Answered step by step

Verified Expert Solution

Question

1 Approved Answer

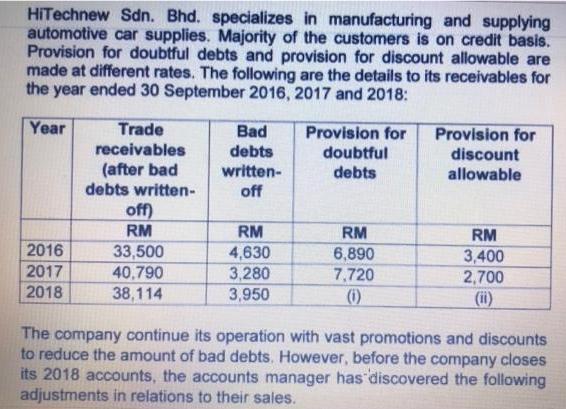

HITechnew Sdn. Bhd. specializes in manufacturing and supplying automotive car supplies. Majority of the customers is on credit basis. Provision for doubtful debts and

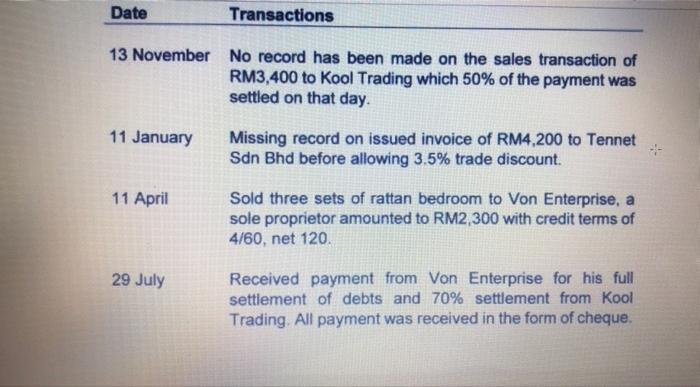

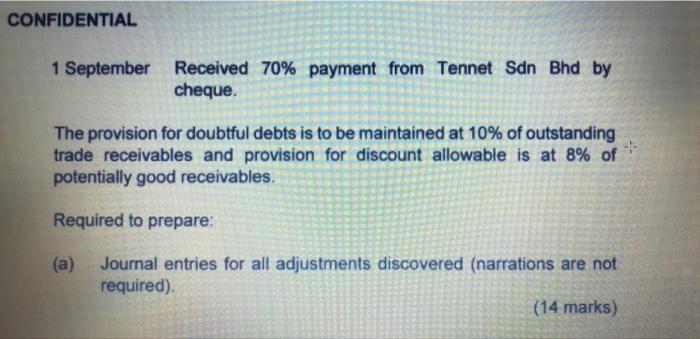

HITechnew Sdn. Bhd. specializes in manufacturing and supplying automotive car supplies. Majority of the customers is on credit basis. Provision for doubtful debts and provision for discount allowable are made at different rates. The following are the details to its receivables for the year ended 30 September 2016, 2017 and 2018: Year Trade Bad Provision for doubtful Provision for receivables (after bad debts written- debts discount written- off debts allowable off) RM RM RM RM 3,400 2,700 2016 4,630 3,280 6,890 33,500 40,790 38,114 2017 7,720 2018 3,950 (ii) The company continue its operation with vast promotions and discounts to reduce the amount of bad debts. However, before the company closes its 2018 accounts, the accounts manager has discovered the following adjustments in relations to their sales. Date Transactions 13 November No record has been made on the sales transaction of RM3,400 to Kool Trading which 50% of the payment was settled on that day. 11 January Missing record on issued invoice of RM4,200 to Tennet Sdn Bhd before allowing 3.5% trade discount. Sold three sets of rattan bedroom to Von Enterprise, a sole proprietor amounted to RM2,300 with credit terms of 4/60, net 120. 11 April Received payment from Von Enterprise for his full settlement of debts and 70% settlement from Kool Trading. All payment was received in the form of cheque. 29 July CONFIDENTIAL 1 September Received 70% payment from Tennet Sdn Bhd by cheque. The provision for doubtful debts is to be maintained at 10% of outstanding trade receivables and provision for discount allowable is at 8% of potentially good receivables. Required to prepare: (a) Journal entries for all adjustments discovered (narrations are not required). (14 marks)

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1H00 1311 Caih alc 100 Do Kool rading ale 3400 TO Salel alc 4053 Tennet ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started