Answered step by step

Verified Expert Solution

Question

1 Approved Answer

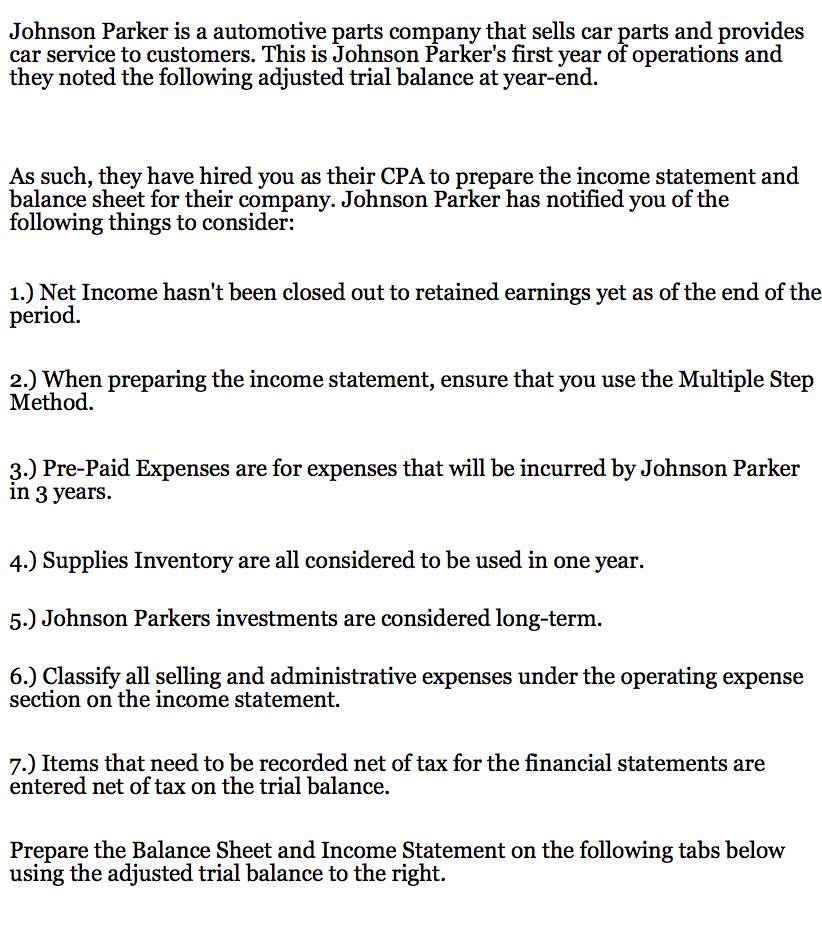

Johnson Parker is a automotive parts company that sells car parts and provides car service to customers. This is Johnson Parker's first year of

