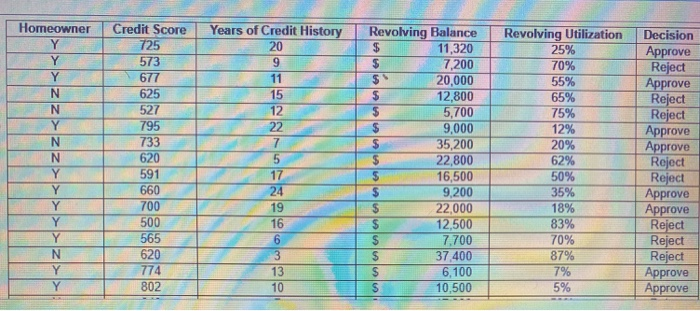

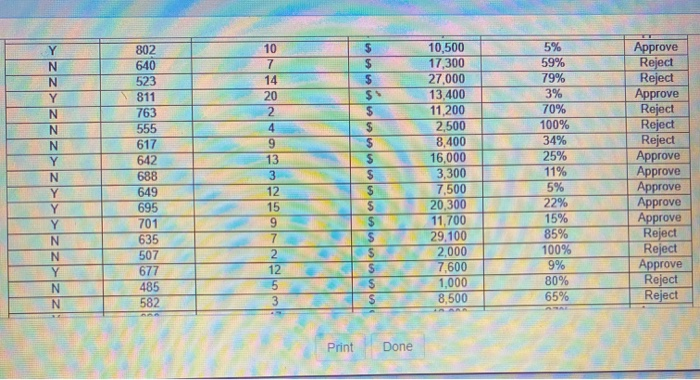

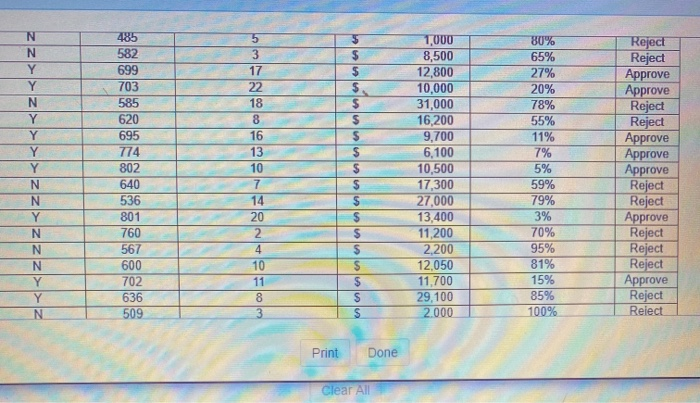

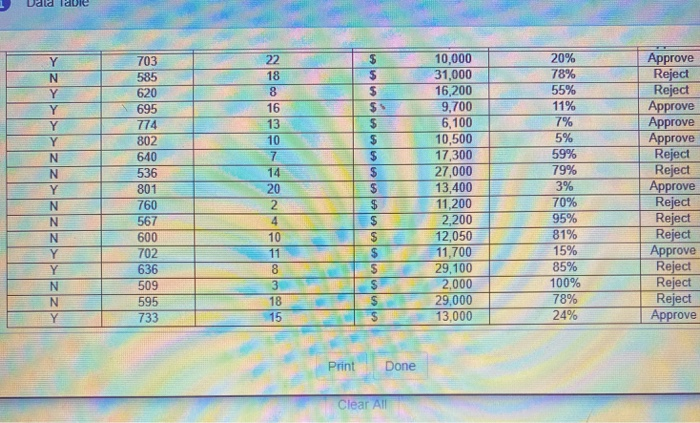

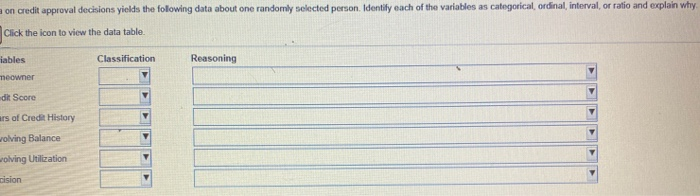

Homeowner Y Y Y N N Y N N Y Y Y Y Credit Score 725 573 677 625 527 795 733 620 591 660 700 500 565 620 774 Years of Credit History 20 9 11 15 12 22 7 5 17 24 19 16 6 3 13 10 Revolving Balance $ 11,320 $ 7,200 $ 20,000 $ 12,800 $ 5,700 $ 9,000 $ 35,200 $ 22,800 $ 16,500 $ 9,200 $ 22,000 $ 12,500 $ 7.700 $ 37.400 S 6.100 S 10,500 Revolving Utilization 25% 70% 55% 65% 75% 12% 20% 62% 50% 35% 18% 83% 70% 87% 7% 5% Decision Approve Reject Approve Reject Reject Approve Approve Reject Reject Approve Approve Reject Reject Reject Approve Approve N Y Y 802 Y N N Y N N N Y N Y Y Y N N Y N N 802 640 523 811 763 555 617 642 688 649 695 701 635 507 677 485 582 10 7 14 20 2 4 9 13 3 12 15 9 $ $ $ $$ $ $ $ $ $ $ $ $ 10,500 17,300 27,000 13,400 11,200 2.500 8,400 16,000 3,300 7,500 20,300 11,700 29.100 2,000 7,600 1,000 8,500 5% 59% 79% 3% 70% 100% 34% 25% 11% 5% 22% 15% 85% 100% 9% 80% 65% Approve Reject Reject Approve Reject Reject Reject Approve Approve Approve Approve Approve Reject Reject Approve Reject Reject 2 12 5 3 S $ $ S Print Done 485 582 699 703 585 620 695 774 802 N N Y Y N Y Y Y Y N N Y N N N Y Y N 5 3 17 22 18 8 16 13 10 7 14 20 2. 4 10 11 8 3 5 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ S S 1,000 8,500 12,800 10,000 31,000 16,200 9,700 6,100 10,500 17,300 27,000 13,400 11,200 2,200 12,050 11,700 29,100 2.000 80% 65% 27% 20% 78% 55% 11% 7% 5% 59% 79% 3% 70% 95% 81% 15% 85% 100% Reject Reject Approve Approve Reject Reject Approve Approve Approve Reject Reject Approve Reject Reject Reject Approve Reject Relect 640 536 801 760 567 600 702 636 509 Print Done Clear All Y N Y Y Y Y N N Y N N N Y Y N N Y 703 585 620 695 774 802 640 536 801 760 567 600 702 636 509 595 733 22 18 8 16 13 10 7 14 20 2 4 10 11 8 3 18 15 $ $ $ $$ $ $ $ $ $ $ $ $ $ $ $ S $ 10,000 31,000 16,200 9,700 6,100 10,500 17,300 27,000 13,400 11,200 2,200 12,050 11,700 29,100 2,000 29,000 13,000 20% 78% 55% 11% 7% 5% 59% 79% 3% 70% 95% 81% 15% 85% 100% 78% 24% Approve Reject Reject Approve Approve Approve Reject Reject Approve Reject Reject Reject Approve Reject Reject Reject Approve Print Done Clear All on credit approval decisions yields the folowing data about one randomly selected person. Identify each of the variables as categorical ordinal interval, or ratio and explain why Click the icon to view the data table iables