Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hogwarts Life offers a pension plan that pays a lump sum benefit of 750,000 at the end of the year of death while employed

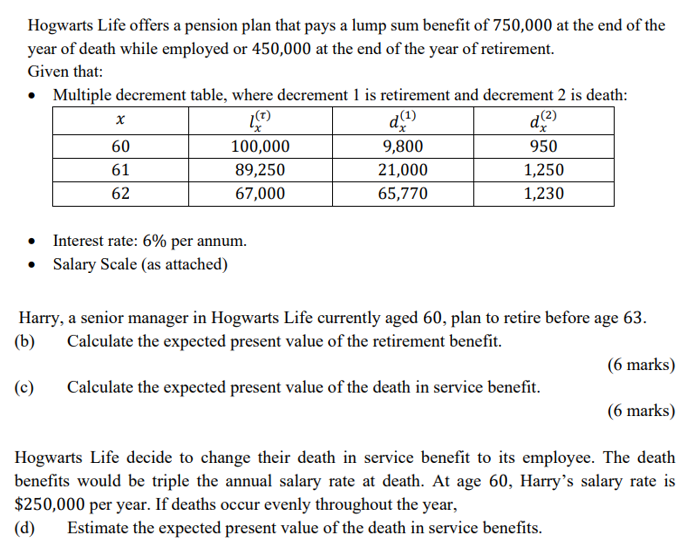

Hogwarts Life offers a pension plan that pays a lump sum benefit of 750,000 at the end of the year of death while employed or 450,000 at the end of the year of retirement. Given that: Multiple decrement table, where decrement 1 is retirement and decrement 2 is death: d(2) 950 1,250 1,230 x 60 61 62 100,000 89,250 67,000 Interest rate: 6% per annum. Salary Scale (as attached) 9,800 21,000 65,770 Harry, a senior manager in Hogwarts Life currently aged 60, plan to retire before age 63. Calculate the expected present value of the retirement benefit. (b) (6 marks) (c) Calculate the expected present value of the death in service benefit. (6 marks) Hogwarts Life decide to change their death in service benefit to its employee. The death benefits would be triple the annual salary rate at death. At age 60, Harry's salary rate is $250,000 per year. If deaths occur evenly throughout the year, (d) Estimate the expected present value of the death in service benefits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the expected present value of the retirement benefit and the death in service benefit for Harry a senior manager in Hogwarts Life aged ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started