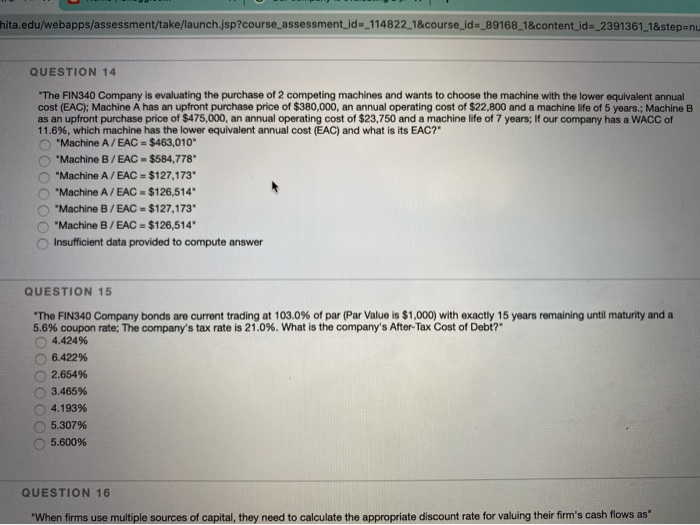

hita.edu/webapps/assessment/take/launch.jsp?course_assessment_id=_114822_1&course_id=_89168_1&content_id=_2391361_1&step=nu QUESTION 14 "The FIN340 Company is evaluating the purchase of 2 competing machines and wants to choose the machine with the lower equivalent annual cost (EAC); Machine A has an upfront purchase price of $380,000, an annual operating cost of $22,800 and a machine life of 5 years.; Machine B as an upfront purchase price of $475,000, an annual operating cost of $23,750 and a machine life of 7 years; If our company has a WACC of 11.6%, which machine has the lower equivalent annual cost (EAC) and what is its EAC? "Machine A/EAC = $463,010" "Machine B/EAC = $584,778 "Machine A/ EAC = $127,173 "Machine A / EAC = $126,514 "Machine B / EAC = $127,173" "Machine B/EAC = $126,514" Insufficient data provided to compute answer OOOOOOO QUESTION 15 "The FIN340 Company bonds are current trading at 103.0% of par (Par Value is $1,000) with exactly 15 years remaining until maturity and a 5.6% coupon rate; The company's tax rate is 21.0%. What is the company's After-Tax Cost of Debt? 4.424% 6.422% 2.654% 3.465% 4.193% 5.307% 5.600% QUESTION 16 "When firms use multiple sources of capital, they need to calculate the appropriate discount rate for valuing their firm's cash flows as hita.edu/webapps/assessment/take/launch.jsp?course_assessment_id=_114822_1&course_id=_89168_1&content_id=_2391361_1&step=nu QUESTION 14 "The FIN340 Company is evaluating the purchase of 2 competing machines and wants to choose the machine with the lower equivalent annual cost (EAC); Machine A has an upfront purchase price of $380,000, an annual operating cost of $22,800 and a machine life of 5 years.; Machine B as an upfront purchase price of $475,000, an annual operating cost of $23,750 and a machine life of 7 years; If our company has a WACC of 11.6%, which machine has the lower equivalent annual cost (EAC) and what is its EAC? "Machine A/EAC = $463,010" "Machine B/EAC = $584,778 "Machine A/ EAC = $127,173 "Machine A / EAC = $126,514 "Machine B / EAC = $127,173" "Machine B/EAC = $126,514" Insufficient data provided to compute answer OOOOOOO QUESTION 15 "The FIN340 Company bonds are current trading at 103.0% of par (Par Value is $1,000) with exactly 15 years remaining until maturity and a 5.6% coupon rate; The company's tax rate is 21.0%. What is the company's After-Tax Cost of Debt? 4.424% 6.422% 2.654% 3.465% 4.193% 5.307% 5.600% QUESTION 16 "When firms use multiple sources of capital, they need to calculate the appropriate discount rate for valuing their firm's cash flows as