Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 2 After establishing their company's fiscal year-end to be October 31, Natalie and Curtis began operating Coffee Delights Inc. on November 1, 2024.

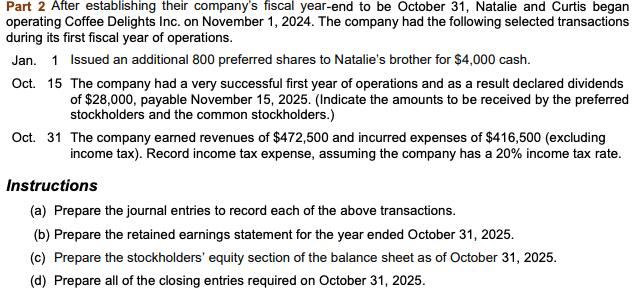

Part 2 After establishing their company's fiscal year-end to be October 31, Natalie and Curtis began operating Coffee Delights Inc. on November 1, 2024. The company had the following selected transactions during its first fiscal year of operations. Jan. 1 Issued an additional 800 preferred shares to Natalie's brother for $4,000 cash. Oct. 15 The company had a very successful first year of operations and as a result declared dividends of $28,000, payable November 15, 2025. (Indicate the amounts to be received by the preferred stockholders and the common stockholders.) Oct. 31 The company earned revenues of $472,500 and incurred expenses of $416,500 (excluding income tax). Record income tax expense, assuming the company has a 20% income tax rate. Instructions (a) Prepare the journal entries to record each of the above transactions. (b) Prepare the retained earnings statement for the year ended October 31, 2025. (c) Prepare the stockholders' equity section of the balance sheet as of October 31, 2025. (d) Prepare all of the closing entries required on October 31, 2025. Part 2 After establishing their company's fiscal year-end to be October 31, Natalie and Curtis began operating Coffee Delights Inc. on November 1, 2024. The company had the following selected transactions during its first fiscal year of operations. Jan. 1 Issued an additional 800 preferred shares to Natalie's brother for $4,000 cash. Oct. 15 The company had a very successful first year of operations and as a result declared dividends of $28,000, payable November 15, 2025. (Indicate the amounts to be received by the preferred stockholders and the common stockholders.) Oct. 31 The company earned revenues of $472,500 and incurred expenses of $416,500 (excluding income tax). Record income tax expense, assuming the company has a 20% income tax rate. Instructions (a) Prepare the journal entries to record each of the above transactions. (b) Prepare the retained earnings statement for the year ended October 31, 2025. (c) Prepare the stockholders' equity section of the balance sheet as of October 31, 2025. (d) Prepare all of the closing entries required on October 31, 2025.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Prepare the journal entries to record each of the above transactions Jan 1 Natalies brother purcha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started