Answered step by step

Verified Expert Solution

Question

1 Approved Answer

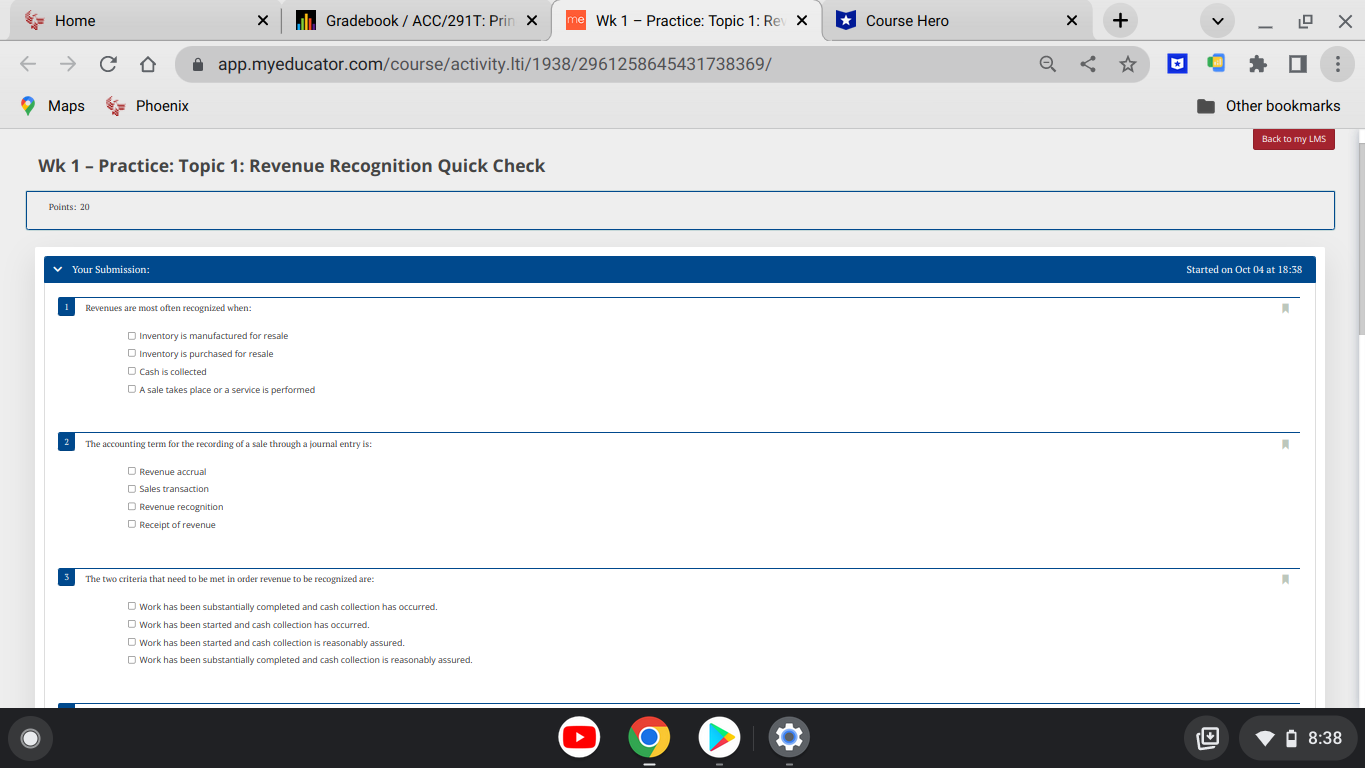

Home Maps Phoenix Points: 20 Wk 1 - Practice: Topic 1: Revenue Recognition Quick Check Your Submission: 2 3 X il Gradebook/ ACC/291T: Prin

