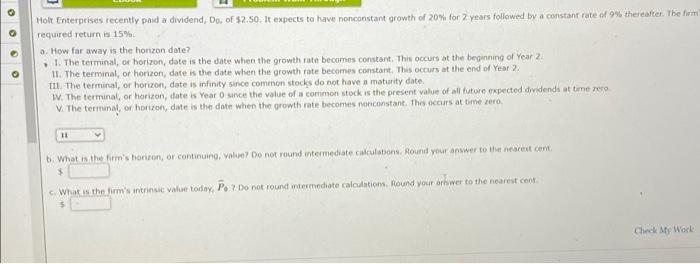

Holt Enterprises recently paid a dividend. Do, of $2.50. It expects to have nonconstant growth of 20% for 2 years followed by a constant rate of 9% thereafter. The firm required return is 15% a. How far away is the horizon date? 1. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the beginning of Year 2 II. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the end of Year 2 ILL. The terminal, or horizon, date is infinity since common stocks do not have a maturity date WV. The terminal, or horizon, date is Year since the value of a common stock is the present value of all future expected dividends at timerera V The terminal, or horizon, date is the date when the growth rate becomes non constant. This occurs at time zero. 11 b. What is the firm's harron, or continuing value? Do not round intermediate calculations. Round your answer to the nearest cent c. What is the firm's intrinsic value today, Po? Do not found intermediate calculations, Round your arwer to the nearest cont Check My Work Holt Enterprises recently paid a dividend. Do, of $2.50. It expects to have nonconstant growth of 20% for 2 years followed by a constant rate of 9% thereafter. The firm required return is 15% a. How far away is the horizon date? 1. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the beginning of Year 2 II. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the end of Year 2 ILL. The terminal, or horizon, date is infinity since common stocks do not have a maturity date WV. The terminal, or horizon, date is Year since the value of a common stock is the present value of all future expected dividends at timerera V The terminal, or horizon, date is the date when the growth rate becomes non constant. This occurs at time zero. 11 b. What is the firm's harron, or continuing value? Do not round intermediate calculations. Round your answer to the nearest cent c. What is the firm's intrinsic value today, Po? Do not found intermediate calculations, Round your arwer to the nearest cont Check My Work