Answered step by step

Verified Expert Solution

Question

1 Approved Answer

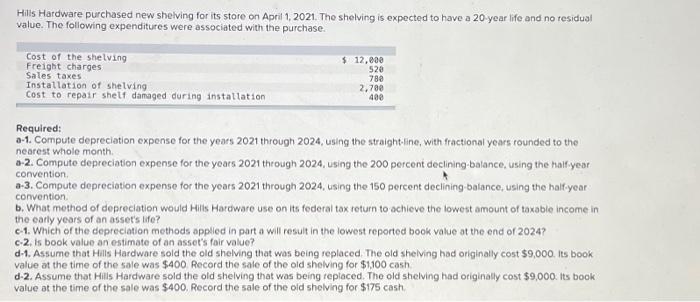

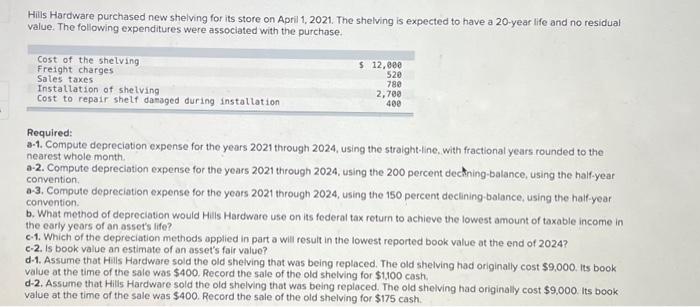

Hills Hardware purchased new shelving for its store on April 1, 2021. The shelving is expected to have a 20-year life and no residual value.

Hills Hardware purchased new shelving for its store on April 1, 2021. The shelving is expected to have a 20-year life and no residual value. The following expenditures were associated with the purchase. Cost of the shelving Freight charges Sales taxes Installation of shelving Cost to repair shelf damaged during installation $ 12,000 520 780 2,700 400 Required: a-1. Compute depreciation expense for the years 2021 through 2024, using the straight-line, with fractional years rounded to the nearest whole month. a-2. Compute depreciation expense for the years 2021 through 2024, using the 200 percent declining-balance, using the half-year convention. a-3. Compute depreciation expense for the years 2021 through 2024, using the 150 percent declining-balance, using the half-year convention. b. What method of depreciation would Hills Hardware use on its federal tax return to achieve the lowest amount of taxable income in the early years of an asset's life? c-1. Which of the depreciation methods applied in part a will result in the lowest reported book value at the end of 2024? c-2. Is book value an estimate of an asset's fair value? d-1. Assume that Hills Hardware sold the old shelving that was being replaced. The old shelving had originally cost $9,000. Its book value at the time of the sale was $400. Record the sale of the old shelving for $1,100 cash. d-2. Assume that Hills Hardware sold the old shelving that was being replaced. The old shelving had originally cost $9,000. Its book value at the time of the sale was $400. Record the sale of the old shelving for $175 cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started