Answered step by step

Verified Expert Solution

Question

1 Approved Answer

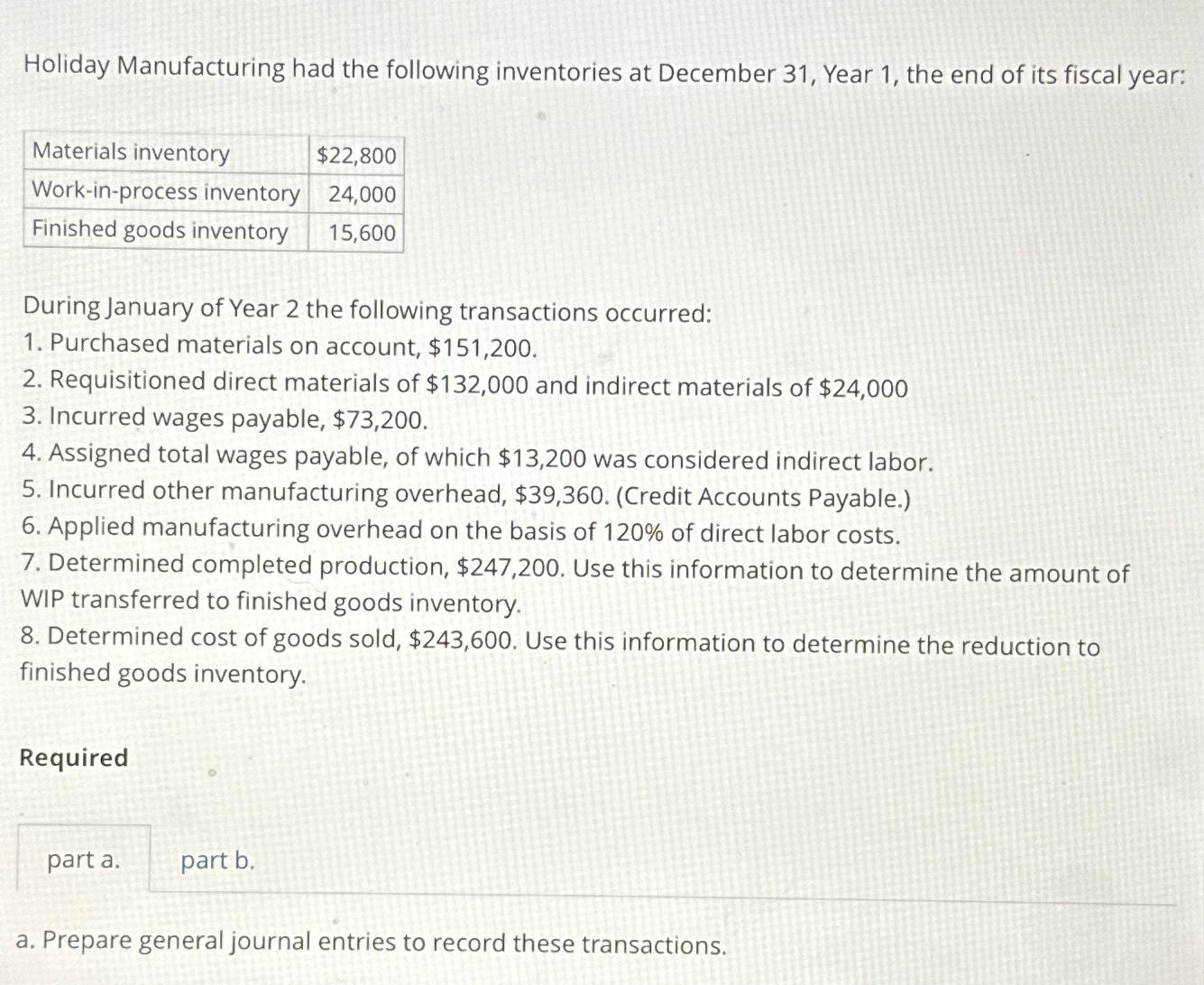

Holiday Manufacturing had the following inventories at December 31, Year 1, the end of its fiscal year: Materials inventory $22,800 Work-in-process inventory 24,000 Finished

Holiday Manufacturing had the following inventories at December 31, Year 1, the end of its fiscal year: Materials inventory $22,800 Work-in-process inventory 24,000 Finished goods inventory 15,600 During January of Year 2 the following transactions occurred: 1. Purchased materials on account, $151,200. 2. Requisitioned direct materials of $132,000 and indirect materials of $24,000 3. Incurred wages payable, $73,200. 4. Assigned total wages payable, of which $13,200 was considered indirect labor. 5. Incurred other manufacturing overhead, $39,360. (Credit Accounts Payable.) 6. Applied manufacturing overhead on the basis of 120% of direct labor costs. 7. Determined completed production, $247,200. Use this information to determine the amount of WIP transferred to finished goods inventory. 8. Determined cost of goods sold, $243,600. Use this information to determine the reduction to finished goods inventory. Required part a. part b. a. Prepare general journal entries to record these transactions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

General Journal Entries for Holiday Manufacturing part a Transaction 1 Purchase of Materials Materia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started