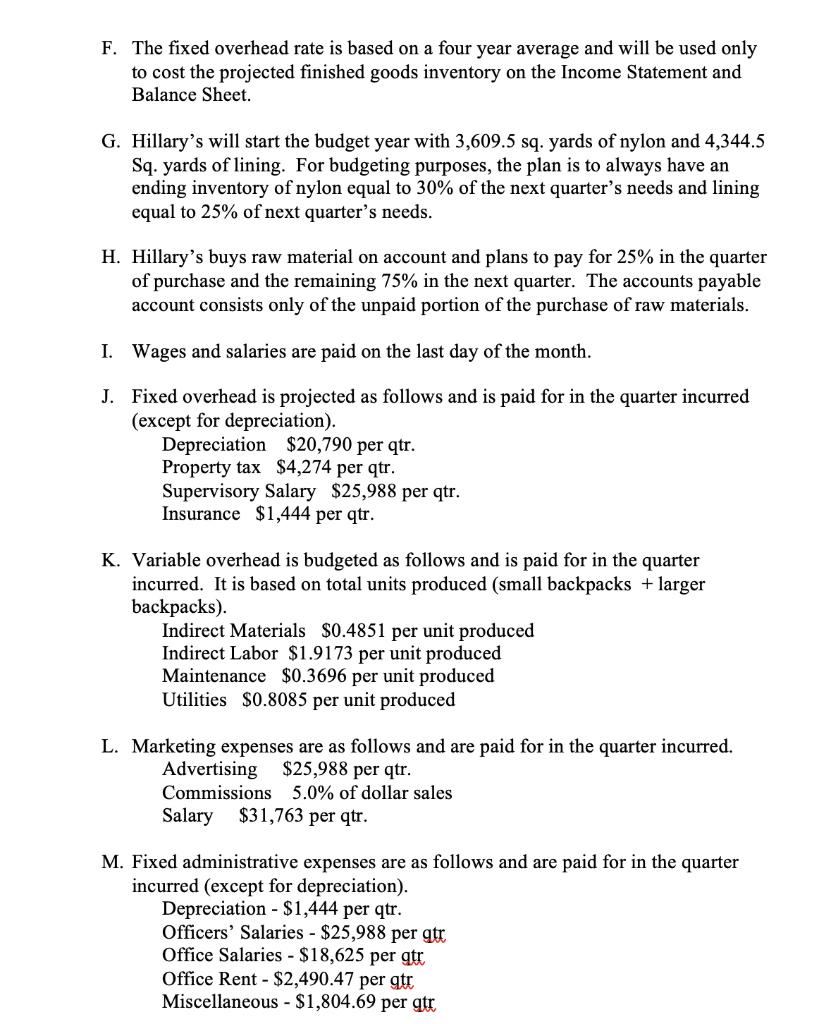

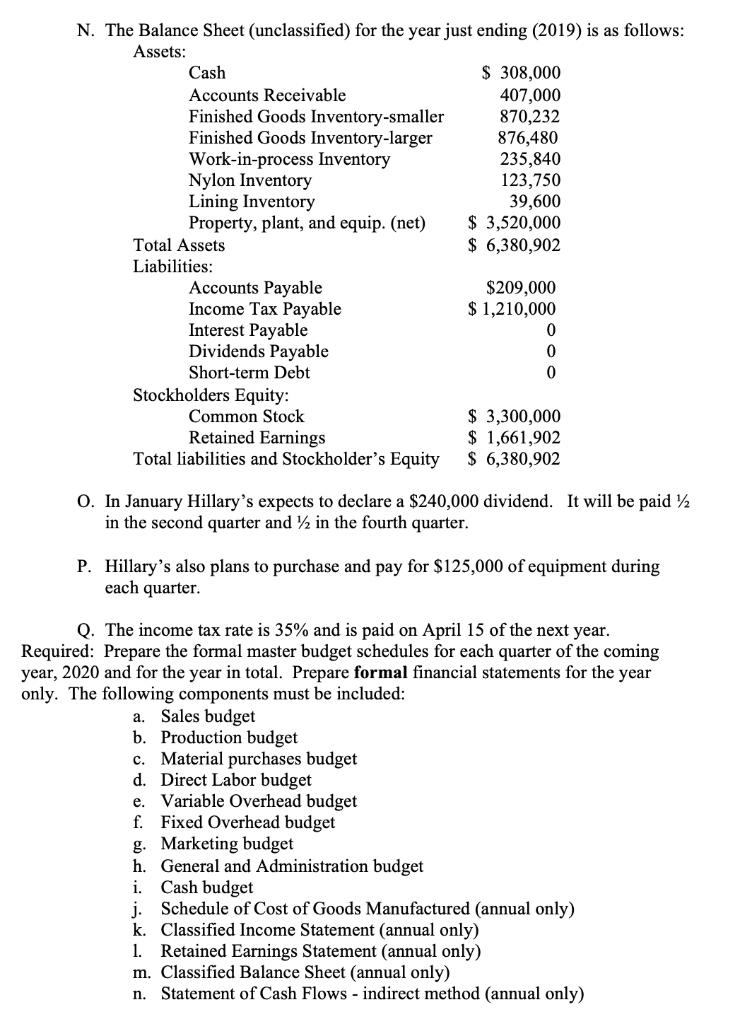

Hillary's Handbags Manufacturing Co. produces nylon handbags and larger bags to sell to tourists visiting the Western United States and other tourist areas. The design of the two products is unique and represents a breakthrough in the industry. The company is completing its ninth year of operations and is preparing to build its master budget for the coming year, 2021. The budget will detail each quarter's activity and the activity for the year in total. The master budget will be based on the following information: A. Projected 2021 unit sales for each quarter and for the first two quarters of +2022 are as follows: Year Produce First Quarter Second Quarter Third Quarter Fourth Quarter 2021 Handbags Direct Material Nylon Lining Direct Labor: Cutting Sewing 10,395 20,790 16,170 13,629 Overhead: Variable Fixed B. The selling price for the above quarters is projected at $75.00 per smaller bags and $195.00 per larger bag. 2021 Larger Handbags 9,240 13,860 6,930 2,310 C. Hillary's carefully screens its customers and expects uncollectable accounts. For budget purposes, each quarter has the following collection pattern: 50% of the total sales will be collected in the quarter of sale, 50% of the total will be collected in the quarter following the sale. .330 sq.yd. .110 sq. yd. D. Hillary's ended the current year (2019) with a finished goods inventory of 12,705 smaller bags and 6,930 larger bags. Because of a discouraging economic forecast, it plans to budget an ending inventory of 20% of the next quarter's unit sales. The company's ending Work-in-Process inventory is expected to be $127,050 (this number will only be used in the Cost of Goods Manufactured Statement and Balance Sheet). E. The following are the budgeted standard costs to make 1 finished product. Handbags Larger Handbags .110 hr. .275 hr. Per Travel Bag Per travel bag 2022 Handbags @$10.396 yd. @$2.772 yd. 11,550 18,480 @$20.79 hr. @$34.65 hr. @$3.58 @$2.356 2022 1.375 sq. yd. .55 sq. yd. Larger Handbags 10,395 15,015 .165 hr. .44 hr. Per larger bag Per larger bag @$10.396 yd. @$2.772 yd. @$20.79 hr. @$34.65 hr. @$3.58 @$2.356 F. The fixed overhead rate is based on a four year average and will be used only to cost the projected finished goods inventory on the Income Statement and Balance Sheet. G. Hillary's will start the budget year with 3,609.5 sq. yards of nylon and 4,344.5 Sq. yards of lining. For budgeting purposes, the plan is to always have an ending inventory of nylon equal to 30% of the next quarter's needs and lining equal to 25% of next quarter's needs. H. Hillary's buys raw material on account and plans to pay for 25% in the quarter of purchase and the remaining 75% in the next quarter. The accounts payable account consists only of the unpaid portion of the purchase of raw materials. I. Wages and salaries are paid on the last day of the month. J. Fixed overhead is projected as follows and is paid for in the quarter incurred (except for depreciation). Depreciation $20,790 per qtr. Property tax $4,274 per qtr. Supervisory Salary $25,988 per qtr. Insurance $1,444 per qtr. K. Variable overhead is budgeted as follows and is paid for in the quarter incurred. It is based on total units produced (small backpacks + larger backpacks). Indirect Materials $0.4851 per unit produced Indirect Labor $1.9173 per unit produced Maintenance $0.3696 per unit produced Utilities $0.8085 per unit produced L. Marketing expenses are as follows and are paid for in the quarter incurred. Advertising $25,988 per qtr. Commissions 5.0% of dollar sales Salary $31,763 per qtr. M. Fixed