Answered step by step

Verified Expert Solution

Question

1 Approved Answer

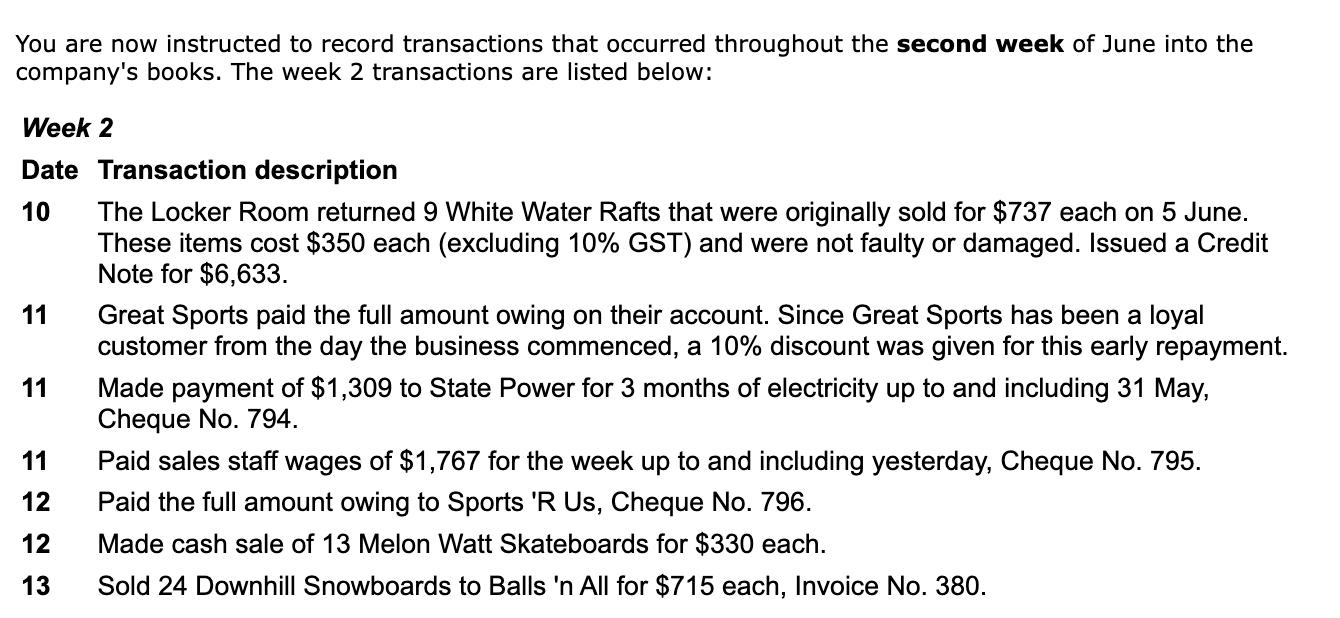

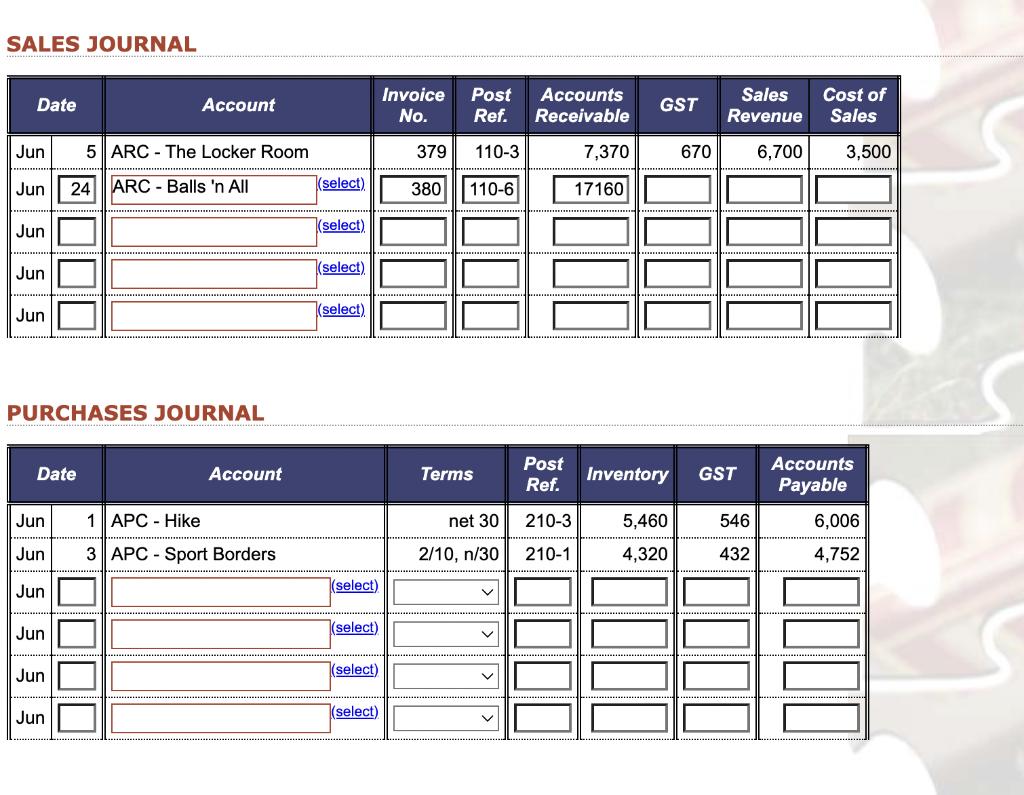

