Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Holton's Nursery has the following amounts listed on their Form 941: (Assume no Section 125 health insurance and that none of the employees had

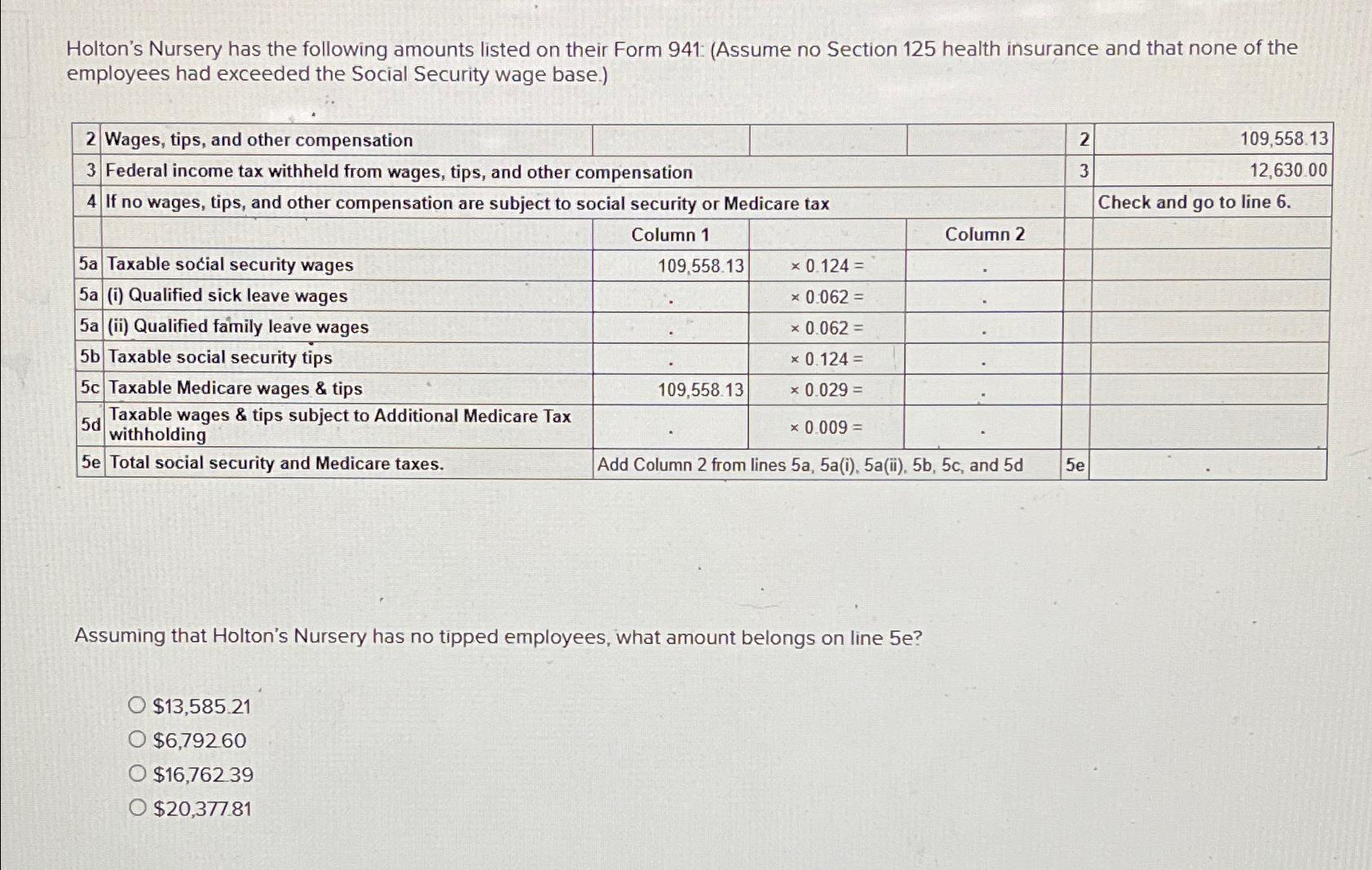

Holton's Nursery has the following amounts listed on their Form 941: (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base.) 2 Wages, tips, and other compensation 3 Federal income tax withheld from wages, tips, and other compensation 4 If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 109,558.13 5a Taxable social security wages 5a (i) Qualified sick leave wages 5a (ii) Qualified family leave wages 5b Taxable social security tips 5c Taxable Medicare wages & tips 5d Taxable wages & tips subject to Additional Medicare Tax withholding 5e Total social security and Medicare taxes. $13,585.21 $6,792.60 O $16,762.39 O $20,377.81 0.124 = 0.062 = 0.062 = * 0.124 = 0.029 = 0.009 = Add Column 2 from lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d 109,558.13 Assuming that Holton's Nursery has no tipped employees, what amount belongs on line 5e? Column 2 2 3 5e 109,558.13 12,630.00 Check and go to line 6.

Step by Step Solution

★★★★★

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount that belongs on line 5e of Form 941 for Holtons Nursery we need to calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started