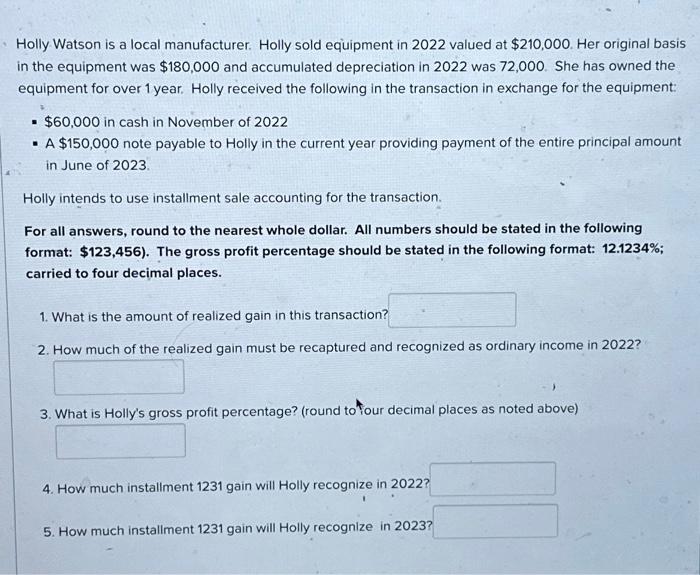

Holly Watson is a local manufacturer. Holly sold equipment in 2022 valued at $210,000. Her original basis in the equipment was $180,000 and accumulated depreciation in 2022 was 72,000 . She has owned the equipment for over 1 year. Holly received the following in the transaction in exchange for the equipment: - $60,000 in cash in November of 2022 - A $150,000 note payable to Holly in the current year providing payment of the entire principal amount in June of 2023. Holly intends to use installment sale accounting for the transaction. For all answers, round to the nearest whole dollar. All numbers should be stated in the following format: $123,456 ). The gross profit percentage should be stated in the following format: 12.1234%; carried to four decimal places. 1. What is the amount of realized gain in this transaction: 2. How much of the realized gain must be recaptured and recognized as ordinary income in 2022 ? 3. What is Holly's gross profit percentage? (round to 4. How much installment 1231 gain will Holly recognize in 2022? 5. How much installment 1231 gain will Holly recognize in 2023 ? Holly Watson is a local manufacturer. Holly sold equipment in 2022 valued at $210,000. Her original basis in the equipment was $180,000 and accumulated depreciation in 2022 was 72,000 . She has owned the equipment for over 1 year. Holly received the following in the transaction in exchange for the equipment: - $60,000 in cash in November of 2022 - A $150,000 note payable to Holly in the current year providing payment of the entire principal amount in June of 2023. Holly intends to use installment sale accounting for the transaction. For all answers, round to the nearest whole dollar. All numbers should be stated in the following format: $123,456 ). The gross profit percentage should be stated in the following format: 12.1234%; carried to four decimal places. 1. What is the amount of realized gain in this transaction: 2. How much of the realized gain must be recaptured and recognized as ordinary income in 2022 ? 3. What is Holly's gross profit percentage? (round to 4. How much installment 1231 gain will Holly recognize in 2022? 5. How much installment 1231 gain will Holly recognize in 2023