administrative expenses are as follows and are paid for in the quarter incurred (except for depreciation). Depreciation - $1,444 per qtr. Officers' Salaries - $25,988 per gtr Office Salaries - $18,625 per qtr Office Rent - $2,490.47 per gtr Miscellaneous - $1,804.69 per gtr N. The Balance Sheet (unclassified) for the year just ending (2019) is as follows: Assets: Cash Accounts Receivable Finished Goods Inventory-smaller Finished Goods Inventory-larger Work-in-process Inventory Nylon Inventory Lining Inventory Property, plant, and equip. (net) Total Assets Liabilities: Accounts Payable Income Tax Payable Interest Payable Dividends Payable Short-term Debt Stockholders Equity: Common Stock Retained Earnings Total liabilities and Stockholder's Equity $ 308,000 407,000 870,232 876,480 235,840 123,750 39,600 a. Sales budget b. Production budget $ 3,520,000 $ 6,380,902 c. Material purchases budget d. Direct Labor budget e. Variable Overhead budget f. Fixed Overhead budget $209,000 $ 1,210,000 O. In January Hillary's expects to declare a $240,000 dividend. It will be paid in the second quarter and in the fourth quarter. g. Marketing budget h. General and Administration budget i. Cash budget 0 0 0 P. Hillary's also plans to purchase and pay for $125,000 of equipment during each quarter. $ 3,300,000 $ 1,661,902 $ 6,380,902 Q. The income tax rate is 35% and is paid on April 15 of the next year. Required: Prepare the formal master budget schedules for each quarter of the coming year, 2020 and for the year in total. Prepare formal financial statements for the year only. The following components must be included: j. Schedule of Cost of Goods Manufactured (annual only) k. Classified Income Statement (annual only) 1. Retained Earnings Statement (annual only) m. Classified Balance Sheet (annual only) n. Statement of Cash Flows - indirect method (annual only) Hillary's Handbags Manufacturing Co. produces nylon handbags and larger bags to sell to tourists visiting the Western United States and other tourist areas. The design of the two products is unique and represents a breakthrough in the industry. The company is completing its ninth year of operations and is preparing to build its master budget for the coming year, 2021. The budget will detail each quarter's activity and the activity for the year in total. The master budget will be based on the following information: A. Projected 2021 unit sales for each quarter and for the first two quarters of +2022 are as follows: Year Produce First Quarter Second Quarter Third Quarter Fourth Quarter 2021 Handbags Direct Material Nylon Lining Direct Labor: Cutting Sewing 10,395 20,790 16,170 13,629 Overhead: Variable Fixed B. The selling price for the above quarters is projected at $75.00 per smaller bags and $195.00 per larger bag. 2021 Larger Handbags 9,240 13,860 6,930 2,310 C. Hillary's carefully screens its customers and expects uncollectable accounts. For budget purposes, each quarter has the following collection pattern: 50% of the total sales will be collected in the quarter of sale, 50% of the total will be collected in the quarter following the sale. .330 sq.yd. .110 sq. yd. D. Hillary's ended the current year (2019) with a finished goods inventory of 12,705 smaller bags and 6,930 larger bags. Because of a discouraging economic forecast, it plans to budget an ending inventory of 20% of the next quarter's unit sales. The company's ending Work-in-Process inventory is expected to be $127,050 (this number will only be used in the Cost of Goods Manufactured Statement and Balance Sheet). E. The following are the budgeted standard costs to make 1 finished product. Handbags Larger