Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hoa Phat Group (HPG) is going to build a new steel factory in Da Nang province with the total investment of $100 million. Hoa Phat

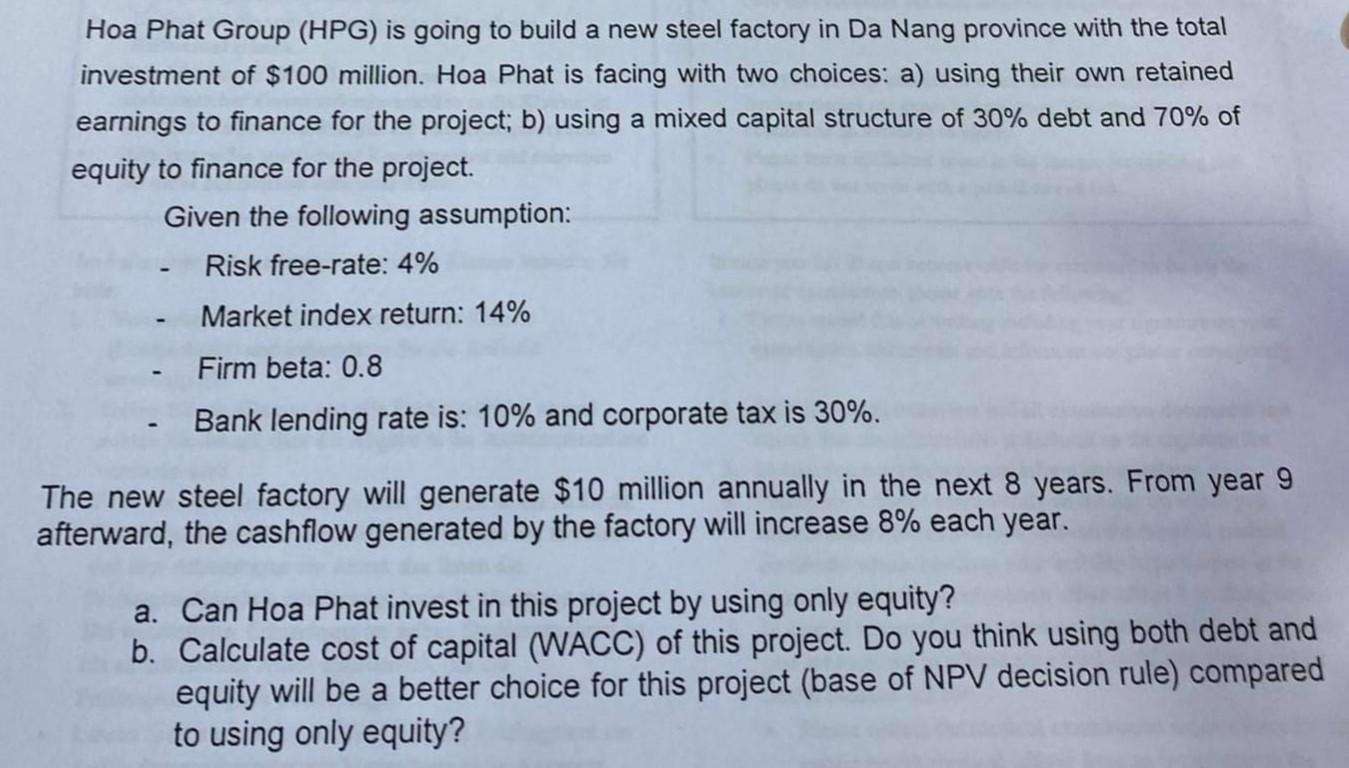

Hoa Phat Group (HPG) is going to build a new steel factory in Da Nang province with the total investment of $100 million. Hoa Phat is facing with two choices: a) using their own retained earnings to finance for the project; b) using a mixed capital structure of 30% debt and 70% of equity to finance for the project. Given the following assumption: Risk free-rate: 4% Market index return: 14% Firm beta: 0.8 - Bank lending rate is: 10% and corporate tax is 30%. - The new steel factory will generate $10 million annually in the next 8 years. From year 9 afterward, the cashflow generated by the factory will increase 8% each year. a. Can Hoa Phat invest in this project by using only equity? b. Calculate cost of capital (WACC) of this project. Do you think using both debt and equity will be a better choice for this project (base of NPV decision rule) compared to using only equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started