Answered step by step

Verified Expert Solution

Question

1 Approved Answer

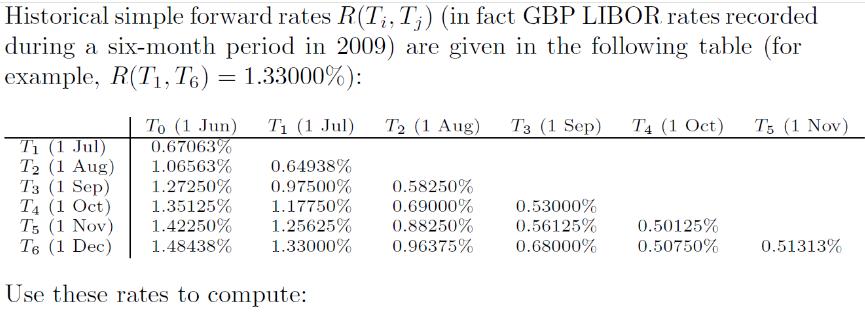

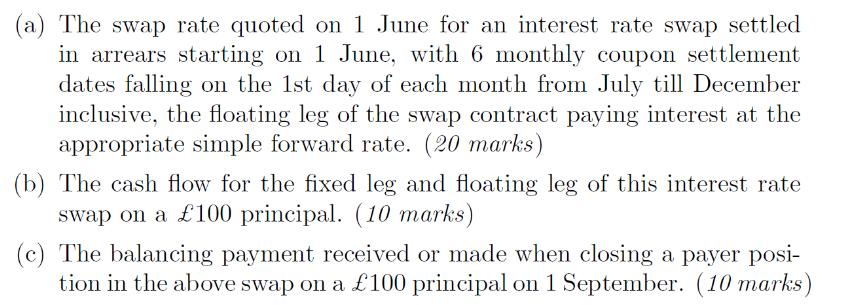

Historical simple forward rates R(Ti,Tj) (in fact GBP LIBOR rates recorded during a six-month period in 2009) are given in the following table (for

Historical simple forward rates R(Ti,Tj) (in fact GBP LIBOR rates recorded during a six-month period in 2009) are given in the following table (for example, R(T1, T6) = 1.33000%): To (1 Jun) T (1 Jul) T2 (1 Aug) 0.67063% 1.06563% 0.64938% 1.27250% 0.97500% 0.58250% 1.35125% 1.17750% 0.69000% 1.25625% 0.88250% 1.33000% 0.96375% T (1 Jul) T2 (1 Aug) T3 (1 Sep) T4 (1 Oct) T5 (1 Nov). 1.42250% T6 (1 Dec) 1.48438% Use these rates to compute: T3 (1 Sep) T4 (1 Oct) T5 (1 Nov) 0.53000% 0.56125% 0.68000% 0.50125% 0.50750% 0.51313% (a) The swap rate quoted on 1 June for an interest rate swap settled in arrears starting on 1 June, with 6 monthly coupon settlement dates falling on the 1st day of each month from July till December inclusive, the floating leg of the swap contract paying interest at the appropriate simple forward rate. (20 marks) (b) The cash flow for the fixed leg and floating leg of this interest rate swap on a 100 principal. (10 marks) (c) The balancing payment received or made when closing a payer posi- tion in the above swap on a 100 principal on 1 September. (10 marks)

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a The swap rate quoted on 1 June for an interest rate swap settled in arrears starting on 1 June with 6 monthly coupon settlement dates falling on the 1st day of each month from July till Dec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started