Handbags .110 hr. .275 hr. Per Travel Bag Per travel bag 2022 Handbags @$10.396 yd. @$2.772 yd. 11,550 18,480 @$20.79 hr. @$34.65 hr. @$3.58 @$2.356 2022 1.375 sq. yd. .55 sq. yd. Larger Handbags 10,395 15,015 .165 hr. .44 hr. Per larger bag Per larger bag @$10.396 yd. @$2.772 yd. @$20.79 hr. @$34.65 hr. @$3.58 @$2.356 F. The fixed overhead rate is based on a four year average and will be used only to cost the projected finished goods inventory on the Income Statement and Balance Sheet. G. Hillary's will start the budget year with 3,609.5 sq. yards of nylon and 4,344.5 Sq. yards of lining. For budgeting purposes, the plan is to always have an ending inventory of nylon equal to 30% of the next quarter's needs and lining equal to 25% of next quarter's needs. H. Hillary's buys raw material on account and plans to pay for 25% in the quarter of purchase and the remaining 75% in the next quarter. The accounts payable account consists only of the unpaid portion of the purchase of raw materials. I. Wages and salaries are paid on the last day of the month. J. Fixed overhead is projected as follows and is paid for in the quarter incurred (except for depreciation). Depreciation $20,790 per qtr. Property tax $4,274 per qtr. Supervisory Salary $25,988 per qtr. Insurance $1,444 per qtr. K. Variable overhead is budgeted as follows and is paid for in the quarter incurred. It is based on total units produced (small backpacks + larger backpacks). Indirect Materials $0.4851 per unit produced Indirect Labor $1.9173 per unit produced Maintenance $0.3696 per unit produced Utilities $0.8085 per unit produced L. Marketing expenses are as follows and are paid for in the quarter incurred. Advertising $25,988 per qtr. Commissions 5.0% of dollar sales Salary $31,763 per qtr. M. Fixed administrative expenses are as follows and are paid for in the quarter incurred (except for depreciation). Depreciation - $1,444 per qtr. Officers' Salaries - $25,988 per gtr Office Salaries - $18,625 per qtr Office Rent - $2,490.47 per gtr Miscellaneous - $1,804.69 per gtr N. The Balance Sheet (unclassified) for the year just ending (2019) is as follows: Assets: Cash Accounts Receivable Finished Goods Inventory-smaller Finished Goods Inventory-larger Work-in-process Inventory Nylon Inventory Lining Inventory Property, plant, and equip. (net) Total Assets Liabilities: Accounts Payable Income Tax Payable Interest Payable Dividends Payable Short-term Debt Stockholders Equity: Common Stock Retained Earnings Total liabilities and Stockholder's Equity $ 308,000 407,000 870,232 876,480 235,840 123,750 39,600 a. Sales budget b. Production budget $ 3,520,000 $ 6,380,902 c. Material purchases budget d. Direct Labor budget e. Variable Overhead budget f. Fixed Overhead budget $209,000 $ 1,210,000 O. In January Hillary's expects to declare a $240,000 dividend. It will be paid in the second quarter and in the fourth quarter. g. Marketing budget h. General and Administration budget i. Cash budget 0 0 0 P. Hillary's also plans to purchase and pay for $125,000 of equipment during each quarter. $ 3,300,000 $ 1,661,902 $ 6,380,902 Q. The income tax rate is 35% and is paid on April 15 of the next year. Required: Prepare the formal master budget schedules for each quarter of the coming year, 2020 and for the year in total. Prepare formal financial statements for the year only. The following components must be included: j. Schedule of Cost of Goods Manufactured (annual only) k. Classified Income Statement (annual only) 1. Retained Earnings Statement (annual only) m. Classified Balance Sheet (annual only) n. Statement of Cash Flows - indirect method (annual only) Hillary's