Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hint: You may want to copy s i may want to copy some data tables into Excel and conduct the analysis there. . H. King

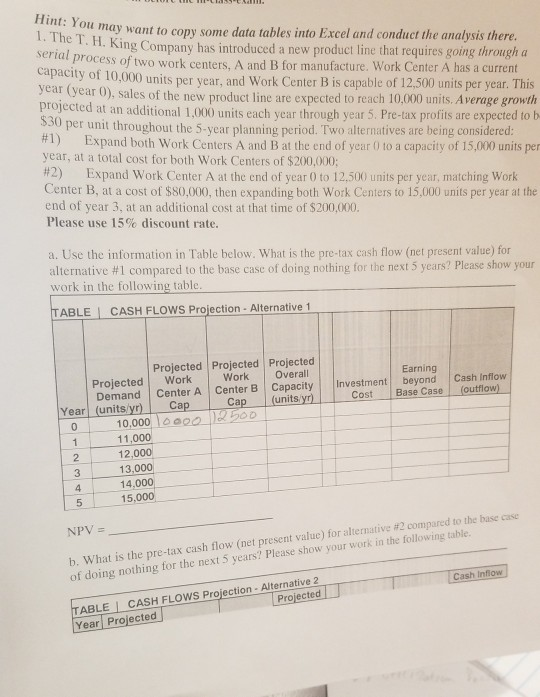

Hint: You may want to copy s i may want to copy some data tables into Excel and conduct the analysis there. . H. King Company has introduced a new product line that requires going through a serial process a process of two work centers, A and B for manufacture. Work Center A has a current capacity of 10,000 units per year, and Work Center B is capable of 12,500 units per year. This year (year 0), sales of the new product line are expected to reach 10.000 units. Average growth projected at an additional 1,000 units each year through year 5. Pre-tax profits are expected to b $30 per unit throughout the 5-year planning period. Two alternatives are being considered: #1) Expand both Work Centers A and B at the end of year 0 to a capacity of 15,000 units per year, at a total cost for both Work Centers of $200,000; H2) Expand Work Center A at the end of year 0 to 12,500 units per year, matching Work Center B, at a cost of $80,000, then expanding both Work Centers to 15,000 units per year at the end of year 3, at an additional cost at that time of $200,000. Please use 15% discount rate. a. Use the information in Table below. What is the pre-tax cash flow (net present value) for alternative #1 compared to the base case of doing nothing for the next 5 years? Please show your work in the following table. TABLE CASH FLOWS Projection - Alternative 1 Investment Cost Earning beyond Base Case Cash Inflow _outflow) Projected Projected Projected Projected Work Work Overall Demand Center A Center B Capacity Year (units/yr) Cap Cap (units/yr) 10,000 10000 2500 11,000 12.000 13,000 14.000 5 15,000 NPV = b. What is the pre-tax cash flow (net present value) for alternative #2.compared to the base case of doing nothing for the next 5 years? Please show your work in the following table. Cash Inflow TABLE CASH FLOWS Projection - Alternative 2 Year Projected Projected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started