Answered step by step

Verified Expert Solution

Question

1 Approved Answer

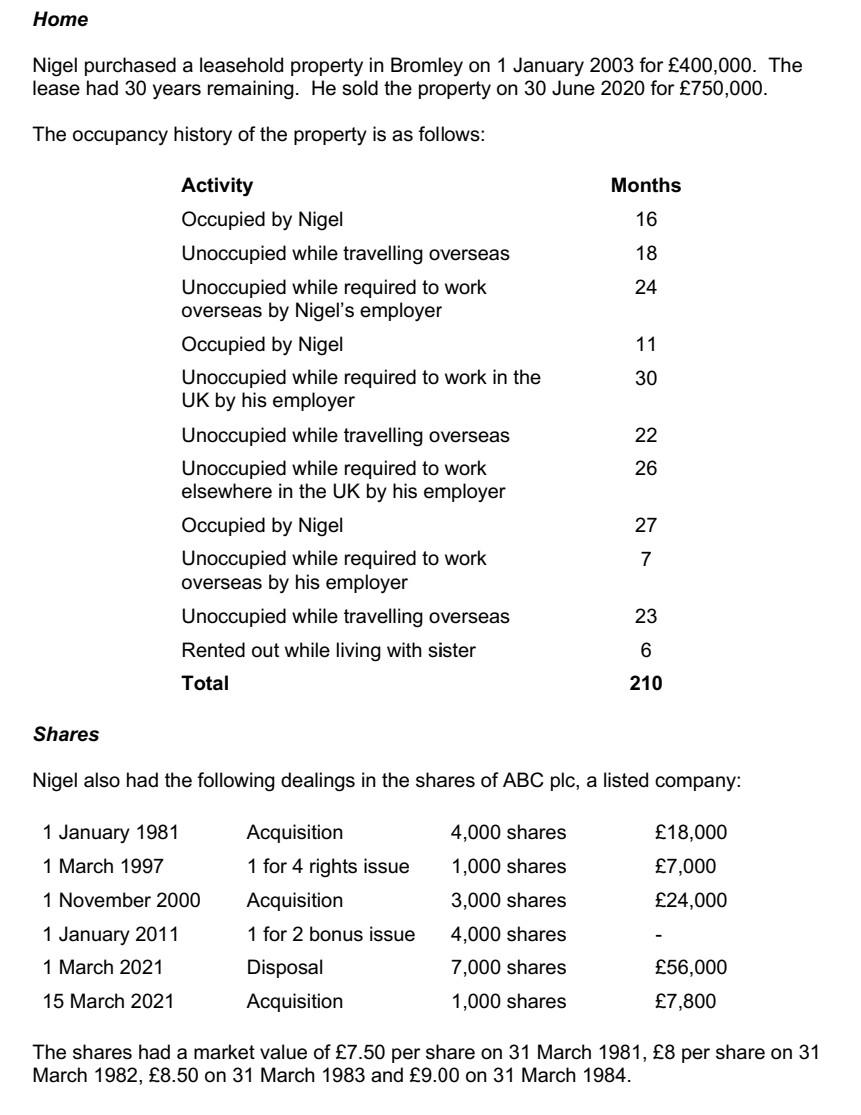

Home Nigel purchased a leasehold property in Bromley on 1 January 2003 for 400,000. The lease had 30 years remaining. He sold the property on

