Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hilton Company is a Canadian-controlled private corporation. Mr. Hilton, who bought the shares at their paid-up capital value of $2,500 intends to wind it

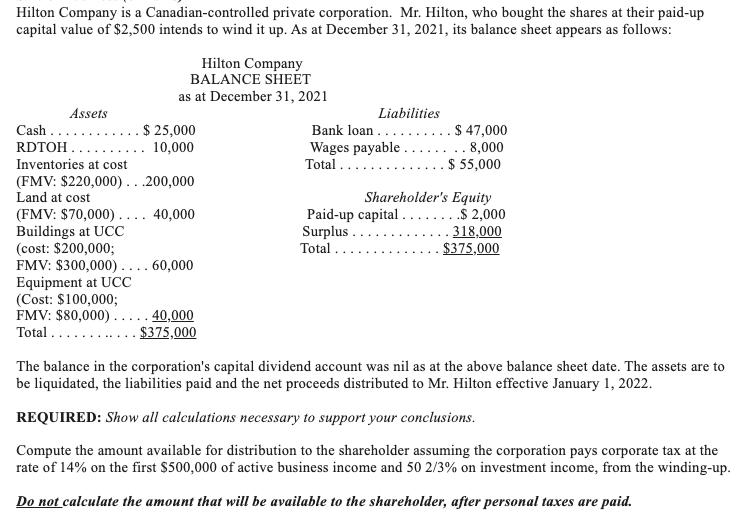

Hilton Company is a Canadian-controlled private corporation. Mr. Hilton, who bought the shares at their paid-up capital value of $2,500 intends to wind it up. As at December 31, 2021, its balance sheet appears as follows: Assets Hilton Company BALANCE SHEET as at December 31, 2021 Cash. RDTOH Inventories at cost (FMV: $220,000)...200,000 Land at cost $ 25,000 10,000 (FMV: $70,000).... 40,000 Buildings at UCC (cost: $200,000; FMV: $300,000).... 60,000 Equipment at UCC (Cost: $100,000; FMV: $80,000).....40,000 Total... . $375,000 Liabilities Bank loan. ... Wages payable Total... $ 47,000 .. 8,000 $ 55,000 Shareholder's Equity Paid-up capital. Surplus.. Total. .$ 2,000 318,000 . $375,000 The balance in the corporation's capital dividend account was nil as at the above balance sheet date. The assets are to be liquidated, the liabilities paid and the net proceeds distributed to Mr. Hilton effective January 1, 2022. REQUIRED: Show all calculations necessary to support your conclusions. Compute the amount available for distribution to the shareholder assuming the corporation pays corporate tax at the rate of 14% on the first $500,000 of active business income and 50 2/3% on investment income, from the winding-up. Do not calculate the amount that will be available to the shareholder, after personal taxes are paid.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Proceeds from the sale of assets Cash 25000 Inventories 220000 Land 70000 Buildings 300000 E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started