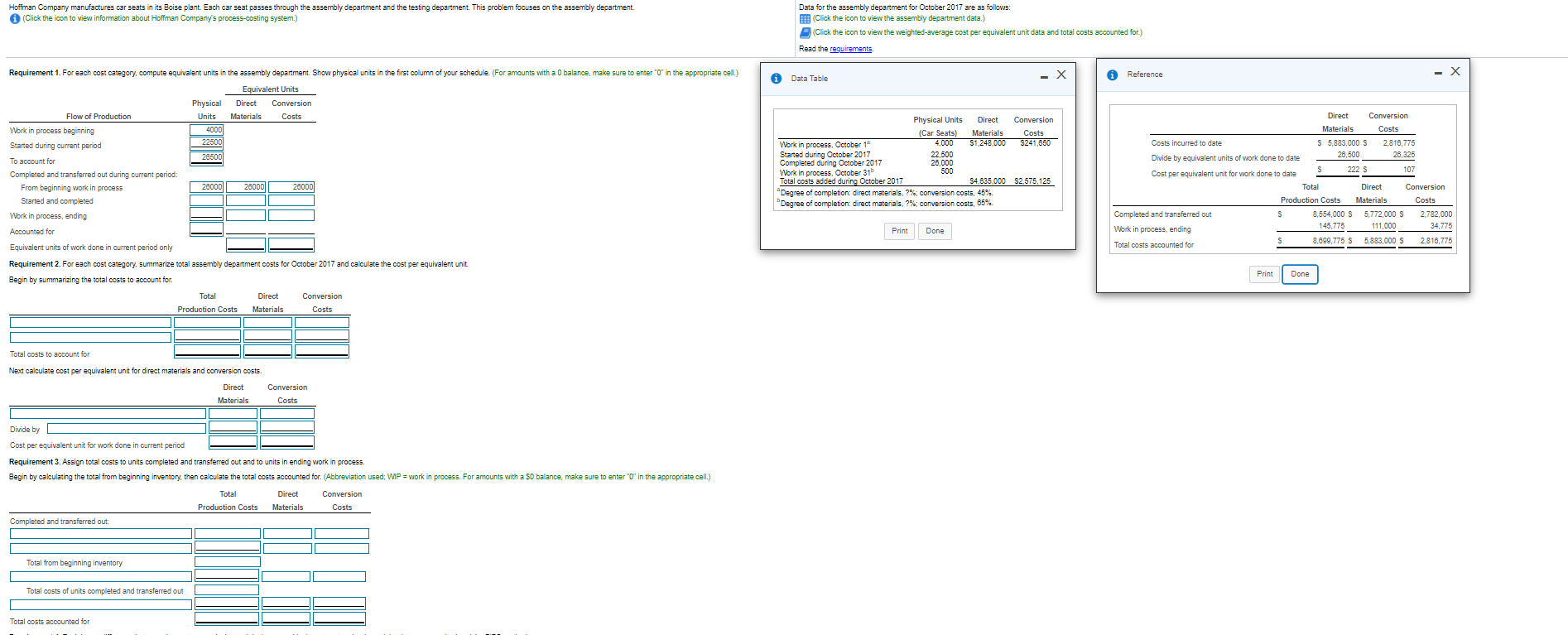

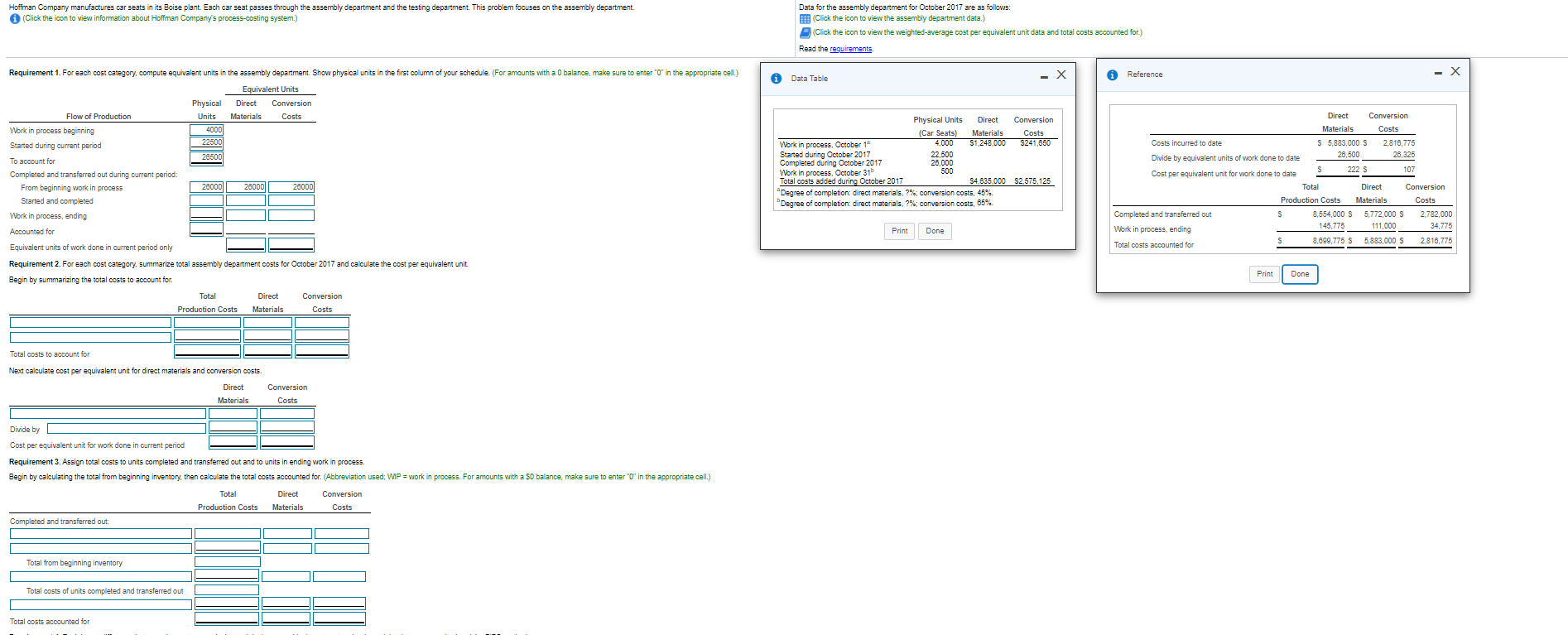

Hoffman Company manufactures car seats in its Boise plant. Each car seat passes through the assembly department and the testing department. This problem focuses on the assembly department. (Click the icon to view information about Hoffman Company's process-costing system.) Data for the assembly department for October 2017 are as follows: (Click the icon to view the assembly department data.) Click the icon to view the weighted average cost per equivalent unit data and total costs accounted for.) Read the requirements i Reference Data Table Requirement 1. For each cost category, compute equivalent units in the assembly department. Show physical units in the first column of your schedule. (For amounts with a 0 balance, make sure to enter "O in the appropriate cell) Equivalent Units Physical Direct Conversion Flow of Production Units Materials Costs Work in process beginning 4000 22500 Started during current period To account for 28500 Completed and transferred out during current period: From beginning work in process 26000 280001 28000 Started and completed Work in process, ending Accounted for Equivalent units of work done in current period only Requirement 2. For each cost category, summarize total assembly department costs for October 2017 and calculate the cost per equivalent unit Begin by summarizing total costs to account for Total Direct Conversion Production Costs Materials Costs Physical Units Direct Conversion (Car