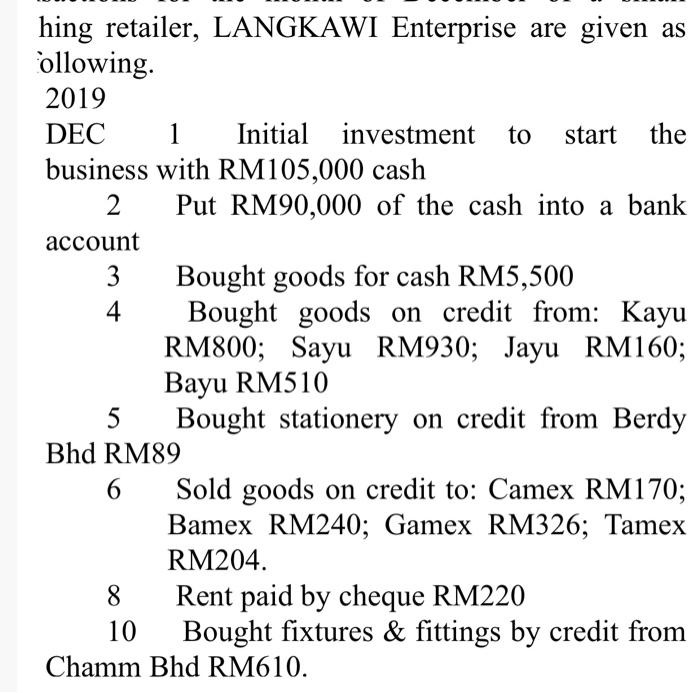

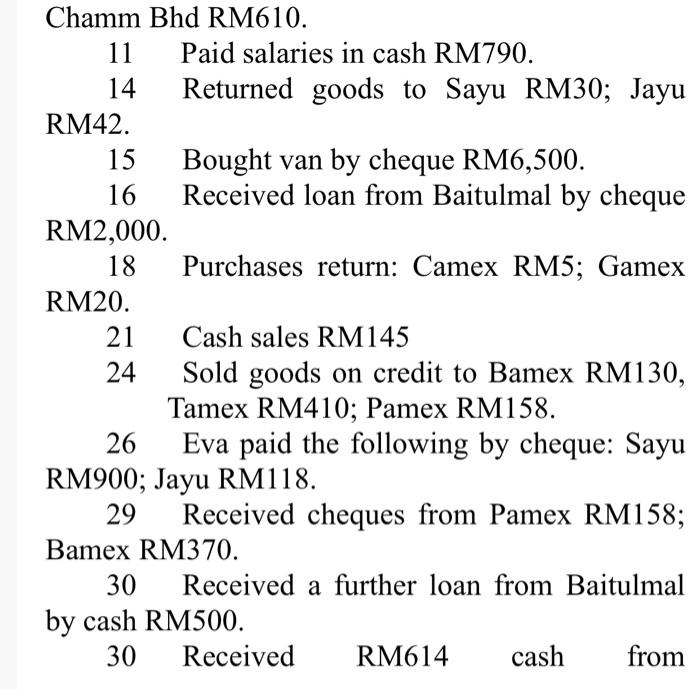

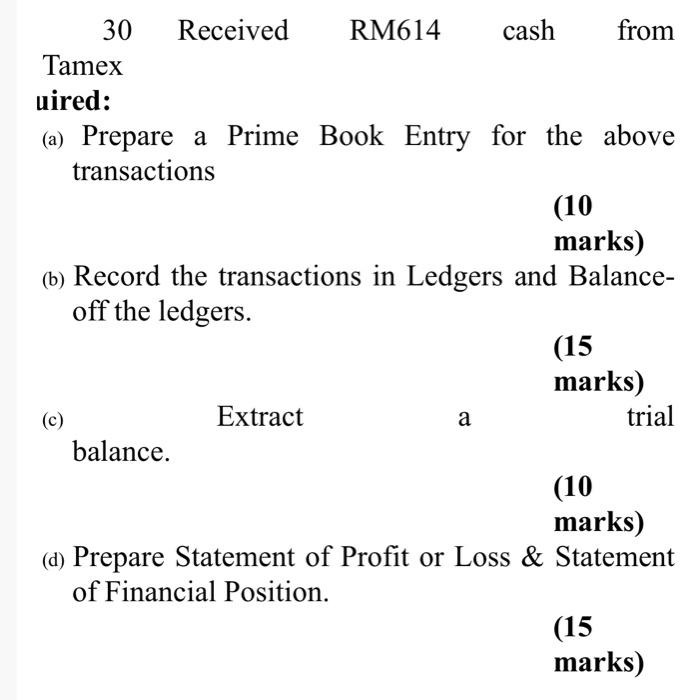

hing retailer, LANGKAWI Enterprise are given as following 2019 DEC 1 Initial investment to start the business with RM105,000 cash 2 Put RM90,000 of the cash into a bank account 3 Bought goods for cash RM5,500 4 Bought goods on credit from: Kayu RM800; Sayu RM930; Jayu RM160; Bayu RM510 5 Bought stationery on credit from Berdy Bhd RM89 6 Sold goods on credit to: Camex RM170; Bamex RM240; Gamex RM326; Tamex RM204. 8 Rent paid by cheque RM220 10 Bought fixtures & fittings by credit from Chamm Bhd RM610. Chamm Bhd RM610. 11 Paid salaries in cash RM790. 14 Returned goods to Sayu RM30; Jayu RM42. 15 Bought van by cheque RM6,500. 16 Received loan from Baitulmal by cheque RM2,000. 18 Purchases return: Camex RM5; Gamex RM20. 21 Cash sales RM145 24 Sold goods on credit to Bamex RM130, Tamex RM410; Pamex RM158. 26 Eva paid the following by cheque: Sayu RM900; Jayu RM118. 29 Received cheques from Pamex RM158; Bamex RM370. 30 Received a further loan from Baitulmal by cash RM500. 30 Received RM614 cash from 30 Received RM614 cash from Tamex uired: (a) Prepare a Prime Book Entry for the above transactions (10 marks) (b) Record the transactions in Ledgers and Balance- off the ledgers. (15 marks) Extract a trial balance. (10 marks) (a) Prepare Statement of Profit or Loss & Statement of Financial Position. (C) (15 marks) marks) (e) Briefly explain about Accounting Cycle according to the standards. (10 marks) (f) Explain about the Accounting Principles and its importance in preparing accounting information. (10 marks) (g) Explain briefly on the history of Accounting Standards and its development in Malaysia with examples of its professional bodies well. (15 marks) (h) Discuss and explain on the importance Provision for Doubtful Debt according to situations in making a performance decision in a business entity. as hing retailer, LANGKAWI Enterprise