Question

HMS Motor Services Company (HMS) is a European corporation that manufactures commercial vehicles and passenger cars in many countries in North America, South America, Asia

HMS Motor Services Company (HMS) is a European corporation that manufactures commercial vehicles and passenger cars in many countries in North America, South America, Asia and Europe. It also provides automotive financing services through its wholly owned HMS Financial. HMS has raised capital from share issues and external bonds issues to finance its operations. Its shares are listed on the London Stock Exchange. It has been using IFRS for financial reporting purposes. The compensation provided to HMSs top executives is guided by pay-for-performance and includes base salary, short-term incentives, and long-term incentives. The short-term incentives are linked to HMSs GAAP-based net income, among other financial metrics. Despite the compensation structure, HMSs top executives set a tone at top that the company endeavors to maintain a reliable and ethical financial reporting. It is now January 25, 2021. HMS is in the process of preparing its year-end financial statements for an audit. However, possible financial reporting issues must be identified, and necessary adjustments must be made to several accounts before books for the year can be closed. You are aware that the draft financial statements were completed on January 18, 2021 and had incorporated all the information available up to January 18, 2021. The applicable income tax rate is 21% for both 2020 and 2019.

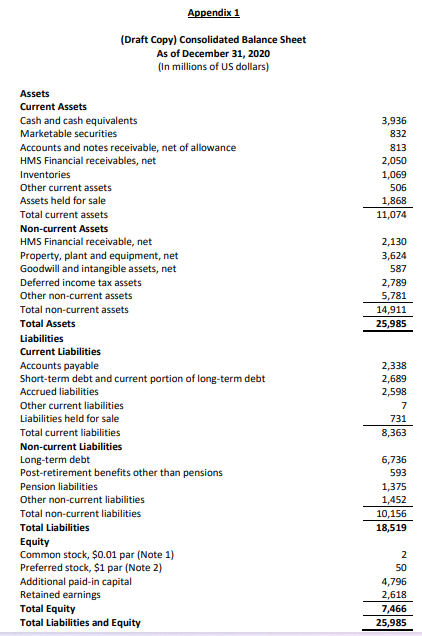

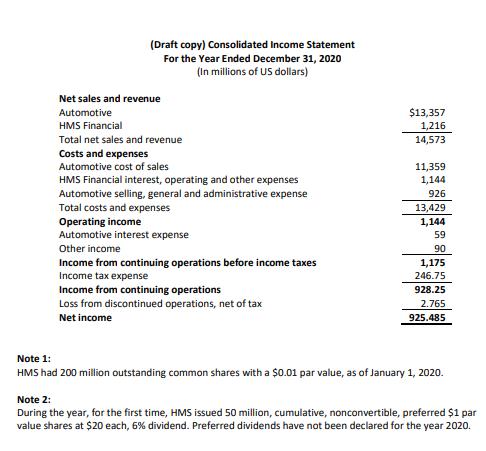

The CFO has provided you with the draft copy of the consolidated balance sheet as of December 31, 2020, and consolidated income statement for the year ended December 31, 2020 (Appendix 1). The CFO also has provided the following information:

-

Due to the economic recession and the fierce competition in South America, HMS has experienced low sales in this market in recent years. As a result, HMSs board of directors decided to dispose of its South America segment and formulated a formal plan in 2019. Negotiation with the potential buyer, SSS Group, was ongoing in 2020. On January 25, 2021, a Master Agreement was reached, and the net consideration to be paid, all in cash, would be $1,050 million. Other costs to close the sale are estimated to be insignificant. HMS agreed to use some of the proceeds from the sale (220 million) to reduce its pension liabilities two weeks after the sale is closed, with the remaining amount available for operation and investment needs. As of December 31, 2020, the South America segments assets were held for sale at a carrying value of $1,868 million and the related liabilities were held for sale at a carrying value of $731 million. The segment had a small operating loss of $2,765,000, net of tax, in 2020.

-

Before 2020, HMS estimated 1% of accounts receivables overdue from 0 to 30 days to be uncollectible, 4% for overdue 3160 days, 25% for overdue 6190 days, and 50% for overdue greater than 90 days. HMS has been having increased difficulty in collecting on its accounts receivable overdue greater than 90 days. For this reason, the percentage used for overdue greater than 90 days was changed from 50% to 80%, effective on January 1, 2020. The CFO estimated that if the new percentage had been used in 2019, an additional $300,000 bad debt expense would have been charged. The bad debt expense for 2020 was calculated using the new percentage.

Please report issues with the given information and create journal/adjusting entry and update balances on the financial statements in the appendix to reflect the adjustments.

Appendix 1 (Draft Copy) Consolidated Balance Sheet As of December 31, 2020 (In millions of US dollars) Assets Current Assets Cash and cash equivalents Marketable securities Accounts and notes receivable, net of allowance HMS Financial receivables, net Inventories Other current assets Assets held for sale Total current assets Non-current Assets HMS Financial receivable, net Property, plant and equipment, net Goodwill and intangible assets, net Deferred income tax assets Other non-current assets Total non-current assets Total Assets Liabilities Current Liabilities Accounts payable Short-term debt and current portion of long-term debt Accrued liabilities Other current liabilities Liabilities held for sale Total current liabilities Non-current Liabilities Long-term debt Post-retirement benefits other than pensions Pension liabilities Other non-current liabilities Total non-current liabilities Total Liabilities Equity Common stock, $0.01 par (Note 1) Preferred stock, $1 par (Note 2) Additional paid-in capital Retained earnings Total Equity Total Liabilities and Equity 3,936 832 813 2,050 1,069 506 1,868 11,074 2,130 3,624 587 2,789 5,781 14,911 25,985 2,338 2,689 2,598 7 731 8,363 6,736 593 1,375 1,452 10,156 18,519 2 50 4,796 2,618 7,466 25,985 (Draft copy) Consolidated Income Statement For the Year Ended December 31, 2020 (In millions of US dollars) Net sales and revenue Automotive $13,357 1,216 HMS Financial Total net sales and revenue 14,573 Costs and expenses Automotive cost of sales 11,359 1,144 HMS Financial interest, operating and other expenses Automotive selling, general and administrative expense 926 13,429 Total costs and expenses Operating income 1,144 Automotive interest expense 59 Other income 90 1,175 Income from continuing operations before income taxes Income tax expense 246.75 Income from continuing operations 928.25 Loss from discontinued operations, net of tax 2.765 Net income 925.485 Note 1: HMS had 200 million outstanding common shares with a $0.01 par value, as of January 1, 2020. Note 2: During the year, for the first time, HMS issued 50 million, cumulative, nonconvertible, preferred $1 par value shares at $20 each, 6% dividend. Preferred dividends have not been declared for the year 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started