Handbags Manufacturing Co. produces nylon handbags and larger bags to sell to tourists visiting the Western United States and other tourist areas. The design of the two products is unique and represents a breakthrough in the industry. The company is completing its ninth year of operations and is preparing to build its master budget for the coming year, 2021. The budget will detail each quarter's activity and the activity for the year in total. The master budget will be based on the following information: A. Projected 2021 unit sales for each quarter and for the first two quarters of +2022 are as follows: Year Produce First Quarter Second Quarter Third Quarter Fourth Quarter 2021 Handbags Direct Material Nylon Lining Direct Labor: Cutting Sewing 10,395 20,790 16,170 13,629 Overhead: Variable Fixed B. The selling price for the above quarters is projected at $75.00 per smaller bags and $195.00 per larger bag. 2021 Larger Handbags 9,240 13,860 6,930 2,310 C. Hillary's carefully screens its customers and expects uncollectable accounts. For budget purposes, each quarter has the following collection pattern: 50% of the total sales will be collected in the quarter of sale, 50% of the total will be collected in the quarter following the sale. .330 sq.yd. .110 sq. yd. D. Hillary's ended the current year (2019) with a finished goods inventory of 12,705 smaller bags and 6,930 larger bags. Because of a discouraging economic forecast, it plans to budget an ending inventory of 20% of the next quarter's unit sales. The company's ending Work-in-Process inventory is expected to be $127,050 (this number will only be used in the Cost of Goods Manufactured Statement and Balance Sheet). E. The following are the budgeted standard costs to make 1 finished product. Handbags Larger Handbags .110 hr. .275 hr. Per Travel Bag Per travel bag 2022 Handbags @$10.396 yd. @$2.772 yd. 11,550 18,480 @$20.79 hr. @$34.65 hr. @$3.58 @$2.356 2022 1.375 sq. yd. .55 sq. yd. Larger Handbags 10,395 15,015 .165 hr. .44 hr. Per larger bag Per larger bag @$10.396 yd. @$2.772 yd. @$20.79 hr. @$34.65 hr. @$3.58 @$2.356 F. The fixed overhead rate is based on a four year average and will be used only to cost the projected finished goods inventory on the Income Statement and Balance Sheet. G. Hillary's will start the budget year with 3,609.5 sq. yards of nylon and 4,344.5 Sq. yards of lining. For budgeting purposes, the plan is to always have an ending inventory of nylon equal to 30% of the next quarter's needs and lining equal to 25% of next quarter's needs. H. Hillary's buys raw material on account and plans to pay for 25% in the quarter of purchase and the remaining 75% in the next quarter. The accounts payable account consists only of the unpaid portion of the purchase of raw materials. I. Wages and salaries are paid on the last day of the month. J. Fixed overhead is projected as follows and is paid for in the quarter incurred (except for depreciation). Depreciation $20,790 per qtr. Property tax $4,274 per qtr. Supervisory Salary $25,988 per qtr. Insurance $1,444 per qtr. K. Variable overhead is budgeted as follows and is paid for in the quarter incurred. It is based on total units produced (small backpacks + larger backpacks). Indirect Materials $0.4851 per unit produced Indirect Labor $1.9173 per unit produced Maintenance $0.3696 per unit produced Utilities $0.8085 per unit produced L. Marketing expenses are as follows and are paid for in the quarter incurred. Advertising $25,988 per qtr. Commissions 5.0% of dollar sales Salary $31,763 per qtr. M. Fixed administrative expenses are as follows and are paid for in the quarter incurred (except for