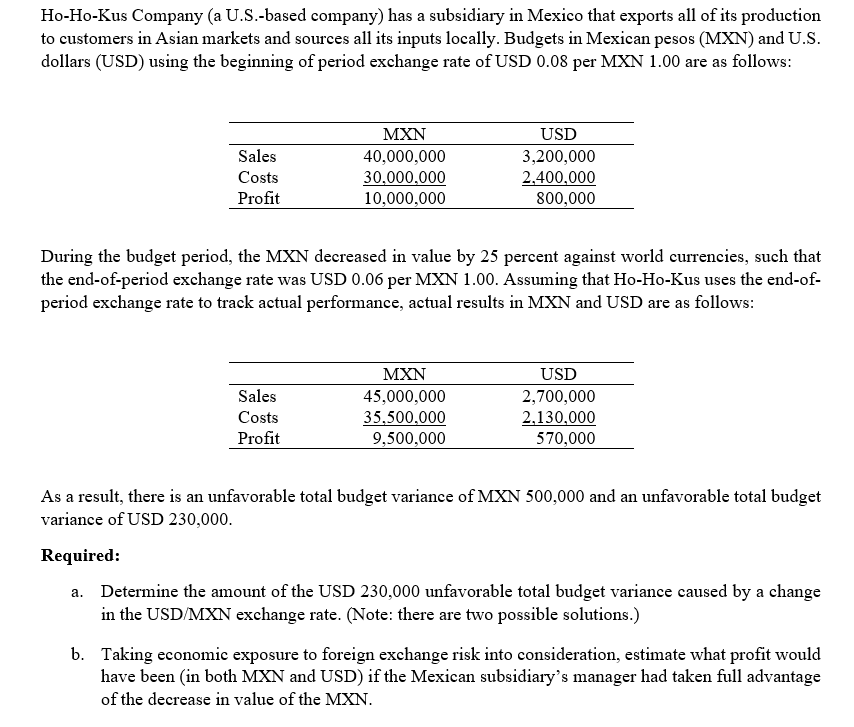

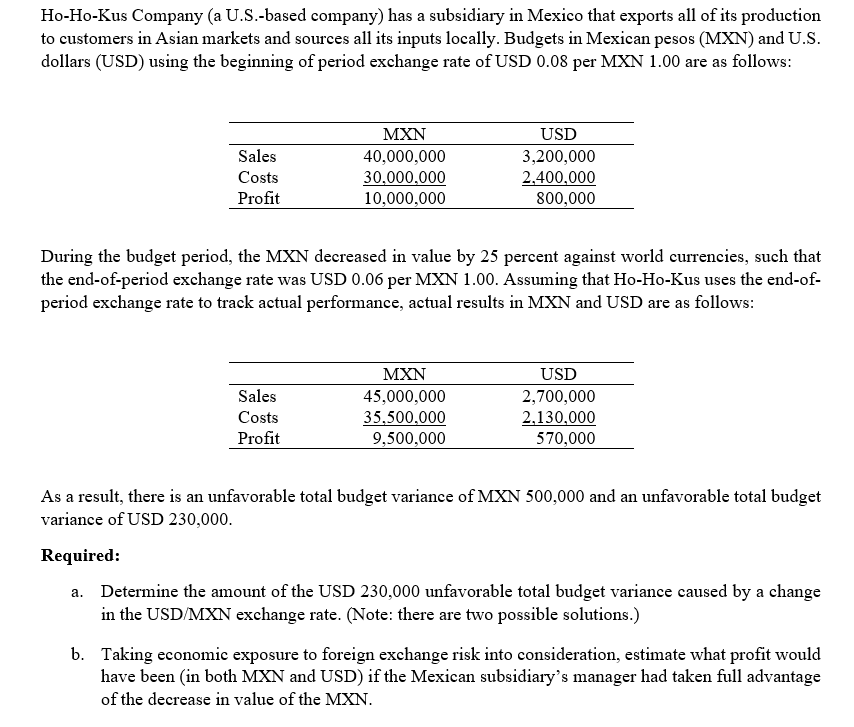

Ho-Ho-Kus Company (a U.S.-based company) has a subsidiary in Mexico that exports all of its production to customers in Asian markets and sources all its inputs locally. Budgets in Mexican pesos (MXN) and U.S dollars (USD) using the beginning of period exchange rate of USD 0.08 per MXN 1.00 are as follows USD 3,200,000 2,400,000 MXN 40,000,000 30,000,000 10,000,000 Sales Costs Profit 800,000 During the budget period, the MXN decreased in value by 25 percent against world currencies, such that the end-of-period exchange rate was USD 0.06 per MXN 1.00. Assuming that Ho-Ho-Kus uses the end-of period exchange rate to track actual performance, actual results in MXN and USD are as follows USD 2,700,000 2,130,000 MXN 45,000,000 35.500,000 9,500,000 Sales Costs Profit 570,000 As a result, there is an unfavorable total budget variance of MXN 500,000 and an unfavorable total budget variance of USD 230,000 Require: Determine the amount of the USD 230,000 unfavorable total budget variance caused by a change in the USD/MXN exchange rate. (Note: there are two possible solutions.) a. b. Taking economic exposure to foreign exchange risk into consideration, estimate what profit would have been (in both MXN and USD) if the Mexican subsidiary's manager had taken full advantage of the decrease in value of the MXN Ho-Ho-Kus Company (a U.S.-based company) has a subsidiary in Mexico that exports all of its production to customers in Asian markets and sources all its inputs locally. Budgets in Mexican pesos (MXN) and U.S dollars (USD) using the beginning of period exchange rate of USD 0.08 per MXN 1.00 are as follows USD 3,200,000 2,400,000 MXN 40,000,000 30,000,000 10,000,000 Sales Costs Profit 800,000 During the budget period, the MXN decreased in value by 25 percent against world currencies, such that the end-of-period exchange rate was USD 0.06 per MXN 1.00. Assuming that Ho-Ho-Kus uses the end-of period exchange rate to track actual performance, actual results in MXN and USD are as follows USD 2,700,000 2,130,000 MXN 45,000,000 35.500,000 9,500,000 Sales Costs Profit 570,000 As a result, there is an unfavorable total budget variance of MXN 500,000 and an unfavorable total budget variance of USD 230,000 Require: Determine the amount of the USD 230,000 unfavorable total budget variance caused by a change in the USD/MXN exchange rate. (Note: there are two possible solutions.) a. b. Taking economic exposure to foreign exchange risk into consideration, estimate what profit would have been (in both MXN and USD) if the Mexican subsidiary's manager had taken full advantage of the decrease in value of the MXN