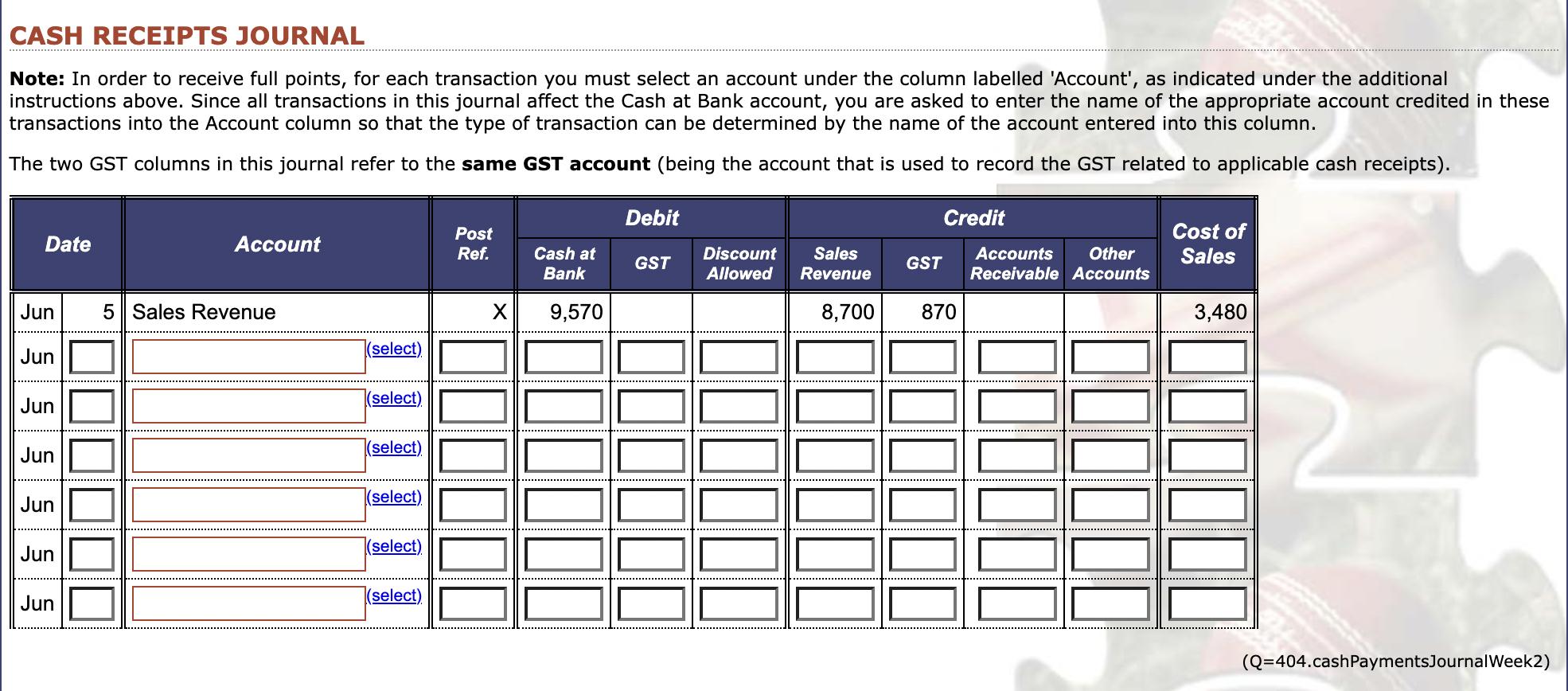

You are now instructed to record transactions that occurred throughout the second week of June into the company's books. The week 2 transactions are