depreciation). Depreciation - $1,444 per qtr. Officers' Salaries - $25,988 per gtr Office Salaries - $18,625 per qtr Office Rent - $2,490.47 per gtr Miscellaneous - $1,804.69 per gtr N. The Balance Sheet (unclassified) for the year just ending (2019) is as follows: Assets: Cash Accounts Receivable Finished Goods Inventory-smaller Finished Goods Inventory-larger Work-in-process Inventory Nylon Inventory Lining Inventory Property, plant, and equip. (net) Total Assets Liabilities: Accounts Payable Income Tax Payable Interest Payable Dividends Payable Short-term Debt Stockholders Equity: Common Stock Retained Earnings Total liabilities and Stockholder's Equity $ 308,000 407,000 870,232 876,480 235,840 123,750 39,600 a. Sales budget b. Production budget $ 3,520,000 $ 6,380,902 c. Material purchases budget d. Direct Labor budget e. Variable Overhead budget f. Fixed Overhead budget $209,000 $ 1,210,000 O. In January Hillary's expects to declare a $240,000 dividend. It will be paid in the second quarter and in the fourth quarter. g. Marketing budget h. General and Administration budget i. Cash budget 0 0 0 P. Hillary's also plans to purchase and pay for $125,000 of equipment during each quarter. $ 3,300,000 $ 1,661,902 $ 6,380,902 Q. The income tax rate is 35% and is paid on April 15 of the next year. Required: Prepare the formal master budget schedules for each quarter of the coming year, 2020 and for the year in total. Prepare formal financial statements for the year only. The following components must be included: j. Schedule of Cost of Goods Manufactured (annual only) k. Classified Income Statement (annual only) 1. Retained Earnings Statement (annual only) m. Classified Balance Sheet (annual only) n. Statement of Cash Flows - indirect method (annual only) Hillary's Handbags Manufacturing Co. produces nylon handbags and larger bags to sell to tourists visiting the Western United States and other tourist areas. The design of the two products is unique and represents a breakthrough in the industry. The company is completing its ninth year of operations and is preparing to build its master budget for the coming year, 2021. The budget will detail each quarter's activity and the activity for the year in total. The master budget will be based on the following information: A. Projected 2021 unit sales for each quarter and for the first two quarters of +2022 are as follows: Year Produce First Quarter Second Quarter Third Quarter Fourth Quarter 2021 Handbags Direct Material Nylon Lining Direct Labor: Cutting Sewing 10,395 20,790 16,170 13,629 Overhead: Variable Fixed B. The selling price for the above quarters is projected at $75.00 per smaller bags and $195.00 per larger bag. 2021 Larger Handbags 9,240 13,860 6,930 2,310 C. Hillary's carefully screens its customers and expects uncollectable accounts. For budget purposes, each quarter has the following collection pattern: 50% of the total sales will be collected in the quarter of sale, 50% of the total will be collected in the quarter following the sale. .330 sq.yd. .110 sq. yd. D. Hillary's ended the current year (2019) with a finished goods inventory of 12,705 smaller bags and 6,930 larger bags. Because of a discouraging economic forecast, it plans to budget an ending inventory of 20% of the next quarter's unit sales. The company's ending Work-in-Process inventory is expected to be $127,050 (this number will only be used in the Cost of Goods Manufactured Statement and Balance Sheet). E. The following are the budgeted standard costs to make 1 finished product. Handbags Larger Handbags .110 hr. .275 hr. Per Travel Bag Per travel bag 2022 Handbags @$10.396 yd. @$2.772 