Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hilyard Management reported pretax accounting income of $150, $130, and $130 million in 2021, 2022, and 2023, which included $60 million from instalment sales

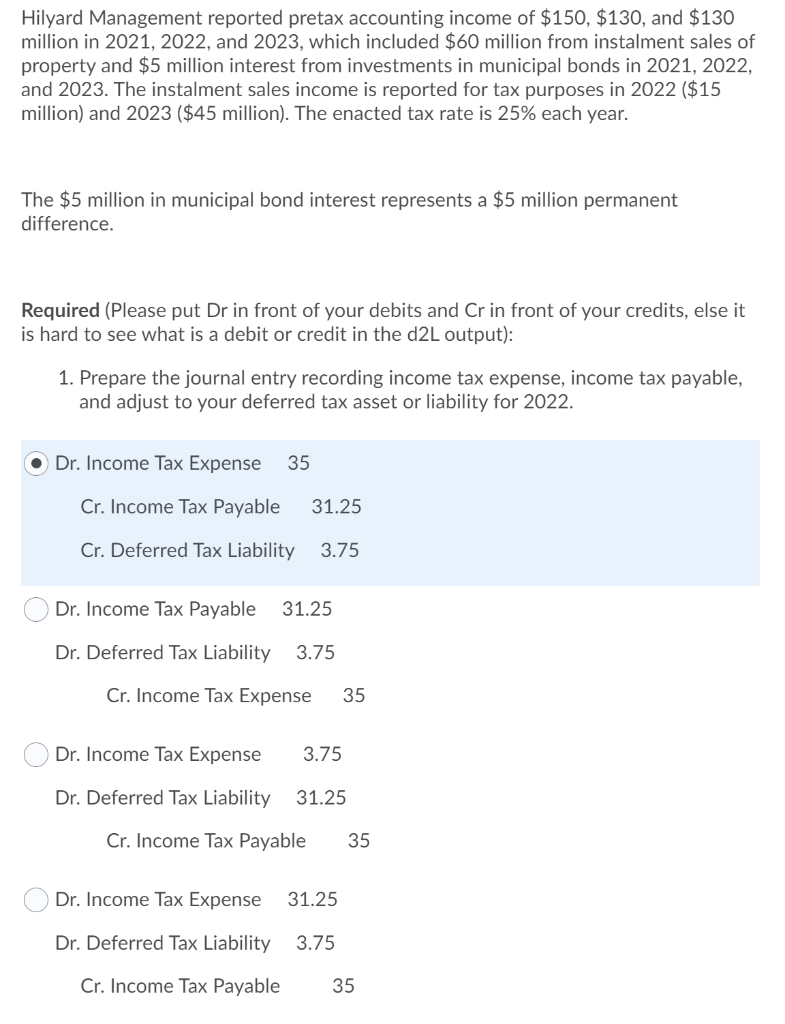

Hilyard Management reported pretax accounting income of $150, $130, and $130 million in 2021, 2022, and 2023, which included $60 million from instalment sales of property and $5 million interest from investments in municipal bonds in 2021, 2022, and 2023. The instalment sales income is reported for tax purposes in 2022 ($15 million) and 2023 ($45 million). The enacted tax rate is 25% each year. The $5 million in municipal bond interest represents a $5 million permanent difference. Required (Please put Dr in front of your debits and Cr in front of your credits, else it is hard to see what is a debit or credit in the d2L output): 1. Prepare the journal entry recording income tax expense, income tax payable, and adjust to your deferred tax asset or liability for 2022. Dr. come Tax Expense 35 Cr. Income Tax Payable 31.25 Cr. Deferred Tax Liability 3.75 Dr. Income Tax Payable 31.25 Dr. Deferred Tax Liability 3.75 Cr. Income Tax Expense 35 Dr. Income Tax Expense 3.75 Dr. Deferred Tax Liability 31.25 Cr. Income Tax Payable 35 Dr. Income Tax Expense 31.25 Dr. Deferred Tax Liability 3.75 Cr. Income Tax Payable 35

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The journal entries are prepared to keep the record of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started