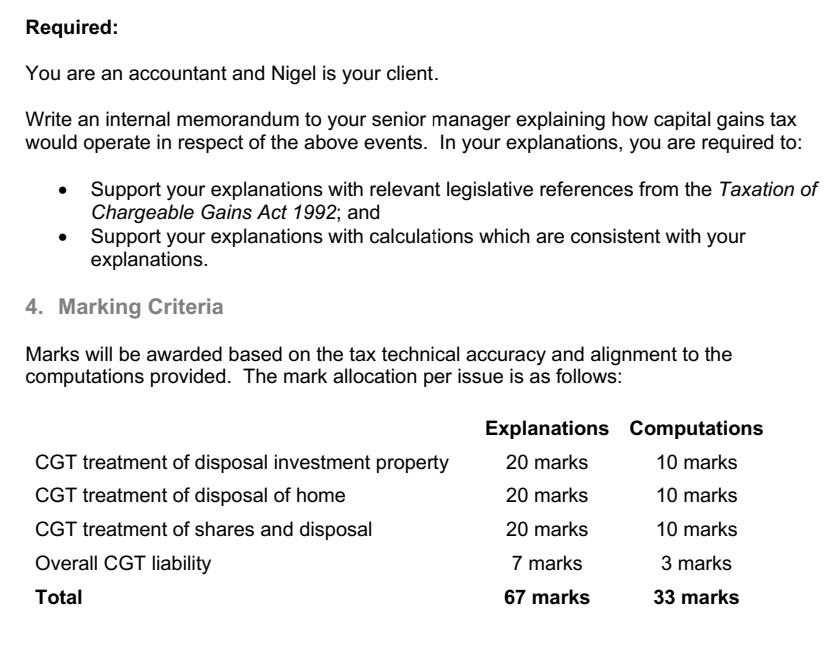

Home Nigel purchased a leasehold property in Bromley on 1 January 2003 for 400,000. The lease had 30 years remaining. He sold the property on 30 June 2020 for 750,000. The occupancy history of the property is as follows: Months 16 18 24 11 30 Activity Occupied by Nigel Unoccupied while travelling overseas Unoccupied while required to work overseas by Nigel's employer Occupied by Nigel Unoccupied while required to work in the UK by his employer Unoccupied while travelling overseas Unoccupied while required to work elsewhere in the UK by his employer Occupied by Nigel Unoccupied while required to work overseas by his employer Unoccupied while travelling overseas Rented out while living with sister Total 22 26 27 7 23 6 210 Shares Nigel also had the following dealings in the shares of ABC plc, a listed company: 18,000 7,000 24,000 1 January 1981 1 March 1997 1 November 2000 1 January 2011 1 March 2021 15 March 2021 Acquisition 1 for 4 rights issue Acquisition 1 for 2 bonus issue Disposal Acquisition 4,000 shares 1,000 shares 3,000 shares 4,000 shares 7,000 shares 1,000 shares 56,000 7,800 The shares had a market value of 7.50 per share on 31 March 1981, 8 per share on 31 March 1982, 8.50 on 31 March 1983 and 9.00 on 31 March 1984. Required: You are an accountant and Nigel is your client. Write an internal memorandum to your senior manager explaining how capital gains tax would operate in respect of the above events. In your explanations, you are required to: Support your explanations with relevant legislative references from the Taxation of Chargeable Gains Act 1992, and Support your explanations with calculations which are consistent with your explanations. . 4. Marking Criteria Marks will be awarded based on the tax technical accuracy and alignment to the computations provided. The mark allocation per issue is as follows: CGT treatment of disposal investment property CGT treatment of disposal of home CGT treatment of shares and disposal Overall CGT liability Total Explanations Computations 20 marks 10 marks 20 marks 10 marks 20 marks 10 marks 7 marks 3 marks 67 marks 33 marks Home Nigel purchased a leasehold property in Bromley on 1 January 2003 for 400,000. The lease had 30 years remaining. He sold the property on 30 June 2020 for 750,000. The occupancy history of the property is as follows: Months 16 18 24 11 30 Activity Occupied by Nigel Unoccupied while travelling overseas Unoccupied while required to work overseas by Nigel's employer Occupied by Nigel Unoccupied while required to work in the UK by his employer Unoccupied while travelling overseas Unoccupied while required to work elsewhere in the UK by his employer Occupied by Nigel Unoccupied while required to work overseas by his employer Unoccupied while travelling overseas Rented out while living with sister Total 22 26 27 7 23 6 210 Shares Nigel also had the following dealings in the shares of ABC plc, a listed company: 18,000 7,000 24,000 1 January 1981 1 March 1997 1 November 2000 1 January 2011 1 March 2021 15 March 2021 Acquisition 1 for 4 rights issue Acquisition 1 for 2 bonus issue Disposal Acquisition 4,000 shares 1,000 shares 3,000 shares 4,000 shares 7,000 shares 1,000 shares 56,000 7,800 The shares had a market value of 7.50 per share on 31 March 1981, 8 per share on 31 March 1982, 8.50 on 31 March 1983 and 9.00 on 31 March 1984. Required: You are an accountant and Nigel is your client. Write an internal memorandum to your senior manager explaining how capital gains tax would operate in respect of the above events. In your explanations, you are required to: Support your explanations with relevant legislative references from the Taxation of Chargeable Gains Act 1992, and Support your explanations with calculations which are consistent with your explanations. . 4. Marking Criteria Marks will be awarded based on the tax technical accuracy and alignment to the computations provided. The mark allocation per issue is as follows: CGT treatment of disposal investment property CGT treatment of disposal of home CGT treatment of shares and disposal Overall CGT liability Total Explanations Computations 20 marks 10 marks 20 marks 10 marks 20 marks 10 marks 7 marks 3 marks 67 marks 33 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started