Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Holiday Travel Australasia commenced business on 1 April 2021. Alice Adare is a good manager but a poor accountant. From the trial balance prepared

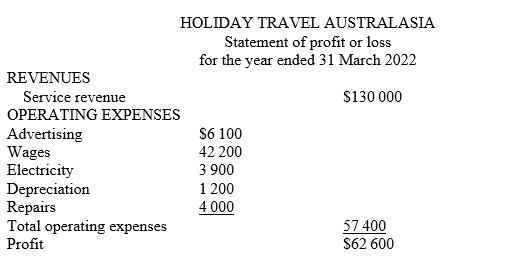

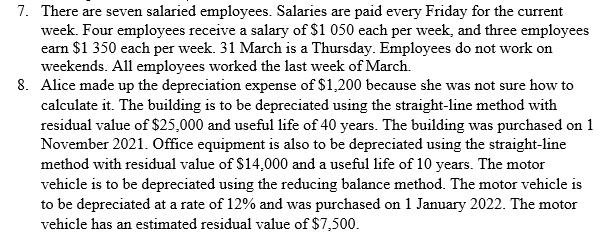

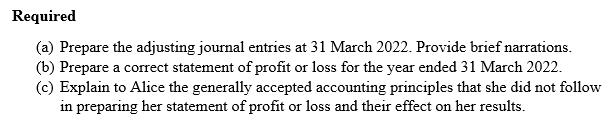

Holiday Travel Australasia commenced business on 1 April 2021. Alice Adare is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Alice prepared the following statement of profit or loss for the year ended 31 March 2022. Alice knew something was wrong with the statement because profit up to February had not exceeded $40 000 (approximately $3,600 per month). Knowing that you are an experienced accountant, she asks you to review the statement of profit or loss and other data. You first look at the trial balance. In addition to the account balances reported in the statement of profit or loss, the general ledger contains these selected balances at 31 March 2022. Advertising supplies on hand Prepaid insurance Bank loan Building Office Equipment Motor Vehicle Salaries payable Subscription Revenue in Advance $10 000 31 180 50 000 85 000 62 000 58 000 Nil 53 900 REVENUES HOLIDAY TRAVEL AUSTRALASIA Statement of profit or loss for the year ended 31 March 2022 $130 000 Service revenue OPERATING EXPENSES Advertising Wages Electricity Depreciation Repairs Total operating expenses Profit $6 100 42 200 3 900 1 200 4.000 57 400 $62 600 You then make enquiries and discover the following. 1. Service revenues include advanced money for holidays after March, $12 000. 2. There was only $2 300 of advertising supplies on hand at 31 March. 3. Holiday Travel Australasia has separate insurance policies on its buildings, motor vehicles and its general insurance. Policy B4564 on the building was purchased on 1 June 2021 for $9 900. The policy has a term of 3 years. Policy A2958 on the vehicles was purchased on 1 August 2021 for $5 280. This policy has a term of 2 years. The general insurance policy was a 1-year policy of $1 600 paid on 1 July 2021. The following invoices had not been paid or recorded: advertising for week of 24 March, $2 200; repairs made 10 March, $2 000; and electricity expense, $800. 4. 5. The business took out the loan on 1 October 2021 at an annual interest rate of 3%. 6. Subscription revenue received in advance $53 900: the entity began selling magazine subscriptions on 1 January 2022 on an annual basis. The selling price of a subscription is $55. A review of subscription contracts reveals the following: Subscription start date 1 January 1 February 1 March Number of subscriptions 200 300 480 980 The annual subscription is for 12 monthly issues. The March magazine for all of the subscriptions had been delivered to the subscribers at 31 March 2022. 7. There are seven salaried employees. Salaries are paid every Friday for the current week. Four employees receive a salary of $1 050 each per week, and three employees earn $1 350 each per week. 31 March is a Thursday. Employees do not work on weekends. All employees worked the last week of March. 8. Alice made up the depreciation expense of $1,200 because she was not sure how to calculate it. The building is to be depreciated using the straight-line method with residual value of $25,000 and useful life of 40 years. The building was purchased on 1 November 2021. Office equipment is also to be depreciated using the straight-line method with residual value of $14,000 and a useful life of 10 years. The motor vehicle is to be depreciated using the reducing balance method. The motor vehicle is to be depreciated at a rate of 12% and was purchased on 1 January 2022. The motor vehicle has an estimated residual value of $7,500. Required (a) Prepare the adjusting journal entries at 31 March 2022. Provide brief narrations. (b) Prepare a correct statement of profit or loss for the year ended 31 March 2022. (c) Explain to Alice the generally accepted accounting principles that she did not follow in preparing her statement of profit or loss and their effect on her results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information lets address the requirements step by step a Prepare the adjusting journal entries at 31 March 2022 Provide brief narrations 1 Prepaid Advertising Supplies Adjustment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started