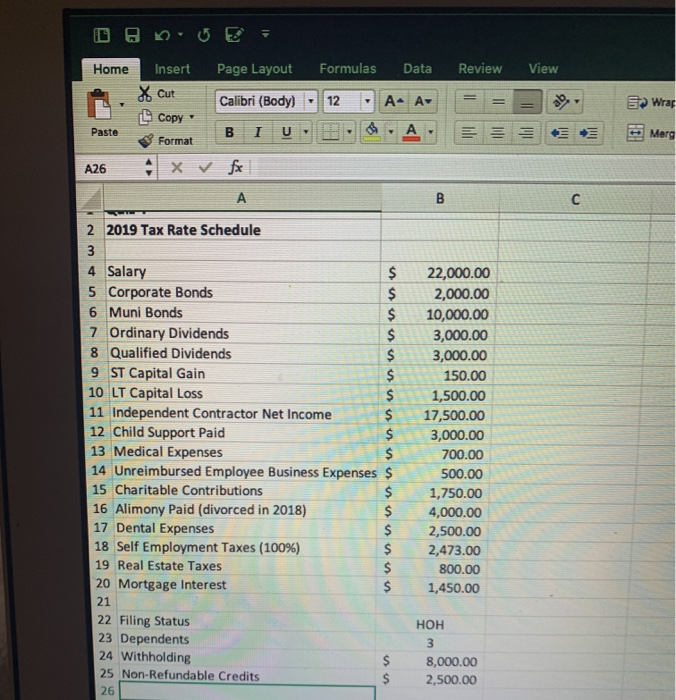

Home . Paste A26 Insert Page Layout Formulas Data Review View Cut Calibri (Body) - 12 An Av = = = Copy Format B I u. : A. EE E E , xv fees EWrap Merg 2 2019 Tax Rate Schedule 4 Salary $ 5 Corporate Bonds $ 6 Muni Bonds 7 Ordinary Dividends $ 8 Qualified Dividends 9 ST Capital Gain 10 LT Capital Loss $ 11 Independent Contractor Net Income $ 12 Child Support Paid $ 13 Medical Expenses $ 14 Unreimbursed Employee Business Expenses $ 15 Charitable Contributions 16 Alimony Paid (divorced in 2018) $ 17 Dental Expenses $ 18 Self Employment Taxes (100%) 19 Real Estate Taxes 20 Mortgage Interest $ 21 22 Filing Status 23 Dependents 24 Withholding 25 Non-Refundable Credits 22,000.00 2,000.00 10,000.00 3,000.00 3,000.00 150.00 1,500.00 17,500.00 3,000.00 700.00 500.00 1,750.00 4,000.00 2,500.00 2,473.00 800.00 1,450.00 $ 8,000.00 2,500.00 26 27 Calculate: 28 Gross Income 29 Adjusted Gross Income 30 Taxable Income 31 Income Tax Liability 32 Tax Due/(Refund) 34 Marginal Tax Rate 35 Average Tax Rate 36 Effective Tax Rate Home . Paste A26 Insert Page Layout Formulas Data Review View Cut Calibri (Body) - 12 An Av = = = Copy Format B I u. : A. EE E E , xv fees EWrap Merg 2 2019 Tax Rate Schedule 4 Salary $ 5 Corporate Bonds $ 6 Muni Bonds 7 Ordinary Dividends $ 8 Qualified Dividends 9 ST Capital Gain 10 LT Capital Loss $ 11 Independent Contractor Net Income $ 12 Child Support Paid $ 13 Medical Expenses $ 14 Unreimbursed Employee Business Expenses $ 15 Charitable Contributions 16 Alimony Paid (divorced in 2018) $ 17 Dental Expenses $ 18 Self Employment Taxes (100%) 19 Real Estate Taxes 20 Mortgage Interest $ 21 22 Filing Status 23 Dependents 24 Withholding 25 Non-Refundable Credits 22,000.00 2,000.00 10,000.00 3,000.00 3,000.00 150.00 1,500.00 17,500.00 3,000.00 700.00 500.00 1,750.00 4,000.00 2,500.00 2,473.00 800.00 1,450.00 $ 8,000.00 2,500.00 26 27 Calculate: 28 Gross Income 29 Adjusted Gross Income 30 Taxable Income 31 Income Tax Liability 32 Tax Due/(Refund) 34 Marginal Tax Rate 35 Average Tax Rate 36 Effective Tax Rate