Question

Kathy has recently opened Girly Shop, a store specializing in fashionable stockings. Kathy has just completed a course in managerial accounting, and she believes

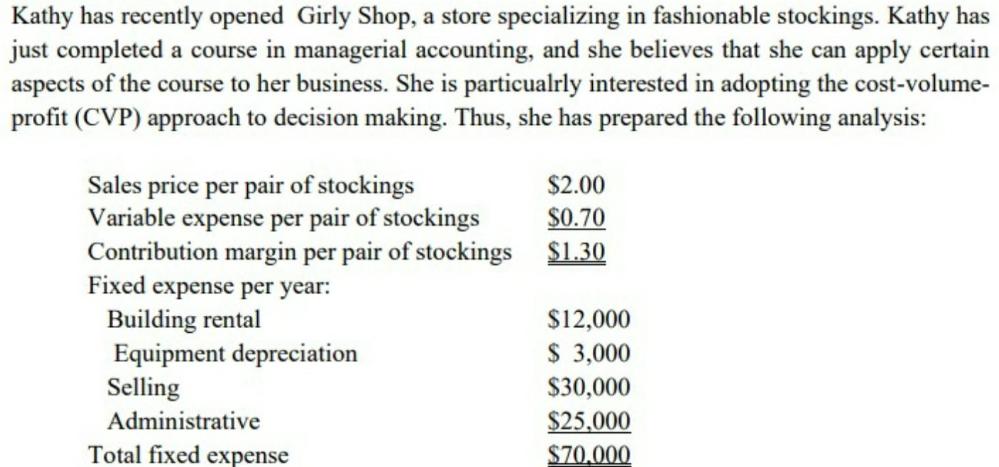

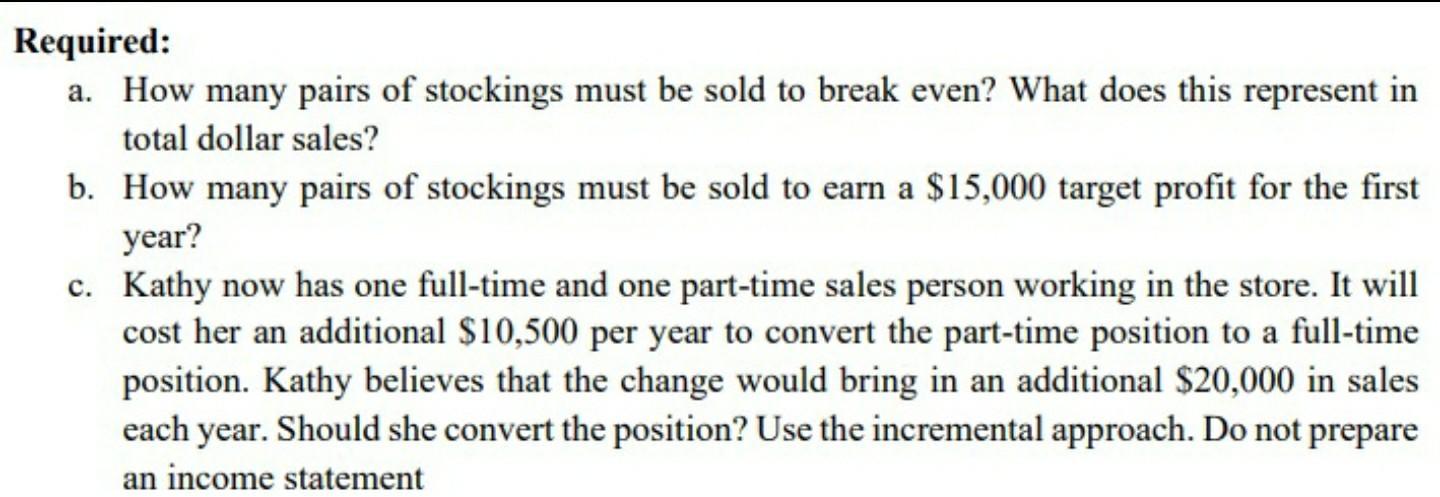

Kathy has recently opened Girly Shop, a store specializing in fashionable stockings. Kathy has just completed a course in managerial accounting, and she believes that she can apply certain aspects of the course to her business. She is particualrly interested in adopting the cost-volume- profit (CVP) approach to decision making. Thus, she has prepared the following analysis: Sales price per pair of stockings Variable expense per pair of stockings Contribution margin per pair of stockings Fixed expense per year: Building rental Equipment depreciation Selling Administrative Total fixed expense $2.00 $0.70 $1.30 $12,000 $ 3,000 $30,000 $25,000 $70.000

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a The breakeven point is when total revenue equals total expenses This can be represented by the equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Law Principles and Practices

Authors: Arnold J. Goldman, William D. Sigismond

9th edition

1133586562, 978-1285632995, 1285632990, 978-1285675367, 978-1133586562

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App