Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hogs Hats is a retail company that buys hats from a manufacturer and sells them in its store. You have been assigned to help

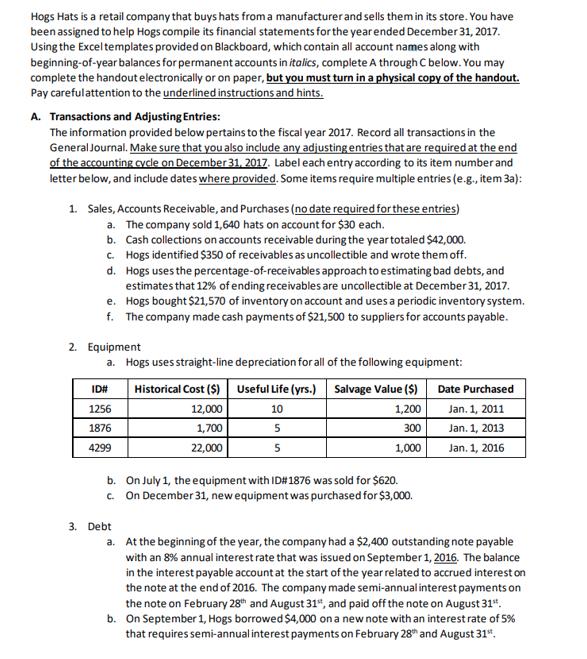

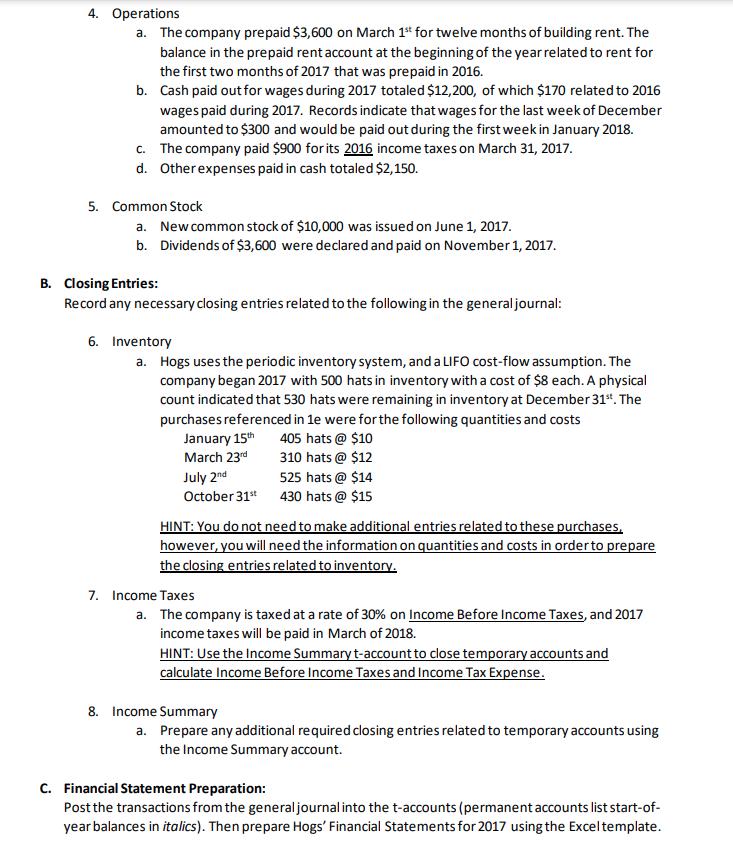

Hogs Hats is a retail company that buys hats from a manufacturer and sells them in its store. You have been assigned to help Hogs compile its financial statements for the year ended December 31, 2017. Using the Excel templates provided on Blackboard, which contain all account names along with beginning-of-year balances for permanent accounts in italics, complete A through C below. You may complete the handout electronically or on paper, but you must turn in a physical copy of the handout. Pay careful attention to the underlined instructions and hints. A. Transactions and Adjusting Entries: The information provided below pertains to the fiscal year 2017. Record all transactions in the General Journal. Make sure that you also include any adjusting entries that are required at the end of the accounting cycle on December 31, 2017. Label each entry according to its item number and letter below, and include dates where provided. Some items require multiple entries (e.g., item 3a): 1. Sales, Accounts Receivable, and Purchases (no date required for these entries) a. The company sold 1,640 hats on account for $30 each. b. Cash collections on accounts receivable during the year totaled $42,000. c. Hogs identified $350 of receivables as uncollectible and wrote them off. d. Hogs uses the percentage-of-receivables approach to estimating bad debts, and estimates that 12% of ending receivables are uncollectible at December 31, 2017. Hogs bought $21,570 of inventory on account and uses a periodic inventory system. f. The company made cash payments of $21,500 to suppliers for accounts payable. e. 2. Equipment a. Hogs uses straight-line depreciation for all of the following equipment: ID# 1256 1876 4299 Historical Cost ($) Useful Life (yrs.) Salvage Value ($) 12,000 10 1,200 1,700 5 300 22,000 5 1,000 b. On July 1, the equipment with ID# 1876 was sold for $620. On December 31, new equipment was purchased for $3,000. c. Date Purchased Jan. 1, 2011 Jan. 1, 2013 Jan. 1, 2016 3. Debt a. At the beginning of the year, the company had a $2,400 outstanding note payable with an 8% annual interest rate that was issued on September 1, 2016. The balance in the interest payable account at the start of the year related to accrued interest on the note at the end of 2016. The company made semi-annual interest payments on the note on February 28th and August 31", and paid off the note on August 31. b. On September 1, Hogs borrowed $4,000 on a new note with an interest rate of 5% that requires semi-annual interest payments on February 28th and August 31, 4. Operations a. The company prepaid $3,600 on March 1st for twelve months of building rent. The balance in the prepaid rent account at the beginning of the year related to rent for the first two months of 2017 that was prepaid in 2016. b. Cash paid out for wages during 2017 totaled $12,200, of which $170 related to 2016 wages paid during 2017. Records indicate that wages for the last week of December amounted to $300 and would be paid out during the first week in January 2018. The company paid $900 for its 2016 income taxes on March 31, 2017. c. d. Other expenses paid in cash totaled $2,150. 5. Common Stock a. New common stock of $10,000 was issued on June 1, 2017. b. Dividends of $3,600 were declared and paid on November 1, 2017. B. Closing Entries: Record any necessary closing entries related to the following in the general journal: 6. Inventory a. Hogs uses the periodic inventory system, and a LIFO cost-flow assumption. The company began 2017 with 500 hats in inventory with a cost of $8 each. A physical count indicated that 530 hats were remaining in inventory at December 31st. The purchases referenced in 1e were for the following quantities and costs January 15th March 23rd July 2nd October 31st 405 hats @ $10 310 hats @ $12 525 hats @ $14 430 hats @ $15 HINT: You do not need to make additional entries related to these purchases, however, you will need the information on quantities and costs in order to prepare the closing entries related to inventory. 7. Income Taxes a. The company is taxed at a rate of 30% on Income Before Income Taxes, and 2017 income taxes will be paid in March of 2018. HINT: Use the Income Summary t-account to close temporary accounts and calculate Income Before Income Taxes and Income Tax Expense. 8. Income Summary a. Prepare any additional required closing entries related to temporary accounts using the Income Summary account. C. Financial Statement Preparation: Post the transactions from the general journal into the t-accounts (permanent accounts list start-of- year balances in italics). Then prepare Hogs' Financial Statements for 2017 using the Excel template.

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started