Seats) Materials Costs Work in process, October 10 4,000 $1.248,000 $241,850 Started during October 2017 Completed during October 2017 Work in process, October 31 Total costs added during October 2017 S4,635,000 $2,575,125 Degree of completion direct materials, 2% conversion costs, 45% Degree completion direct materials. 2%: conversion costs, 65% Direct Conversion Materials Costs Costs incurred to date $ 5,883.000 S 2.818,775 26,500 Divide by equivalent units of work done to date 26,325 222 107 Cost per equivalent unit for work done to date Total Direct Conversion Production Costs Materials Costs Completed and transferred out s 8,554,000 S 5,772,000 S 2,782,000 145.775 Work in process, ending 111,000 34 775 Total costs accounted for 8,699,775 S 5,883,000 Print Done 2,816,775 Print Done Total costs to socount for Next calculate cost per equivalent unit for direct materials and conversion costs Direct Materials Conversion Costs Divide by Cost per equivalent unit for work done in current period Requirement 3. Assign total costs to units completed and transferred out and to units in ending work in process. Begin by calculating the total from beginning inventory, then calculate the total costs accounted for. (Abbreviation used: WIP = work in process. For amounts with a $0 balance, make sure to enter "O' in the appropriate cell.) Total Direct Conversion Production Costs Materials Costs Completed and transferred out: Total from beginning inventory Total costs of units completed and transferred out Total costs accounted for