![\[(Q=430 . \text { Inventory4_week } 2)\]Downhill Snowboards](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/09/6318661055790_1662543369896.jpg)

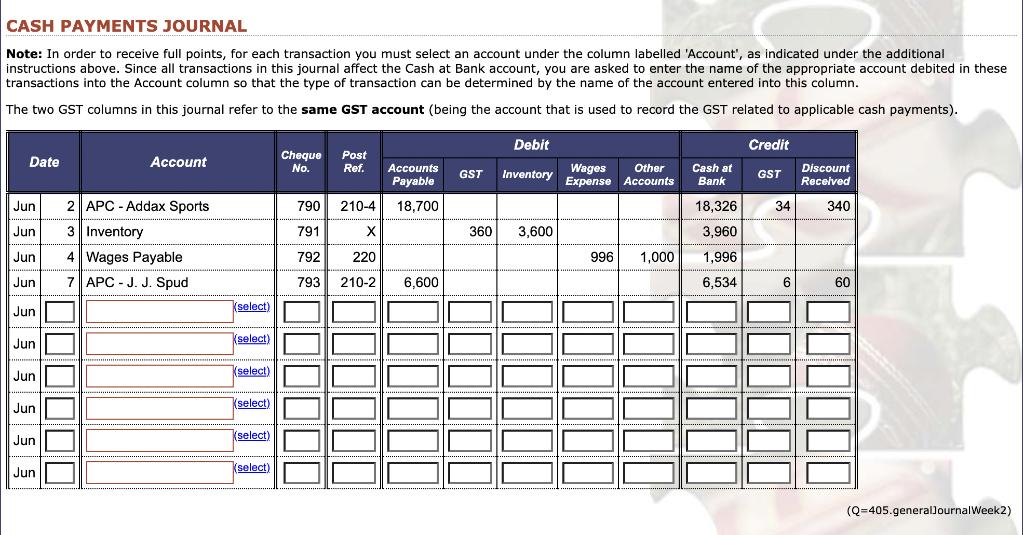

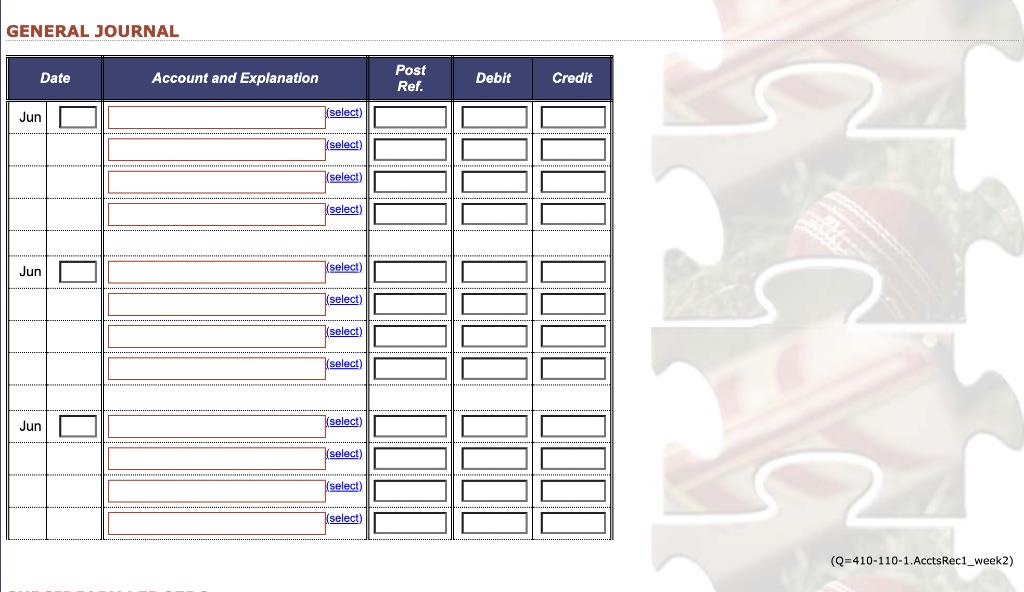

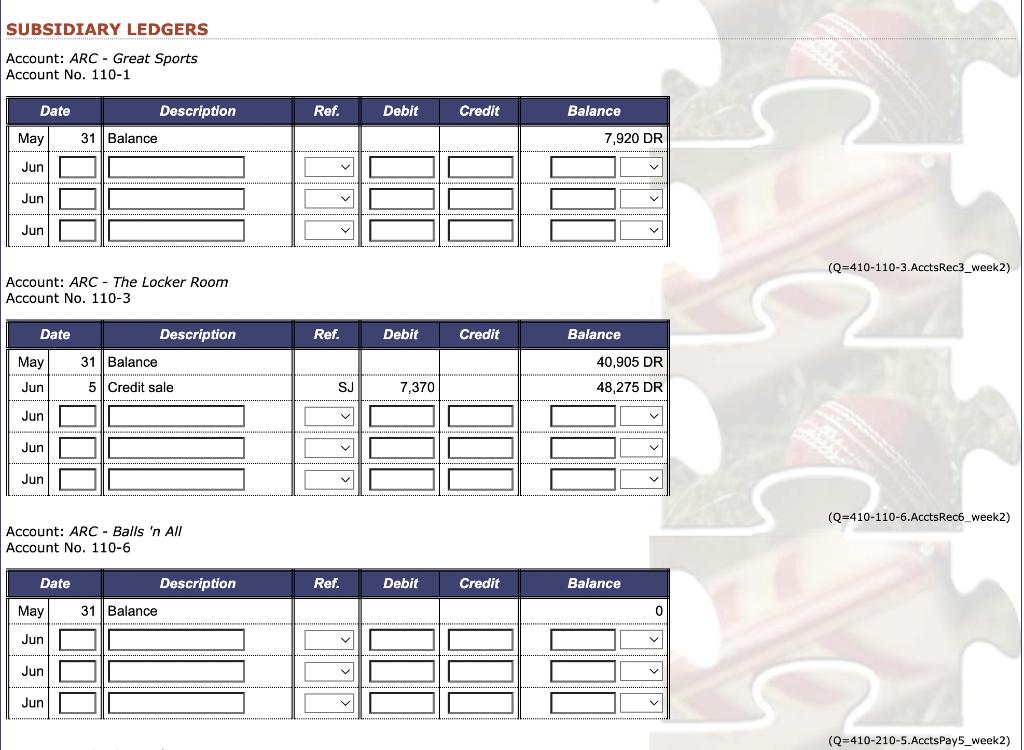

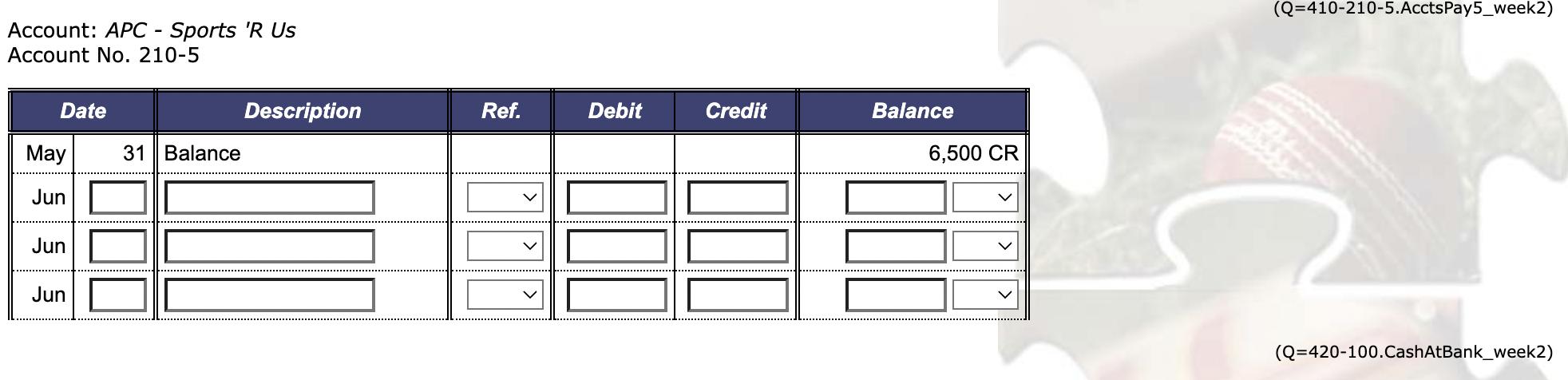

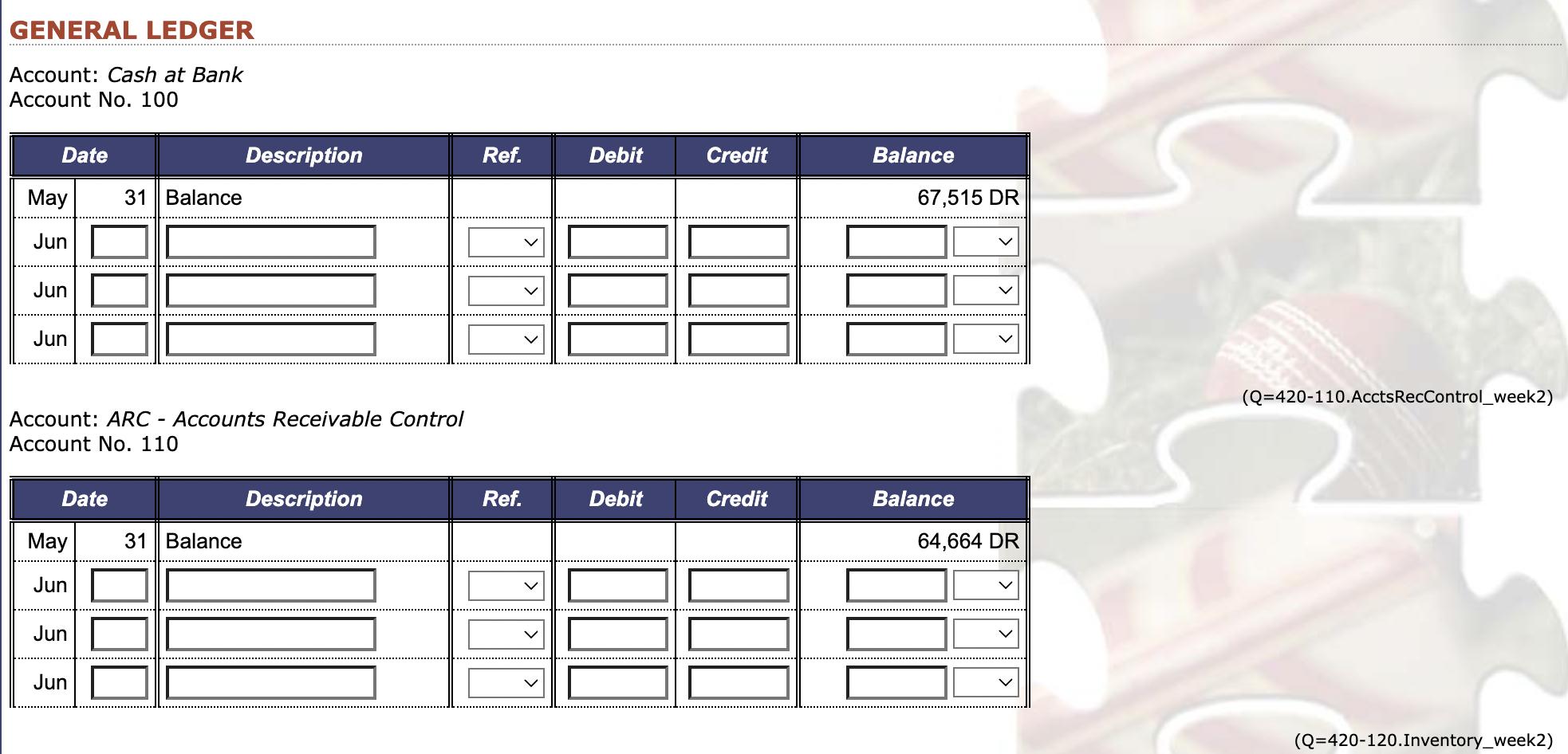

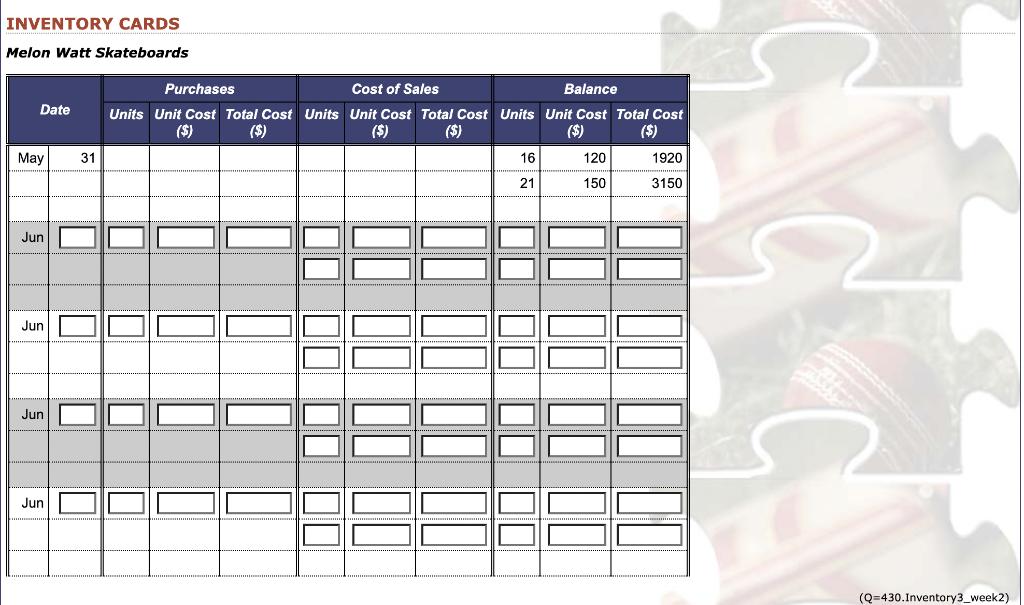

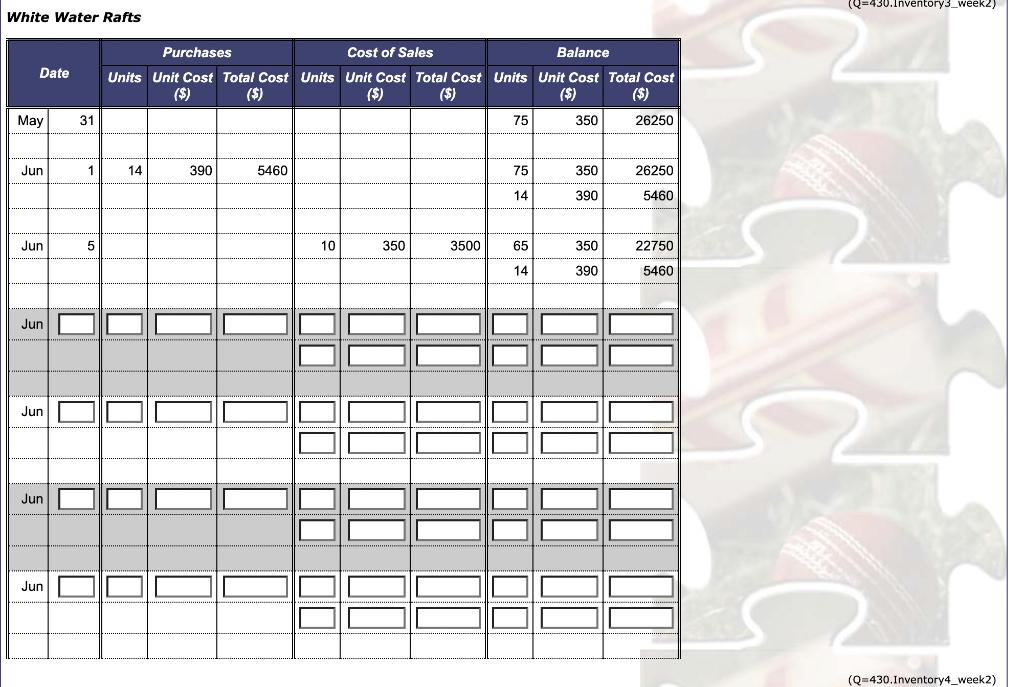

You are now instructed to record transactions that occurred throughout the second week of June into the company's books. The week 2 transactions are listed below: Week 2 Date Transaction description 10 11 11 11 12 12 13 The Locker Room returned 9 White Water Rafts that were originally sold for $737 each on 5 June. These items cost $350 each (excluding 10% GST) and were not faulty or damaged. Issued a Credit Note for $6,633. Great Sports paid the full amount owing on their account. Since Great Sports has been a loyal customer from the day the business commenced, a 10% discount was given for this early repayment. Made payment of $1,309 to State Power for 3 months of electricity up to and including 31 May, Cheque No. 794. ing yesterday, Cheque No. 795. Paid sales staff wages of $1,767 for the week up to and Paid the full amount owing to Sports 