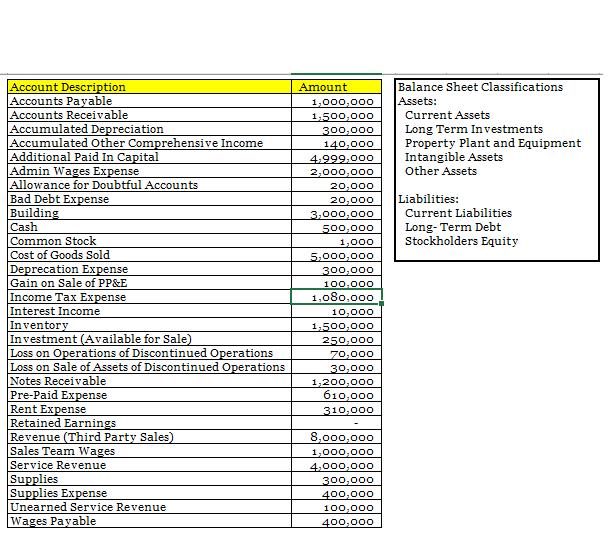

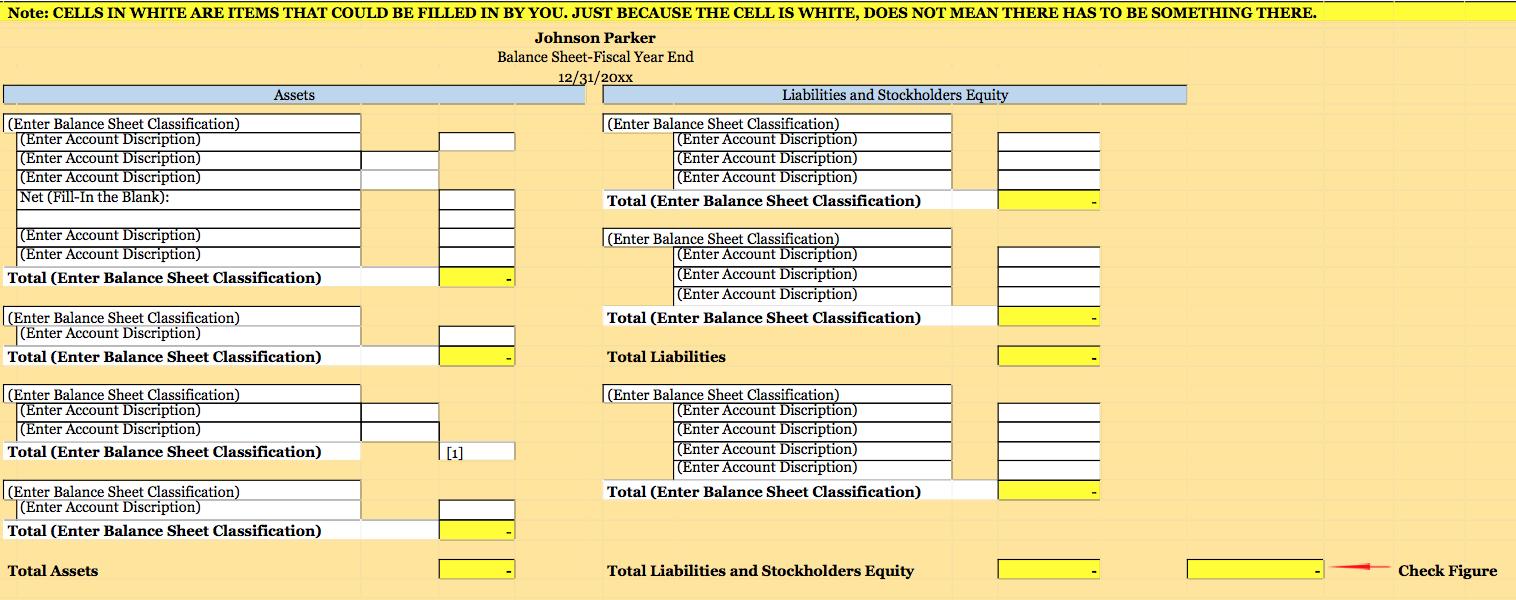

Johnson Parker is a automotive parts company that sells car parts and provides car service to customers. This is Johnson Parker's first year of operations and they noted the following adjusted trial balance at year-end. As such, they have hired you as their CPA to prepare the income statement and balance sheet for their company. Johnson Parker has notified you of the following things to consider: 1.) Net Income hasn't been closed out to retained earnings yet as of the end of the period. 2.) When preparing the income statement, ensure that you use the Multiple Step Method. 3.) Pre-Paid Expenses are for expenses that will be incurred by Johnson Parker in 3 years. 4.) Supplies Inventory are all considered to be used in one year. 5.) Johnson Parkers investments are considered long-term. 6.) Classify all selling and administrative expenses under the operating expense section on the income statement. 7.) Items that need to be recorded net of tax for the financial statements are entered net of tax on the trial balance. Prepare the Balance Sheet and Income Statement on the following tabs below using the adjusted trial balance to the right. Account Description Accounts Payable Accounts Receivable Accumulated Depreciation Accumulated Other Comprehensive Income Additional Paid In Capital Admin Wages Expense Allowance for Doubtful Accounts Bad Debt Expense Building Cash Common Stock Cost of Goods Sold Deprecation Expense Gain on Sale of PP&E Income Tax Expense Interest Income Inventory Investment (Available for Sale) Loss on Operations of Discontinued Operations Loss on Sale of Assets of Discontinued Operations Notes Receivable Pre-Paid Expense Rent Expense Retained Earnings Revenue (T ird Party Sales) Sales Team Wages Service Revenue. Supplies Supplies Expense Unearned Service Revenue Wages Payable Amount 1,000,000 1,500,000 300,000 140,000 4.999,000 2,000,000 20,000 20,000 3,000,000 500,000 1,000 5,000,000 300,000 100,000 1,080,000 10,000 1,500,000 250,000 70,000 30,000 1,200,000 610,000 310,000 8,000,000 1,000,000 4,000,000 300,000 400,000 100,000 400,000 Balance Sheet Classifications Assets: Current Assets Long Term Investments Property Plant and Equipment Intangible Assets Other Assets Liabilities: Current Liabilities Long-Term Debt Stockholders Equity Note: CELLS IN WHITE ARE ITEMS THAT COULD BE FILLED IN BY YOU. JUST BECAUSE THE CELL IS WHITE, DOES NOT MEAN THERE HAS TO BE SOMETHING THERE. Johnson Parker Balance Sheet-Fiscal Year End 12/31/20xx (Enter Balance Sheet Classification) (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) Net (Fill-In the Blank): Assets (Enter Account Discription) (Enter Account Discription) Total (Enter Balance Sheet Classification) (Enter Balance Sheet Classification) (Enter Account Discription) Total (Enter Balance Sheet Classification) (Enter Balance Sheet Classification) (Enter Account Discription) (Enter Account Discription) Total (Enter Balance Sheet Classification) (Enter Balance Sheet Classification) (Enter Account Discription) Total (Enter Balance Sheet Classification) Total Assets [1] Liabilities and Stockholders Equity (Enter Balance Sheet Classification) (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) Total (Enter Balance Sheet Classification) (Enter Balance Sheet Classification) (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) Total (Enter Balance Sheet Classification) Total Liabilities (Enter Balance Sheet Classification) (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) Total (Enter Balance Sheet Classification) Total Liabilities and Stockholders Equity Check Figure Note: CELLS IN WHITE ARE ITEMS THAT COULD BE FILLED IN BY YOU. JUST BECAUSE THE CELL IS WHITE, DOES NOT MEAN THERE HAS TO BE SOMETHING THERE. Johnson Parker Multiple Step Income Statement-Fiscal Year End 12/31/20XX (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) Total Revenue (Enter Account Discription) (Enter Account Discription) Gross Profit Operating Expenses (Selling and Administrative) (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) (Enter Account Discription) Total Operating Expenses Income from Operations (Enter Income Statement Classif.) (Enter Account Discription) (Enter Account Discription) Total (Enter Income Statement Classif.) (Enter Income Statement Classif.) (Enter Account Discription) (Enter Account Discription) Total (Enter Income Statement Classif.) Income from Continued Operations (Before Tax) (Enter Account Discription) Income from Continued Operations (Enter Income Statement Classif.) (Enter Account Discription) (Enter Account Discription) (Enter Income Statement Classif.) Income Before Extraordinary Items (Enter Account Discription) Net Income Fill this number in Fill this number in (Net of amounts include in the settlement of an operation) Fill this number in Fill this number in

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Johnson Parker Multiple Step Income Statement Fiscal Year End 123120XX Revenue third party sales Ser...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started