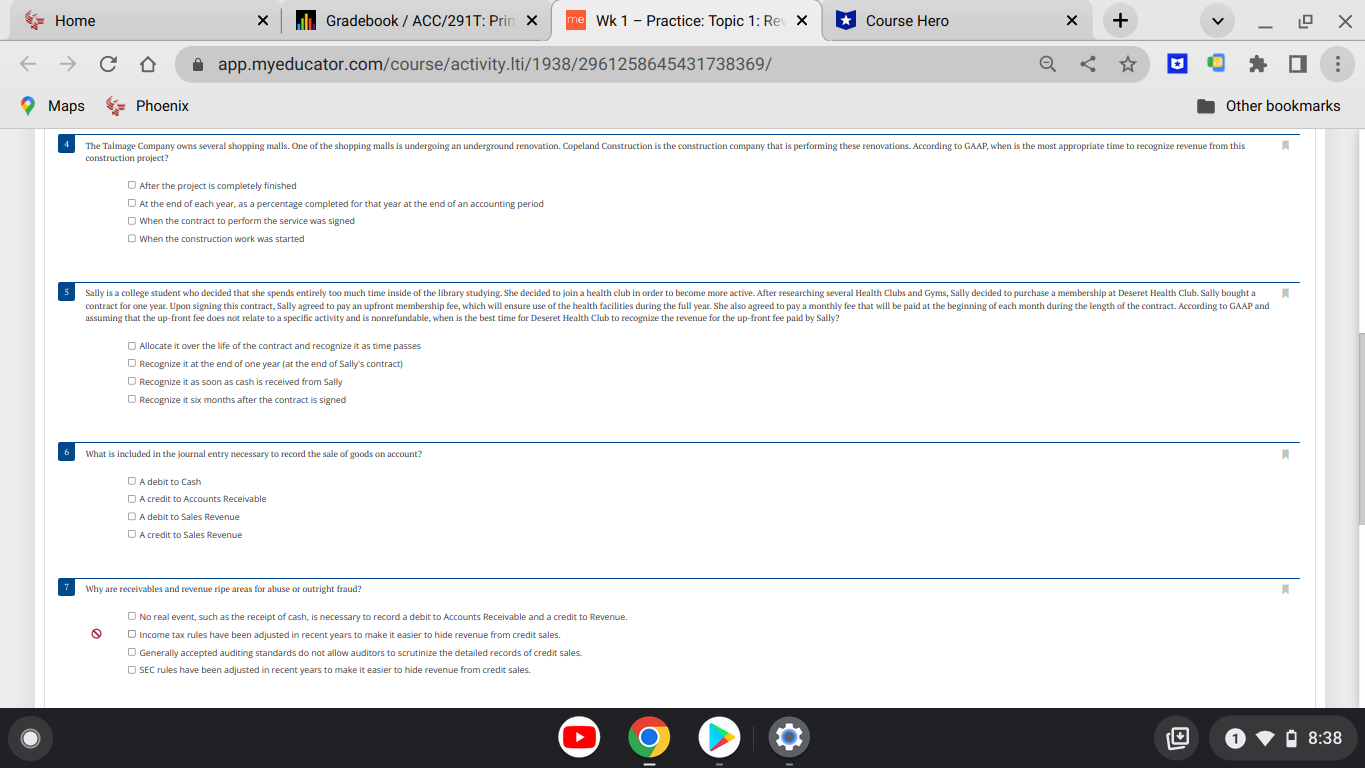

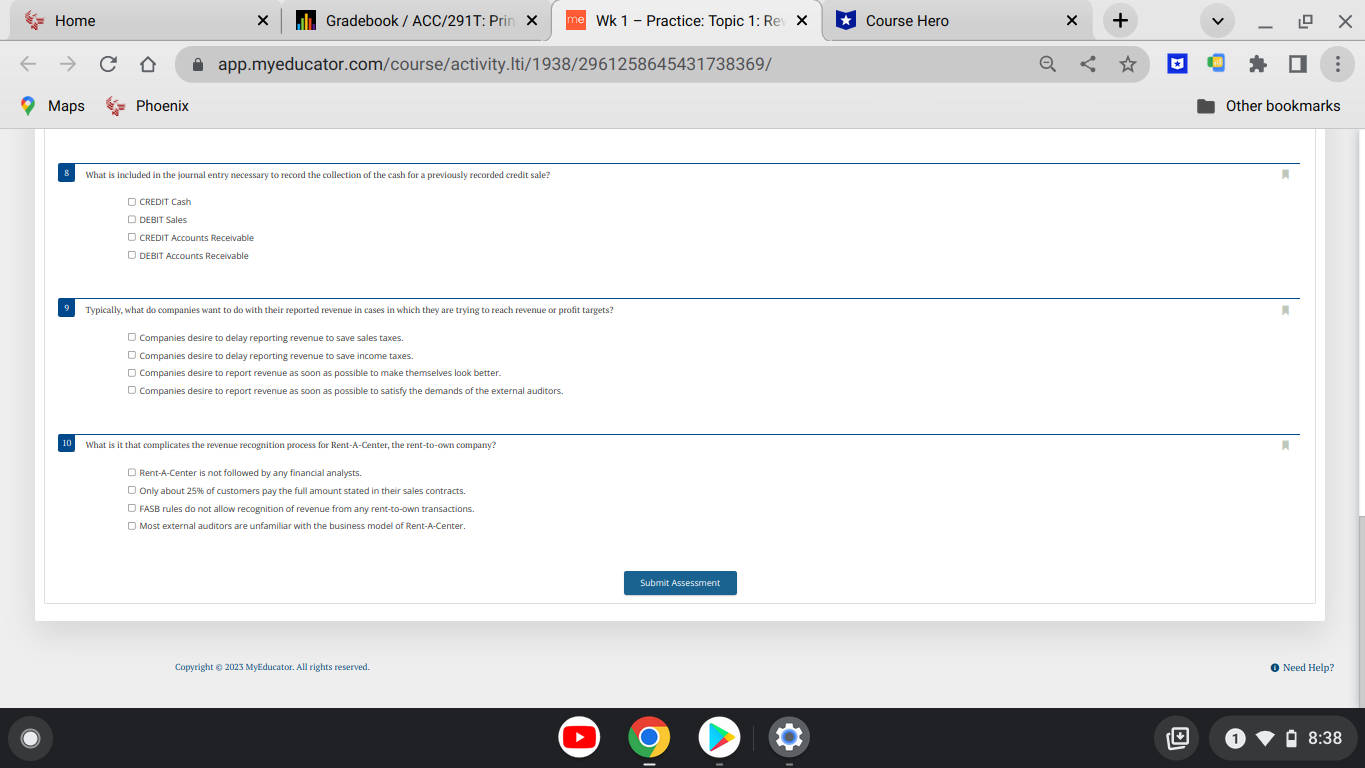

Home Maps Phoenix Points: 20 Wk 1 - Practice: Topic 1: Revenue Recognition Quick Check Your Submission: 2 3 X il Gradebook/ ACC/291T: Prin X me Wk 1 - Practice: Topic 1: Rev X app.myeducator.com/course/activity.Iti/1938/2961258645431738369/ Revenues are most often recognized when: O Inventory is manufactured for resale Inventory is purchased for resale O Cash is collected DA sale takes place or a service is performed The accounting term for the recording of a sale through a journal entry is: Revenue accrual Sales transaction O Revenue recognition Receipt of revenue The two criteria that need to be met in order revenue to be recognized are: Work has been substantially completed and cash collection has occurred. Work has been started and cash collection has occurred. Work has been started and cash collection is reasonably assured. Work has been substantially completed and cash collection is reasonably assured. Course Hero X + LO X Other bookmarks Back to my LMS Started on Oct 04 at 18:38 . . 8:38 Home Maps 6 X Gradebook/ ACC/291T: Prin X me Wk 1 - Practice: Topic 1: Rev X app.myeducator.com/course/activity.Iti/1938/2961258645431738369/ O After the project is completely finished At the end of each year, as a percentage completed for that year at the end of an accounting period When the contract to perform the service was signed When the construction work was started Phoenix The Talmage Company owns several shopping malls. One of the shopping malls is undergoing an underground renovation. Copeland Construction is the construction company that is performing these renovations. According to GAAP, when is the most appropriate time to recognize revenue from this construction project? Allocate it over the life of the contract and recognize it as time passes Recognize it at the end of one year (at the end of Sally's contract) Recognize it as soon as cash is received from Sally O Recognize it six months after the contract is signed What is included in the journal entry necessary to record the sale of goods on account? DA debit to Cash A credit to Accounts Receivable A debit to Sales Revenue A credit to Sales Revenue Why are receivables and revenue ripe areas for abuse or outright fraud? No real event, such as the receipt of cash, is necessary to record a debit to Accounts Receivable and a credit to Revenue. O Income tax rules have been adjusted in recent years to make it easier to hide revenue from credit sales. Generally accepted auditing standards do not allow auditors