'R Us, Cheque No. 796. Made cash sale of 13 Melon Watt Skateboards for $330 each. Sold 24 Downhill Snowboards to Balls 'n All for $715 each, Invoice No. 380. SALES JOURNAL Date Jun Jun 24 ARC Balls 'n All Jun Jun Jun Date PURCHASES JOURNAL Jun Jun Jun Account Jun Jun Jun 5 ARC The Locker Room Account 1 APC Hike 3 APC - Sport Borders (select) (select) (select) (select) (select) (select) (select) (select) Invoice Post Accounts No. Ref. Receivable 110-3 379 380 110-6 Terms net 30 2/10, n/30 Post Ref. 210-3 210-1 7,370 17160 GST 670 5,460 4,320 Sales Revenue 6,700 Inventory GST 546 432 Cost of Sales 3,500 Accounts Payable 6,006 4,752 CASH RECEIPTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labelled 'Account', as indicated under the additional instructions above. Since all transactions in this journal affect the Cash at Bank account, you are asked to enter the name of the appropriate account credited in these transactions into the Account column so that the type of transaction can be determined by the name of the account entered into this column. The two GST columns in this journal refer to the same GST account (being the account that is used to record the GST related to applicable cash receipts). Date Jun Jun Jun Jun Jun Jun Jun Account 5 Sales Revenue (select) (select) (select) (select) (select) (select) Post Ref. X Cash at Bank 9,570 Debit GST Discount Sales Allowed Revenue 8,700 IL Credit GST 870 Accounts Other Receivable Accounts Cost of Sales 3,480 (Q=404.cashPaymentsJournalWeek2) CASH PAYMENTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labelled 'Account', as indicated under the additional instructions above. Since all transactions in this journal affect the Cash at Bank account, you are asked to enter the name of the appropriate account debited in these transactions into the Account column so that the type of transaction can be determined by the name of the account entered into this column. The two GST columns in this journal refer to the same GST account (being the account that is used to record the GST related to applicable cash payments). Date Jun 2 APC -Addax Sports Jun 3 Inventory Jun 4 Wages Payable Jun 7 APC - J. J. Spud Jun Jun Jun Jun Jun Account Jun (select) (select) (select) (select) (select) (select) Cheque Post No. Ref. Accounts Payable 18,700 790 210-4 791 X 792 220 793 210-2 6,600 0000 Debit GST Inventory 360 3,600 Wages Other Expense Accounts 996 1,000 Cash at Bank 18,326 3,960 1,996 6,534 Credit GST 34 6 Discount Received 340 60 (Q=405.general JournalWeek2) GENERAL JOURNAL Date Jun Jun Jun Account and Explanation (select) (select) (select) (select) (select) (select) (select) (select) (select) (select) (select) (select) Post Ref. Debit Credit (Q-410-110-1.AcctsRec1_week2) SUBSIDIARY LEDGERS Account: ARC - Great Sports Account No. 110-1 Date May Jun Jun Jun Date Account: ARC- The Locker Room Account No. 110-3 May Jun Jun Jun Jun Date May Jun 31 Balance Jun Account: ARC- Balls 'n All Account No. 110-6 Jun Description 31 Balance 5 Credit sale 5000 Description 31 Balance Description Ref. v v Ref. SJ v v Ref. V V Debit Debit 7,370 Debit Credit Credit Credit Balance 7,920 DR Balance V Balance V V 40,905 DR 48,275 DR V v 0 V V v (Q-410-110-3.AcctsRec3_week2) (Q-410-110-6.AcctsRec6_week2) (Q-410-210-5.AcctsPay5_week2) Account: APC - Sports 'R Us Account No. 210-5 Date May Jun Jun Jun 31 Balance Description Ref. Debit Credit Balance 6,500 CR (Q=410-210-5.Accts Pay5_week2) (Q=420-100.CashAtBank_week2) GENERAL LEDGER Account: Cash at Bank Account No. 100 Date May Jun Jun Jun Date Account: ARC - Accounts Receivable Control Account No. 110 May Jun Jun 31 Balance Jun Description 31 Balance Description Ref. Ref. Debit Debit Credit Credit Balance 67,515 DR Balance 64,664 DR (Q=420-110.Accts RecControl_week2) (Q=420-120.Inventory_week2) Account: Inventory Account No. 120 Date May Jun Jun Jun Account: GST