Classification Reasoning meowner dit Score ars of Credit History wolving Balance wolving Utilization cision Homeowner Y Y Y N N Y N N Y Y Y Y Credit Score 725 573 677 625 527 795 733 620 591 660 700 500 565 620 774 Years of Credit History 20 9 11 15 12 22 7 5 17 24 19 16 6 3 13 10 Revolving Balance $ 11,320 $ 7,200 $ 20,000 $ 12,800 $ 5,700 $ 9,000 $ 35,200 $ 22,800 $ 16,500 $ 9,200 $ 22,000 $ 12,500 $ 7.700 $ 37.400 S 6.100 S 10,500 Revolving Utilization 25% 70% 55% 65% 75% 12% 20% 62% 50% 35% 18% 83% 70% 87% 7% 5% Decision Approve Reject Approve Reject Reject Approve Approve Reject Reject Approve Approve Reject Reject Reject Approve Approve N Y Y 802 Y N N Y N N N Y N Y Y Y N N Y N N 802 640 523 811 763 555 617 642 688 649 695 701 635 507 677 485 582 10 7 14 20 2 4 9 13 3 12 15 9 $ $ $ $$ $ $ $ $ $ $ $ $ 10,500 17,300 27,000 13,400 11,200 2.500 8,400 16,000 3,300 7,500 20,300 11,700 29.100 2,000 7,600 1,000 8,500 5% 59% 79% 3% 70% 100% 34% 25% 11% 5% 22% 15% 85% 100% 9% 80% 65% Approve Reject Reject Approve Reject Reject Reject Approve Approve Approve Approve Approve Reject Reject Approve Reject Reject 2 12 5 3 S $ $ S Print Done 485 582 699 703 585 620 695 774 802 N N Y Y N Y Y Y Y N N Y N N N Y Y N 5 3 17 22 18 8 16 13 10 7 14 20 2. 4 10 11 8 3 5 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ S S 1,000 8,500 12,800 10,000 31,000 16,200 9,700 6,100 10,500 17,300 27,000 13,400 11,200 2,200 12,050 11,700 29,100 2.000 80% 65% 27% 20% 78% 55% 11% 7% 5% 59% 79% 3% 70% 95% 81% 15% 85% 100% Reject Reject Approve Approve Reject Reject Approve Approve Approve Reject Reject Approve Reject Reject Reject Approve Reject Relect 640 536 801 760 567 600 702 636 509 Print Done Clear All Y N Y Y Y Y N N Y N N N Y Y N N Y 703 585 620 695 774 802 640 536 801 760 567 600 702 636 509 595 733 22 18 8 16 13 10 7 14 20 2 4 10 11 8 3 18 15 $ $ $ $$ $ $ $ $ $ $ $ $ $ $ $ S $ 10,000 31,000 16,200 9,700 6,100 10,500 17,300 27,000 13,400 11,200 2,200 12,050 11,700 29,100 2,000 29,000 13,000 20% 78% 55% 11% 7% 5% 59% 79% 3% 70% 95% 81% 15% 85% 100% 78% 24% Approve Reject Reject Approve Approve Approve Reject Reject Approve Reject Reject Reject Approve Reject Reject Reject Approve Print Done Clear All on credit approval decisions yields the folowing data about one randomly selected person. Identify each of the variables as categorical ordinal interval, or ratio and explain why Click the icon to view the data table iables Classification Reasoning meowner dit Score ars of Credit History wolving Balance wolving Utilization cision