to scrutinize the detailed records of credit sales. SEC rules have been adjusted in recent years to make it easier to hide revenue from credit sales. A Sally is a college student who decided that she spends entirely too much time inside of the library studying. She decided to join a health club in order to become more active. After researching several Health Clubs and Gyms, Sally decided to purchase a membership at Deseret Health Club. Sally bought a contract for one year. Upon signing this contract, Sally agreed to pay an upfront membership fee, which will ensure use of the health facilities during the full year. She also agreed to pay a monthly fee that will be paid at the beginning of each month during the length of the contract. According to GAAP and assuming that the up-front fee does not relate to a specific activity and is nonrefundable, when is the best time for Deseret Health Club to recognize the revenue for the up-front fee paid by Sally? Course Hero 9 X + LO X Other bookmarks A 8:38 Home Maps 8 9 10 Phoenix Gradebook / ACC/291T: Prin X app.myeducator.com/course/activity. Iti/1938/2961258645431738369/ X What is included in the journal entry necessary to record the collection of the cash for a previously recorded credit sale? CREDIT Cash DEBIT Sales D CREDIT Accounts Receivable DEBIT Accounts Receivable Typically, what do companies want to do with their reported revenue in cases in which they are trying to reach revenue or profit targets? O Companies desire to delay reporting revenue to save sales taxes. O Companies desire to delay reporting revenue to save income taxes. Companies desire to report revenue as soon as possible to make themselves look better. O Companies desire to report revenue as soon as possible to satisfy the demands of the external auditors. What is it that complicates the revenue recognition process for Rent-A-Center, the rent-to-own company? O Rent-A-Center is not followed by any financial analysts. Only about 25% of customers pay the full amount stated in their sales contracts. FASB rules do not allow recognition of revenue from any rent-to-own transactions. Most external auditors are unfamiliar with the business model of Rent-A-Center. me Wk 1 - Practice: Topic 1: Rev X Copyright 2023 MyEducator. All rights reserved. Submit Assessment 9 Course Hero X + I LO X Other bookmarks Need Help? 8:38

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

It appears that the content provided is a mix of various topics related to revenue recognition and a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started