Outlays Account No. 135 Date May Jun Jun Jun Date May Jun 31 Balance Jun Account: Electricity Payable Account No. 221 Jun 31 Balance Description 31 Balance Description Description Ref. v v Ref. v v v Ref. v V Debit Debit Debit Credit Credit Credit Balance 67,780 DR Balance 19,302 DR Balance V 1,247 CR V (Q=420-120.Inventory_week2) (Q-420-135.TaxPaid_week2) (Q=420-221.Electricity Payable_week2) (Q=420-270.TaxCollected_week2) Account: GST Collections Account No. 240 Date May Jun Jun Jun Date Account: Sales Revenue Account No. 400 May Jun Jun Jun 31 Balance Date Description 31 Balance Account: Sales Returns and Allowances Account No. 401 May 31 Balance Jun Jun Jun Description Description Ref. Ref. Ref. v Debit Debit Debit Credit Credit Credit Balance 11,271 CR Balance Balance v v V v (Q-420-400.SalesRevenue_week2) 5 (Q=420-401.SalesReturns_week2) (Q=420-402.DiscountRecd_week2) Account: Discount Received Account No. 402 Date May Jun Jun Jun Account: Cost of Sales Account No. 500 Date May Jun Jun Jun Date May Jun 31 Balance Jun Account: Wages Expense Account No. 516 Jun 31 Balance Description Description 31 Balance Description Ref. Ref. v Ref. v Debit Debit Debit Credit Credit Credit Balance Balance Balance V v V v V V (Q=420-500.CostOfSales_week2) (Q=420-516.WagesExpense_week2) (Q=420-541.Electricity