Question

Hoki Poki, a cash-method general partnership, recorded the following items for its current tax year: Rental real estate income $ 8,000 Sales revenue 82,000 1245

Hoki Poki, a cash-method general partnership, recorded the following items for its current tax year:

| Rental real estate income | $ 8,000 |

|---|---|

| Sales revenue | 82,000 |

| 1245 recapture income | 2,000 |

| Interest income | 2,000 |

| Cost of goods sold | (33,000) |

| DepreciationMACRS | (20,000) |

| Supplies expense | (3,000) |

| Employee wages | (19,000) |

| Investment interest expense | (20,000) |

| Partner's medical insurance premiums paid by Hoki Poki | (6,000) |

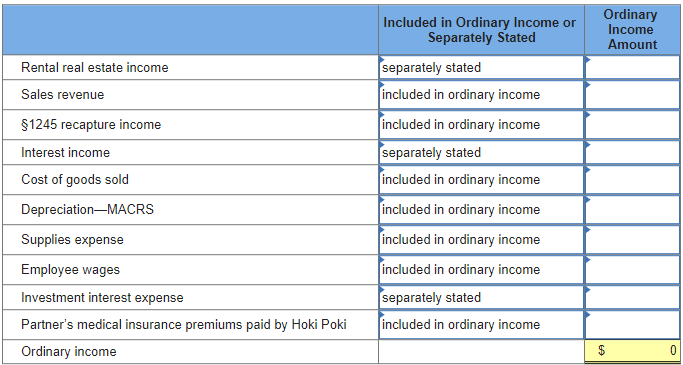

As part of preparing Hoki Poki's current-year return, identify the items that should be included in computing its ordinary business income (loss) and those that should be separately stated. [Hint: See Schedule K-1 and related preparer's instructions at www.irs.gov.] If you determine an item to be an ordinary income item, include the amount to be able to calculate ordinary income.

Note: Negative amounts should be entered with a minus sign. Leave no answer blank. Enter zero if applicable.

\begin{tabular}{|l|l|l|} \hline & IncludedinOrdinaryIncomeorSeparatelyStated & OrdinaryIncomeAmount \\ \hline Rental real estate income & separately stated & \\ \hline Sales revenue & included in ordinary income & \\ \hline$1245 recapture income & included in ordinary income & \\ \hline Interest income & separately stated & \\ \hline Cost of goods sold & included in ordinary income & \\ \hline Depreciation-MACRS & included in ordinary income & \\ \hline Supplies expense & included in ordinary income & \\ \hline Employee wages & separately stated & \\ \hline Investment interest expense & included in ordinary income & \\ \hline Partner's medical insurance premiums paid by Hoki Poki & & $ \\ \hline Ordinary income & & 0 \\ \hline \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started