Answered step by step

Verified Expert Solution

Question

1 Approved Answer

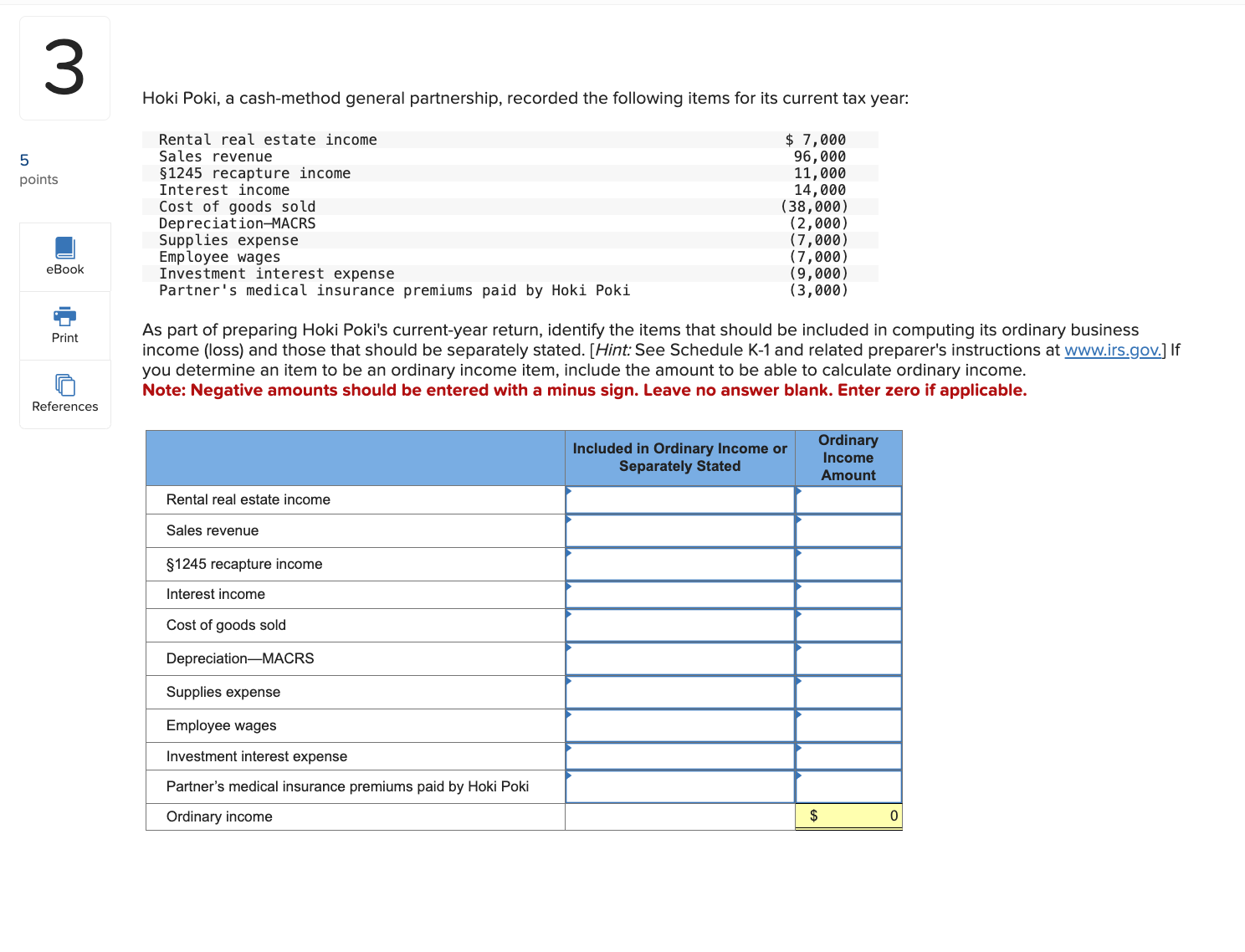

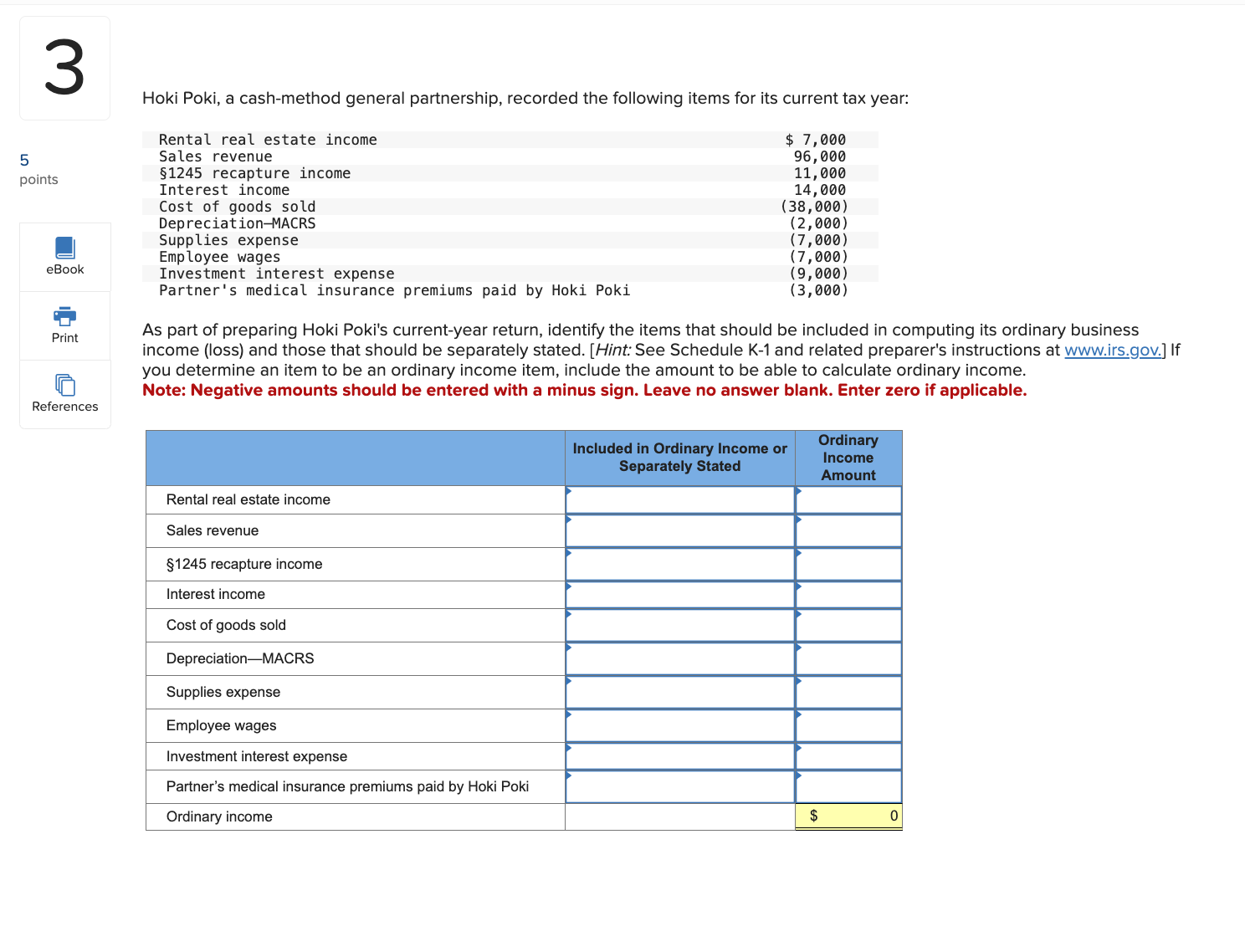

Hoki Poki, a cash - method general partnership, recorded the following items for its current tax year: Rental real estate income $ 7 , 0

Hoki Poki, a cashmethod general partnership, recorded the following items for its current tax year:

Rental real estate income $

Sales revenue

recapture income

Interest income

Cost of goods sold

DepreciationMACRS

Supplies expense

Employee wages

Investment interest expense

Partner's medical insurance premiums paid by Hoki Poki

As part of preparing Hoki Poki's currentyear return, identify the items that should be included in computing its ordinary business income loss and those that should be separately stated. Hint: See Schedule K and related preparer's instructions at wwwirs.gov. If you determine an item to be an ordinary income item, include the amount to be able to calculate ordinary income.

Note: Negative amounts should be entered with a minus sign. Leave no answer blank. Enter zero if applicable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started