Expense_week2) Account: Electricity Expense Account No. 541 Date May Jun Jun Jun Date Account: Discount Allowed Account No. 573 May Jun Jun 31 Balance Jun Description 31 Balance Description Ref. Ref. Debit Debit Credit Credit Balance Balance 0 > 0 2 (Q=420-573.DiscountAllowed_week2) (Q=430.Inventory1_week2) INVENTORY CARDS Melon Watt Skateboards Date May Jun Jun Jun Jun 31 Purchases Cost of Sales Balance Units Unit Cost Total Cost Units Unit Cost Total Cost Units Unit Cost Total Cost ($) ($) ($) ($) ($) ($) 16 21 120 150 1920 3150 (Q=430.Inventory3_week2) White Water Rafts Date May Jun Jun Jun Jun Jun Jun 31 1 5 Purchases Cost of Sales Balance Units Unit Cost Total Cost Units Unit Cost Total Cost Units Unit Cost Total Cost ($) ($) ($) ($) ($) 14 390 5460 10 350 3500 75 75 14 65 14 350 350 390 350 390 26250 26250 5460 22750 5460 (Q=430.Inventory3_week2) (Q=430.Inventory4_week2) Downhill Snowboards Date May Jun Jun Jun Jun 31 Purchases Cost of Sales Balance Units Unit Cost Total Cost Units Unit Cost Total Cost Units Unit Cost Total Cost ($) ($) ($) ($) ($) 16 20 270 320 4320 6400 (Q=430.Inventory4_week2)

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Transactions Week 2 PURCHASE JOURNAL Date Jun 8 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started