Question

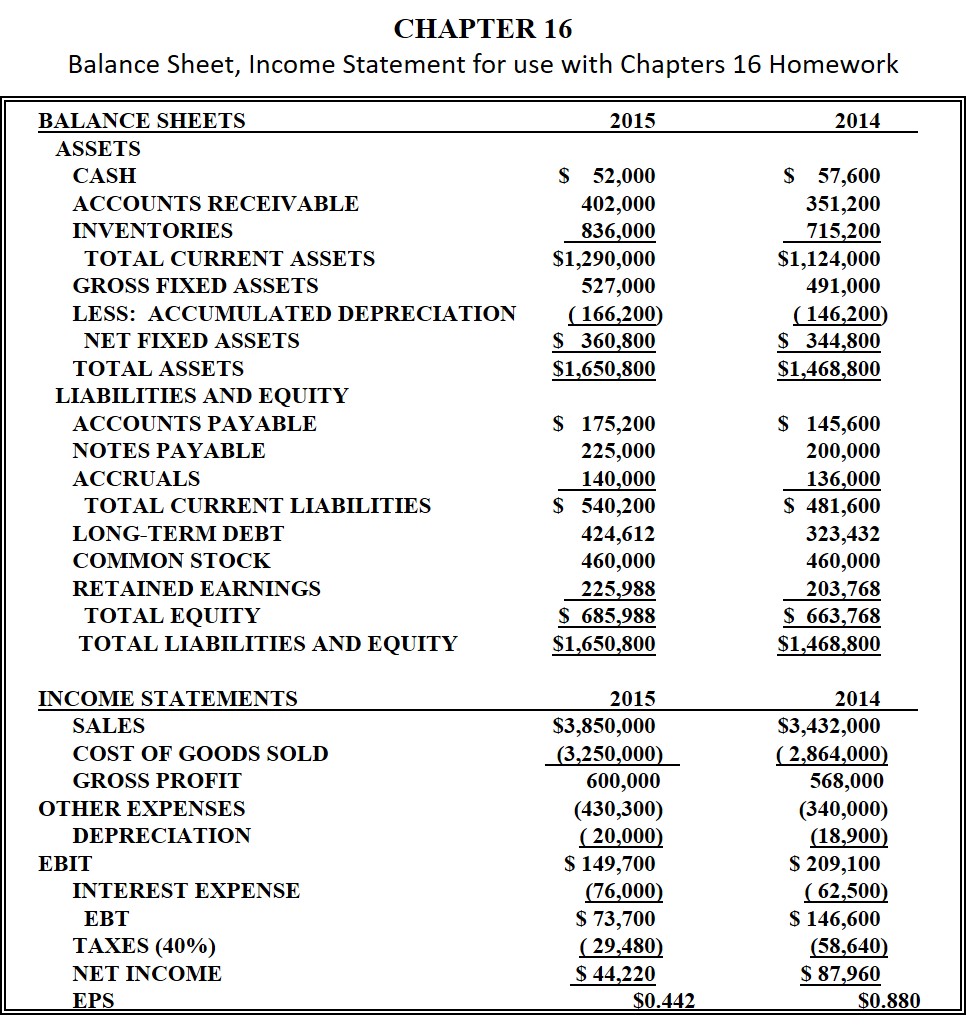

Holcomb and Cromworthy are forecasting a 10% increase in sales next year. Assume the company is operating at 90% capacity. The company has 100,000 shares

Holcomb and Cromworthy are forecasting a 10% increase in sales next year. Assume the company is operating at 90% capacity. The company has 100,000 shares of common stock outstanding and dividends are $0.22 per share.

At 90% capacity what level will sales have to reach for the discretionary items to become spontaneous that is move in direct proportion to sales?

Compute the new level of net income for the company .

Compute the company's additional retained earnings for the year

Compute the new level of total assets required Calculate the new level of current liabilities

Compute the company's new level of retained earnings on the balance sheet Calculate the level of Additional Funds Needed (AFN) to support the increase in sales.

CHAPTER 16 Balance Sheet, Income Statement for use with Chapters 16 Homework BALANCE SHEETS 2015 2014 ASSETS S 52,000 402,000 836,000 $1,290,000 527,000 (166,200) S360,800 $1,650,800 S 57,600 351,200 715,200 $1,124,000 491,000 (146,200) S 344,800 $1,468,800 CASH ACCOUNTS RECEIVABLE INVENTORIES TOTAL CURRENT ASSETS GROSS FIXED ASSETS LESS: ACCUMULATED DEPRECIATION NET FIXED ASSETS TOTAL ASSETS LIABILITIES AND EQUITY S 175,200 225,000 140,000 S 540,200 424,612 460,000 225,988 S 685,988 $1,650,800 S 145,600 200,000 136,000 S 481,600 323,432 460,000 203,768 S 663,768 $1,468,800 ACCOUNTS PAYABLE NOTES PAYABLE ACCRUALS TOTAL CURRENT LIABILITIES LONG-TERM DEBT COMMON STOCK RETAINED EARNINGS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 2014 S3,432,000 (2,864,000 568,000 (340,000) (18,900) S 209,100 62,500) S 146,600 (58,640) $ 87,960 INCOME STATEMENTS 2015 S3,850,000 3.250.000 600,000 (430,300) (20,000) S 149,700 (76,000) S 73,700 (29,480) S 44,220 SALES COST OF GOODS SOLD GROSS PROFIT OTHER EXPENSES DEPRE CIATION EBIT INTEREST EXPENSE EBT TAXES (40%) NET INCOME EPS 0.442 S0.880Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started