are given as following 2019 DEC 1 Initial investment to start the business with RM105,000 cash 2 Put RM90,000 of the cash into a bank account 3 Bought goods for cash RM5,500 4 Bought goods on credit from: Kayu RM800; Sayu RM930; Jayu RM160; Bayu RM510 5 Bought stationery on credit from Berdy Bhd RM89 6 Sold goods on credit to: Camex RM170; Bamex RM240; Gamex RM326; Tamex RM204. 8 Rent paid by cheque RM220 10 Bought fixtures & fittings by credit from Chamm Bhd RM610. Chamm Bhd RM610. 11 Paid salaries in cash RM790. 14 Returned goods to Sayu RM30; Jayu RM42. 15 Bought van by cheque RM6,500. 16 Received loan from Baitulmal by cheque RM2,000. 18 Purchases return: Camex RM5; Gamex RM20. 21 Cash sales RM145 24 Sold goods on credit to Bamex RM130, Tamex RM410; Pamex RM158. 26 Eva paid the following by cheque: Sayu RM900; Jayu RM118. 29 Received cheques from Pamex RM158; Bamex RM370. 30 Received a further loan from Baitulmal by cash RM500. 30 Received RM614 cash from 30 Received RM614 cash from Tamex uired: (a) Prepare a Prime Book Entry for the above transactions (10 marks) (b) Record the transactions in Ledgers and Balance- off the ledgers. (15 marks) Extract a trial balance. (10 marks) (a) Prepare Statement of Profit or Loss & Statement of Financial Position. (C) (15 marks) marks) (e) Briefly explain about Accounting Cycle according to the standards. (10 marks) (f) Explain about the Accounting Principles and its importance in preparing accounting information. (10 marks) (g) Explain briefly on the history of Accounting Standards and its development in Malaysia with examples of its professional bodies well. (15 marks) (h) Discuss and explain on the importance Provision for Doubtful Debt according to situations in making a performance decision in a business entity. as

![For Heintz/parrys College Accounting, Chapters 1-15, 22nd Edition, [instant Access]](https://dsd5zvtm8ll6.cloudfront.net/si.question.images/book_images/2022/04/6257c8d15b633_2096257c8d10b1d2.jpg)