Answered step by step

Verified Expert Solution

Question

1 Approved Answer

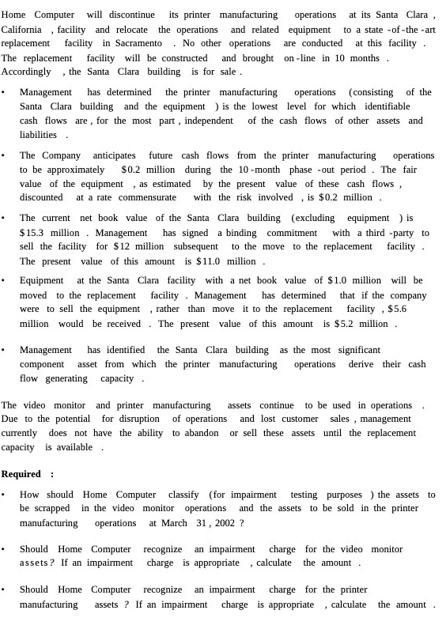

Home Computer will discontinue its printer manufacturing operations at its Santa Clara, California, facility and relocate the operations and related equipment to a state-of-the-art

Home Computer will discontinue its printer manufacturing operations at its Santa Clara, California, facility and relocate the operations and related equipment to a state-of-the-art replacement facility in Sacramento No other operations are conducted at this facility The replacement facility will be constructed and brought on-line in 10 months. Accordingly, the Santa Clara building is for sale. . + . Management has determined the printer manufacturing operations (consisting of the Santa Clara building and the equipment ) is the lowest level for which identifiable cash flows are, for the most part, independent of the cash flows of other assets and liabilities. . The Company anticipates future cash flows from the printer manufacturing operations to be approximately $0.2 million during the 10-month phase-out period. The fair value of the equipment, as estimated by the present value of these cash flows, discounted at a rate commensurate with the risk involved, is $0.2 million. The current net book value of the Santa Clara building (excluding equipment ) is $15.3 million Management has signed a binding commitment with a third-party to sell the facility for $12 million subsequent to the move to the replacement facility. The present value of this amount is $11.0 million. Equipment at the Santa Clara facility with a net book value of $1.0 million will be moved to the replacement facility Management has determined that if the company were to sell the equipment, rather than move it to the replacement facility, $5.6 million would be received. The present value of this amount is $5.2 million. The video monitor and printer manufacturing assets continue to be used in operations Due to the potential for disruption of operations and lost customer sales, management currently does not have the ability to abandon or sell these assets until the replacement capacity is available Management has identified the Santa Clara building as the most significant component asset from which the printer manufacturing operations derive their cash flow generating capacity. Required: How should Home Computer classify (for impairment testing purposes) the assets to be scrapped in the video monitor operations and the assets to be sold in the printer manufacturing operations at March 31, 2002? Should Home Computer recognize an impairment charge for the video monitor assets? If an impairment charge is appropriate calculate the amount. Should Home Computer recognize an impairment charge for the printer manufacturing assets? If an impairment charge is appropriate, calculate the amount.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 For impairment testing purposes Home Computer should classify the assets to be scrapped in the vid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started