Answered step by step

Verified Expert Solution

Question

1 Approved Answer

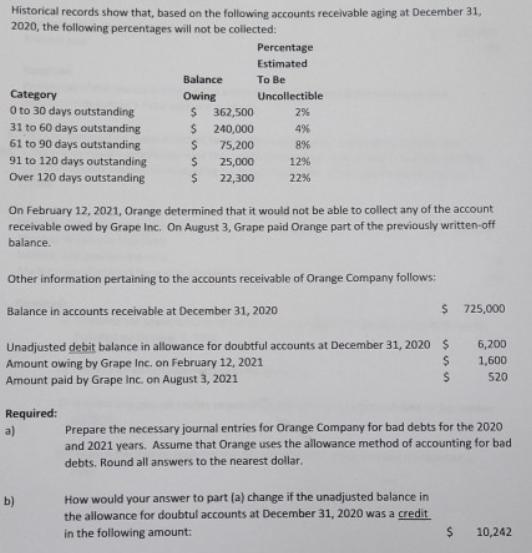

Historical records show that, based on the following accounts receivable aging at December 31, 2020, the following percentages will not be collected: Percentage Estimated

Historical records show that, based on the following accounts receivable aging at December 31, 2020, the following percentages will not be collected: Percentage Estimated To Be Balance Category Owing Uncollectible $ 362,500 2% $ 240,000 4% 0 to 30 days outstanding 31 to 60 days outstanding 61 to 90 days outstanding 91 to 120 days outstanding Over 120 days outstanding S 75,200 8% $ 25,000 12% $ 22,300 22% On February 12, 2021, Orange determined that it would not be able to collect any of the account receivable owed by Grape Inc. On August 3, Grape paid Orange part of the previously written-off balance. Other information pertaining to the accounts receivable of Orange Company follows: Balance in accounts receivable at December 31, 2020 $ 725,000 6,200 Unadjusted debit balance in allowance for doubtful accounts at December 31, 2020 $ Amount owing by Grape Inc. on February 12, 2021 Amount paid by Grape Inc. on August 3, 2021 $ 1,600 S 520 Required: a) Prepare the necessary journal entries for Orange Company for bad debts for the 2020 and 2021 years. Assume that Orange uses the allowance method of accounting for bad debts. Round all answers to the nearest dollar. b) How would your answer to part (a) change if the unadjusted balance in the allowance for doubtul accounts at December 31, 2020 was a credit in the following amount: $ 10,242

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Age Group 01 to 30 Days past due 31 to 60 Days past due 61 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started