yd. 11,550 18,480 @$20.79 hr. @$34.65 hr. @$3.58 @$2.356 2022 1.375 sq. yd. .55 sq. yd. Larger Handbags 10,395 15,015 .165 hr. .44 hr. Per larger bag Per larger bag @$10.396 yd. @$2.772 yd. @$20.79 hr. @$34.65 hr. @$3.58 @$2.356 F. The fixed overhead rate is based on a four year average and will be used only to cost the projected finished goods inventory on the Income Statement and Balance Sheet. G. Hillary's will start the budget year with 3,609.5 sq. yards of nylon and 4,344.5 Sq. yards of lining. For budgeting purposes, the plan is to always have an ending inventory of nylon equal to 30% of the next quarter's needs and lining equal to 25% of next quarter's needs. H. Hillary's buys raw material on account and plans to pay for 25% in the quarter of purchase and the remaining 75% in the next quarter. The accounts payable account consists only of the unpaid portion of the purchase of raw materials. I. Wages and salaries are paid on the last day of the month. J. Fixed overhead is projected as follows and is paid for in the quarter incurred (except for depreciation). Depreciation $20,790 per qtr. Property tax $4,274 per qtr. Supervisory Salary $25,988 per qtr. Insurance $1,444 per qtr. K. Variable overhead is budgeted as follows and is paid for in the quarter incurred. It is based on total units produced (small backpacks + larger backpacks). Indirect Materials $0.4851 per unit produced Indirect Labor $1.9173 per unit produced Maintenance $0.3696 per unit produced Utilities $0.8085 per unit produced L. Marketing expenses are as follows and are paid for in the quarter incurred. Advertising $25,988 per qtr. Commissions 5.0% of dollar sales Salary $31,763 per qtr. M. Fixed administrative expenses are as follows and are paid for in the quarter incurred (except for depreciation). Depreciation - $1,444 per qtr. Officers' Salaries - $25,988 per gtr Office Salaries - $18,625 per qtr Office Rent - $2,490.47 per gtr Miscellaneous - $1,804.69 per gtr N. The Balance Sheet (unclassified) for the year just ending (2019) is as follows: Assets: Cash Accounts Receivable Finished Goods Inventory-smaller Finished Goods Inventory-larger Work-in-process Inventory Nylon Inventory Lining Inventory Property, plant, and equip. (net) Total Assets Liabilities: Accounts Payable Income Tax Payable Interest Payable Dividends Payable Short-term Debt Stockholders Equity: Common Stock Retained Earnings Total liabilities and Stockholder's Equity $ 308,000 407,000 870,232 876,480 235,840 123,750 39,600 a. Sales budget b. Production budget $ 3,520,000 $ 6,380,902 c. Material purchases budget d. Direct Labor budget e. Variable Overhead budget f. Fixed Overhead budget $209,000 $ 1,210,000 O. In January Hillary's expects to declare a $240,000 dividend. It will be paid in the second quarter and in the fourth quarter. g. Marketing budget h. General and Administration budget i. Cash budget 0 0 0 P. Hillary's also plans to purchase and pay for $125,000 of equipment during each quarter. $ 3,300,000 $ 1,661,902 $ 6,380,902 Q. The income tax rate is 35% and is paid on April 15 of the next year. Required: Prepare the formal master budget schedules for each quarter of the coming year, 2020 and for the year in total. Prepare formal financial statements for the year only. The following components must be included: j. Schedule of Cost of Goods Manufactured (annual only) k. Classified Income Statement (annual only) 1. Retained Earnings Statement (annual only) m. Classified Balance Sheet (annual only) n. Statement of Cash Flows - indirect method (annual only)

Step by Step Solution

★★★★★

3.57 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started