Answered step by step

Verified Expert Solution

Question

1 Approved Answer

home / study / math / advanced math / advanced math questions and answers / interest rate swan let t, 1-1, ,n be a set

home / study / math / advanced math / advanced math questions and answers / interest rate swan let t, 1-1, ,n be a set of dates, on which payments of the floating ...

Your question has been answered

Let us know if you got a helpful answer. Rate this answer

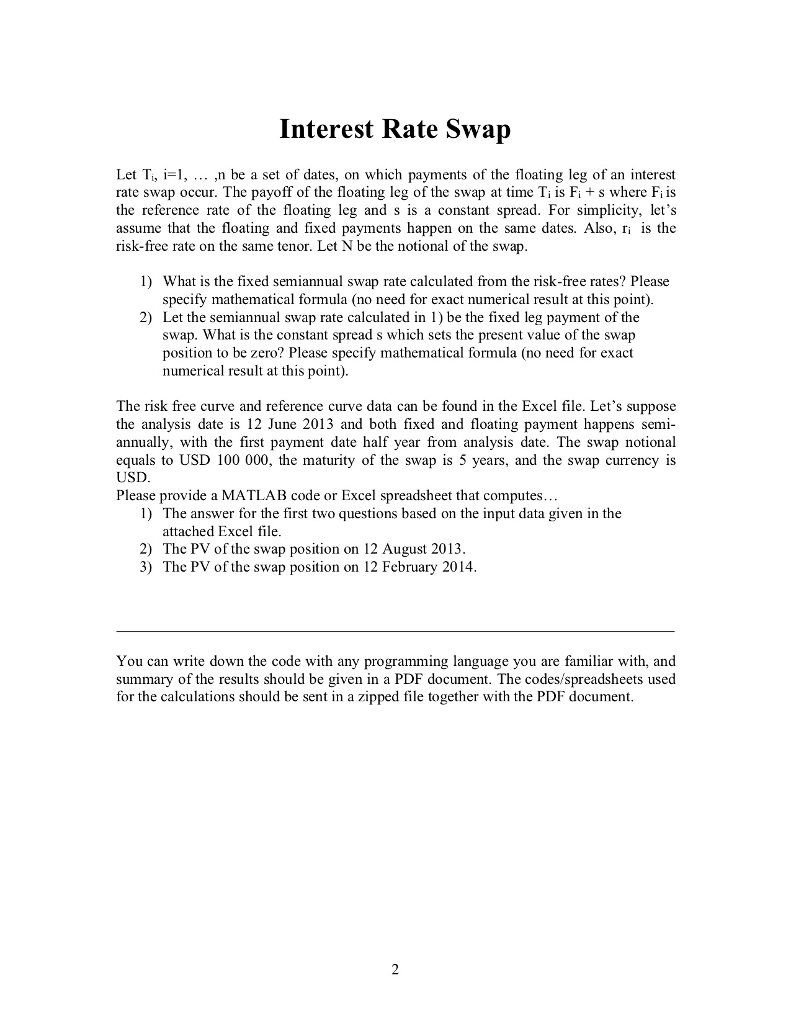

Question: Interest Rate Swan Let T, 1-1, ,n be a set of dates, on which payments of the floating leg of a...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started